- Bitcoin’s daily and weekly charts both showed green signals

- On the contrary, market indicators took a bearish turn

Bitcoins [BTC] The price has remained bullish over the past week after a period of depreciation, with the crypto even rising above $68,000. However, this might not be the end of BTC’s bull rally.

In fact, a key metric showed that the cryptocurrency may continue to rise, indicating that investors should consider HODLing the coin in the coming days.

HODLing Bitcoin is… right?

CoinMarketCaps facts revealed that the price of Bitcoin has risen by more than 2% in the past seven days. This bullish trend has continued over the past 24 hours, with the crypto valued at $68,136 at the time of writing.

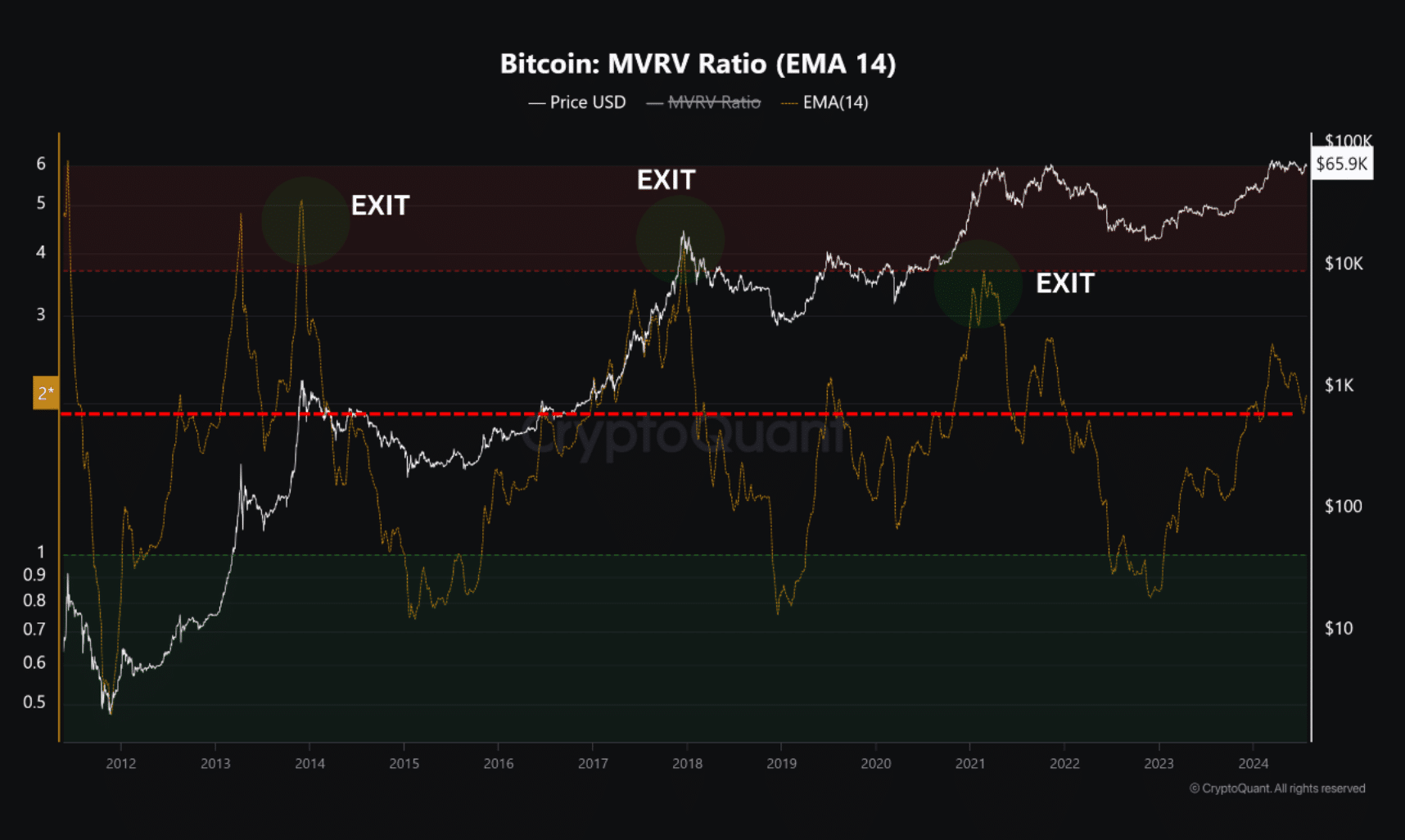

Meanwhile, Tarekonchain, an analyst and author at CryptoQuant, recently shared one analysis shows an interesting development. The analysis used one of the key indicators, the MVRV ratio, to predict what could be expected from BTC in the short term.

According to the same, the MVRV indicator, which is widely recognized as one of the most accurate for long-term investors to determine price peaks and troughs, might start to bounce from the critical level of 2.

This level marks the beginning of a period of volatility before continuing its rise. According to this indicator, Bitcoin still has significant growth potential before reaching its peak, which usually happens when the MVRV reaches a value of 4 or higher.

The said analysis,

“A safe exit strategy from the market should start gradually when the MVRV is in the range of 3.7-3.8.”

Source: CryptoQuant

Therefore, investors should plan for HODL as the chances of continued price appreciation appear likely.

In fact, like AMBCrypto reported earlieron July 25, Marathon Digital [MARA]The world’s largest Bitcoin mining company, announced the purchase of $100 million worth of BTC.

This development also suggested that investors should not consider selling BTC anytime soon.

What do the statistics say?

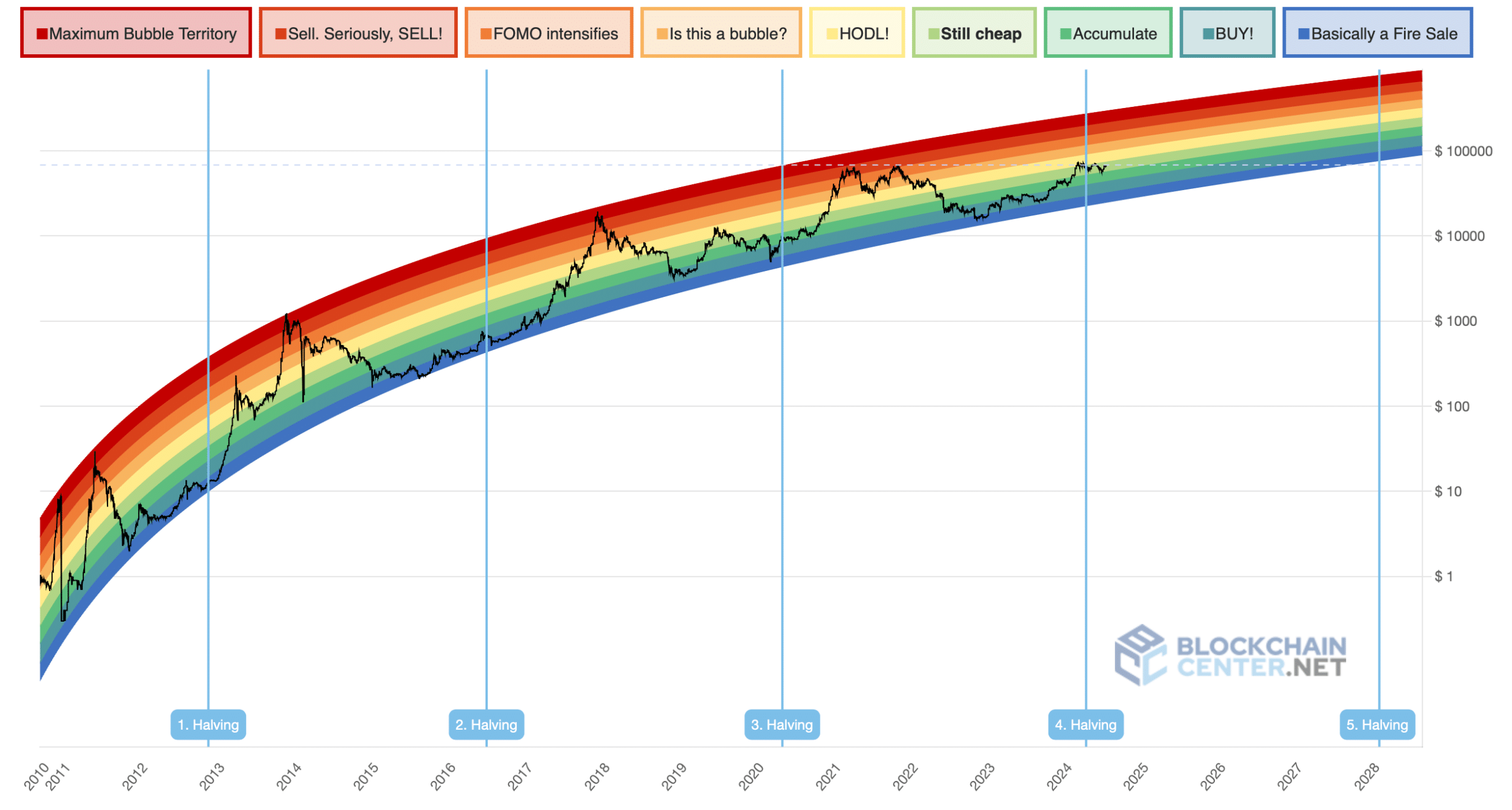

AMBCrypto then checked the Bitcoin Rainbow Chart to find out what this indicator suggested.

According to our analysis, the price of BTC is in the “still cheap” zone, which means that the chance of a price increase is still high.

Source: Blockchaincenter

Finally, our analysis of CryptoQuant’s facts revealed that net deposits of BTC on exchanges have fallen – a sign that selling pressure was low.

The binary CDD was also green. This indicated that the movement of long-term holders over the past seven days was lower than the average. Simply put, they have an incentive to hold on to their coins.

Read Bitcoins [BTC] Price prediction 2024-25

On the contrary, on the price charts, both BTC’s Relative Strength Index (RSI) and Money Flow Index (MFI) registered slight declines – indicating a possible price correction.