- Bitcoin’s volatility was significantly lower than top altcoins.

- XRP led the recent altcoin rally driven by the favorable outcome in the Ripple vs SEC case.

Lately, crypto market participants have been drawn to altcoins, as the king of crypto assets Bitcoin [BTC] there is little left for them to profit from.

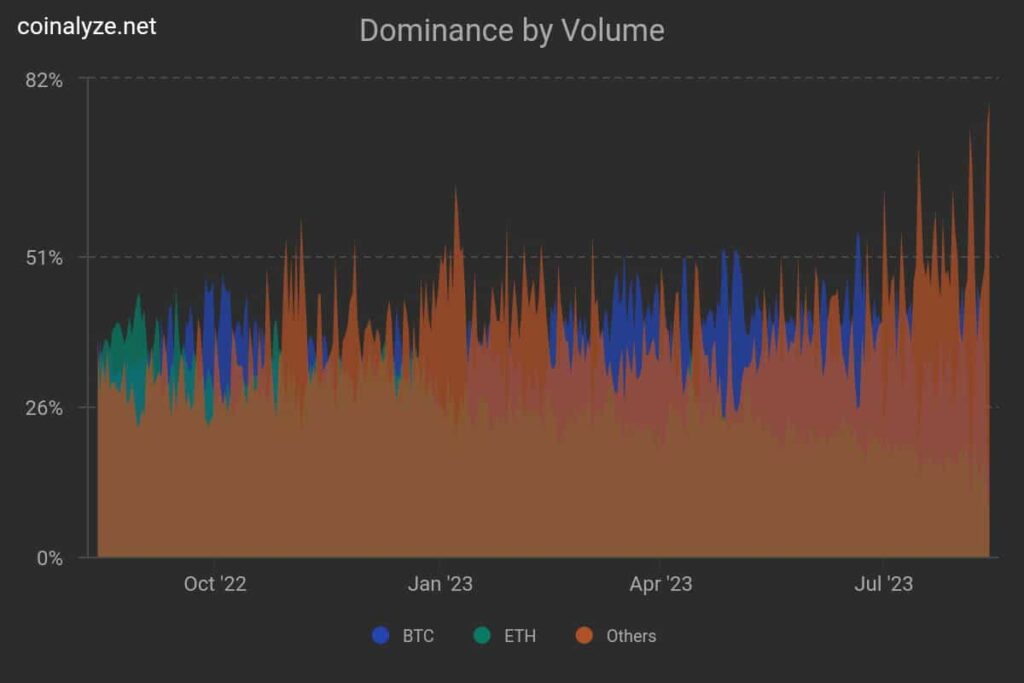

According to an on chain analyst, altcoin dominance by trading volume ripped to 78%, the highest in the past two years. In stark contrast, Bitcoin’s trading volume fell to new lows.

Source: Posted by Maartunn with input from Coinalyze

How much are 1,10,100 BTC worth today?

All quiet on the Bitcoin front

After hitting annual peaks in the June market rally, BTC has made its way through a narrow trading range between $29,000 and $30,000, according to CoinMarketCap. This lackluster move has severely tested the patience of active traders looking to flip coins for quick profits.

Note how from the March peaks, the total amount of BTC traded on the blockchain has dropped. The June rally, built on the hype of institutional interest in cryptos, provided a temporary boost and raised hopes for more trading activity.

However, dashing all hopes, Bitcoin continued to slide, with August proving to be the quietest month. At the time of writing, about $131.8 billion was paid on the network in August, per Token Terminal data.

To put this in context, it was a fraction of the $1 trillion figure recorded in March and less than half of the $345 billion figure recorded last month.

Source: Token Terminal

XRP is leading the altcoin rally

Altcoins, on the other hand, have been a hive of activity. Major coins like Ripple [XRP]Solana [SOL]Cardano [ADA]and Polygon [MATIC] have been charging higher on the volume charts lately.

XRP, the payment-oriented cryptocurrency, deserves a special mention. Since the favorable ruling in the hotly contested legal battle against the US Securities and Exchange Commission (SEC), XRP’s fortunes have skyrocketed.

Source: Sentiment

Recall that the alt exploded by 70% after the court verdict, enticing many XRP investors to unload their bags. In fact, XRP outperformed Bitcoin in terms of trading volume in the days following the event. While the frenzy has largely subsided, XRP remained 34% higher than just before the verdict.

The optimism generated in the market for XRP soon spread to other coins such as SOL, ADA and MATIC. One of the main factors behind the shared excitement was the verdict centering on XRP’s status as “security”.

Like XRP, the SEC labeled aforementioned altcoins as securities in a lawsuit previously filed against cryptocurrency exchange Binance. The resulting FUD put a dent in their trading activity as jittery investors began to dump hordes.

However, after the court cleared XRP of the security label, the market was flooded with excitement rooted in the expectation that the ruling would set a precedent. Apparently, many previous holders of altcoins have tried to get them back.

Bitcoin not ideal for active traders?

Volatility has historically played a big part in an investor’s decision to add crypto instruments to their portfolios. Known for their wild intraday swings, these mercury assets attract long-term bullish traders looking to cash in quick profits and exit their positions.

However, lately it is not Bitcoin, but altcoins have emerged as the ultimate volatile asset. At the time of publication, Bitcoin’s 1-week volatility was significantly lower than top altcoins, according to Santiment.

Source: Sentiment

Is your wallet green? Check out the BTC Profit Calculator

These developments also drew attention to the diverging sentiments surrounding the king coin and its juniors.

Lately, many traders have started taking BTC from the secondary market to HODL. The growing interest in TradFi, the absence of a looming threat from regulators, and the impending halving have bolstered Bitcoin’s narrative as a long-term investment.

This meant that the Bitcoin market was more attractive if you want to keep your coins for a long time, expecting it to weather the headwinds from both TradFi and crypto. If you’re looking for quick profits, Bitcoin may not be an ideal bet.

These observations were supported by the widening gap between long-term and short-term holders of the currency.

The contrast between short-term and long-term investor holdings has reached an unprecedented level.

It’s a matter of time until the next cycle begins to unfold 🚀https://t.co/m1qncCBUi2 pic.twitter.com/WJ7E7FXWtj

— Maartunn (@JA_Maartun) August 14, 2023