- The large transaction volume of Algo rose by 166%, indicating the rising interest rates.

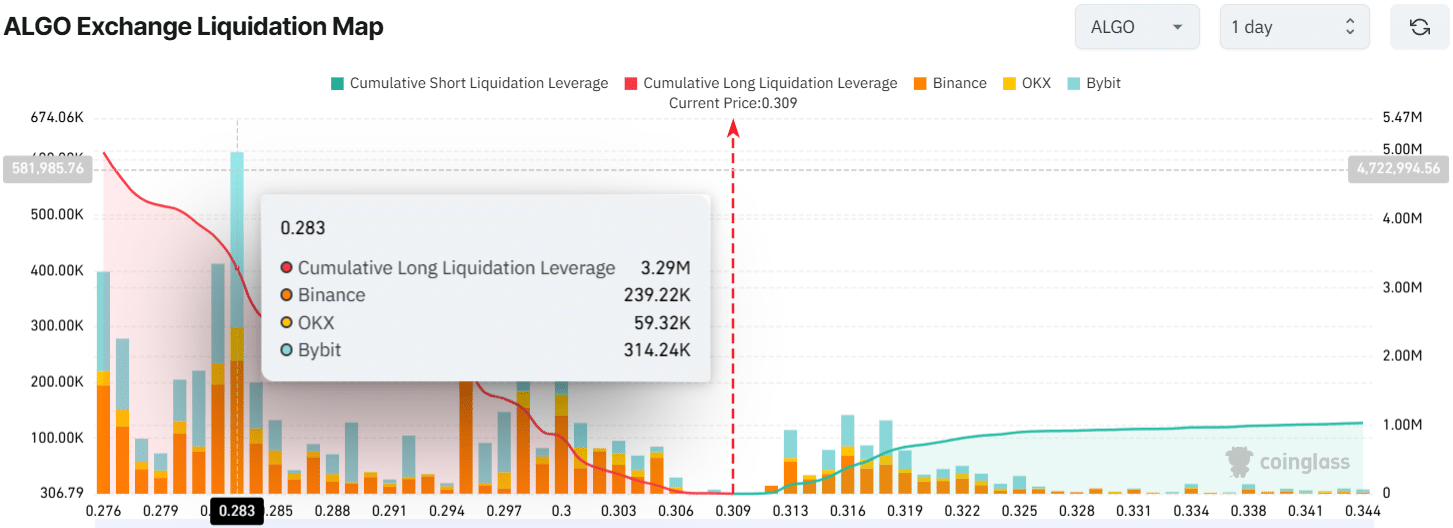

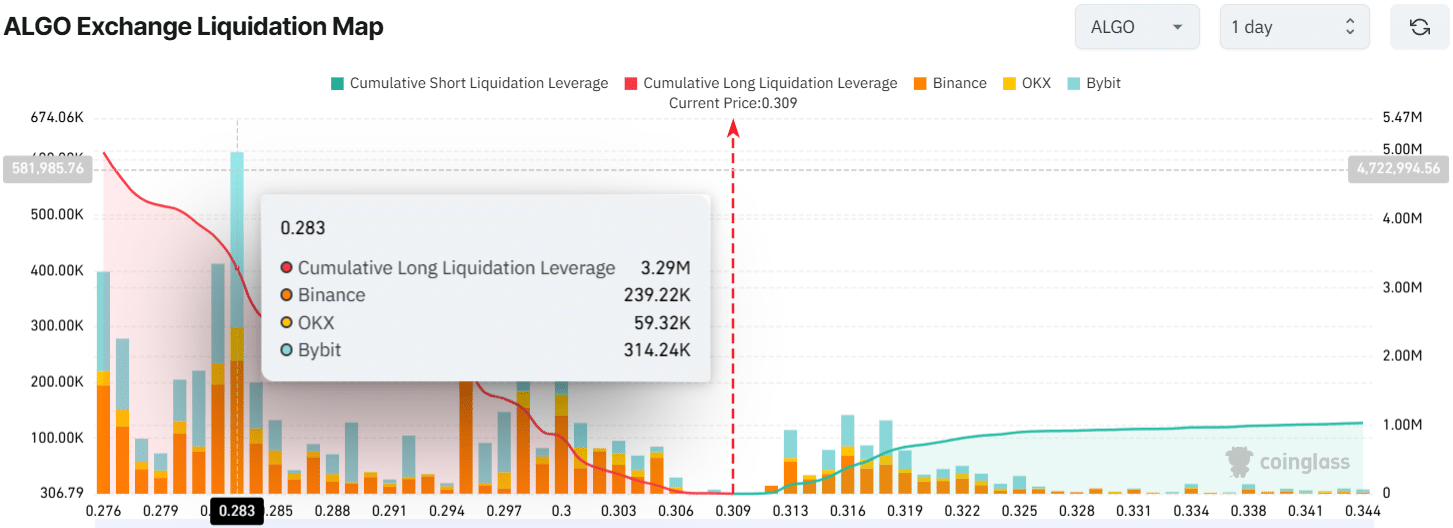

- Traders with long positions were supplied too much at the level of $ 0.283, with $ 3.29 million in open long positions.

After a remarkable price decrease of 45% in recent days, Algorand [ALGO] seemed to shift his market sentiment and show signs of a price rebound.

Nowadays this turning is driven by the increasing interest rate of investors and traders, in addition to bullish price action that is clearly visible in the Daily Algo Chart.

Algorand price promotion and key levels

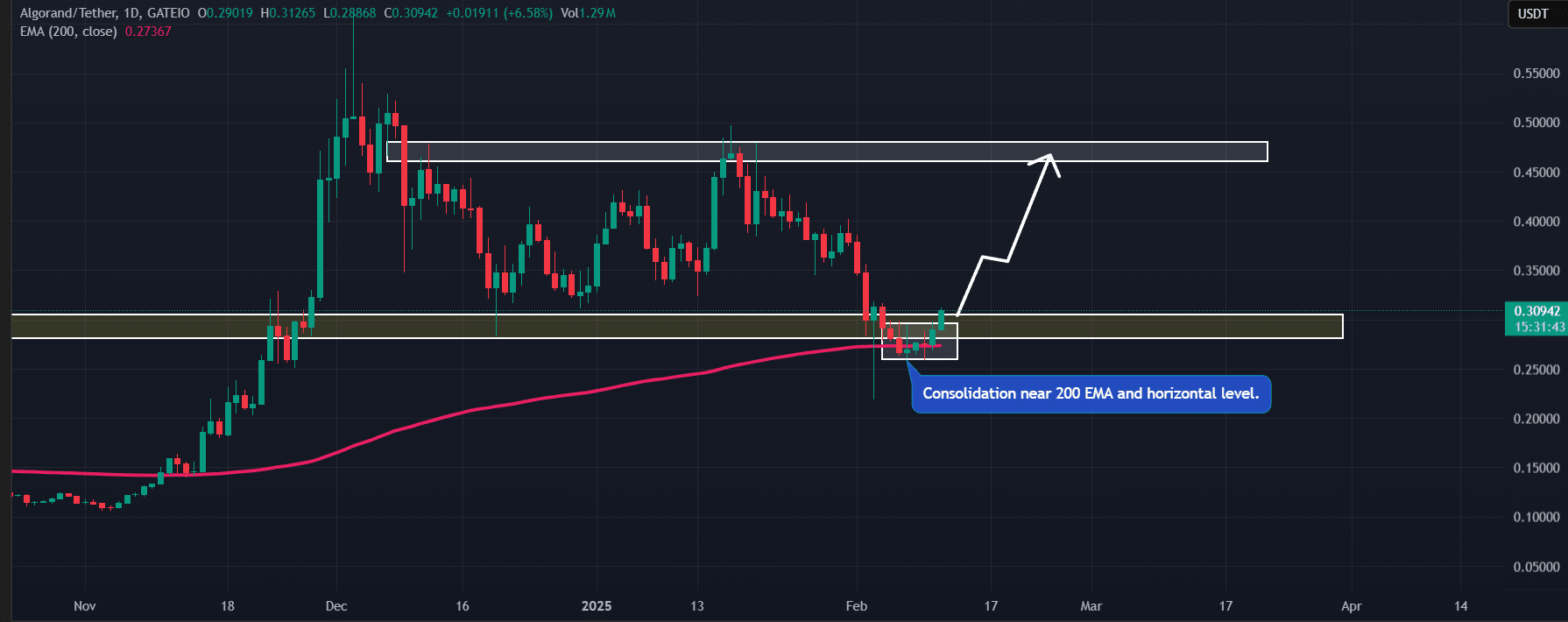

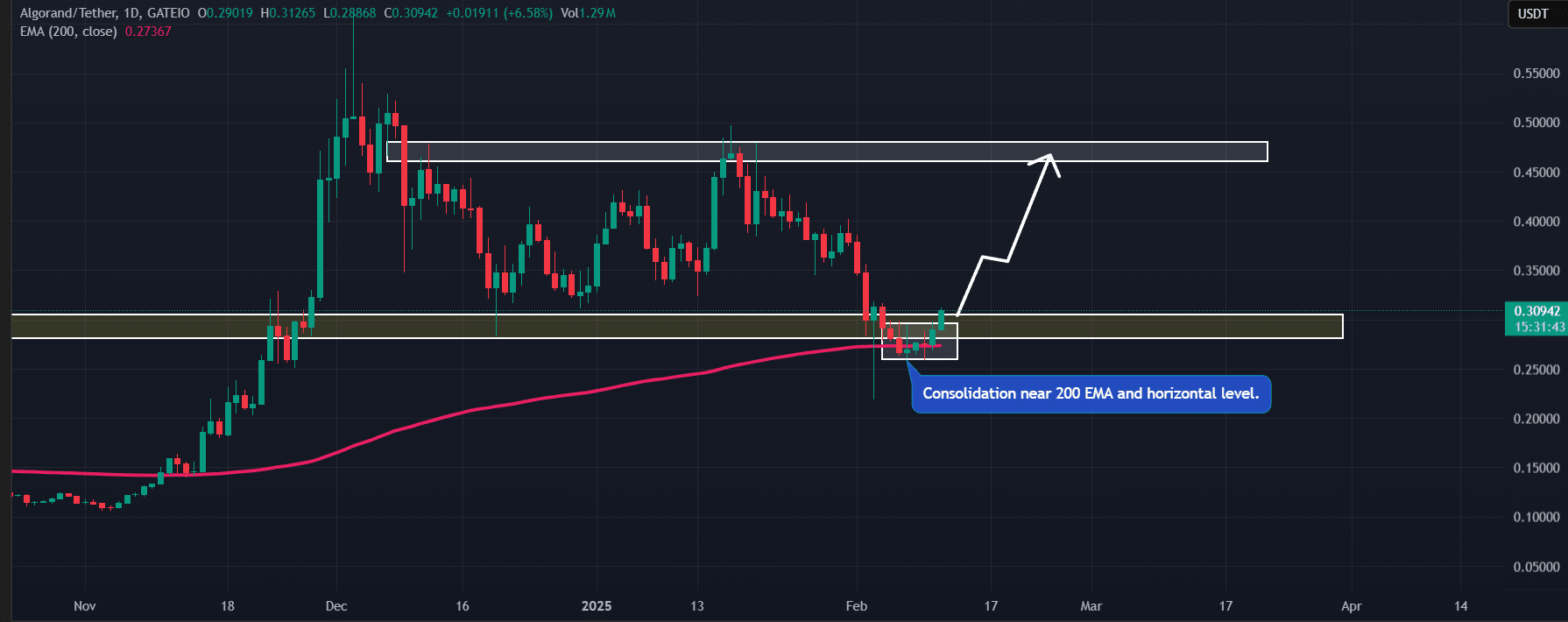

During the recent price fall, it actively reached a crucial level of support of $ 0.28, which has a strong history of price reverse.

However, the price remained at this support level within a narrow consolidation zone at consecutive weeks.

Now, as sentiment about the wider market shifts, Algo is broken out of this zone and shows the drawing of a price rebound.

Source: TradingView

According to the analysis of Ambcrypto, if Algo holds this profit and the daily candle closes above the level of $ 0.315, there is a strong possibility that it could rise by 50% to reach $ 0.45.

Algo not only found support at a crucial horizontal level, but also on the 200-day exponential advancing average (EMA), which enhanced its long-term bullish prospects.

Current price and interest of investors

Algo acted nearly $ 0.31 at the time of the press, with an increase of 9.50% in the last 24 hours.

With this price reputation and bullish price promotion, Algo’s Large transaction volume jumped with 166%, indicating the increased participation of investors and whales.

In the meantime, intraday traders have increased their open positions, as reflected by an increase of 11% in Open Interest (OI) in the last 24 hours.

Important liquidation levels

In addition to these statistics on the chain, intraday traders seemed to be very bullish, placing strong bets on the long side.

From data from the Exchange liquidation card from ALO showed that traders with long positions were used too much at the level of $ 0.283, with $ 3.29 million in long positions.

Conversely, $ 0.318 is another important level where traders with short positions were used too much, with $ 603,190 in short positions at the time of the press.

Source: Coinglass

Read Algorand’s [ALGO] Price forecast 2025–2026

These over-pasted positions are liquidated if the Algosprijs moves in both directions.

When these statistics on the chain are combined with the recent price promotion of Algo, it seems that bulls are currently dominating actively and can support the coming rally.