Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

CRYPOQUANT CEO Ki Young Ju today announced that Bitcoin’s bull’s bull’s cycle “is over” and warned investors to brace themselves for “6-12 months in Bearish or sideways prize action.” This development comes after the veteran on the chain analytics had prefers caution, but had maintained a measured outlook on the market in two weeks ago.

Has the Bitcoin Bull run over?

In a message that was shared today via X, Ki stated: “Bitcoin Bull Cycle is over and expects forish or lateral price action for 6-12 months.”

Related lecture

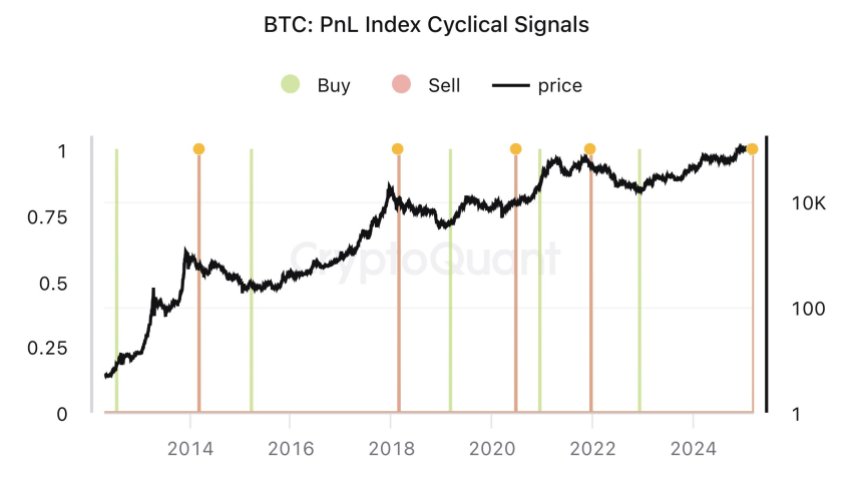

Together with the comment, the CEO emphasized the Bitcoin PNL indexcyclic signals-one index that aggregate multiple on-chain statistics, such as MVRV, SOPR and NUPL, to locate market tops, soils and cyclical turning points in the price of Bitcoin. According to Ki, this indicator has offered historically reliable purchase and sales signals.

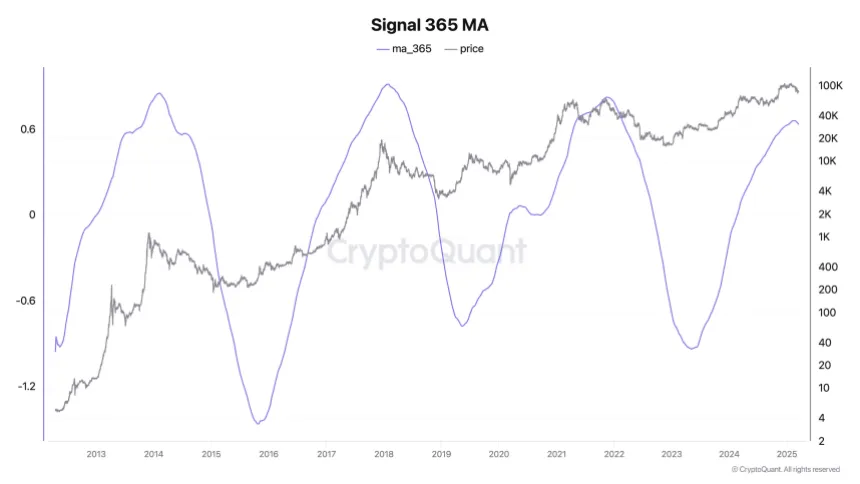

He further explained how an automated warning, which was previously sent to his subscribers, combined these statistics with a progressive average of 365 days. As soon as the trend changes in this 1-year advancing average, this often means a considerable bending point for the market. As proof, Ki has also shared a graph: “This warning applies PCA to indicators on chains such as MVRV, Soprr and NUPL to calculate a progressive average of 365 days.

Ki pointed to drying liquidity and fresh sales pressure through “new whales” that, he said, unload Bitcoin at lower prices. In particular, he revealed that cryptoquant users who had subscribed to his reports have received this signal before today’s public announcement. “With a new liquidity that dries, new whales sell Bitcoin at lower prices.

Related lecture

This last statement contrasts comments from just four days ago, on March 14, when Ki hit a more careful tone and stated: “Bitcoin question seems to be stuck, but it is too early to call it a bear market.”

At that time he shared a graph of the Bitcoin-Digible Question (30-day sum) indicator, which had become somewhat negative and an early signal that the question could decrease. Although Ki pointed out that the question could still recover (as it has in the past lateral phases), he acknowledged the possibility that Bitcoin staggered on the edge of a bear market.

The hinge in sentiment is particularly remarkable considering the position of Ki from two weeks ago. In that earlier post, he believed that the “bull’s cycle is still intact”, the strong Fundamentals and the growing mining capacity credit: “There is no significant activity on chains and important indicators are neutral, which suggests that the bull cycle is still intact.

However, he also warned that the market could run if sentiment did not improve, especially in the United States. With today’s announcement, the warning was apparently crystallized. Reflecting on the potential downward scenario, Ki said at the time: “If the cycle ends here, it is a solution that nobody wanted – not old whales, mining companies, traditional or even Trump.

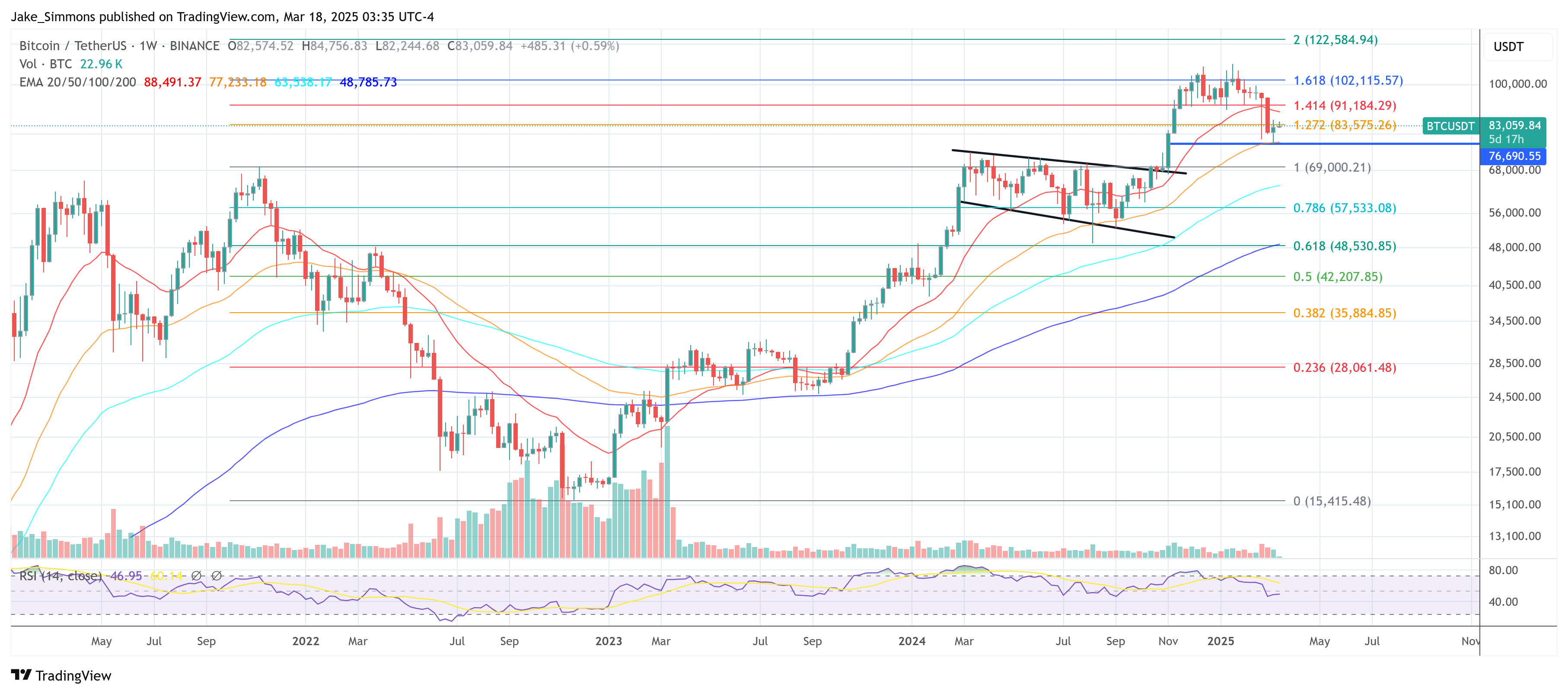

At the time of the press, BTC traded at $ 83,059.

Featured image made with dall.e, graph of tradingview.com