- Ronin’s TVL is up 66% this year.

- However, the number of users in the same period has decreased.

Ronin [RON]the Ethereum sidechain created to power the play-to-earn game Axie Infinity [AXS]has experienced significant growth in recent months, particularly in terms of total value locked (TVL).

Quick update on Ronin Network ($ron).

I am very pleased with the progress $ron made in recent months. Here’s why. A wire…

🧵(1/12) pic.twitter.com/h5WgIWwAq0

— Space G (@magicians1029) July 15, 2023

Read Axie Infinity’s [AXS] Price Forecast 2023-24

According to a Twitter user, despite not focusing on DeFi, the Ronin Network has maintained a strong TVL of around $80 million over the past two months. This TVL outperforms several popular Layer 1 (L1) networks, such as Aptos [APT]Near [NEAR]algorithm [ALGO]Tezos [XTZ]and Stacks [STX]despite the latter having a higher market cap than Ronin.

To put this in perspective, though $ron doesn’t focus on DeFi at all, it still has a much higher TVL than most of your favorite L1s like $app, $at, $algo, $xtz, $stx etc. all of which have a much higher market cap than $ Ron 🤔

🧵(9/12) pic.twitter.com/YpFbA5RXnb

— Space G (@magicians1029) July 15, 2023

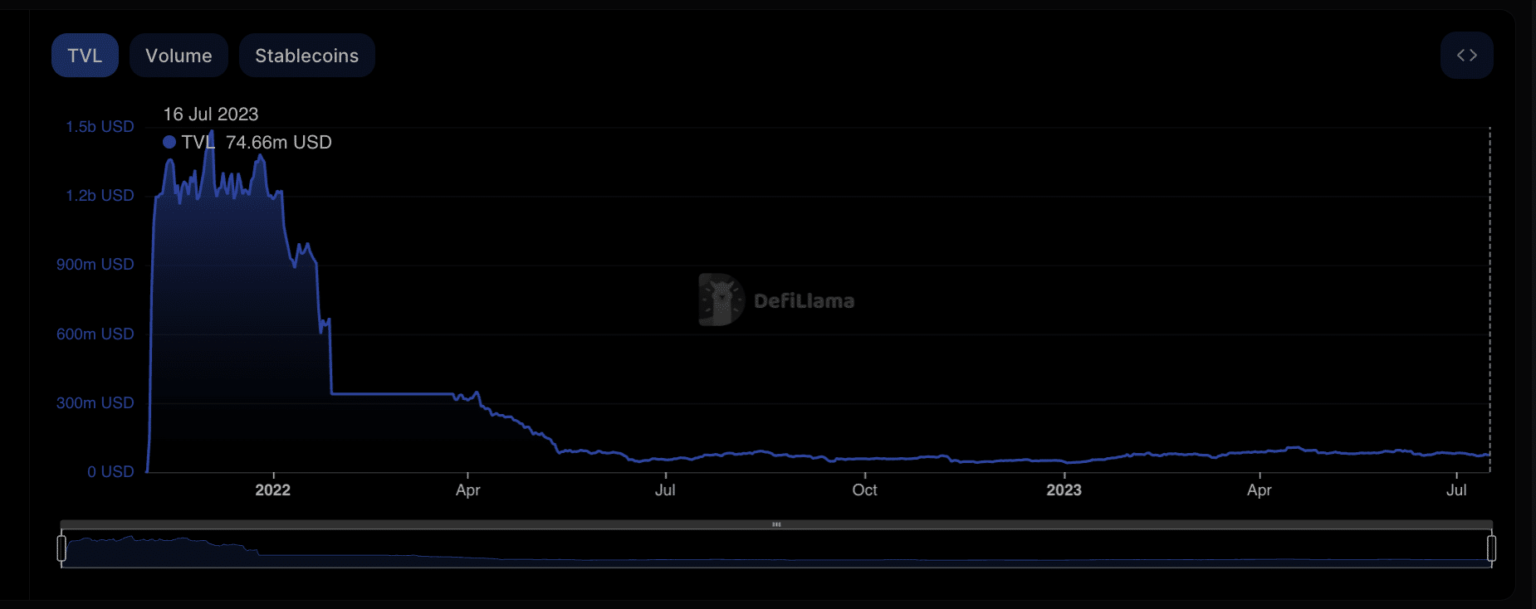

For additional context, data from Defillama revealed significant growth in the sidechain’s TVL since the start of the year. On January 1, Ronin’s TVL was $44.86 million. At $74.66 million at the time of going to press, it has grown 66% since then.

While TVL is on an upward trend so far, it was notable that it has dropped 78% since the Ronin Bridge hack on March 23, 2022. Since its reopening on June 28 of the same year, TVL is up 35%.

Source: DefiLlama

TVL may have risen, but other stats point to an ailing chain

While Ronin’s TVL may have increased in recent months, an on-chain assessment of the sidechain’s network activity revealed a sharp drop in network activity over the same period.

Dates from Nansen revealed a significant drop in the number of daily active addresses on Ronin since March 23. After peaking at 186,403 active addresses that day, the number of daily active users has since plummeted by 92%.

Source: Nansen

Furthermore, there has been a decrease in the number of processed transactions on Ronin since the beginning of the year. Axie Infinity relies on Ronin to facilitate all transactions and store its digital assets such as Axies, Land, SLP, AXS and Wrapped ETH (WETH). At its peak in November 2021, Ronin handled a whopping 560% of the total number of transactions on Ethereum.

Realistic or not, here is the market cap of AXS in terms of BTC

However, as the game’s popularity has declined since its peak, the number of transactions has decreased significantly, currently averaging less than 100,000 transactions per day by 2023.

Source: Nansen

With a continued decline in interest in the game to earn, the number of new Axies being hit on a daily basis has dropped to new lows, while there are practically no new holders left.

Source: Nansen