- Bitcoin’s huge +$ 800 million a day realized losses can mark a likely soil

- The overall question has remained negative, with BTC ETFs that bleed more than $ 5 billion

Bitcoin [BTC] Has remained below $ 85k in the charts after a short dip up to $ 76k – a movement Bitfinex Exchange analysts believe that stabilization could probably signal.

In their weekly market reportThe analysts noted that traders saw a realized loss of $ 818 million a day, a market rinse that always precedes a potential soil.

“Such widespread capitulation often precedes market stabilization, although geopolitical and macro -economic care remains an important overhang.”

Will BTC restore?

Short -term holders (STH) have sold BTC with a loss since October 2024.

Source: Bitfinex

They quoted the Bitcoin Output Profit Ratio (Sopr), who follows the profitability of traders, because it dropped under 1. It indicated that holders sold with a loss.

“Short -term holder SOPR registered his second largest negative print of this cycle at 0.95, indicating that new market leaders capitulate.”

For the recovery shift, Bitfinex analysts claimed that Soprr must rise again above 1, which would suggest that ‘herncumulation’ and ‘bullish continuation’ would be.

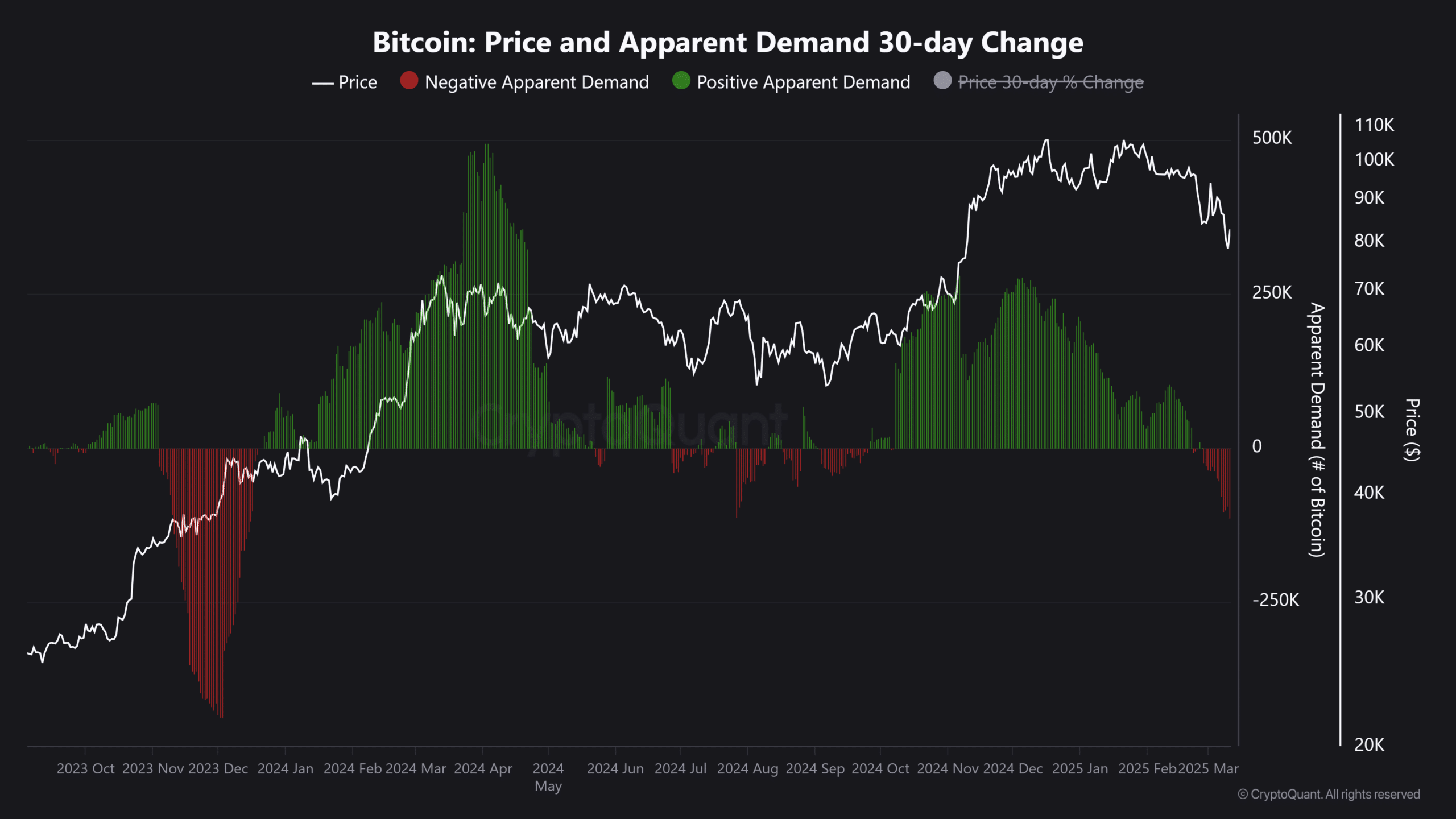

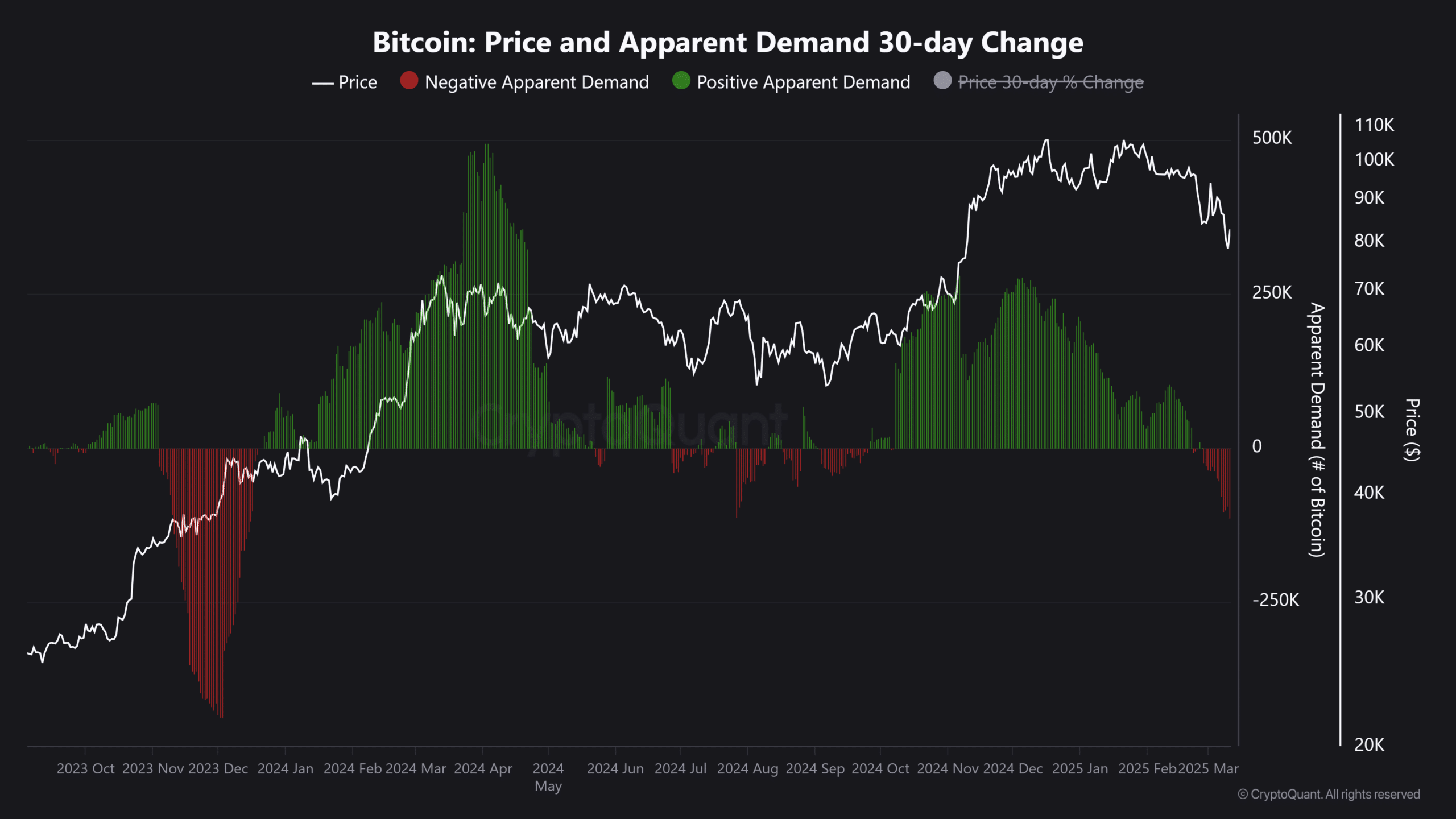

The weak BTC question confirmed the BitFinex warning. According to Cryptoquant data, the demand for the cryptocurrency has even remained negative since the end of February.

Source: Cryptuquant

US Spot BTC ETFs bled $ 1.5 billion in the first half of March. In February alone, the product saw $ 3.56 billion out per SOSO value. They have seen more than $ 5 billion out of bleeding in the last 6 weeks.

Bitfinex analysts also warned that the mixed lecture on American macro -economic factors could still decrease crypto -markets. Despite Trump’s tariff wars, the American CPI inflation data came in cooler than expected for February.

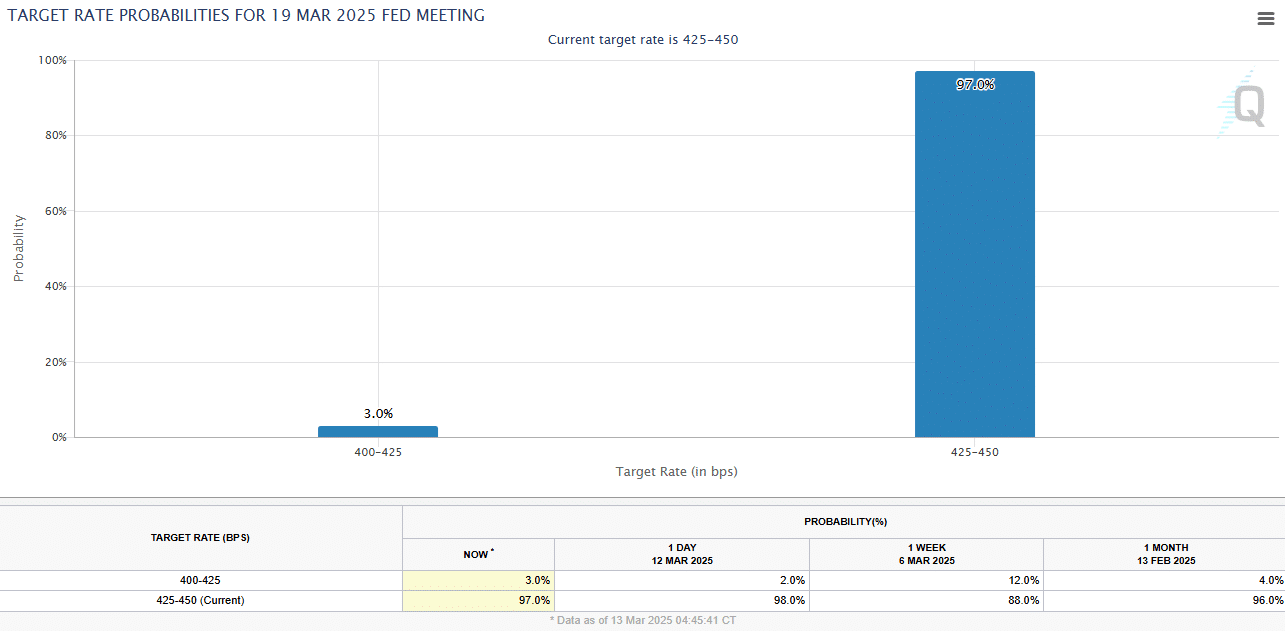

Unfortunately, the market does not expect a reduced FED rate in the next FOMC meeting planned for 19 March. Rentraders have priced a 97%chance that the FED would keep the rates unchanged on the current goal of 4.25%-4.50%.

There is only a 3% chance of a 25bps acceleration during the FOMC meeting next week. As such, BTC can still be stuck Turbulent waters in the short term.