Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

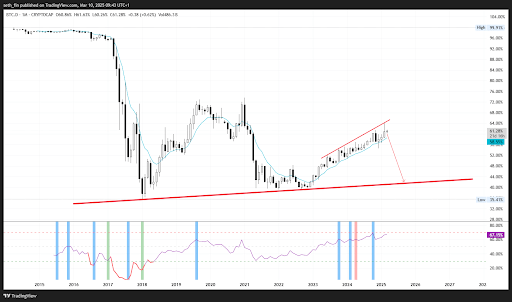

Bitcoin has even retained its dominance on the Altcoin market in the midst of the ongoing price corrections. The leading cryptocurrency is in the spotlight in this market cycle, but a technical prospect suggest that it should give way. In particular, a crypto analyst known as Seth on Social Media Platform X Bitcoin’s Dominance Relative strength index (RSI) as a crucial factor that should change before Bitcoin and the wider market can start a different leg up.

Bitcoin Dominance RSI reaches a new level

Seth’s latest analysis, shared Social Media Platform X, emphasizes a critical observation with regard to Bitcoin’s dominance. He noted that Bitcoin’s monthly dominance RSI recently rose to 70, A level that has never been reached before in the history of Bitcoin. Although at first glance this may seem like a bullish signal, the analyst suggests differently, warns that the dominance RSI must cool down for the final phase of the bull run. This perspective comes when the crypto market experiences a decline, Let investors ask When the next Bullish Golf starts.

Related lecture

RSI, or relative strength index, follows the speed and change of price movements and is used to identify Overbought or over -sold circumstances. With Bitcoin’s RSI dates at such an extreme level, even with the recent price drop, this suggests that the control of BTC across the market is an untenable peak, which can slow down the wider market trally.

According to Seth, that that do not understand This concept does not understand the fundamental mechanics of financial markets, because this principle applies further than just Bitcoin and Altcoins. In view of this, the healthiest path ahead would be a reduction in Bitcoin’s dominance in the coming weeks, with the analyst projecting a decrease in 44% dominance.

Why the RSI -Dominance of BTC matters

A decrease in Bitcoin’s RSI dates would mean that the market is shifting to more balanced circumstances, so that capital can flow into altcoins and raise their prices. By means of beyond bullcyclesEspecially in 2021, the rise of Bitcoin to a peak was often followed by an increase in Altcoin investments, which activated widespread rallies on the market.

Related lecture

Historically, this pattern has the final phase of a bull run, where capital runs away from Bitcoin and to Altcoins with a higher potential for the short -term profit. To Bitcoin’s dominance cools down, The Altcoin sector may have difficulty getting strength and derail the final phase of the BTC Bull Run.

At the time of writing, BTC acts at $ 81,500, which reflects a decrease of 2.5% in the last 24 hours. Market data from Coinmarketcap indicate that Bitcoin’s dominance is currently 61.0%, with an increase of 0.65% within the same period. This growing dominance suggests that capital remains concentrated in BTC.

Featured image of Unsplash, graph of TradingView.com