- Altcoins go in synchronization with Bitcoin and Ethereum, which indicates potential volatility or market picks

- Note accumulative phases before you enter again with Momentum

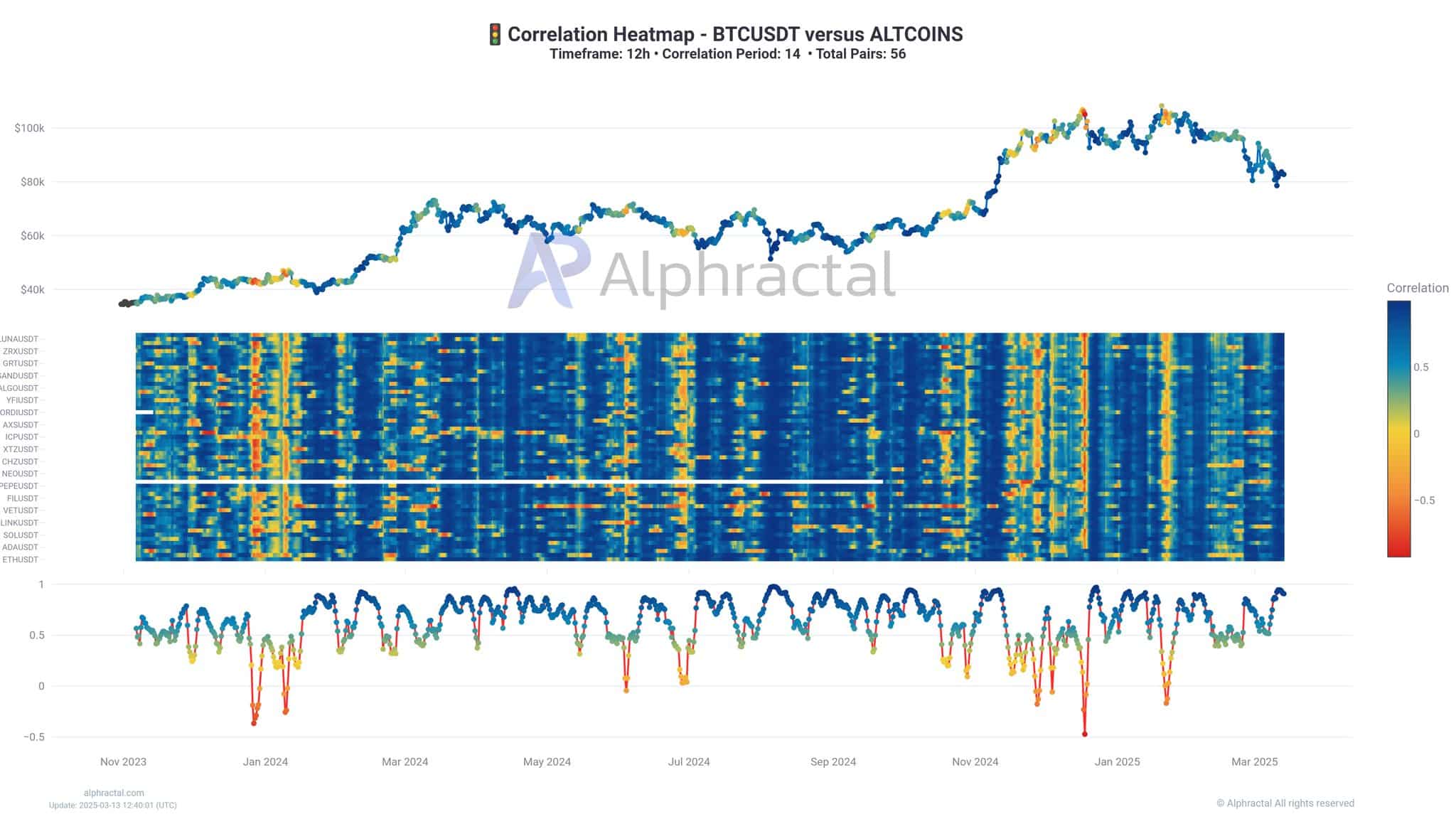

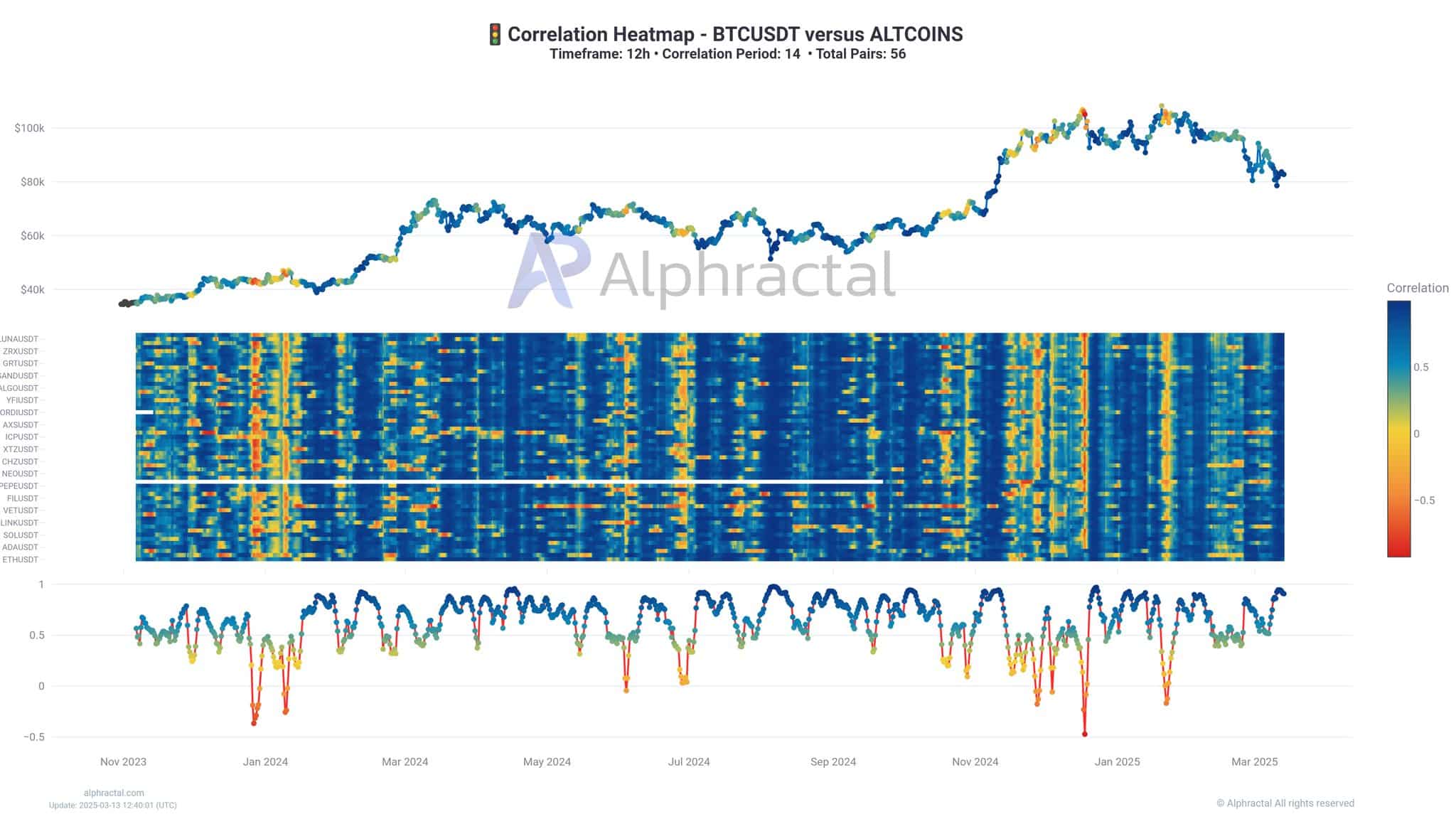

Altcoins move synchronously with Bitcoin again [BTC] and Ethereum [ETH]Signal a return to a high correlation market. Although this may seem stable on the surface, history often shows such an alignment in advance of sharp volatility or local market picks.

Most altcoins remain in sturdy downward trends, making premature submissions particularly risky. At this stage, the Timing-Watch key on signs of accumulation and clear structural shifts before you are considering entering again.

The state of the market – correlation return

The dense blue tires over most altcoin pairs suggest that most altcoins in Lockstep have been moved with BTCUSDT in recent months. This pattern Indicates a market where macro trends dominate, and unique altcoin stories struggle to get a grip.

Source: Alfractaal

Historically, times of low correlation – when the heat folder is spread or red – often preceded large volatility or local market picks.

At the time of writing, the data revealed tightly clustered behavior, which means that it is unlikely that Altcoins performs better independently. Unless Bitcoin and Ethereum first meet.

The three phases of Altcoin -price promotion

Altcoin -Prize cycles usually follow three different phases – downward trend, accumulation and upward trend. Most altcoins are currently deep in the downward phase – characterized by consistently lower lows and persistent sales pressure. This is the danger zone, where early entries often result in losses.

The battery phase follows as soon as the sales pressure fades and the price stabilizes within a defined range. The most important signs include reduced volatility and repeated defense of low reach. Finally, the Uptrend phase starts when the Bullish market structure shifts.

Therefore, look for clean fractions over resistance or withholding withdrawal to go back into a greater conviction.

Reading range low and returning with Momentum

As Altcoins begin to stabilize, the attention is paid to the reach of lows – historically, key zones where sellers lose strength and buyers quietly intervene. These levels often act as staging for momentum shifts. When prices consistently defend a low reach, this can suggest that a change in sentiment is going on.

Structural signals such as higher lows or decisive pimples can indicate the early stages of a trend domination. In earlier cycles, such setups are tailored to broader market recovery. Although not every reach results in a rally, company support often marks the growing trust at important levels.

For now, Bitcoin and Ethereum remain the main indicators. And Altcoins will probably only follow if the momentum goes through.