- BTC has over 138 million social activities, while LINK has over 50 million.

- Successive price developments have contributed to increased social activity.

Recent data indicates that Bitcoin [BTC] and ChainLink [LINK] experienced an increase in their social activity metrics. Examining their price trends provides insight into the underlying reasons for these recent increases.

Bitcoin and Chainlink lead social activities

Dates of Moon crushwhich ranks crypto assets based on social activity, revealed that Bitcoin and Chainlink claimed the top two spots respectively.

The chart compared the rankings of six different assets. This showed that Bitcoin generated more than 138.7 million interactions, while Chainlink collected 56.6 million interactions.

Chainlink’s social activity, in particular, was particularly intriguing as it surpassed Ethereum’s and exceeded the combined total of the remaining three assets.

The social activity metric indicates how many mentions these assets receive, which could be for a variety of reasons. These mentions can draw more attention to the item, both positive and negative.

Bitcoin and Chainlink see plenty of chatters

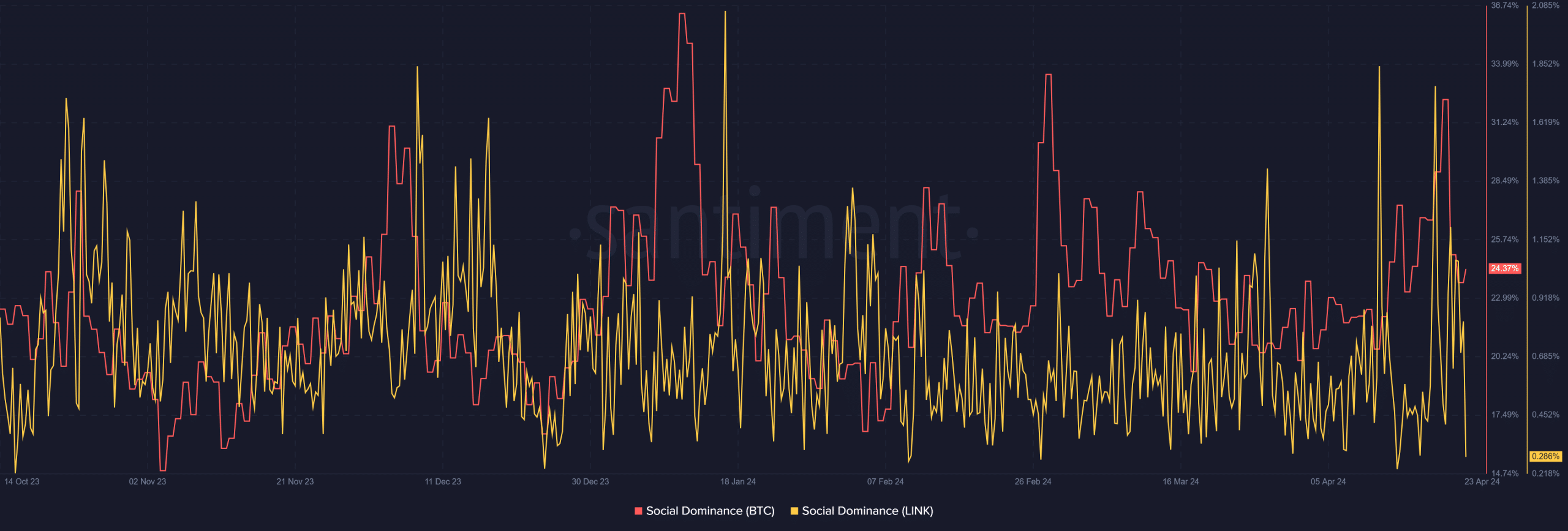

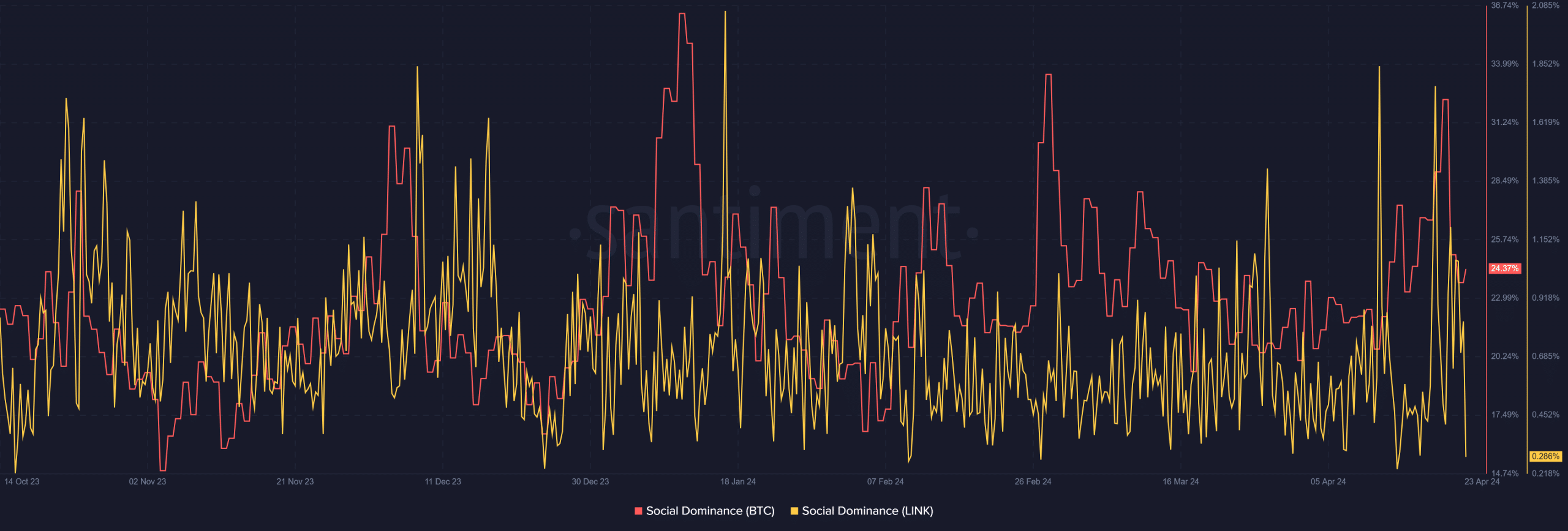

According to AMBCrypto’s analysis of Bitcoin social volume on Santiment, it was noted that on April 22, social volume was higher than the day before. However, compared to the days before, the social volume had decreased.

Despite this decline, Bitcoin’s social volume remained higher than Chainlink’s, as expected.

At the time of writing, the social volume for Bitcoin was over 1,100, while for Chainlink it was 18. On April 22, Bitcoin’s social volume reached over 5,200, while Chainlink’s was 199.

Source: Santiment

Furthermore, research on the Social Dominance Measure showed that Bitcoin had more than 25%. By comparison, Chainlink had less than 1% at the time of writing. This metric illustrates the percentage of discussions each asset occupies within the broader cryptocurrency discourse.

Reason for the increased social activity

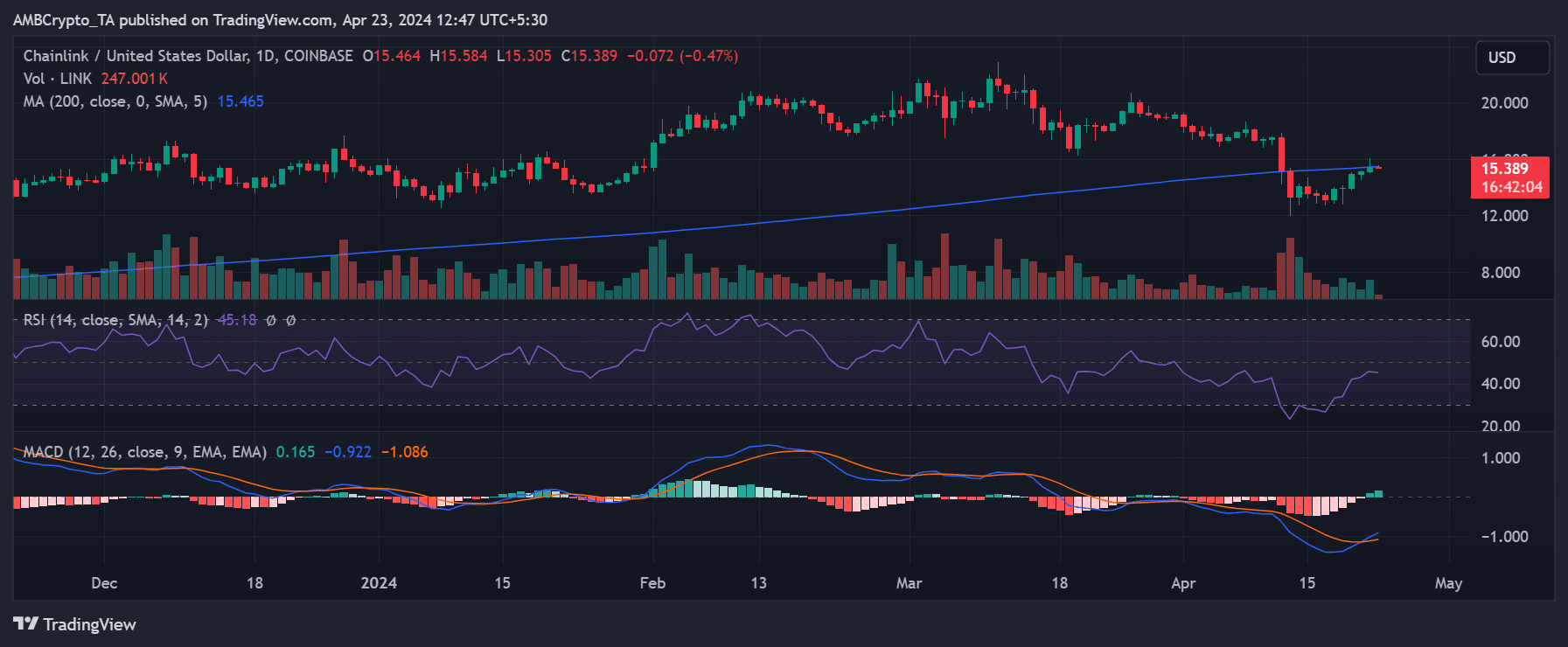

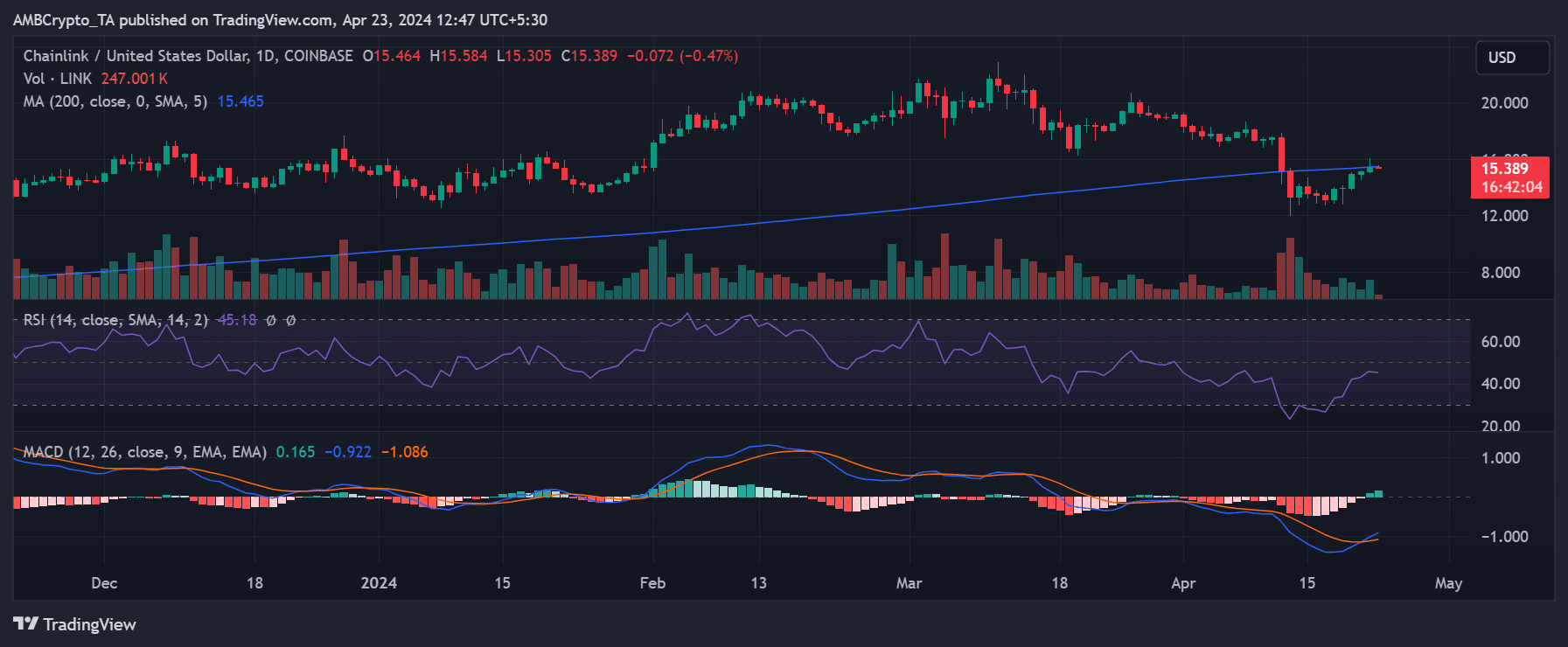

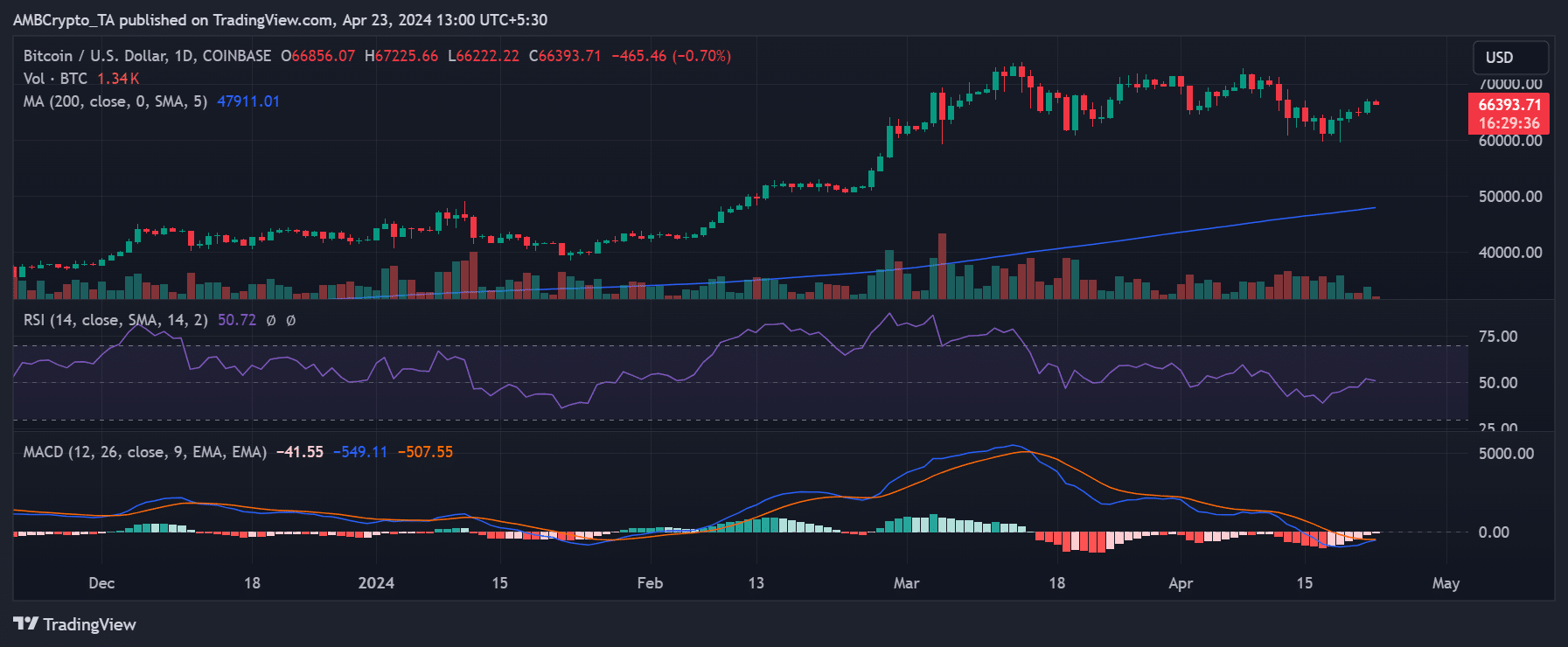

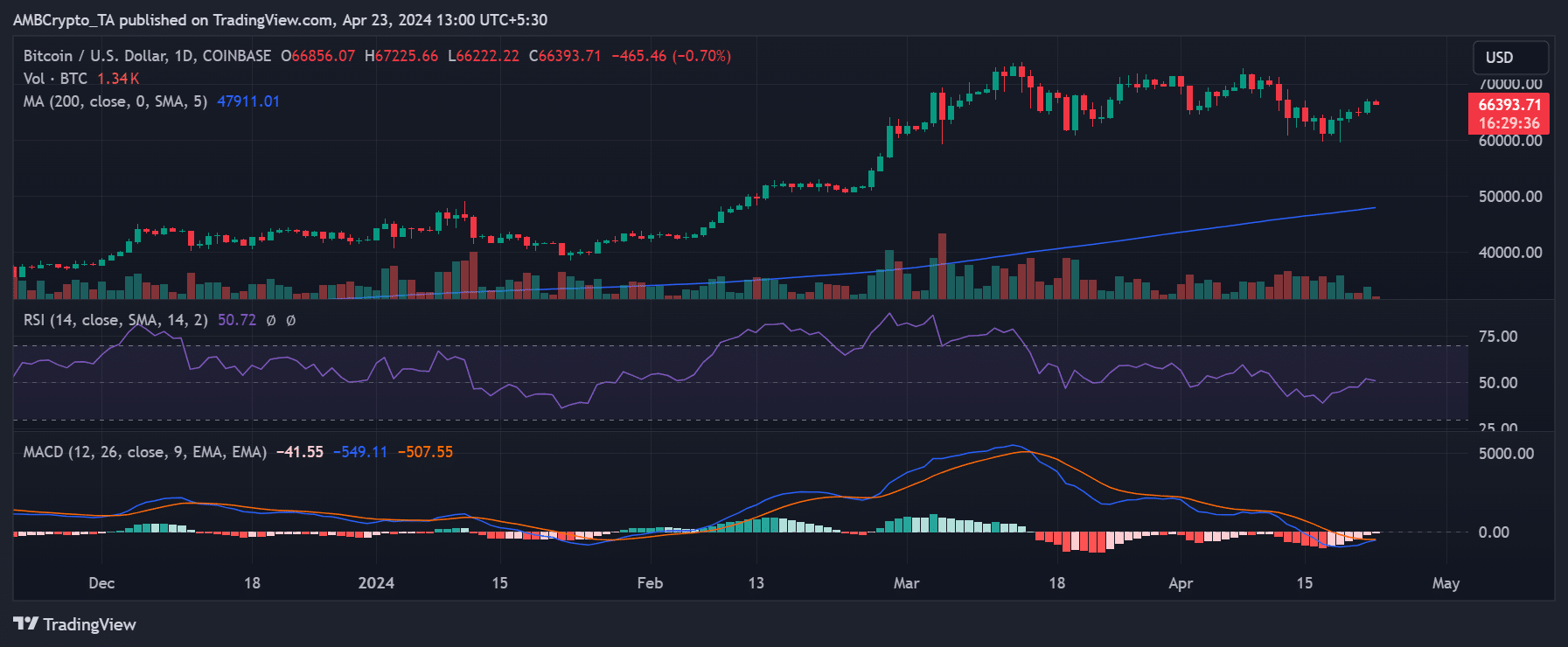

AMBCrypto’s analysis of the daily timeframes for Bitcoin and Chainlink sheds light on the recent rise in their social metrics. BTC and LINK have shown upward trends in recent days, albeit to varying degrees.

Analysis of the Chainlink chart shows a consistent uptrend over the past six days. As of April 18, LINK, up over 5%, was trading at around $13.89.

By the end of trading on April 22, the price had risen to $15.46, up 2.3%. At the time of writing, the stock was trading at around $15.38, with a small decline of less than 1%.

Source: TradingView

Likewise, Bitcoin’s chart suggests a similar trend, although a slight decline on April 21 interrupted the successive uptrend. Bitcoin saw a rise of over 3.8% on April 18, trading around $63,513.

By the end of trading on April 22, it had risen to around $66,859, reflecting an increase of almost 3%.

Source: TradingView

Realistic or not, here is LINK’s market cap in BTC terms

At the time of writing, BTC was trading around $66,250, down less than 1%.

The successive price increases and the attempts of both BTC and LINK to break into new price ranges have received a lot of attention, leading to the observed increase in social activity around these assets.