- Bitcoin has lost 2.5% of its value over the past 24 hours

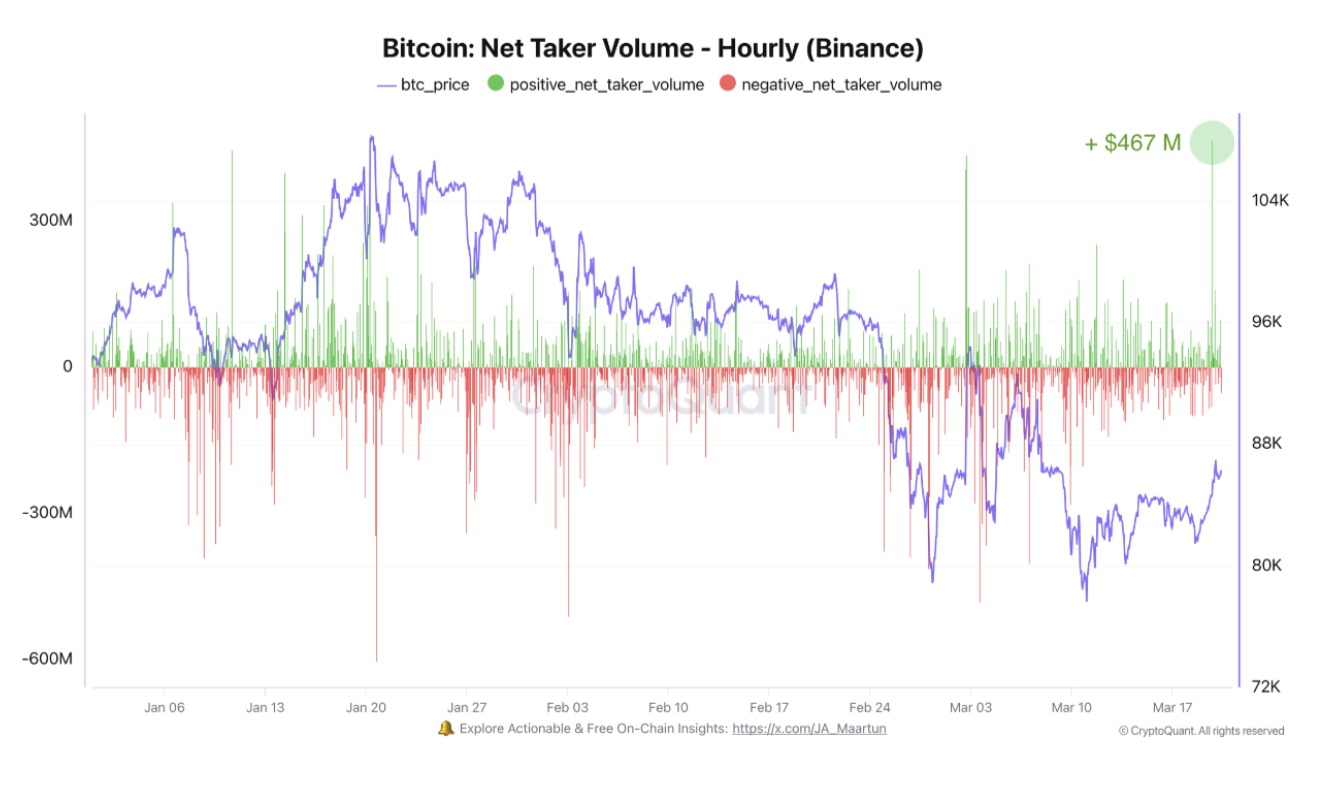

- Bitcoin’s Binance Net Taker -Volume reached a highlight of 2025 of $ 467 million in the charts

In the past week, Bitcoin [BTC] has registered a strong revival, whereby the crypto climbs from a local low of $ 76,600 to a high point of $ 87,470.

The newest price pump is a sign of a possible shift in market dynamics, in which buyers slowly return to the market. In fact according to Cryptoquant’s Bitcoin now sees analysis now a potential walk when buying pressure. Accordingly, the net tone volume on Binance rose by $ 467 million -the highest level of 2025 -in the last day.

Source: Cryptuquant

Such a huge volume peak refers to a stronger buying pressure than selling. Since Binance has the highest trade volume, the revival can mean that sentiment and growing trust among investors are improved.

The rise in trust and the purchasing pressure can be seen further in circulating supply, especially for coins of ≤1 week. At the time of writing, this cohort had fallen by 50% from 5.9% to 2.8%. Such a dip usually means a sharp reduction in all available bitcoin to act.

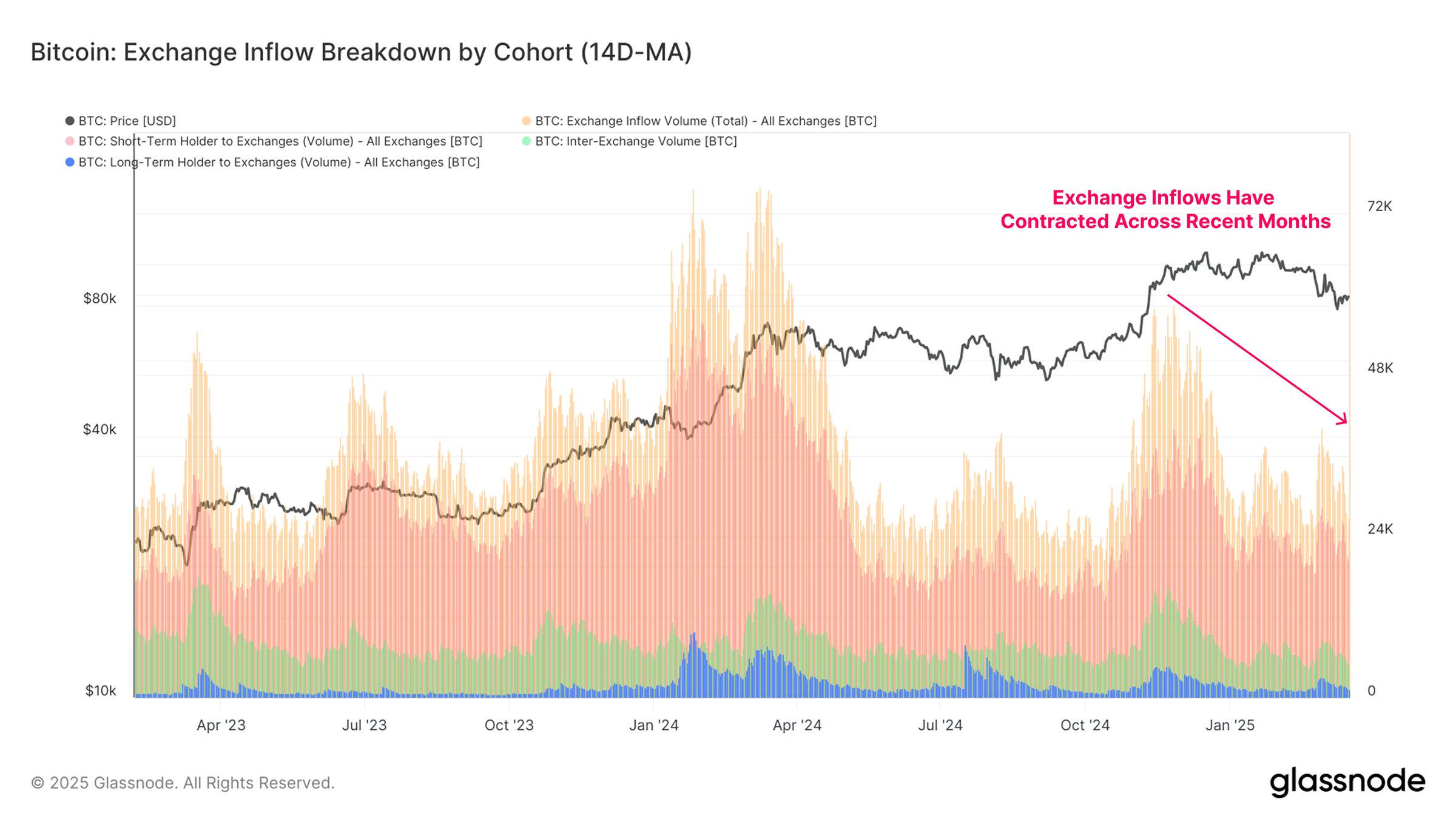

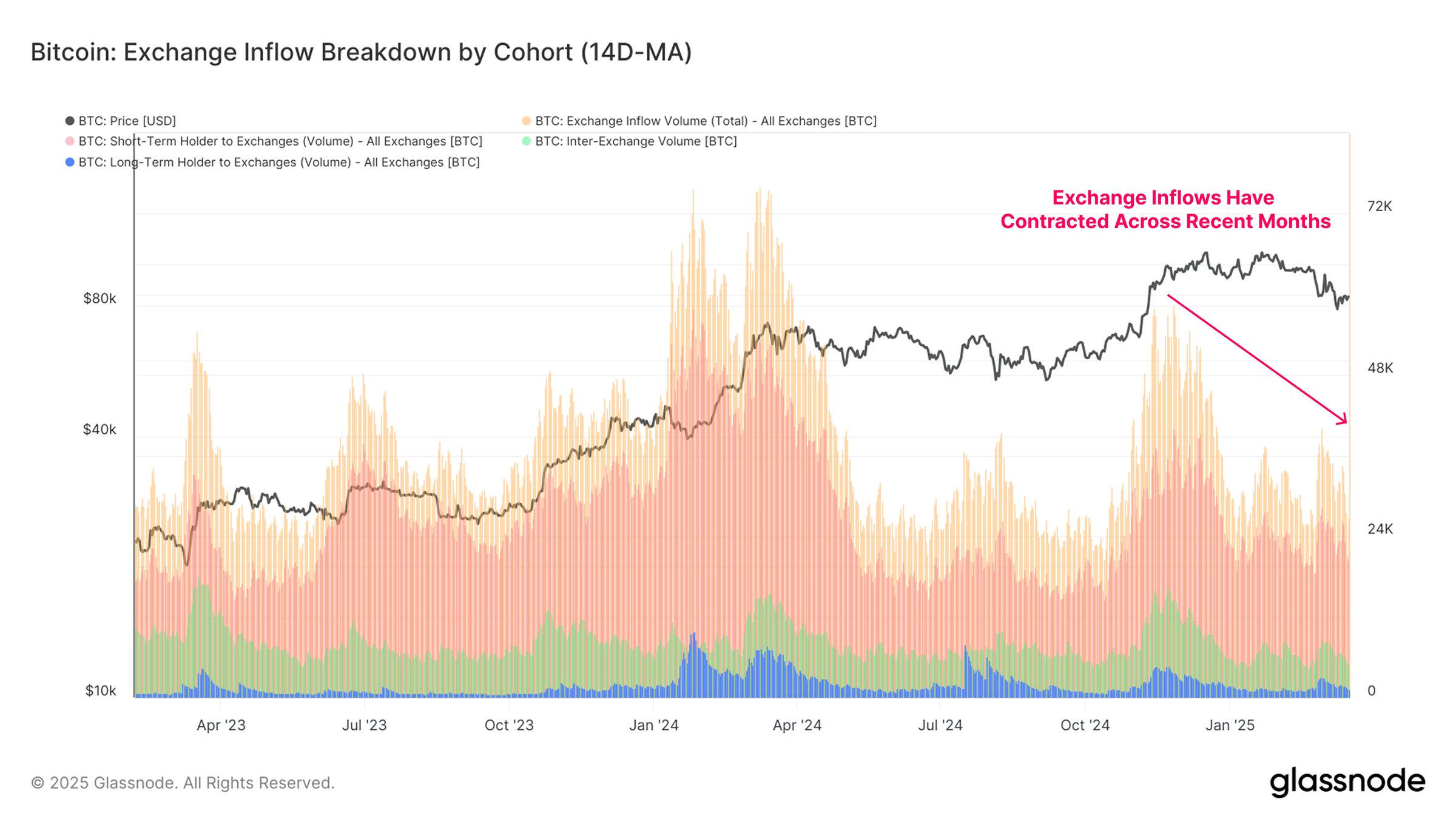

Source: Glassnode

This trend can also be validated by BTC Exchange intake, with the same falls from 58.6k to 26.9k BTC/day, according to Glassnode.

This meant a decrease of 54% – in accordance with capital flows and investor sentiments. Usually a lower inflow with higher capital flows refer a decrease in sales side activity.

What do Bitcoin’s graphs say?

Well, Bitcoin buyers are back on the market. However, that is not all, because BTC also sees a high accumulation percentage for the participants in the market.

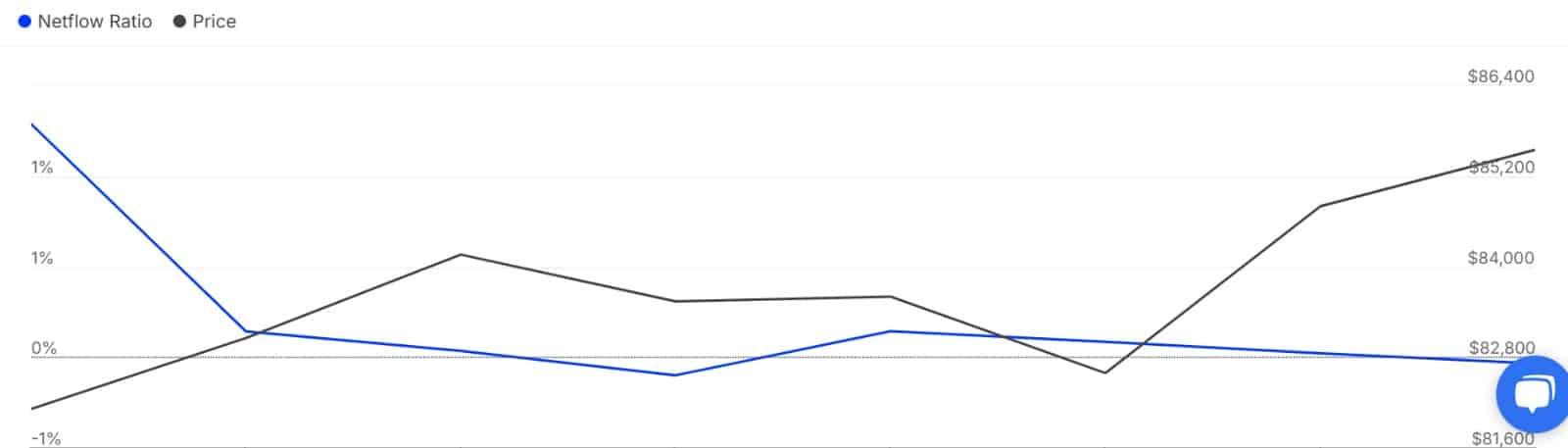

Source: Intotheblock

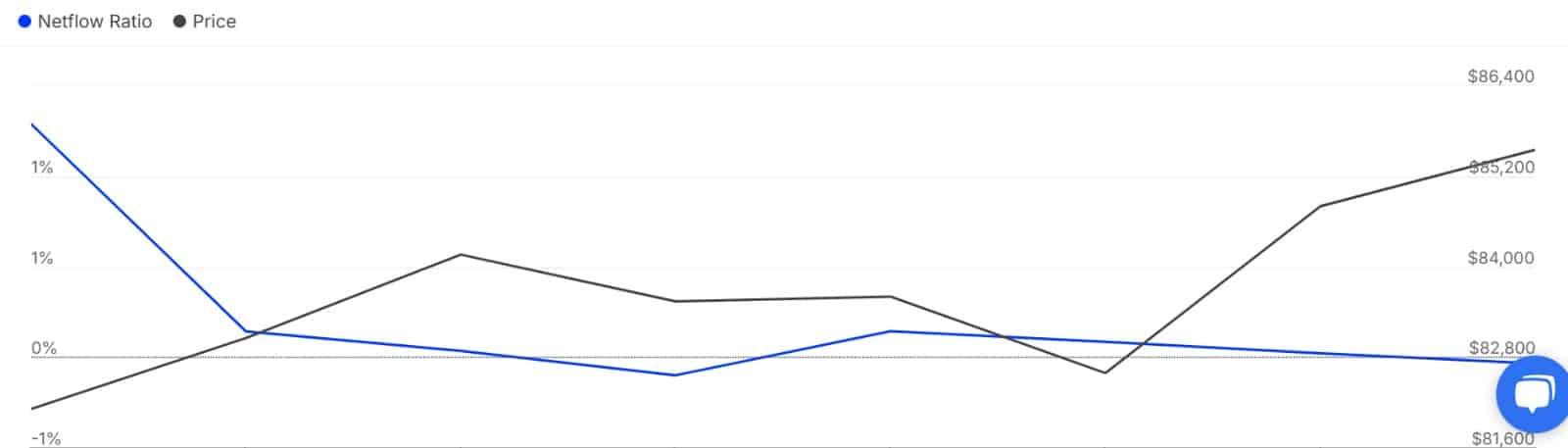

To begin with, look at the behavior of whales, we can see that whales buy more than they sell. As such, the large holders of Bitcoin fell to change the Netflow ratio from 0.17% to -0.04%.

When whale exchange becomes a negative value, it means that whales withdraw more from stock markets than they deposit. Such market behavior is a sign of strong bullish sentiments of large holders.

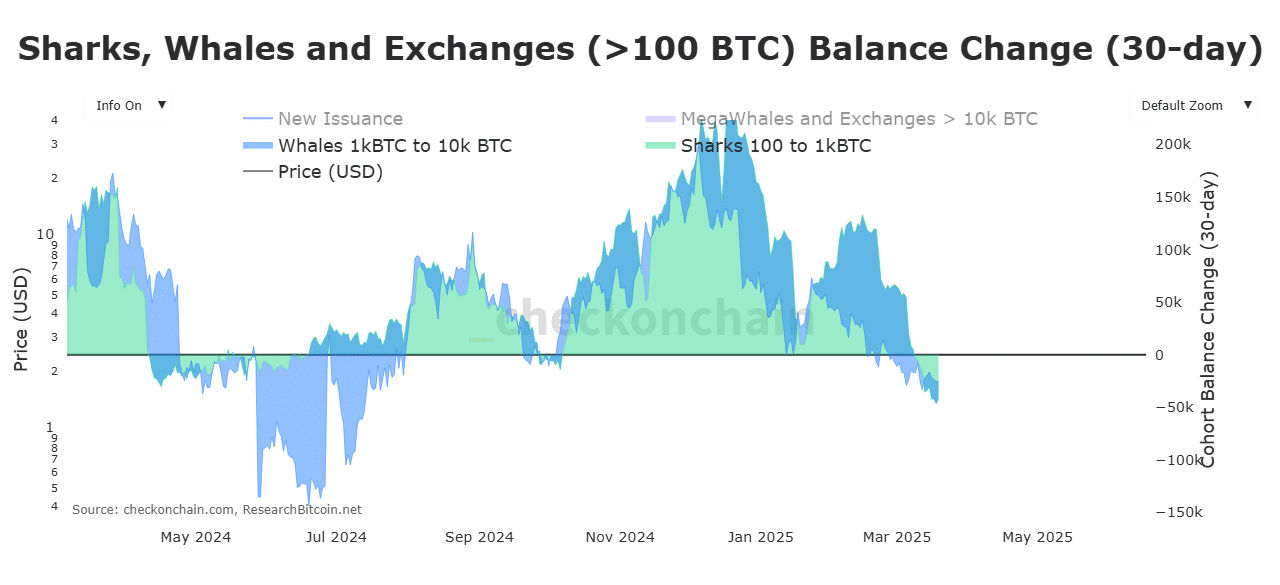

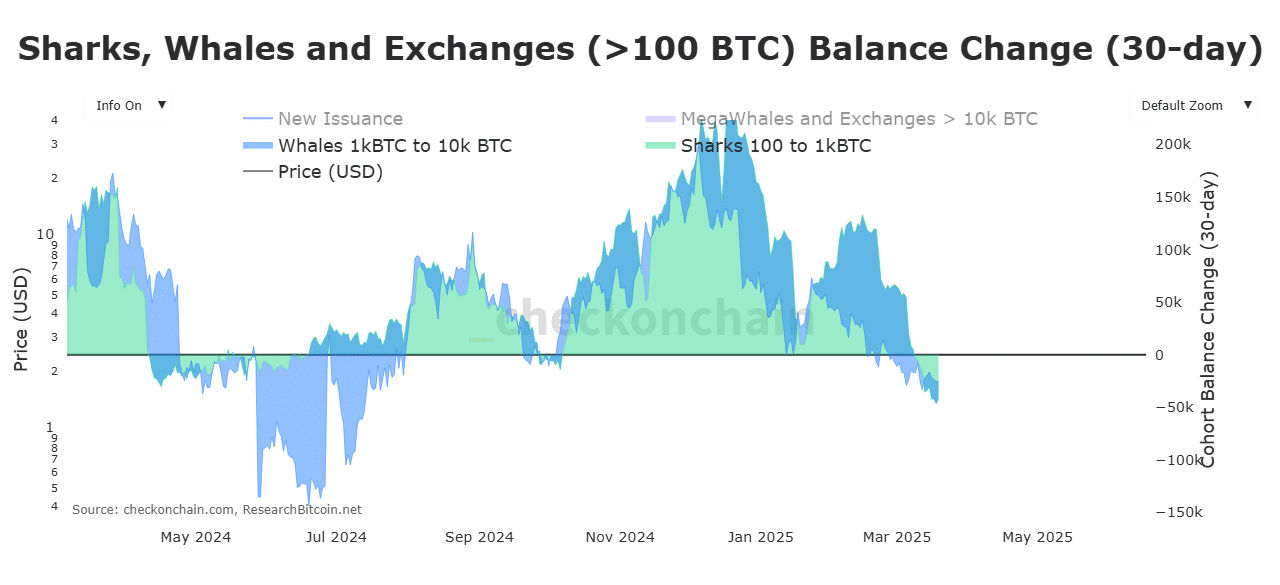

Source: Checkonchain

This trend can be further demonstrated by a falling shark, whales and exchange rate change in the last 30 days.

According to Checkonchain, both sharks and whales registered a falling exchange balance in March 2025. In fact, figures for both sharks and whales, referring to more withdrawal of fairs and therefore an increase in the accumulation of both sets of holders.

What does this mean for Bitcoin?

Historically, a higher purchasing pressure means a strong demand for BTC, which usually leads to higher prices. With buyers who made a comeback in the market, we could see Bitcoin a sustainable recovery on the price charts.

Therefore, if the question that is seen in the past week, BTC could win the $ 86k resistance level. A persistent movement above this level will strengthen the crypto to reclaim the $ 90k level.

On the contrary, as buyers who bought BTC under $ 80k, can see a pullback fall to $ 82,000.