- Bitcoin’s halving has led to unpredictability in the short term.

- The debate over holding Bitcoin versus taking profits emerged amid market fluctuations.

Just four days ago, Bitcoin [BTC] has experienced its long-awaited halving, but its post-halving price performance continues to make headlines due to its unpredictability.

According to CoinMarketCapthe leading cryptocurrency showed all green numbers on the weekly chart at the time of writing, signaling a notable bullish move within the market.

Impact of the Bitcoin halving

Anthony Pompliano, who sheds light on the 30 days before and after Bitcoin’s halving period, in a recent conversation with Bloomberg noted,

“What we have seen historically is that the halving takes some time to kick in.”

Sharing insights from a Bitwise report, he adds:

“In the month before the halving, the average return over the last few bull markets was 19%, in the month after the halving it was 1.7%.”

This highlighted that while there may be short-term fluctuations just before and after the halving, the longer-term trend is generally on an upward trajectory.

If you look closely, this pattern is consistent with basic economics: when the demand for Bitcoin remains constant, but the incoming supply is halved, the price must be adjusted to ensure market equilibrium.

Pompliano suggested that the outcome this time would likely follow the established pattern.

He predicted a potential upward move in Bitcoin’s price in the coming months, in line with historical trends.

“I don’t think it will be any different this time.”

Echoing a similar sentiment, Vijay Boyapatiauthor of ‘The Bullish Case for Bitcoin’, said:

“All things being equal, if demand for bitcoins remained constant, the halving would result in an excess of demand over supply, causing the price to rise.”

What do the numbers say?

However, contrary to the above opinions, Layah HeilpernHost of The Layah Heilpern Show, added,

“If you don’t profit from this crypto bull run, you are making a HUGE mistake…”

This reflects Heilpern’s evolving perspective. While she previously advocated holding cryptocurrency indefinitely, she now advises selling on significant profit realization in this cycle.

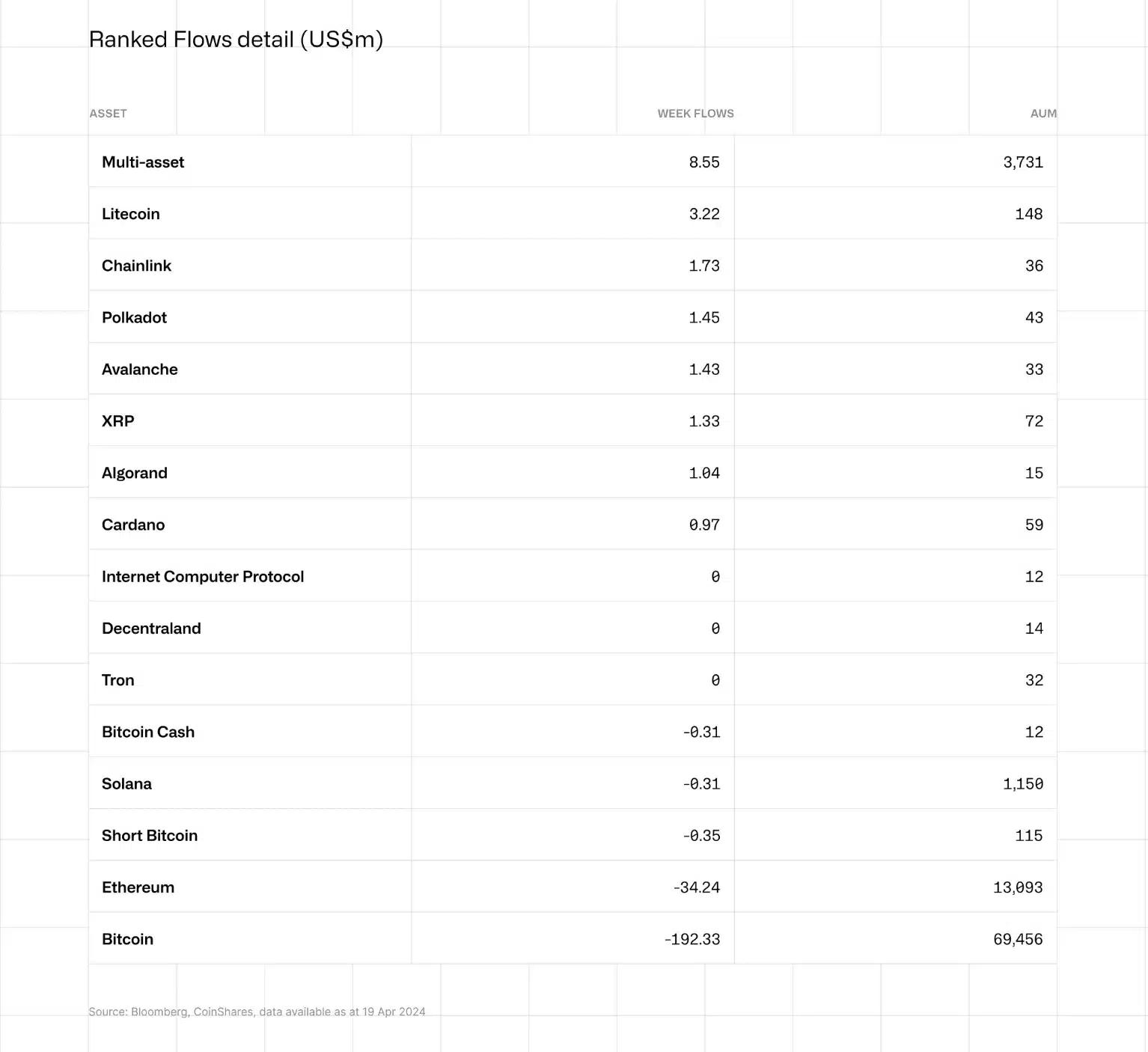

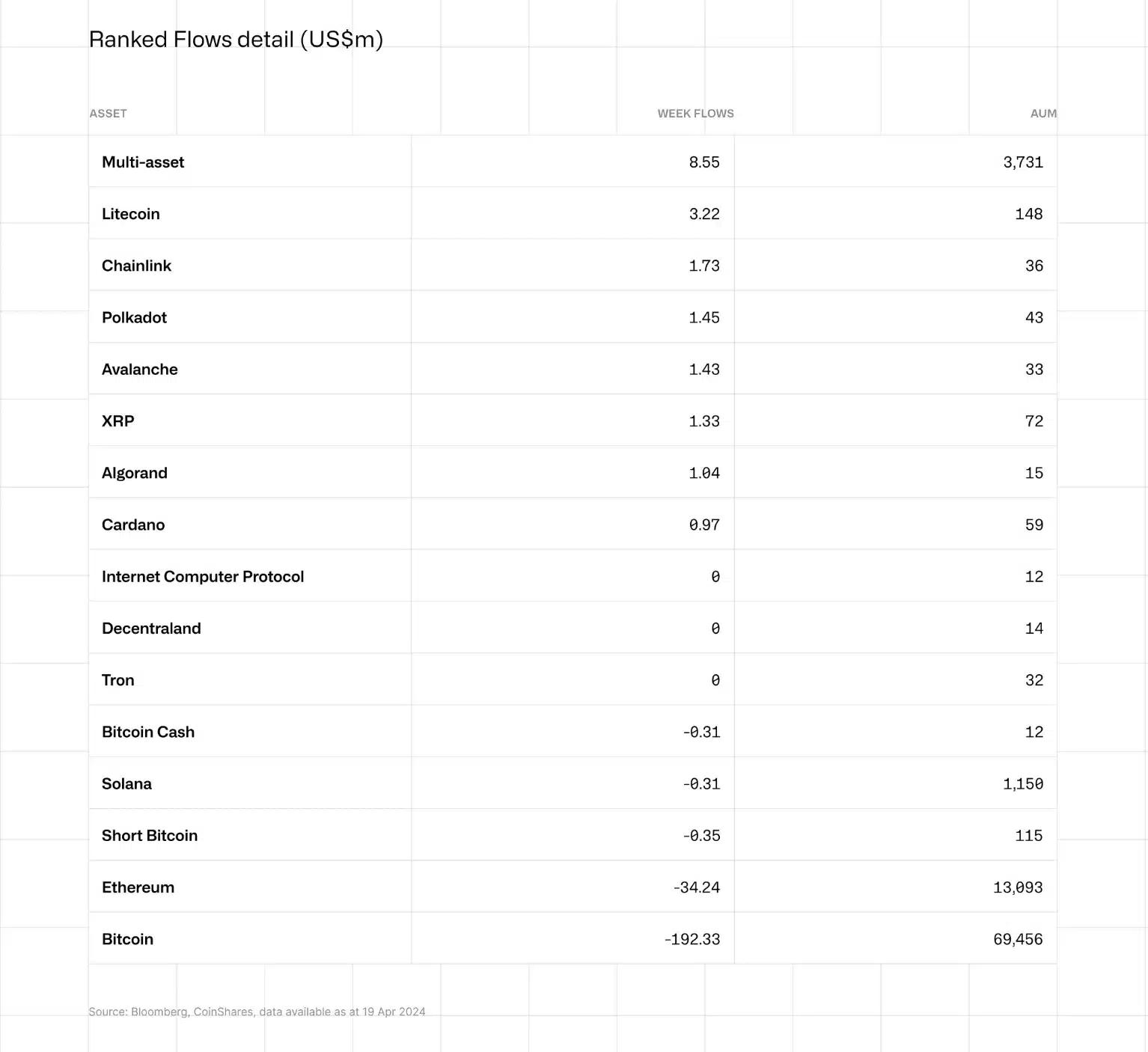

Looking at CoinShares data, needless to say, cryptocurrency outflows amounted to a significant $206 million, with Bitcoin leading the way at $192 million, followed closely by Ethereum. [ETH] with $34 million.

Source: CoinShares

So while short-term fluctuations may raise concerns, Bitcoin’s long-term potential offers significant upside.