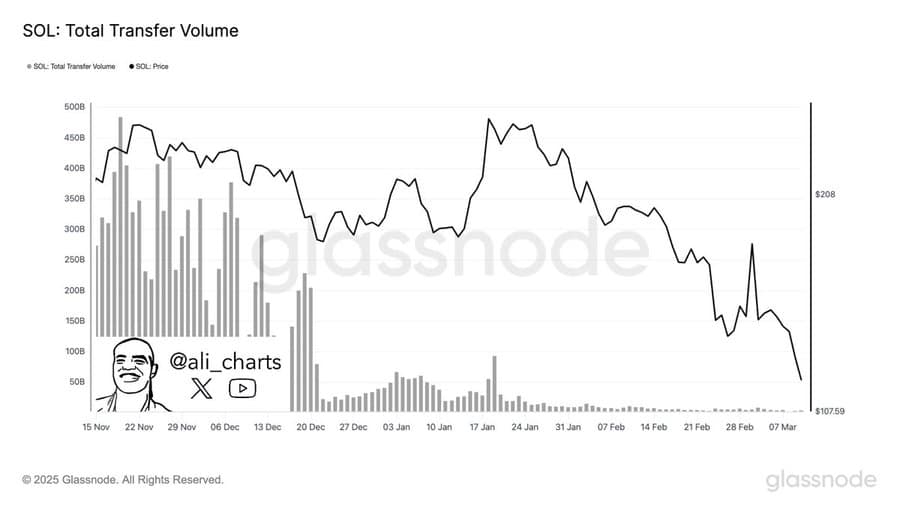

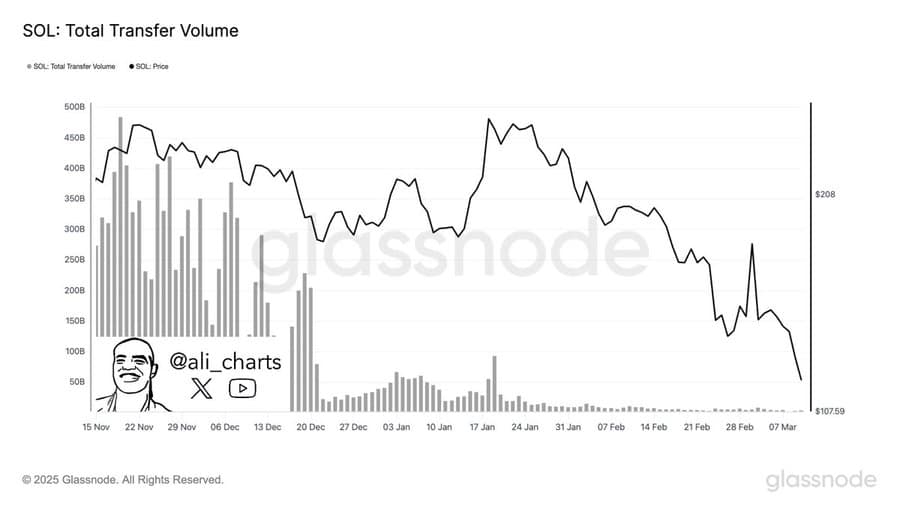

- Solana has seen a significant fall in trade volume, with the same falling to the lowest level of 2024

- In the charts, SOL may run the risk of lowering, especially if the total value is locked further (TVL) falls further

In the past month, the Solana price has shown a number of slow market performance and fell by 36% in the charts. At the time of writing, the sentiment of Martket seemed to point to a further decrease when more sellers arrived.

An analysis of liquidity movement revealed a walk in Sol outflows last month. This is a trend that seems to continue, especially because it loses an important level of support that would usually offer a rebound.

Momentum is massively weakened as Sol

An important contributing factor to the decline of Solana has been the sharp decrease in the momentum. Press data has even shown that the trade volume of the Altcoin has fallen to the lowest level, with only $ 3 million in daily trade volume – a level that is recently seen in September 2024.

When both trade volume and price fall at the same time, this means that market participants sell their participations. This may lead to a further fall in demand.

Source: Glassnode

TVL, which follows the liquidity flow inside Solana -based protocols, also fell considerably. After a peak of $ 12.19 billion in January, it is almost halved, with the same status at $ 6.69 billion at the time of the press.

Such huge liquidity outlets between protocols are a sign that investors who have initially locked their assets are now selling them. This, probably because of the decreasing trust in the active and an attempt to protect themselves at further price decreases.

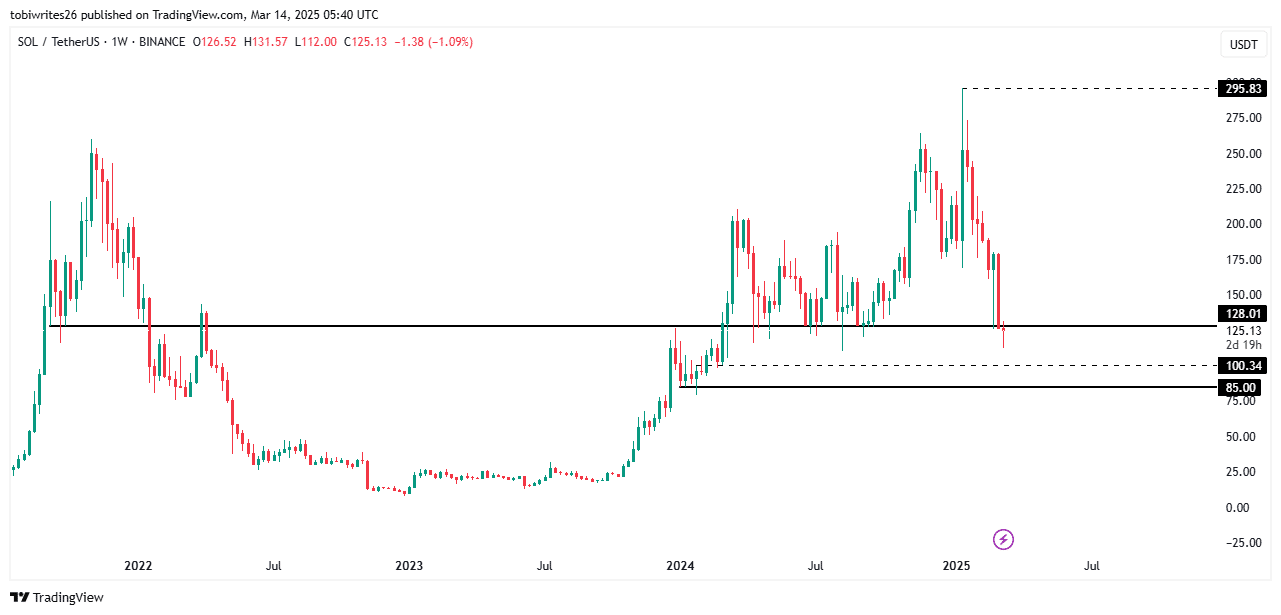

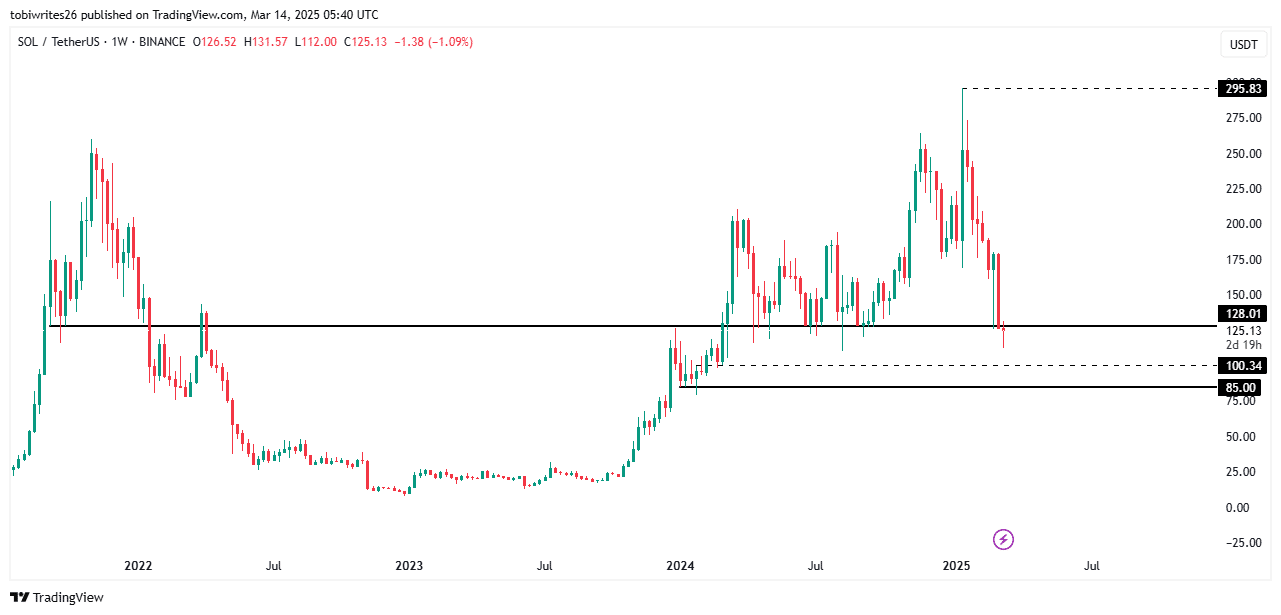

Potential decrease up to $ 100 or lower

Ambcryptos analysis of SOL’s price movement suggested that it could actively fall to $ 100 after losing the most important support level at $ 128.01.

Typical support levels offer a pillow for price and facilitate rebounds, creating a drop-to-rally scenario. However, when they are violated, it means that selling Momentum outweighs the buying of pressure on those levels.

Source: TradingView

If SOL is not above the next support for $ 100.34, it can continue to fall to $ 85. This will actually reduce the actual price range of two digit-one level that is recently seen in 2024.

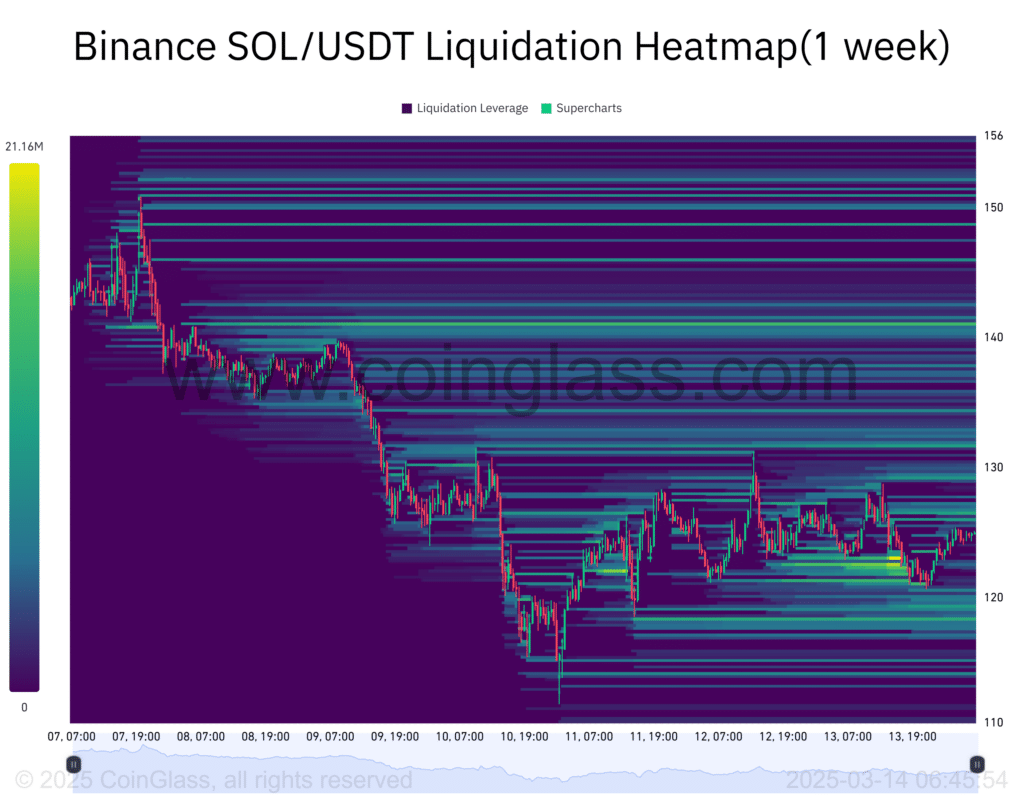

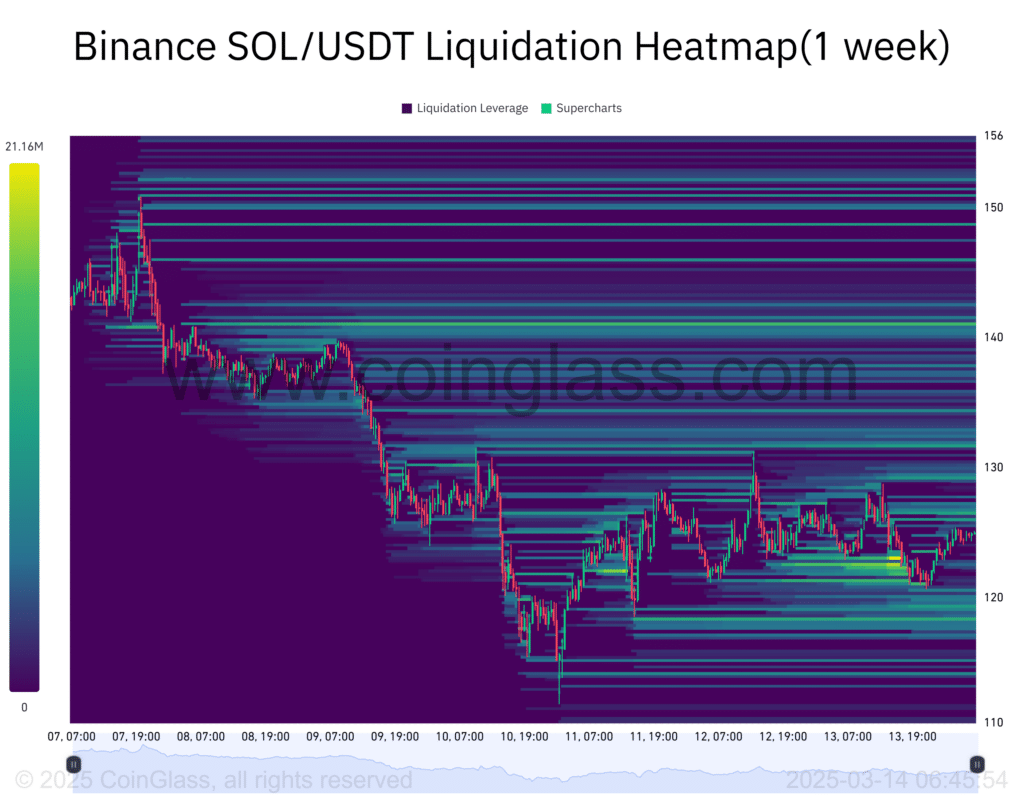

An analysis of the liquidation heat map revealed various liquidity clusters between $ 120 and $ 114. These clusters often work as magnets, pull the price towards them and in some cases push lower.

Given the prevailing downward trend, Sol could fall even further, so that new lows can be set on the charts.

Source: Coinglass

Not all traders are Bearish

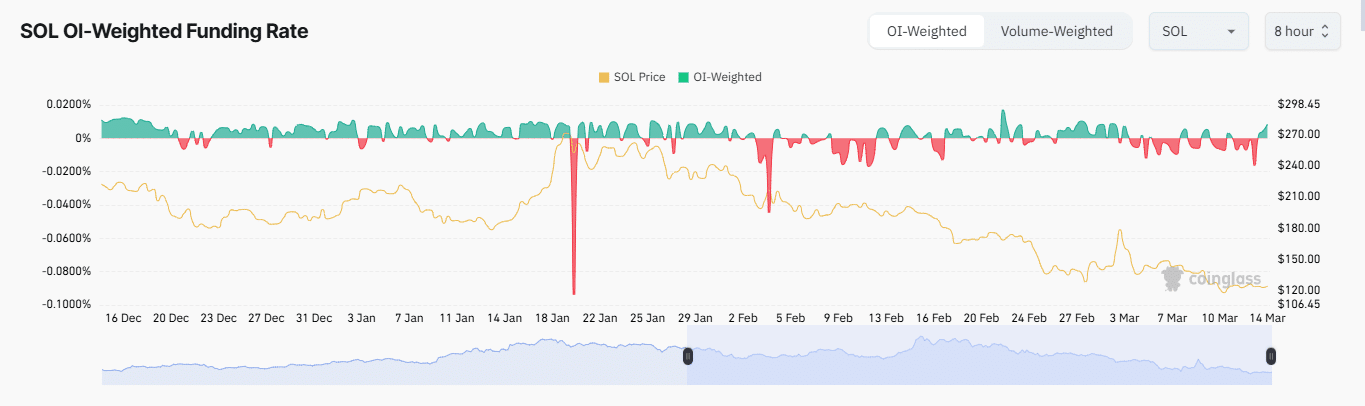

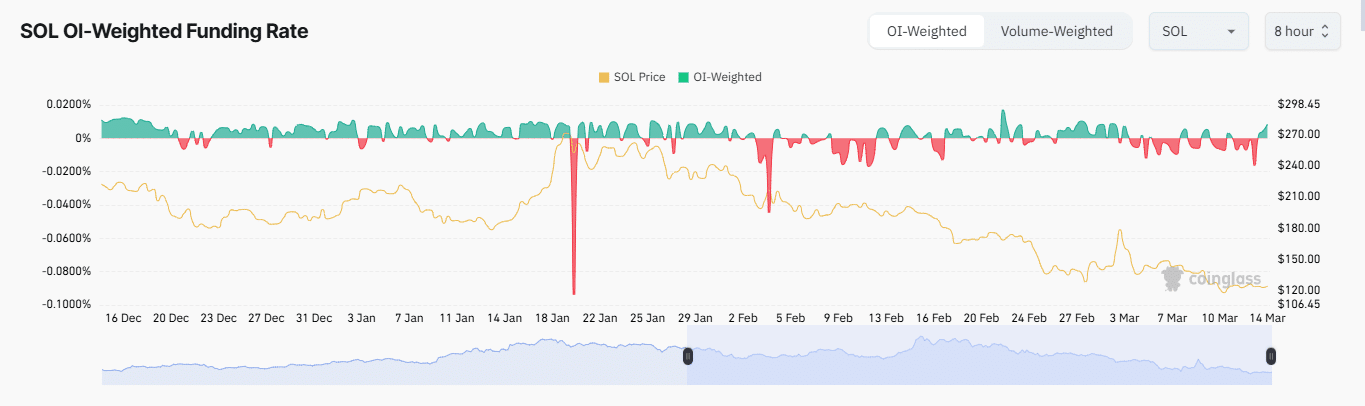

Some traders have placed long bets on the derivatives market pending a SOL -Rebound. Buying volume on the derivatives market has recently increased in addition to the OI-weighted financing percentage.

At the time of 1.004, the long -destruction of Coinglass, which measures the purchase volume compared to the sales volume, had a lecture of 1.004. A level above 1 indicates that there are more buyers than sellers within that period.

Source: Coinglass

This buying sentiment can be further confirmed by the OI-weighted financing interest rate, which combines open interest and financing data to offer a more accurate market for market sentiment. At the time of writing, sentiment had become positive and registered at 0.0086% thanks to an upward trend that started on March 13. This hinted on an increase in long positions.

If buying volume on the derivatives market remains strong and Solana returns the lost support for $ 128, a rebound can be on its way. Otherwise the Altcoin could fall even further.

![Solana [SOL] – Is there any good news after the trade volume Hits 2024 Low?](https://bitcoinplatform.com/wp-content/uploads/2025/03/Solana_Abdul-1000x600.webp)