- AAVE has created a bullish market structure after last week’s decline below local support

- In the short term, a rally above $200 seemed likely

Aaf [AAVE] rose 49.7% over the past five days, surpassing the local high at $180.74. The altcoin had established the $137-$140 region as a support point, but fell below it on November 4.

This divergence was followed by a quick rally, confirming the bullish intent behind AAVE. However, further gains can be expected and the resistance at $206 is the next target. And yet, there is a chance that the $190 zone could slow down the bulls.

AAVE turns $180 in support

Source: AAVE/USDT on TradingView

On November 7, the AAVE climbed past the September high at $180.7. On November 8, the price saw increased volatility, but the bulls were able to defend the $180 level as support.

The Fibonacci extension levels at $206 and $248 would be the next bullish targets. The RSI on the daily chart climbed decisively above the neutral 50. In addition to the price action, this indicated that more gains were likely. However, the OBV struggled to clear the mid-September local high.

This seemed like a warning that buying pressure must be sustained to increase the chances of an AAVE uptrend. However, at the time of writing, price action was encouraging for the bulls and long positions were feasible.

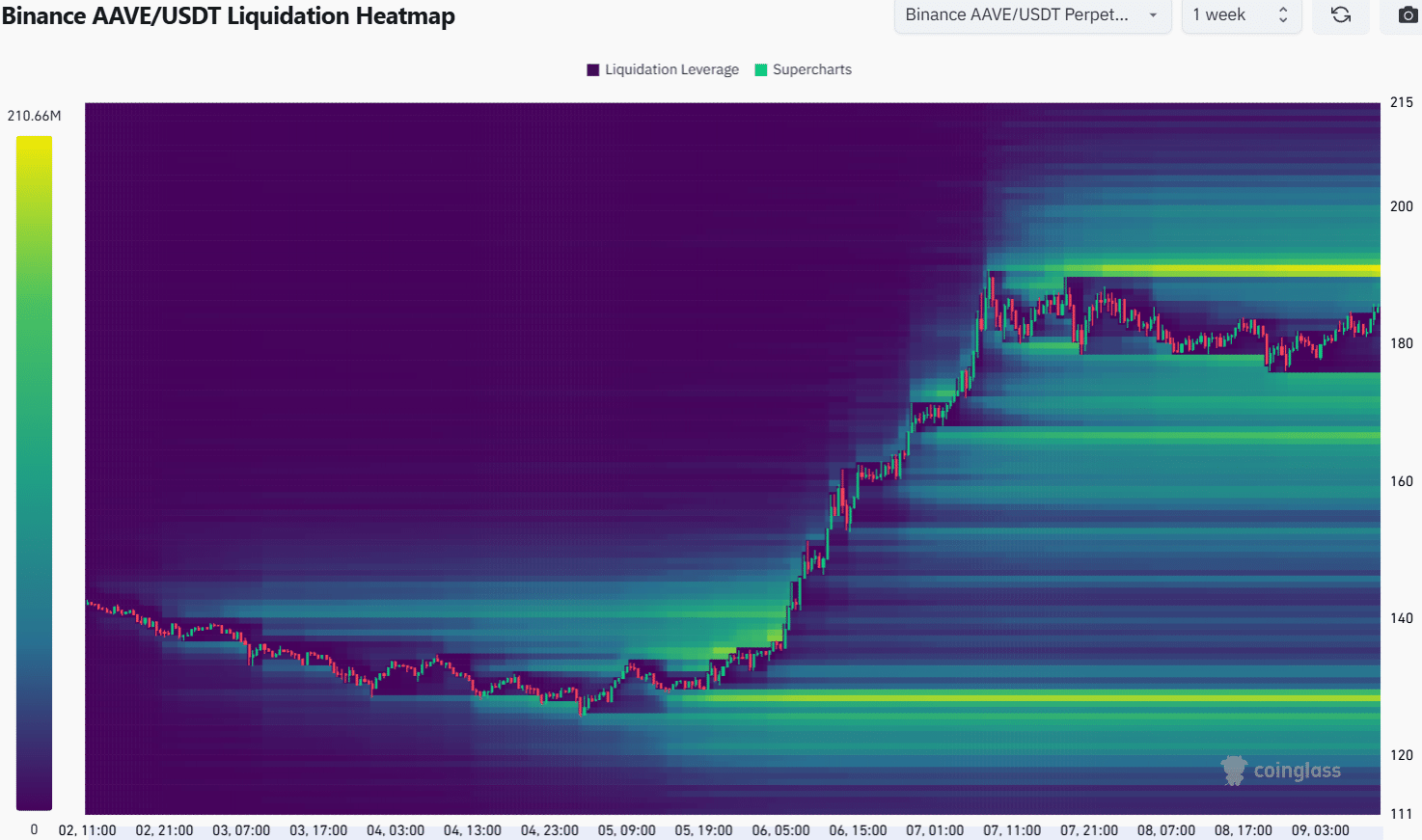

Liquidity pools can cause volatility

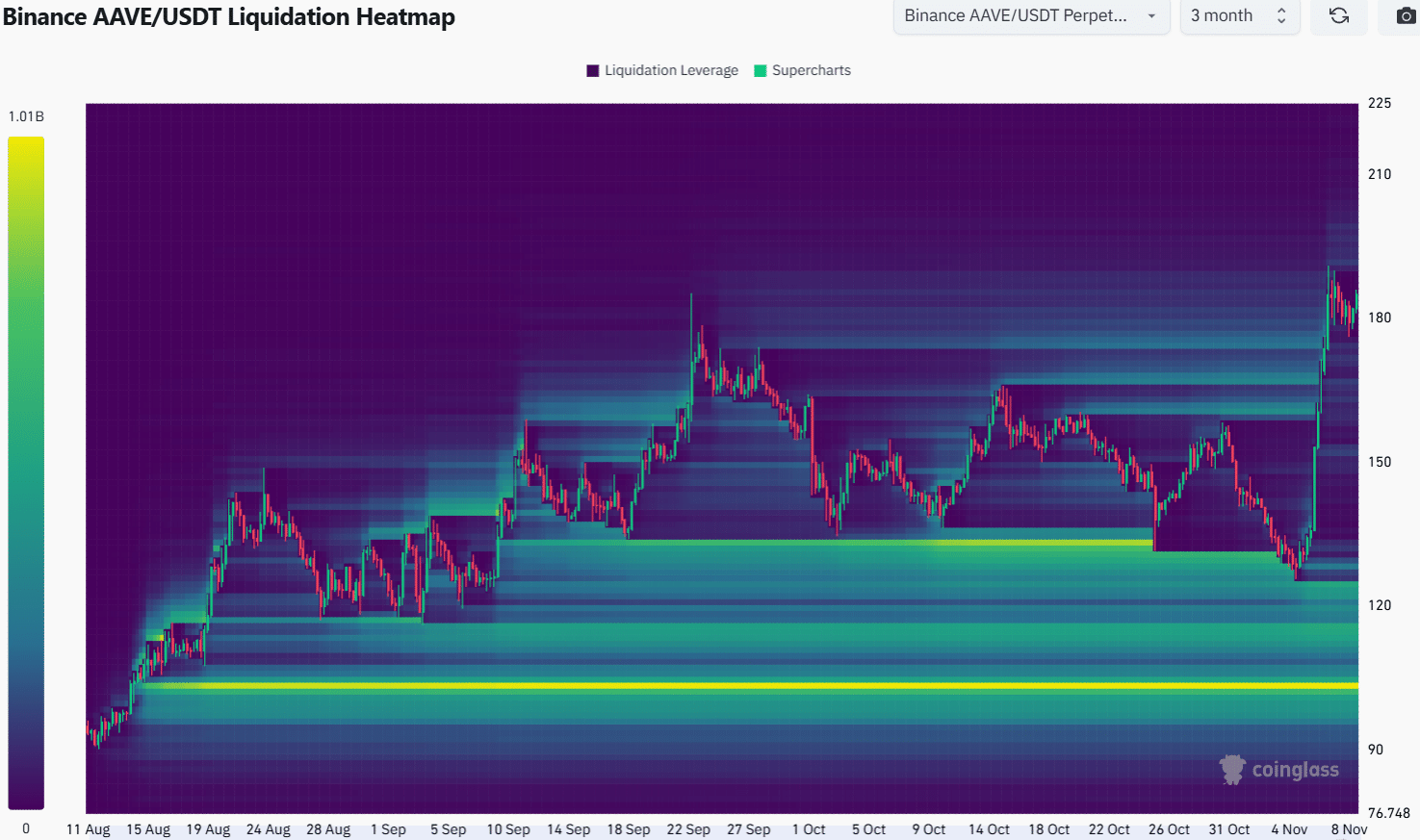

The heatmap of the three-month lookback period outlined the $133, $128 and $121 as regions with significant liquidity. The first two were swept in the second half of October.

The bullish sentiment behind Bitcoin [BTC] helped AAVE rebound strongly after diverging below $130.

The one-week heatmap showed that the $190 region has accumulated a significant number of short liquidation levels over the past two days. This area will probably be visited soon. It is possible that the $171-$175 zone will also be revisited.

Read Aave’s [AAVE] Price forecast 2024-25

Buyers should expect further gains, but the short-term liquidity pools around $190 and $170 could provide volatility before a move past $200 after the weekend.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer