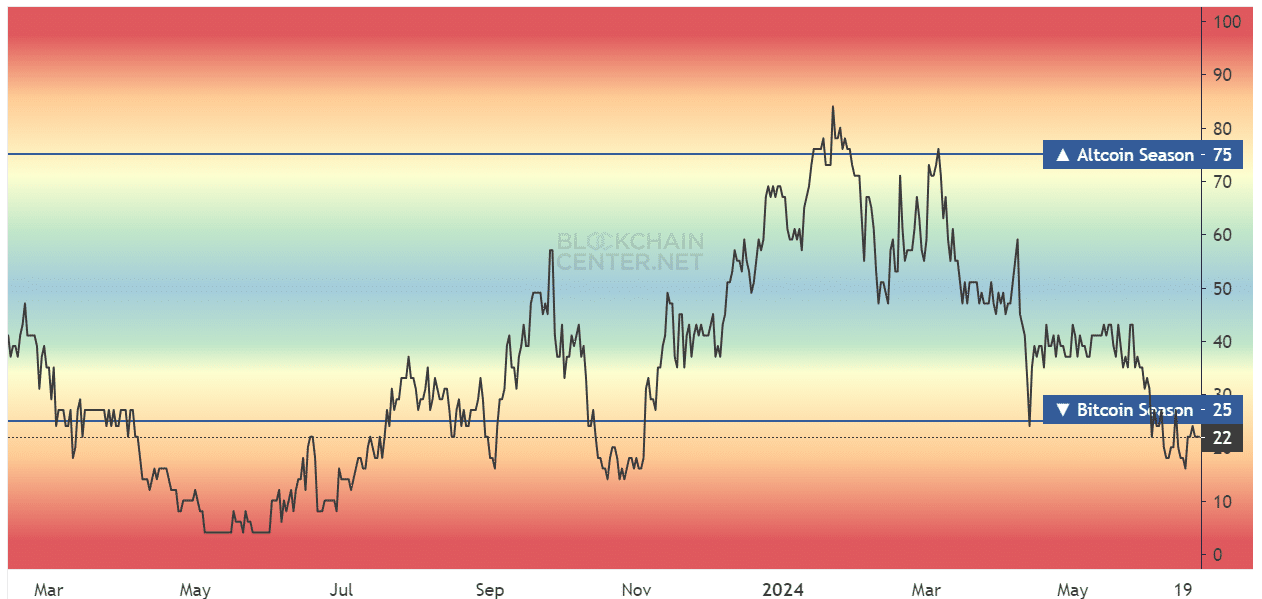

- The altcoin seasonal index showed that investors should bide their time.

- Participants will have to be choosier in their altcoin bets this cycle due to the abundance of new tokens.

Bitcoin [BTC] was trading at $61.5k at the time of writing, just 3% above the low of $59.7k. This range low was defended in the first half of May and the bulls staged a rally to $72k but were unable to sustain it.

Revisiting this crucial support meant that the consolidation phase was still underway and BTC was not yet ready to trend upward. The sub-$60,000 liquidity cluster could attract prices, forcing a deeper correction than most participants expect.

When the king of crypto struggles to establish an uptrend after the halving, it stands to reason that most altcoins are also suffering from bearish pressure. The capital inflows to support altcoin rallies are not yet in place.

Research on the altcoin seasonal index: the results are not encouraging

The altcoin seasonal index attempts to gauge sentiment in the market and whether Bitcoin or the altcoin sector is performing better. If 75% of the top 50 altcoins outperform BTC over a 90-day period, it is said to be altcoin season.

Such a scenario is far from happening. This is because the market lacks the kind of capital inflows and speculative interest that propel an altcoin season.

Traditionally, once Bitcoin makes a big upward move, it tends to consolidate. During this time, BTC holders choose to convert some of their money into altcoins, betting on outsized profits in assets that are much riskier than BTC based on fundamental analysis, tokenomics and market sentiment.

Therefore, before an altseason can happen, we will need Bitcoin to make big gains, as it did between October 2023 and January 2024.

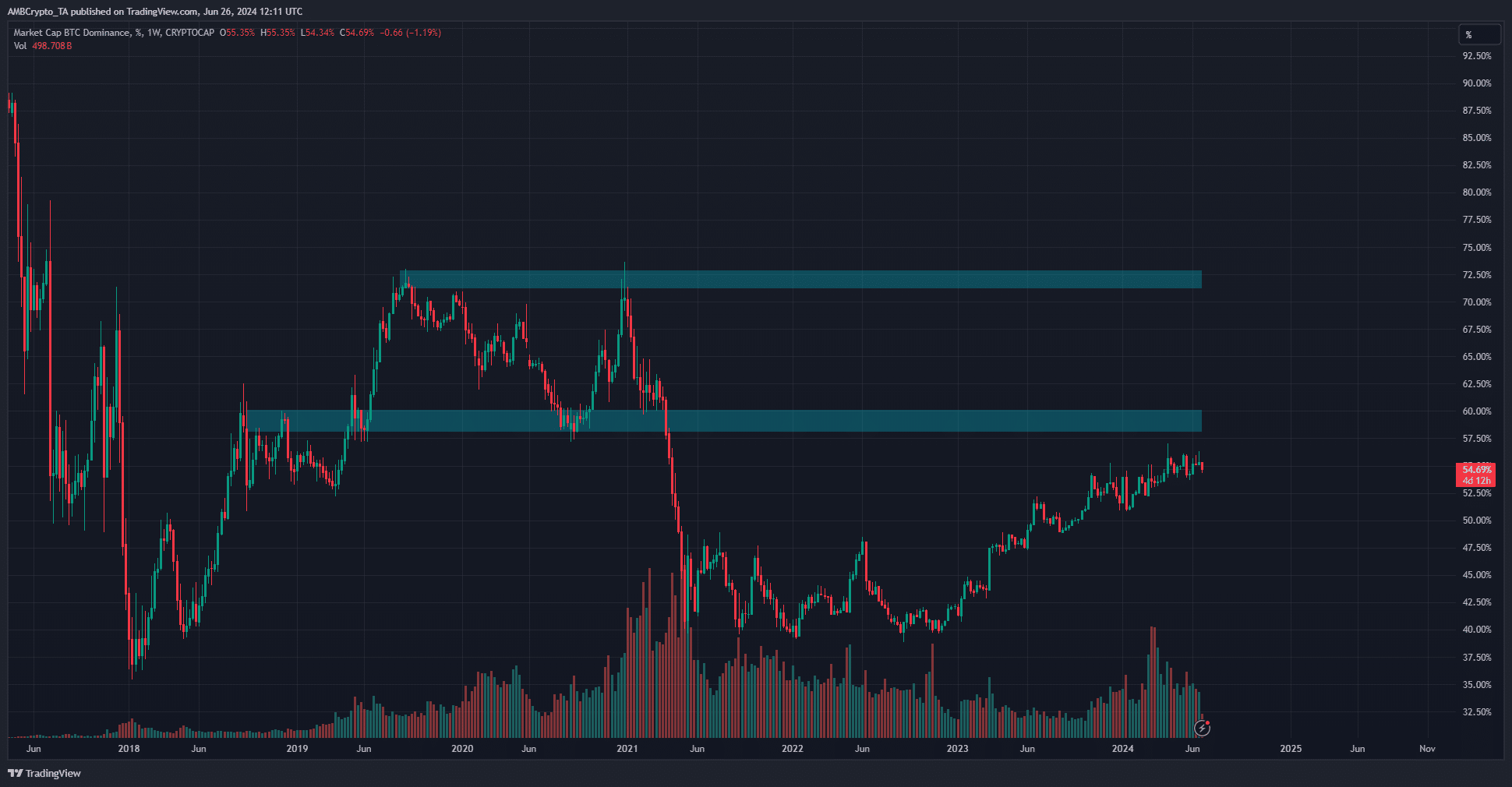

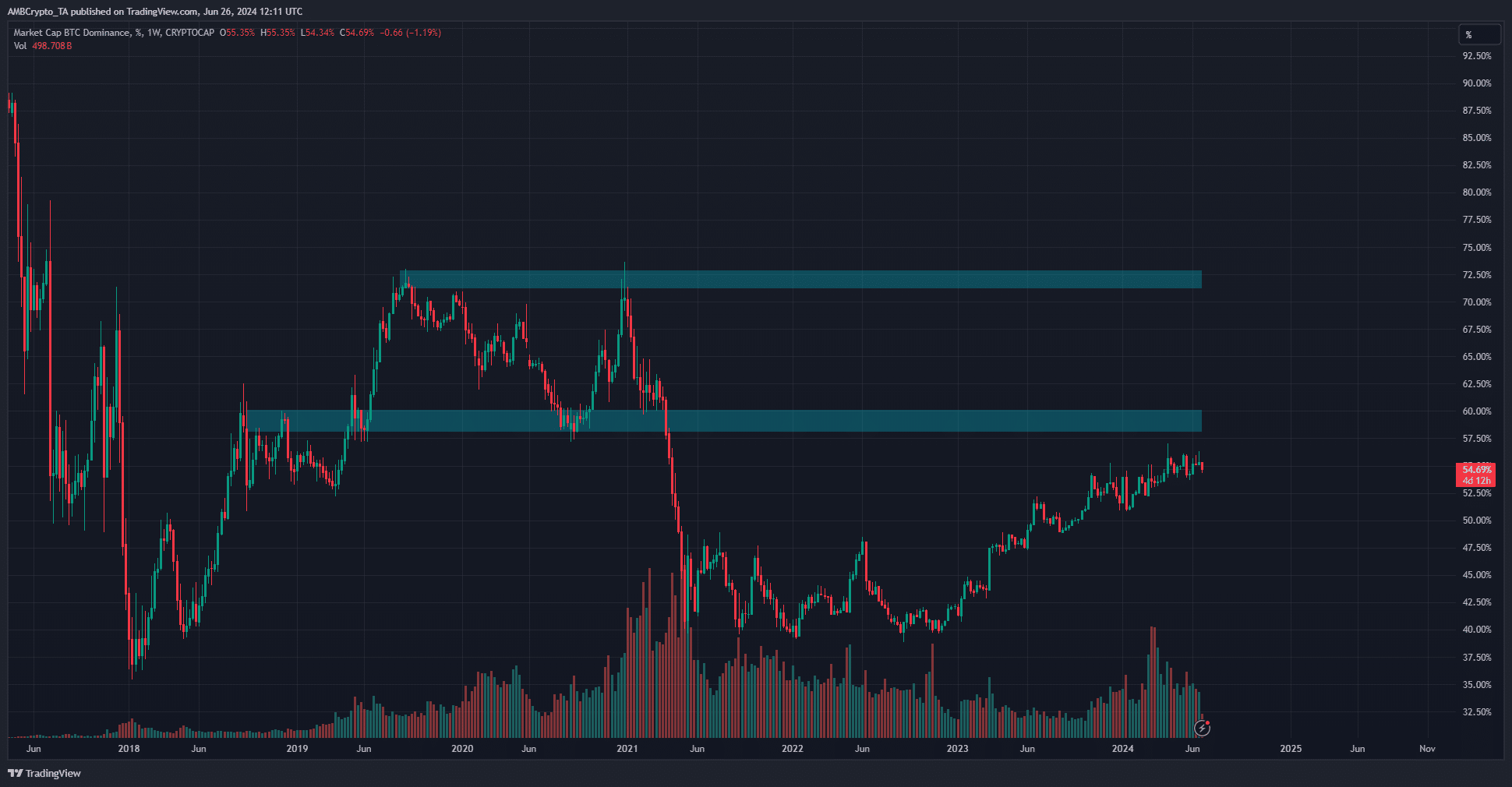

The long-term implications of the dominance graph

Source: BTC.D on TradingView

The 2021 altcoin season officially ran from March to June 2021, based on the altcoin seasonal index. However, if we study the BTC.D chart above, we see that Bitcoin’s dominance started to decline in early 2021 and initiated a recovery in the second half of the same year.

That’s why a sharp dip in BTC.D is a major catalyst for altcoin seasons: it highlights the growth of the altcoin sector compared to Bitcoin.

Since March, the altcoin market has been in a bearish trend. While the trend in the higher time frame has been positive, the current pullback has been brutal.

Read Bitcoin’s [BTC] Price forecast 2024-25

The dilution of the altcoin pool and the constant unlocking of tokens from the existing projects meant that demand had to skyrocket to keep up with the inflating altcoin market.

This in turn could mean that the extraordinary gains in this cycle could be concentrated among fewer alts than in 2021 or 2017, and returns could also decline even further than in previous cycles as participants are no longer early.