- Aave was outperforming most cryptocurrencies at the time of writing.

- Aave’s financing rates showed a bullish bias.

Aaf [AAVE] appears poised to outperform other cryptocurrencies, with the AAVE/BTC chart showing this trend.

The AAVE/USDT pair has been steadily rising, forming higher highs and lower lows. Recently, the weekly candle closed above the true close of a consolidation range that has lasted more than 800 days.

Should the price of AAVE experience a decline on the daily chart, the $108 support zone will be crucial.

As long as the price remains above this zone, the resistance levels can serve as potential price targets.

Source: TradingView

If the price stays above $150, it could aim for the $200 mark before this cycle ends.

However, it is very likely that Aave will reach the $108 price level before heading towards the $200 target.

The financing rates will become green

According to the Hyblock Capital tool, financing rates have turned green, indicating growing optimism among traders about Aave’s pricing potential.

Positive funding rates indicate rising demand for long positions, creating upward momentum as the market anticipates higher prices.

Combined with the current price action of AAVE/USDT, Aave is likely to move higher.

Source: Hyblock Capital

However, if there is significant downward movement, it may be best to stay on the sidelines or cut losses.

Market performance

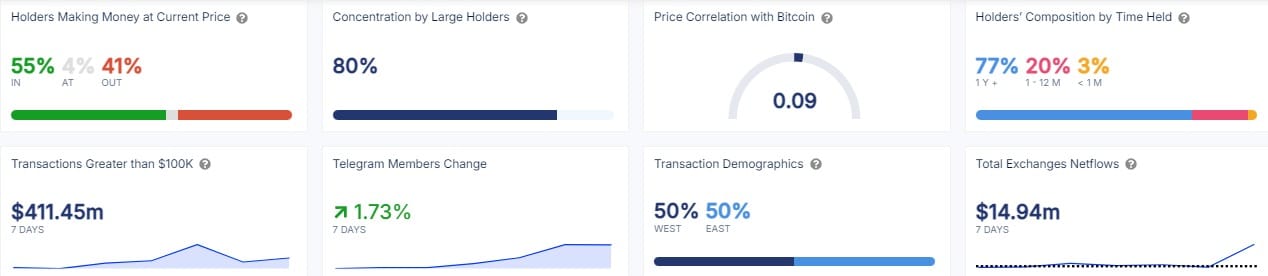

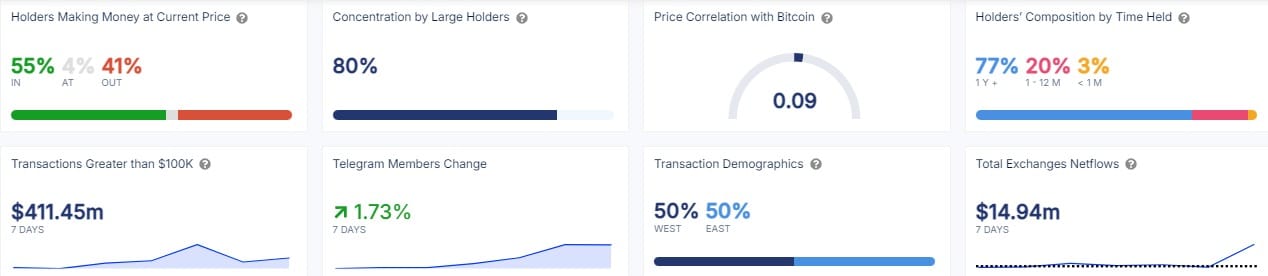

Market performance further supports this bullish outlook. Currently, more than 55% of Aave holders are making a profit at the current price level.

This is a positive indicator as these holders are less likely to liquidate their positions. Furthermore, 80% of Aave’s supply is concentrated among large farmers, adding to expectations of an upward trend.

A large portion, approximately 77% of Aave holders, have owned their tokens for more than a year.

Source: IntoTheBlock

Additionally, large transactions over $100,000 have totaled more than $411 million and Telegram membership has increased by 1.73%.

Net currency inflows currently stand at $14.94 million over the past seven days, providing additional support for a potential price increase.

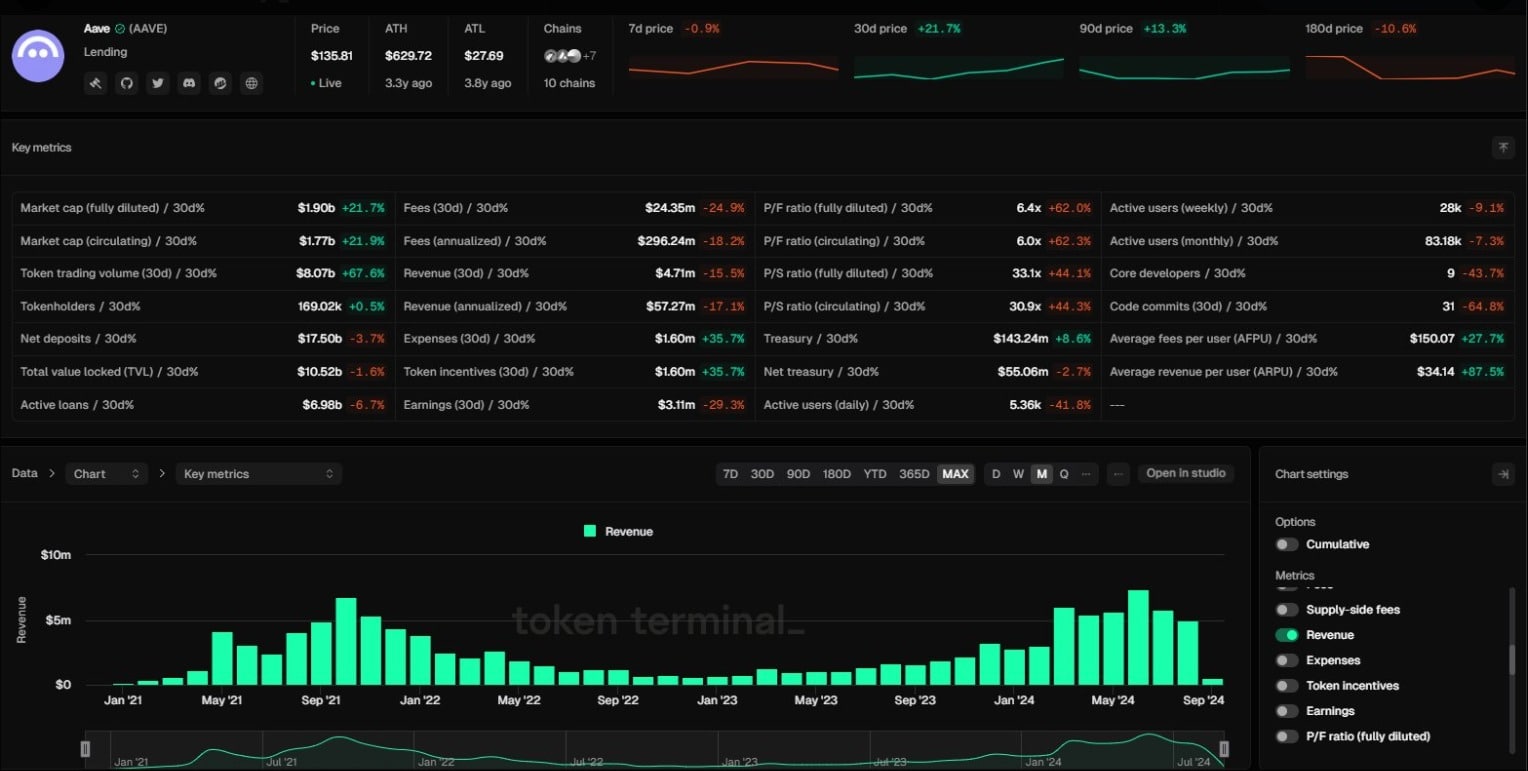

Monthly turnover increases

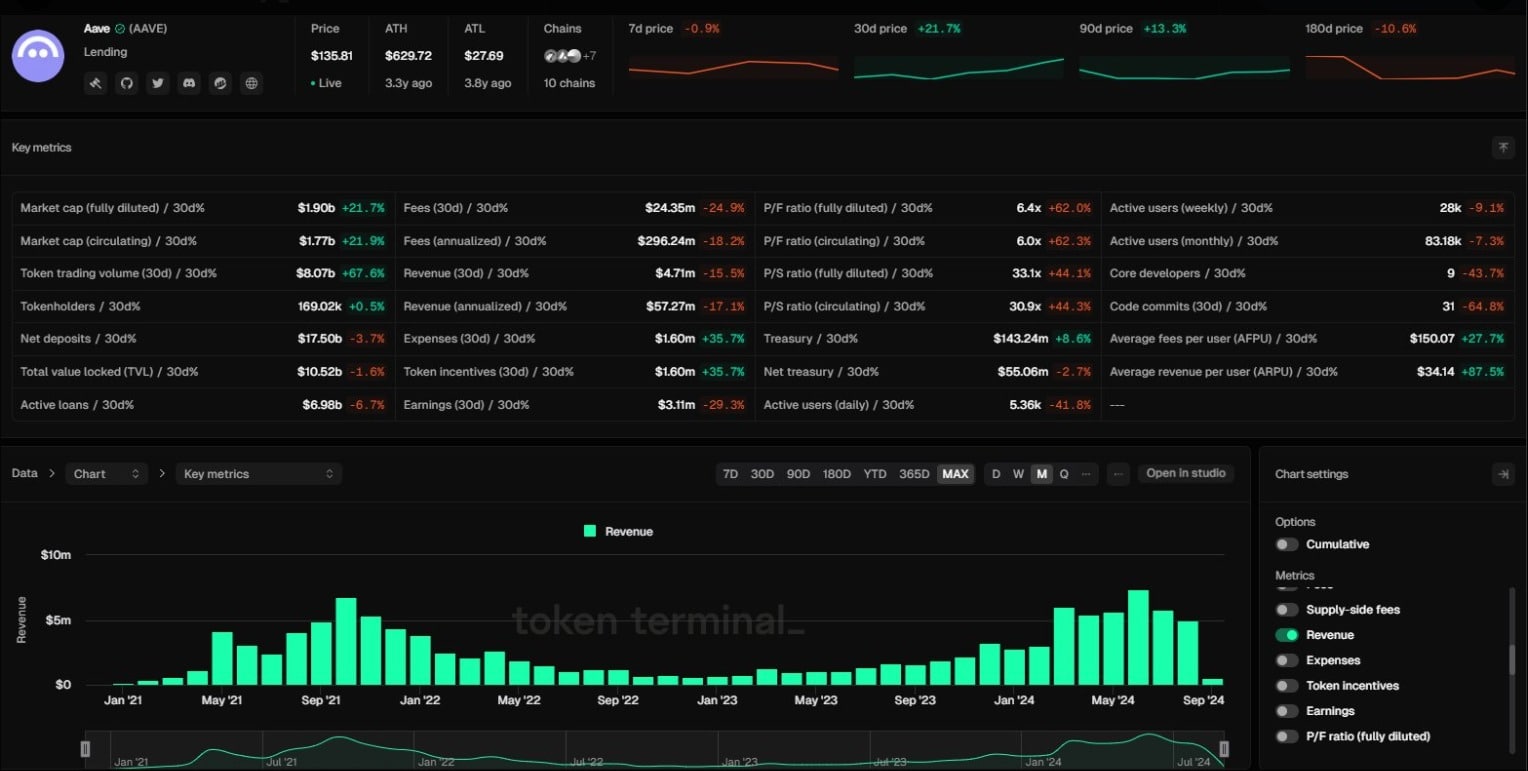

In terms of revenue, Aave has surpassed the monthly revenue high of the previous cycle. Aave now generates $1 million in weekly revenue while handing out only $327,000 in AAVE incentives.

It is also one of the few protocols to exceed their previous revenue peaks, bringing in $7.3 million in July 2024, which is about 9% higher than October 2021 figures.

Read Aave’s [AAVE] Price forecast 2024–2025

The protocol has been gaining market share against its competitors over the past two years, demonstrating product-market fit (PMF).

Source: Token terminal

Additionally, a proposal introduced in July 2024, which proposed adding a fee change to return a portion of the platform’s net excess revenue to token holders, has further supported the token’s strong price performance this year.