- Evaluating the possibility of greater Bitcoin downside as fear continues to rule the market.

- Bitcoin’s currency flows suggest that there is strong demand every time BTC drops below $50,000.

Bitcoin [BTC] faces the risk of bearish capitulation as investors, especially in the retail segment, lose confidence in the bulls.

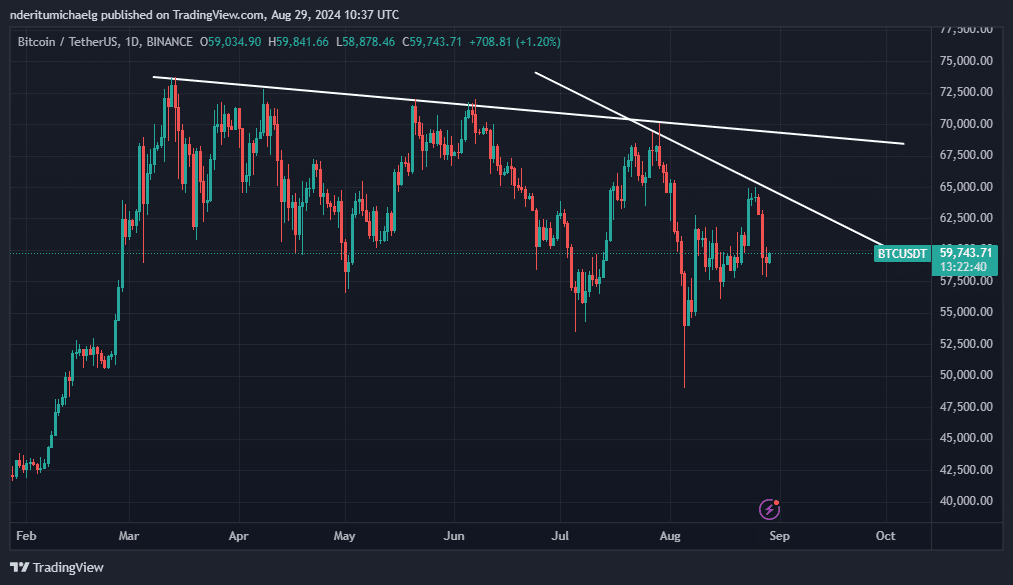

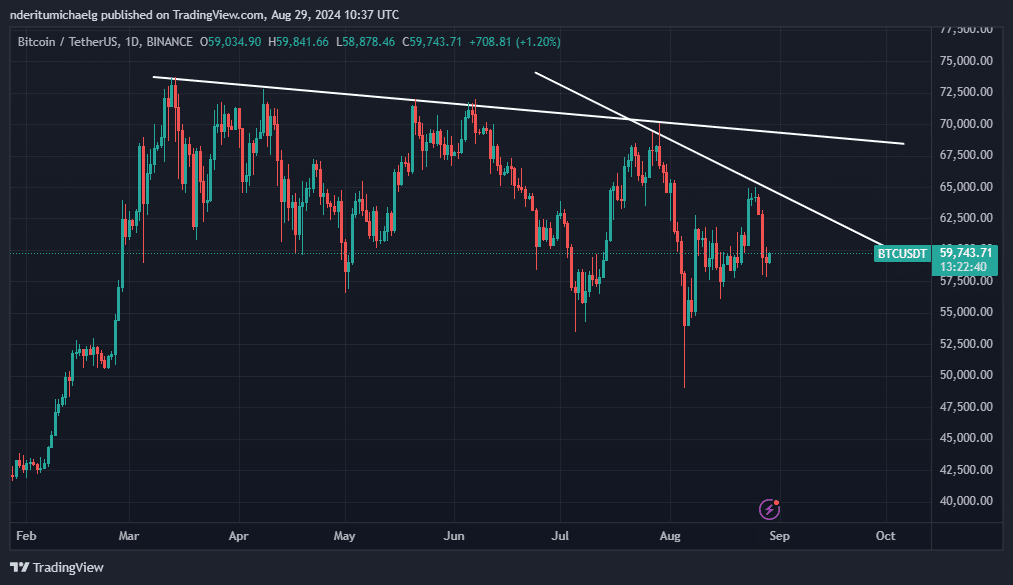

The recent bullish attempt formed a lower high, adding to what we have observed in King Coin since the March peak.

Every bullish attempt since Bitcoin’s historic ATH in March has resulted in lower highs, indicating weaker upside momentum.

This has largely contributed to the erosion of confidence in BTC’s ability to soar to new highs.

Source: TradingView

The latest attempt to break above $60,000 resulted in a resurgence of selling pressure. As a result, market sentiment fell further. The Bitcoin Fear and Greed Index fell from 39 a week ago to 29 at the time of writing.

Source: Alternative.me

The widespread fear was also in line with escalating concerns about the global economic situation, especially as fears of a recession emerged. These fears threatened to destabilize the global investment landscape.

Investors tend to be risk-averse in such scenarios, meaning risky assets like Bitcoin could experience a liquidity outflow.

Bitcoin indicators flash different signals

On the other hand, Bitcoin’s 2022 crash was largely caused by liquidity drying up as governments raised interest rates. Recent developments indicate that interest rate cuts could promote a bullish outcome.

Data about the chain also supported these expectations.

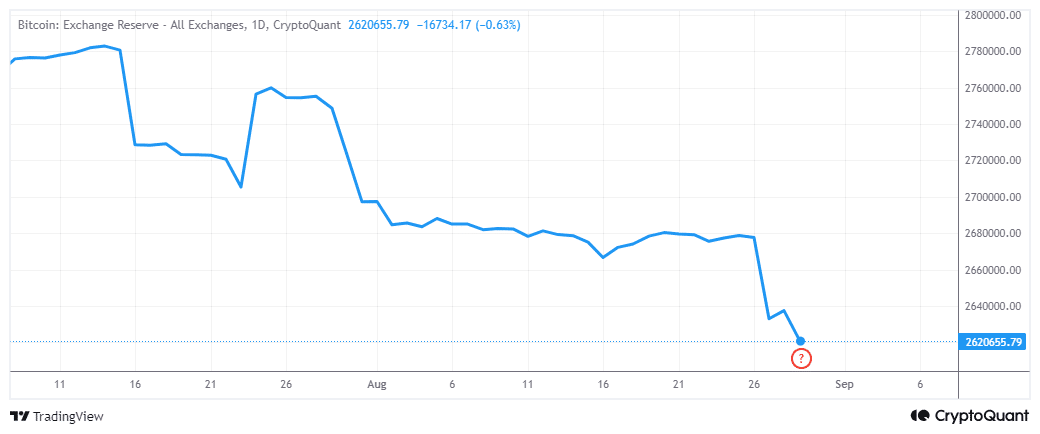

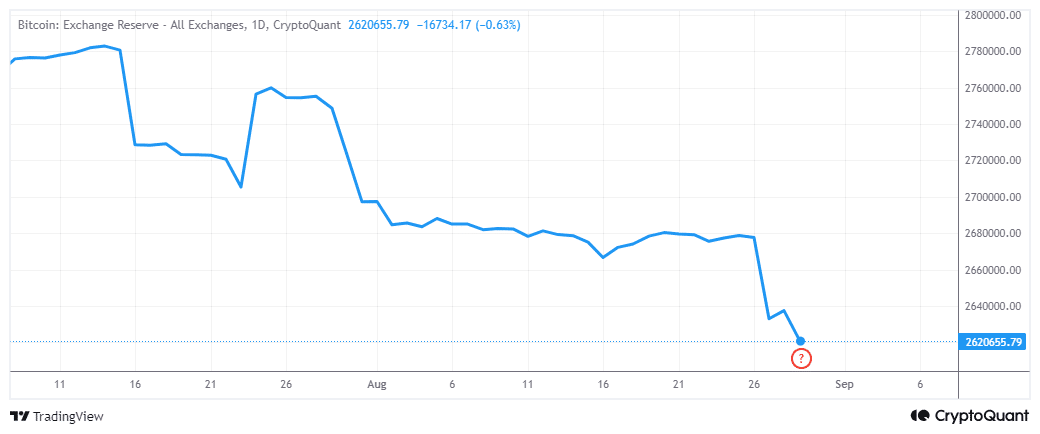

Bitcoin exchange reserves continued to decline despite the recent bearish outcome. This pointed to the fact that long-term demand was still high, and recent market performance is largely a result of short-term volatility.

Source: CryptoQuant

The declining foreign exchange reserves were quite unusual at a time when the market was becoming more anxious. This suggested that HODLers were moving BTC from exchanges into private wallets.

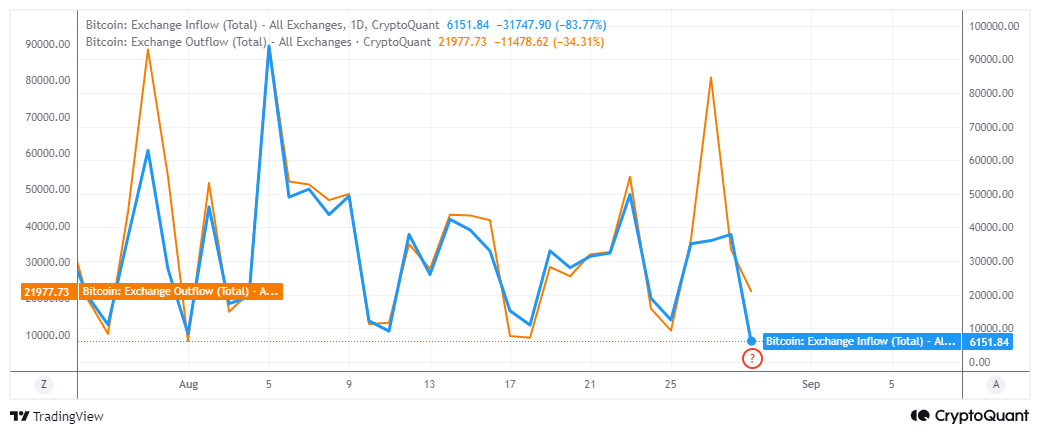

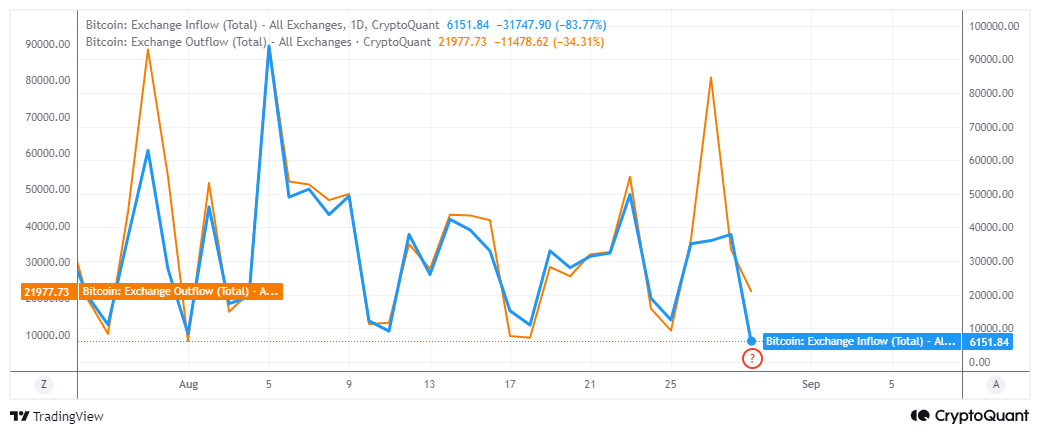

Exchange flow data worked in tandem with the above point. The latest outflow of foreign exchange has been much greater than the inflow.

For example, the last peak in currency flows occurred on August 27, during which outflows peaked at 80,740 BTC. Inflows peaked at 36,071 BTC during the same trading session.

Source: CryptoQuant

Bitcoin flows over the past 24 hours perpetuated a similar narrative. The outflow on the exchanges was higher at 21,977 BTC than the inflow on the exchanges of 6151 BTC.

This indicated strong demand for Bitcoin whenever it dropped below $60,000.

The prevailing demand does not change the fact that Bitcoin has reached lower highs.

Read Bitcoin’s [BTC] Price forecast 2024–2025

There is a significant risk that the macro trend will weaken closer to $50,000 and possibly below, especially if a strong capitulation leads to a large inflow of foreign exchange reserves.

On the other hand, current data indicate that there is still a supply shock that could contribute to higher prices over time.