Oracle’s decentralized network Chainlink and its native token LINK have grown impressively in the past month. Despite experiencing a correction since late December, when LINK hit a 20-month high of $17.6, the token is showing signs of renewed bullish momentum.

Key Resistance Levels for LINK Price Rise

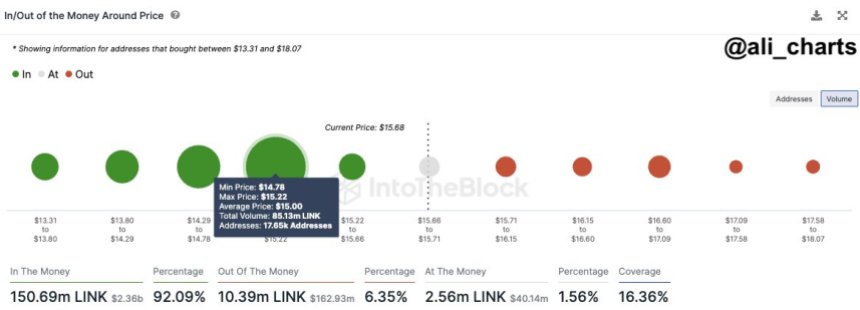

Renowned crypto analyst Ali Martinez has done just that identified a robust demand zone for Chainlink between $14.8 and $15.2, slightly below the current trading price of $15,415.

Within this range, many addresses (17,650) purchased 85.12 million LINK. With limited resistance, LINK appears well positioned to head towards $20.

Based on the analyst’s observations, if the current bullish momentum of the past seven days continues, LINK could reach the top soon. Price point of $20. Looking at the 1-day chart of LINK, the next resistance levels that need to be overcome before potentially rising towards $20 are $15.55, $16.69, and $16.92. Crossing these levels would pave the way for a clear path to the $20 mark.

However, it is important to note that in the absence of major walls of resistance, the battle for the next direction of LINK’s moves remains equally balanced. In the event of another price correction or selling pressure, the token lacks significant support walls to rely on.

If we analyze the 1-day chart of LINK, the first support level in the event of a decline would be around $14.22. If this level is breached, the next support will be at $13.31. A further decline could test the support at the $11 price level. A break from this level could mark a break in LINK’s four-month bullish structure.

Chainlink ecosystem growth

Despite the struggle for supremacy between LINK’s bulls and bearsThe protocol’s ecosystem has shown remarkable growth in key metrics since the last update. For example, Chainlink’s circulating market cap is $8.35 billion, which reflects a positive growth rate of 3.58%.

According to TokenTerminal factsIn terms of revenue in the last 30 days, Chainlink has generated $11.67 thousand. However, this figure shows a decline of 54.16% compared to the previous period, indicating a decline in revenues during this period.

Considering the fully diluted market cap, which takes into account the maximum number of Chainlink tokens that could exist in the future, the value is $14.82 billion. This metric recently saw a slight increase of 3.48%.

When it comes to gain on an annual basis, Chainlink has generated $219.81 thousand. This represents a positive growth rate of 2.64%, indicating an upward trend in corporate profits over a year.

In terms of financial ratios, Chainlink’s price to fully diluted ratio is calculated at an astounding 68,246.47x. This measure compares the company’s market capitalization to its fully diluted market capitalization. It reflects the premium that investors will pay for each unit of potential future tokens.

Similarly, on a fully diluted market cap basis, the price-to-sales ratio is reported to be 68,246.47x. This ratio measures the company’s valuation relative to annualized revenue and indicates how much investors will pay for each dollar of revenue generated.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.