- Bitcoin Spot ETFs witnessed $ 900 million in output, with a total of $ 5.4 billion departure since February.

- The price of BTC fell by almost 12%and fluctuated around $ 77,000, which reflects the growing uncertainty in the institutional sentiment.

Bitcoin [BTC] Spot ETFs have experienced a remarkable decrease in the inflow, with more than $ 900 million in that have been registered in the past five weeks. This sharp decrease has fueled speculation about whether the trust of investors in Bitcoin is starting to decrease.

As institutional investors adjust their portfolios in the midst of economic and regulatory uncertainty, the price of Bitcoin is also affected, so that almost 12% immerses almost 12% in the past month.

With the shifting of market sentiment, a closer analysis of Bitcoin Spot ETF streams and price trends, it is crucial to understand where the market is going.

BTC Spot ETF outflows: a decline of five weeks

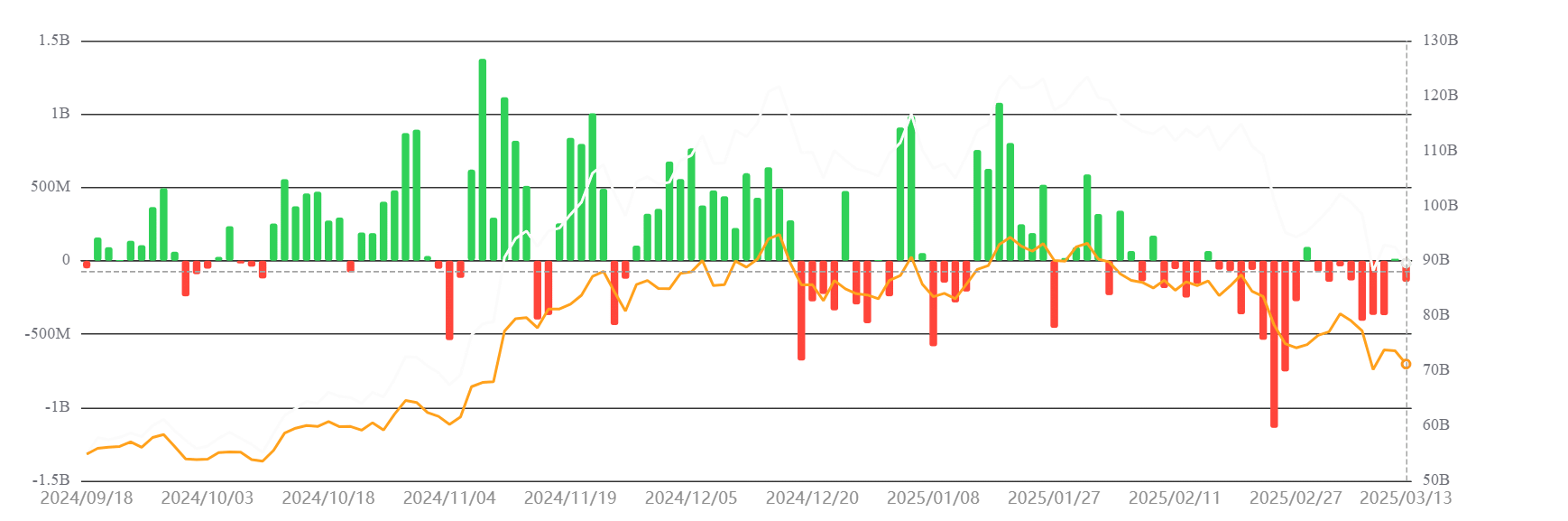

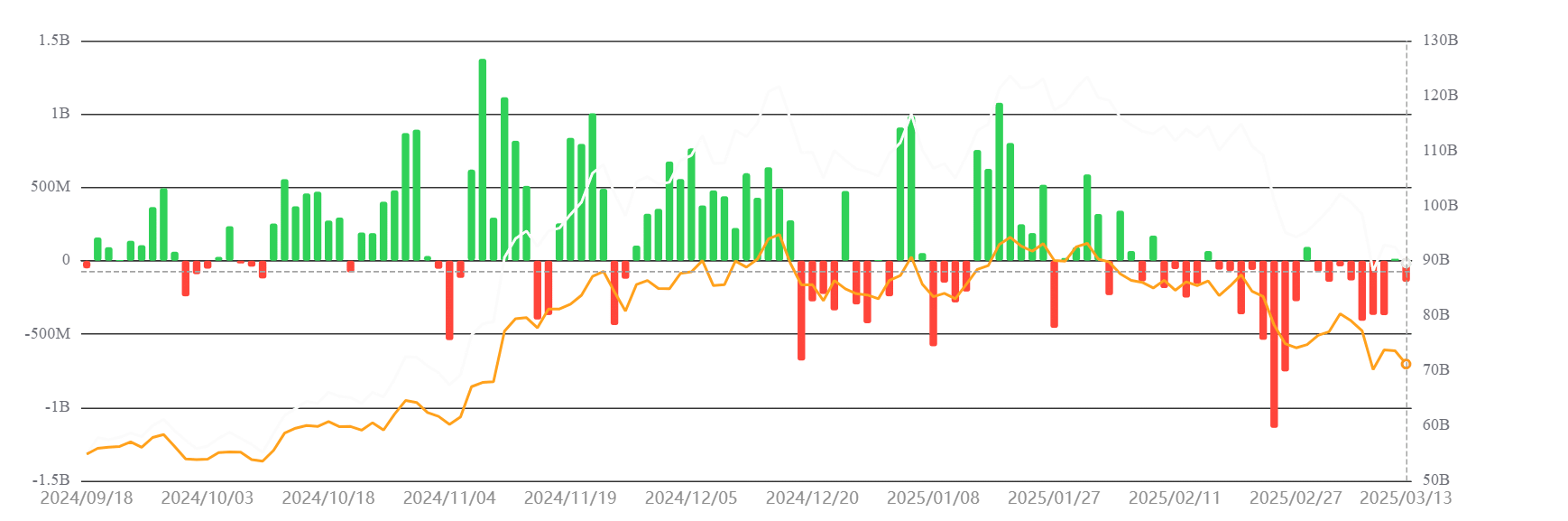

According to recent data from SosovalueBTC Spot ETFs have seen persistent outflows, with the last weekly figures with a net outflow of $ 921.4 million.

This marks the fifth consecutive week of declining capital within these funds, which means that the total outflow has been around $ 5.4 billion to around $ 5.4 billion since mid -February.

Although BTC Spot ETFs initially saw considerable inflow after their approval, recent repayments suggest a shift in the sentiment of investors.

Source: Sosovalue

The timing of these outlets has been merged with the price fall in Bitcoin, which has fallen from $ 84,000 to around $ 77,000.

Although broader market factors contribute to the volatility of Bitcoin, the persistent ETF outflows indicate that institutional investors may be careful with Bitcoin assignments in their portfolios.

The role of institutional investors in BTC Spot ETFs

One of the most important benefits of BTC Spot ETFs is their ability to attract institutional investors in the cryptocurrency market.

Prominent business management companies such as BlackRock and Fidelity introduced Bitcoin ETFs and offer a regulated investment option that Bitcoin exposure offered without the need for direct property. This led to an initial increase in the inflow and contributed to Bitcoin that reached a price price high.

Institutional investors, however, often use strategic methods for the short -term capital allocation. During periods of market uncertainty, they tend to adjust positions quickly, making the current outsourcing possible.

Analysts suggest that institutional investors can divert funds to traditional assets or opportunities with a higher yield, because global financial markets respond to inflation problems and legal changes.

Factors that influence the outflow

There are various contributing factors to the recent BTC Spot ETF repayments. One of the most important concerns is macro -economic conditions.

Rising interest rates and inflation fears have led investors to re-evaluate their portfolios, often prioritize assets with a lower risk over volatile markets such as cryptocurrencies. With traditional markets that offer more attractive risk-corrected returns, Bitcoin Spot ETFs can be confronted with more competition from traditional investment vehicles.

Moreover, Bitcoin’s price volatility plays a role. Historically, great price corrections have sold out and the current price dip may have led some investors to liquidate their BTC companies to protect or minimize losses.

What is the next step for BTC Spot ETFs?

Despite the recent outflows, the long -term prospects for BTC Spot ETFs remain positive. The introduction of these funds has already had a positive effect on the cryptocurrency market and there are indications that institutional acceptance will continue to grow.

In the short term, however, investors will closely monitor macro -economic trends, legal developments and the ability of Bitcoin to recover the most important price levels.

If Bitcoin can stabilize above $ 80,000, this can regain the trust of investors, leading to renewed inflow into BTC Spot ETFs. On the other hand, if the outflows persist and Bitcoin is struggling to find support, a long -term period of market uncertainty could follow.