- AAVE targeted $180-$200 as a bullish pennant shape, signaling strong market potential going forward.

- The increased volume and MACD crossover indicated bullish momentum, but traders were eyeing a possible pullback.

Aaf [AAVE] is on the verge of a new bullish breakout, according to to crypto analyst World of Charts.

The analyst predicted that AAVE’s price could quickly move towards $180-$200 if a bullish pennant pattern plays out successfully.

At the time of writing, AAVE was trading at $134.67representing an increase of 6.30% in the last 24 hours and an increase of 9.40% in the last seven days.

This outlook follows a recent prediction from the same analyst on September 4, where AAVE posted a gain of almost 24% and has now broken a new bullish pennant pattern within the one-hour time frame.

World of Charts predicted a potential price increase of 20-25% if this trend continues.

Technical indicators indicate bullish sentiment

The AAVE chart indicated a strong upward move with the price surpassing the key resistance level at USD 130. The Bollinger Bands widened, indicating increased market volatility.

The price was trading near the upper band, which could indicate overbought conditions, but the 20-period moving average provided support, indicating continued bullish momentum.

Source: TradingView

Moreover, the MACD indicator reflected continued bullish momentum, with the MACD line crossing above the signal line.

Although the histogram bars are shrinking, indicating a possible weakening in momentum, traders are closely monitoring a possible bearish crossover.

Such a signal could lead to a trend reversal in the short term.

Trading volume reflects buyer interest

The recent price increase of AAVE has been supported by an increase in trading volume. In the last 24 hours, AAVE has seen trading volume of $338,983,007, indicating strong buyer interest.

However, volume is starting to show signs of a slight taper, raising concerns that buying pressure may ease.

Analysts are paying close attention to any volume spikes that could confirm the continuation of upward momentum or signal the start of a correction.

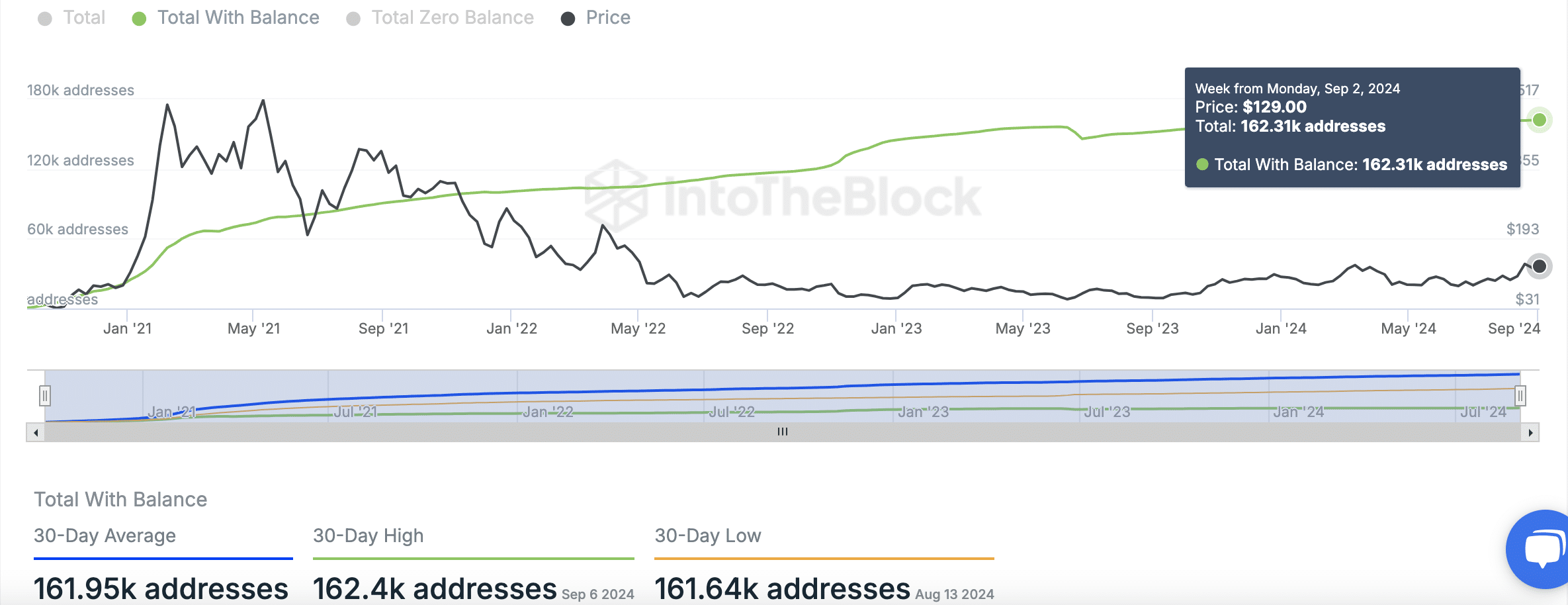

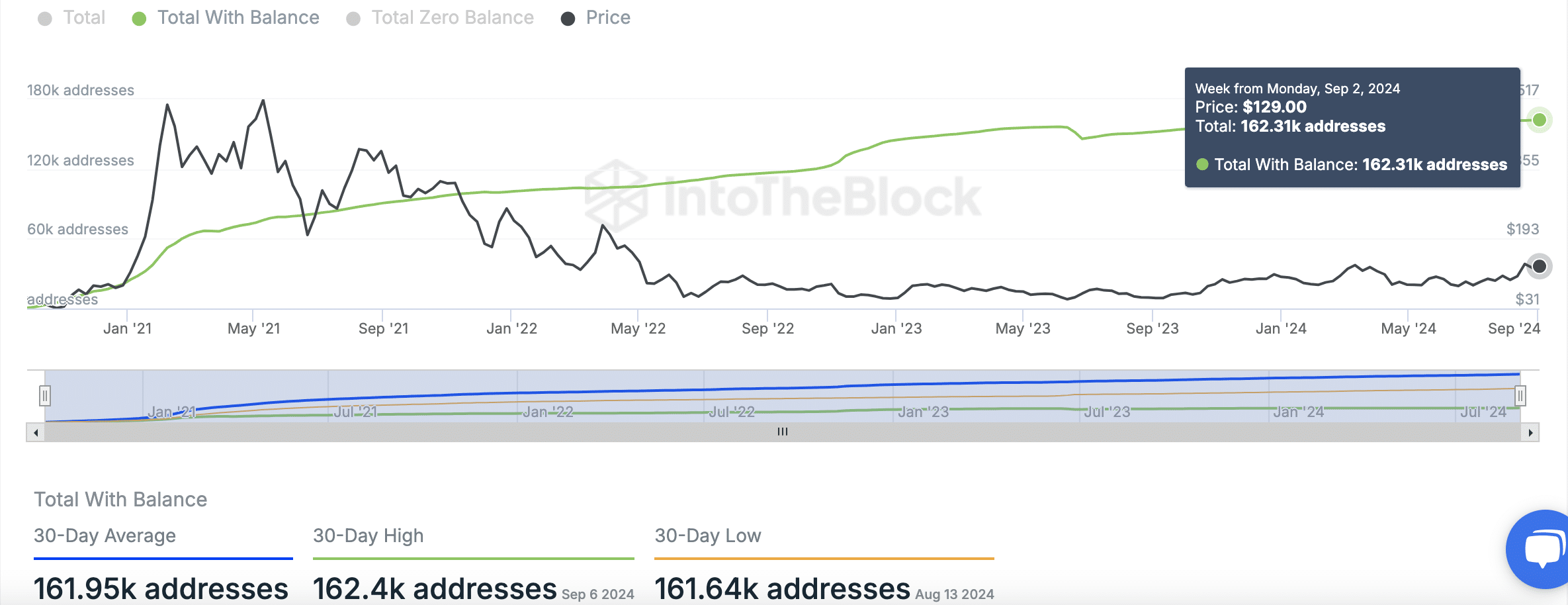

The AAVE network has also shown consistent growth in user activity. As of September 2024, the total number of addresses with a balance has reached approximately 161.95k.

This growth trend reflects strong user retention and increased interest in the protocol, despite continued fluctuations in AAVE’s price.

Source: IntoTheBlock

According to data reported According to AMBCrypto, the AAVE/USDT pair has shown steady price increases, forming a pattern of higher highs and higher lows.

Read Aave’s [AAVE] Price forecast 2024–2025

The weekly candle recently closed above the true close of a consolidation range that has lasted for more than 800 days.

Should AAVE’s price experience a decline, analysts suggest that the $108 support zone will be crucial for maintaining the uptrend.