Quantanalyst PlanB says there is an indicator that suggests Bitcoin (BTC) is ready for an accelerated bull market.

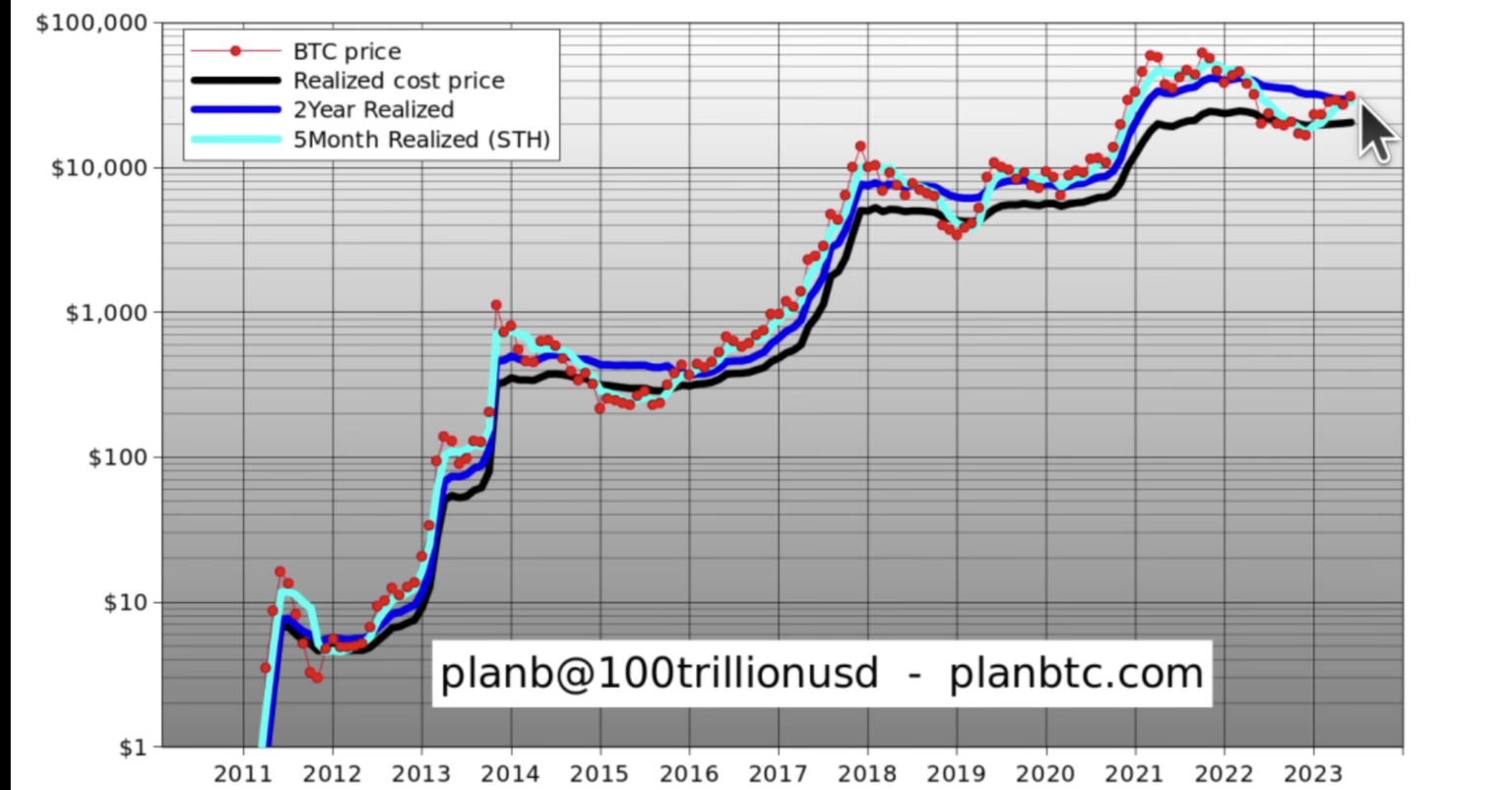

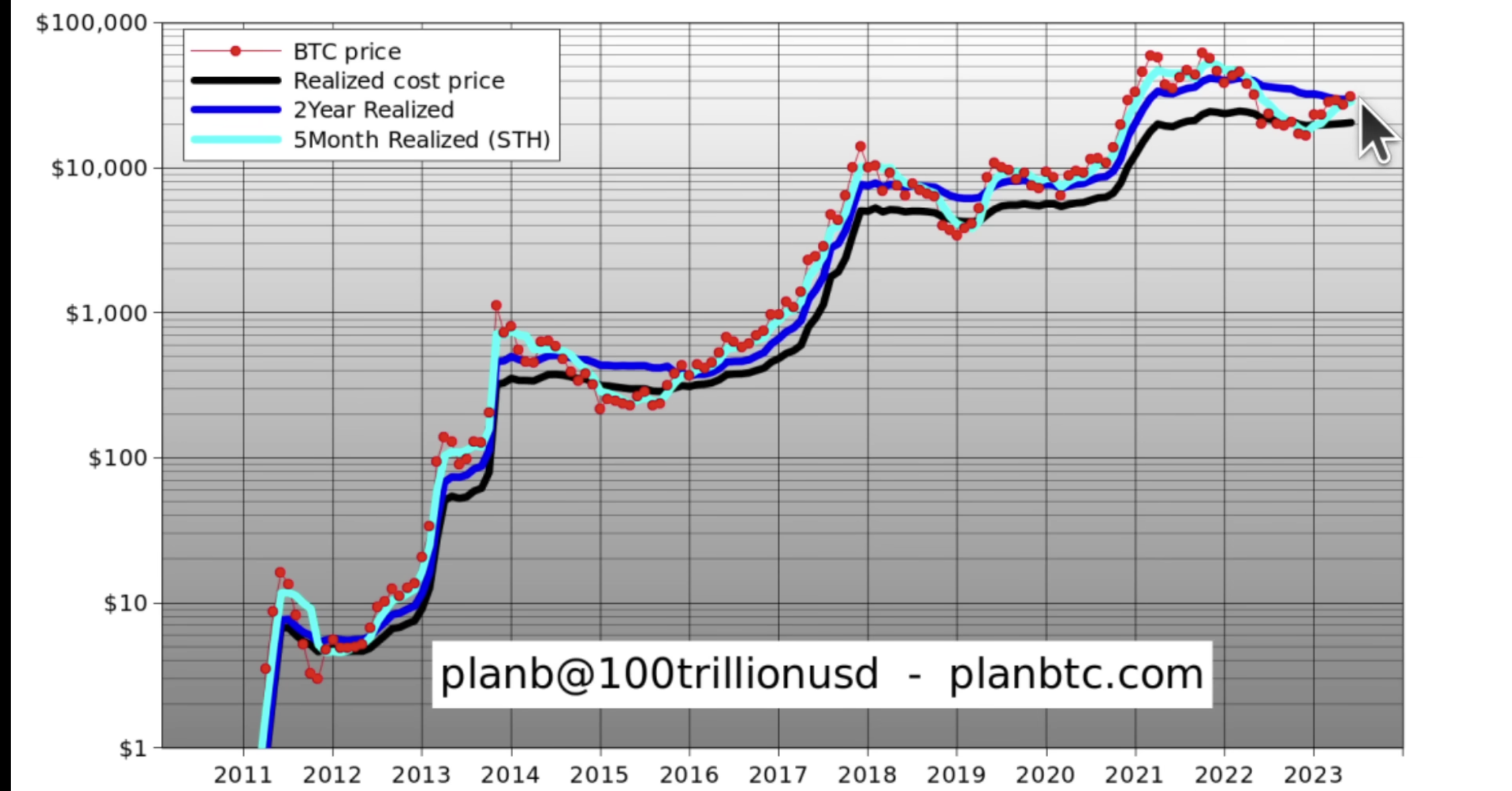

In a new strategy session on YouTube, PlanB tells its 51,600 subscribers that Bitcoin’s realized cost, the average value of the BTC supply calculated at the price at which the coins last moved, indicates that a more pronounced bull market is likely underway. is.

PlanB says that price movements above the two-year realized cost in the past have suggested large moves upwards.

“The main thing we see is that the Bitcoin price, the red dots, has exceeded the two-year realized cost, and has already exceeded the realized cost, and has already exceeded the five-month short-term cost. So now it’s something new… It exceeded the two-year realized price, and that’s an important signal. Of course, the month is not over yet, so we wait and see how [June] close.”

PlanB also notes that the realized cost price measurements are all going up together after years of stagnation.

“Historically, closing above the two-year realized price was a signal that a bull market was on the way [was about to] accelerate. Same here in 2016 and 2019 was a bit of a weird year with the black swan of Covid…

So it’s very interesting and another thing that’s also very interesting, the realized price, the black line, and the biannual realized price, the blue line, started to rise again after a long time. I think it’s been down for about a year, and now, for the first month, it’s back up, and then it gets really interesting, so we’ll have to see what Bitcoin will do.

At the time of writing, Bitcoin is trading at $30,183.

i

Don’t Miss Out – Subscribe to receive email alerts delivered straight to your inbox

Check price action

follow us on Twitter, Facebook And Telegram

Surf the Daily Hodl mix

Generated image: DreamStudio