- Short and medium to long -term statistics revealed various signals for Bitcoin

- Immediate lack of power of Bulls can push the price under $ 80k again

Bitcoin [BTC]At the time of writing, was on a downward trend after losing the $ 92,000 support level in the last week of February. Technical indicators such as the OBV showed that the sales pressure has been dominant, which means that more losses can probably be ahead.

Source: Cryptuquant

In a post Cryptoquantanalyst Darkfost Be aware that the clear question has fallen since December. The apparent Bitcoin question graph compares the new offer of the offer that has been inactive for a year. This graph identifies whether the new BTC is included in the market because of whether there is a lack of purchasing pressure.

The apparent demand ratio fell under zero at the end of February and coincided with the loss of support from $ 92k. And since then it has remained negative. That is why Ambcrypto analyzed other statistics to better understand the behavior of holders.

Bitcoin is confronted with intense pearliness in the short term, but Hodlers have some hope

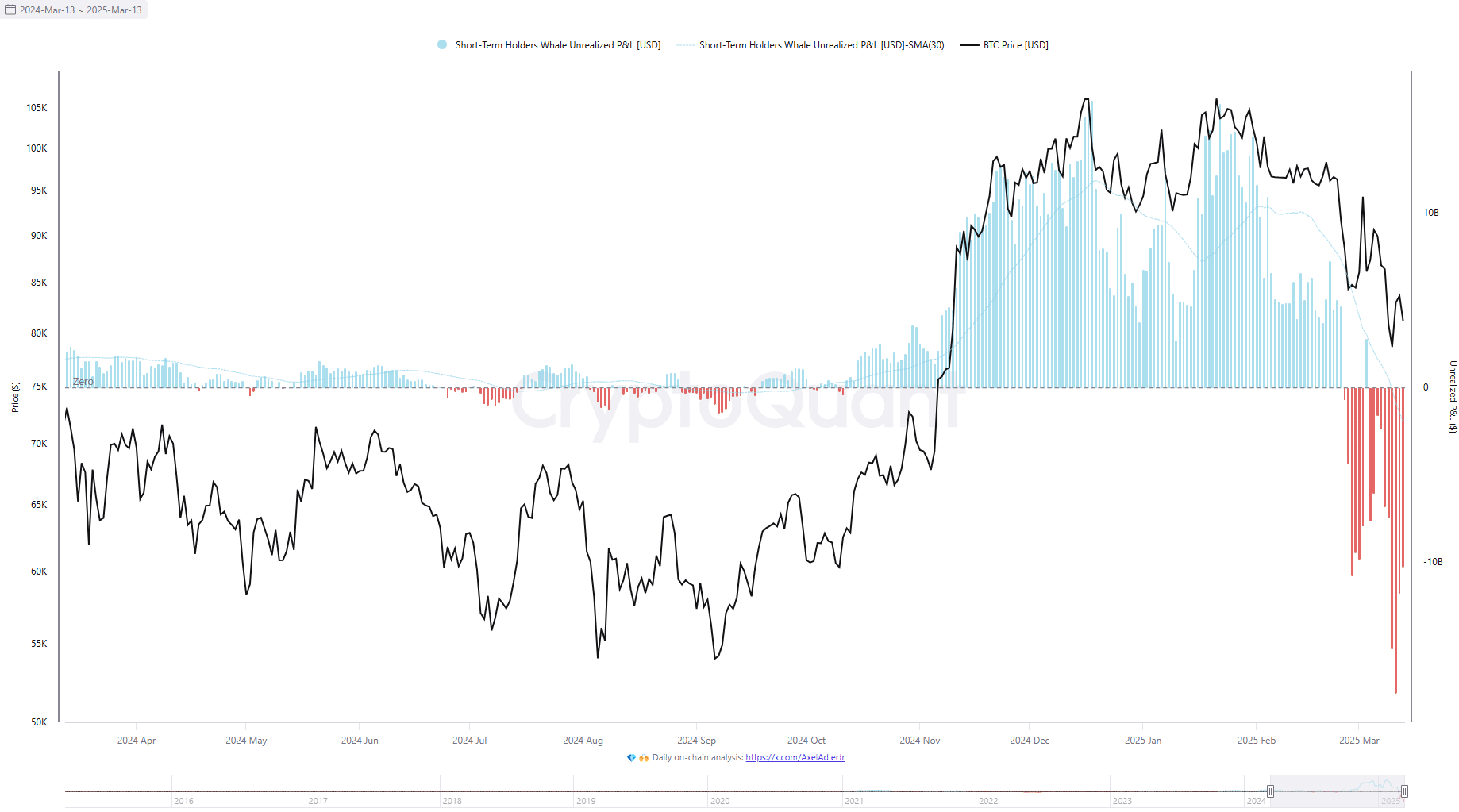

Whale holders with a holding period of less than 155 days are classified as holders in the short term (STHS). These STH whales did not see losses in the last week of February, because the prize maintained the downward trend.

The non -realized losses of the STH whales reached their highest point ever on 11 March, with the value no less than $ 17.52 billion. It went back somewhat lately, but showed the possibility to continue selling to protect against larger losses. In fact, it also created and maintained afraid sentiment on the market.

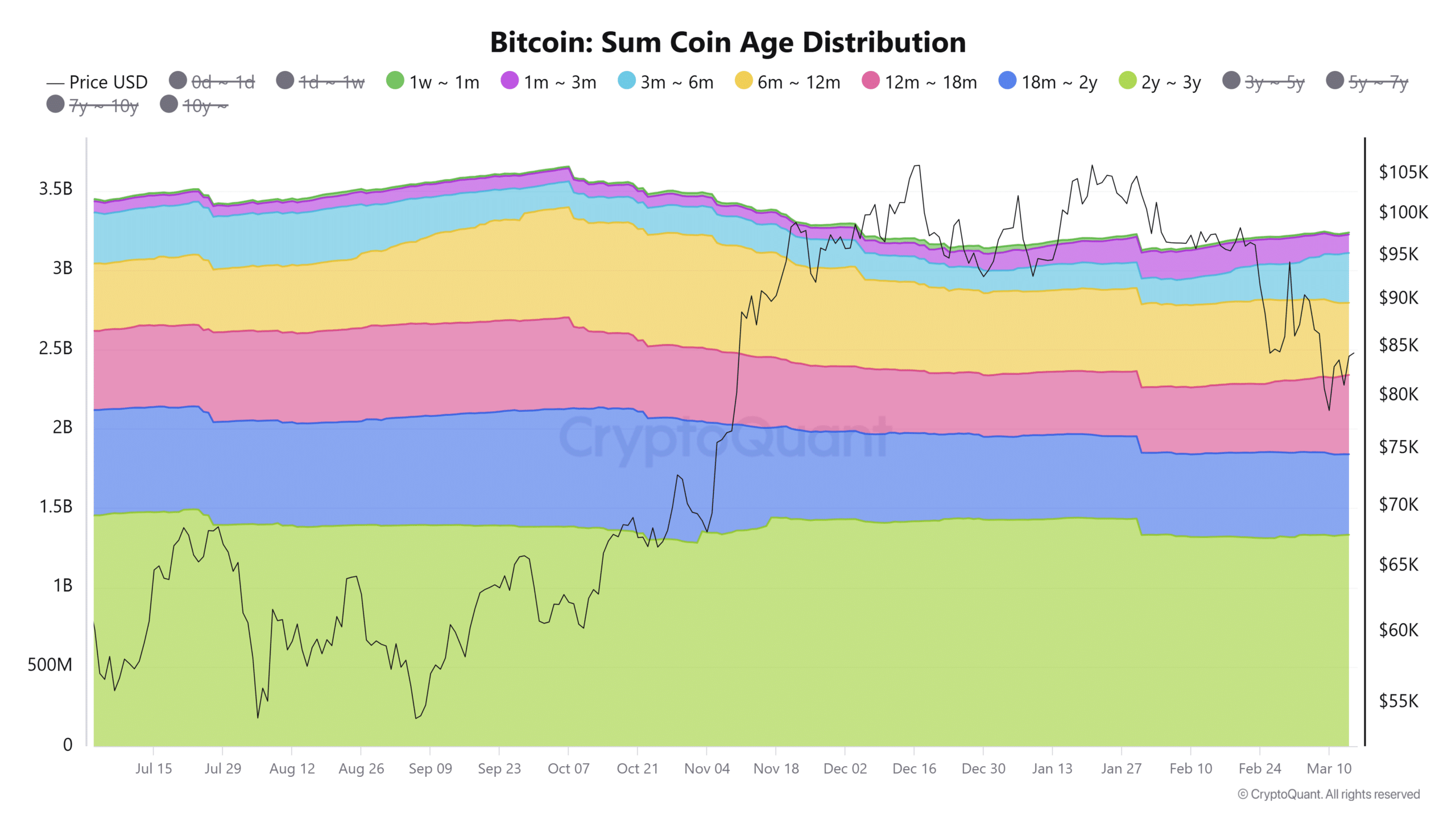

Finally, the Sum Coin Age Distribution analyzes the age of Bitcoin’s unspoken transaction output [UTXO]. The metric gives more weight to the older coins. The age tires are formed based on the age of the Utxos.

Rising values of the SCA within these age tires indicate HODL behavior or accumulation, while falling values indicate distribution and walking in sales pressure.

Since the end of January, the age tires of 1 month-18 months in general have seen an increased hold and accumulation behavior. The age of 6-12 months was noticeably noticed last week. This walk when keeping sentiment in different age tires is a positive sign.

The StH -Walvissen metric showed that recent, large BTC buyers were deep under water. The weak apparent demand showed that there was a lack of immediate purchasing pressure to absorb the supply. However, medium to long-term holders seemed to retain some trust based on the SCA distribution.

Until the short -term pressure is facilitated, Bitcoin could see another price fall under $ 80k.