In a month marked by heightened volatility, Apecoin (APE) was a battleground for bulls looking to avoid a dip below the crucial $1 mark.

This tug-of-war between bulls and potential downside pressure underlines the intense market dynamics surrounding Apecoin, leaving investors on the edge as they monitor the crypto’s price movements in this volatile November landscape.

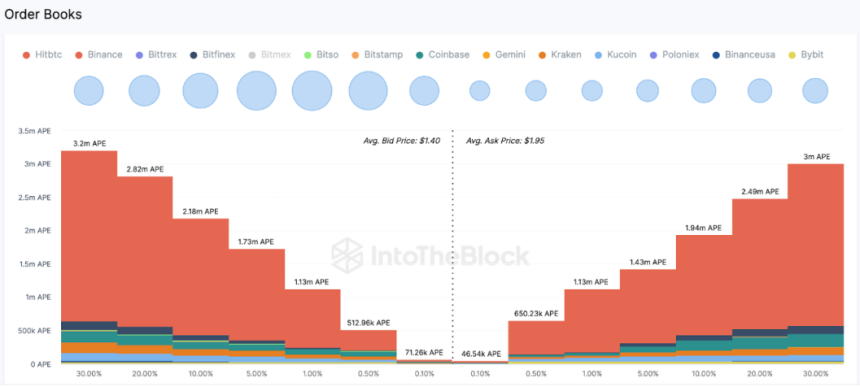

The latest spot market data shows a resolute stance from bullish traders as orders for over 11 million APE tokens have been strategically placed around the current price.

APE has increased by 30% to surpass $1.70 after falling to a weekly low of $1.30 on November 21. On-chain data projects The long-term resilience of Apecoin investors could reinvigorate APE’s pricing opportunities.

APE Total Order Books. Source: IntoTheBlock

Apecoin price recovers from all-time lows

On October 9, Apecoin’s price fell to an all-time low and narrowly avoided falling below the $1 support level. However, the APE token is now up 40% and as of November 24, the meme coin was trading for around $1.45.

The market situation in which APE now operates is difficult. The token’s recent price gains are at risk due to bearish on-chain indicators.

In recent months, the number of APE coins available on exchanges has almost doubled to just over 50 million, which could indicate an increase in buyer demand.

The combination of a decrease in the number of active addresses and an increase in supply on exchanges indicates a pessimistic deviation, which may indicate an impending decline in the price of the meme currency.

During the current rise, two notable corrections have occurred in APE. The Fibonacci level of 61.8% marked the first retracement and 50% marked the second correction.

Total crypto market cap is currently at $1.4 trillion. Chart: TradingView.com

These retracements are thinning, which is a bullish indication of increasing momentum and more buyer condemnation.

Taking this into account, investors can use the 38.2% and 50% Fibonacci levels as a useful guide when placing stop-loss orders, acting as a buffer against any market volatility.

The price of Apecoin is now fluctuating between $1,063 and $1,506, indicating that the market is in a volatile market. There are some indications of stability: the 10-day moving average at $1,410 and the 100-day moving average at $1,303.

Nevertheless, it is important to keep an eye on the resistance levels at $1,695 and $2,139 and the support levels at $0.365 and $0.808. These levels will be critical in influencing APE’s short-term price movements.

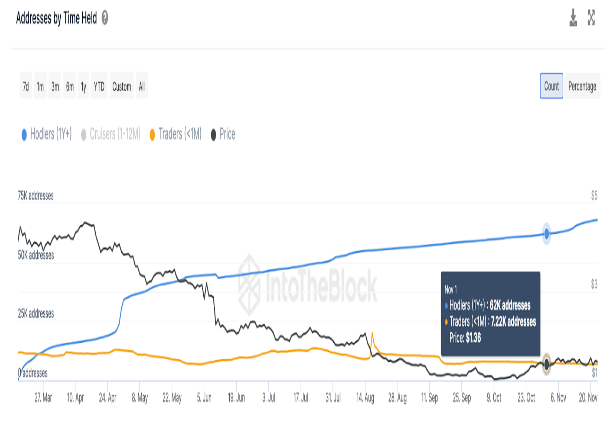

APE addresses by time held. Source: IntoTheBlock

Shift in address dynamics

Meanwhile, as reported by IntoTheBlock, a positive trend divergence is visible between the long-term and short-term holder addresses for APE. As shown in the Addresses Held on Time chart, the number of long-term addresses has increased by 6,060 wallets since the beginning of November.

At the same time, the Apecoin network has experienced a drop of 3,800 in the number of merchants/short-term wallets over the same period, highlighting a notable shift in address dynamics.

The coming week is of great importance for APE investors as it will serve as a crucial assessment of this meme coin’s sustainability and prospects for more upside moves.

(The content of this site should not be construed as investment advice. Investing involves risks. When you invest, your capital is subject to risk).

Featured image from Pexels