- Pepe saw heavy sales pressure, but the exchange reserves have also fallen

- With holders who sell with a loss, confidence in the recovery of the memecoin seemed to be extremely low

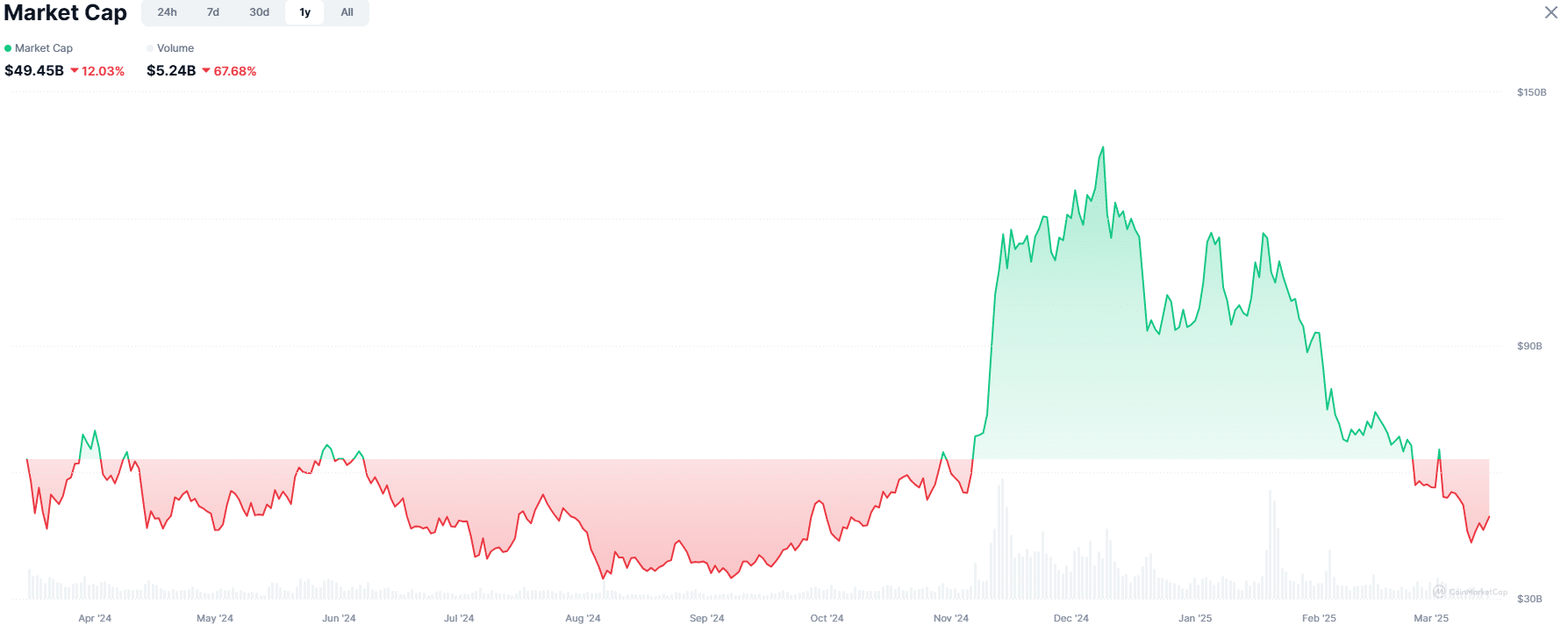

Pepe was bounced by 35.2% at the time of writing in just four days. His daily graph, however, revealed that a downtrend was still in the game and dominant. In fact, it was confronted with a drawing of 75.1% of the highlights of December.

However, it is worth noting that the cryptomarkt as a whole has suffered considerable losses in the last three months.

Source: Mint market cap

The Memecoin sector has been one of the worst performing in recent months.

It has shifted $ 87.5 billion since December 9 – a reduction of 63%. In the light of the lack of considerable bidding in the market, investors can have a little hope here in the recovery of Pepe.

Pepe holders decide – accumulation or capitulation time?

The balance on exchanges saw a relatively flat trend in 2024. By November, when the price began to rise higher, the balance at fairs started to trends. Since then, this downward trend has continued, although the price has also been in a free fall.

This hinted to Hodl behavior of investors – holders withdrew their Pepe and placed it in cold storage. Although this accumulation can be seen as a bullish sign, it has so far done little to stop the fall in the price.

The best output profit ratio (Sopr) divides the realized value of the outputs used (price against which coins were sold) through the value with which they were obtained. Values above 1 indicate that holders with a profit sell, and values lower than 1 signal sales with loss and bearish sentiment.

Since the beginning of February, the SOPR has been lower than 1 – a sign of capitulation among holders. This steady sales pressure forced Pepe to make a series of lower lows. This trend may not turn itself into Bitcoin [BTC] Do and Pepe records an extraordinary question.

Source: Pepe/USDT on TradingView

The MACD was under zero and showed that the momentum was predominantly bearish. The market structure was also Beerarish and is thus since the end of January. The OBV had taken over the past three weeks, but floated around the lows of the beginning of February at the time of the press.

In general, the sellers were dominant. However, the falling Pepe balance on exchanges can be a spark of hope for investors. It is unlikely that it is enough to reverse the downward trend, but it is still a start.