Este Artículo También Está Disponible and Español.

MicroStrategy founder and executive chairman Michael Saylor suggested that the United States could buy a million bitcoin for his strategic reserves. His comments came during an interview with FOX Business prior to Friday’s Crypto top, to be organized by US President Donald Trump.

Saylor, whose company is generally known for its important Bitcoin companies, confirmed that MicroStrategy has around 500,000 of the digital tokens, accounting for “approximately 2.4% of the worldwide offer.” He is one of the many crypto industrial figures that are expected to have joined the president’s roundtable to advise the administration on the policy of digital assets.

Will Trump buy 1 million Bitcoin?

When asked how the government would finance such a large crypto reserve, Saylor pointed to a deliberate, multi-year timeline, which refers to a “six months process” set out by the recent executive order. He added: “There are 12 members in the presidential work committee. There will be involved in the industry. There will be involved with the Senate and the house and I and it is above my wage rate to decide how it will be determined. “

Related lecture

According to Saylor: “The longest bill [by Senator Lummis] has established the idea of strategically acquiring Bitcoin strategically, just consistent day after day to reach a million Bitcoin goal. “It is currently assuming that the US government has 200,000 BTC – an estimated $ 17 billion at today’s prices.

If it continues with extra large -scale purchasing, the effect on the price of Bitcoin can be considerable. Saylor argued, however, that the most “responsible” approach “would be to” go slowly and stable with clear telegraphy and transparency “instead of doing abrupt acquisitions that could move into the market.

Central to Saylor’s position is the classification of Bitcoin as a ‘digital property’, an active without a central issue.

“The real key from Bitcoin is that people understand that it is a digital trait. It is a savings account that enables every American to save their wealth and to retain it over time, “explained Saylor. He emphasized that if the US government provides clarity about this status, this could cause more confidence to regard cryptocurrencies as a legitimate savings vehicle.

Related lecture

When discussing whether tax money must be used to buy Bitcoin, Saylor made a distinction between different digital assets. Although Bitcoin (as a “digital raw material”) is well suited for strategic reserves, he also recognized the importance of digital currencies (stablecoins), tokenized effects (for capital efficiency) and token-based tools. Nevertheless, he has selected Bitcoin as the most important candidate for a national reserve and called it “the one who universally agreed fundamental assets throughout the entire crypto economy”.

🇺🇸 Michael Saylor Hints The US will buy 1 million #Bitcoin For his reserve 🤯

It happens 🚀

pic.twitter.com/jr73pipfny– Vivek⚡️ (@vivek4real_) March 5, 2025

Saylor also found skeptics who question a national Bitcoin reserve compared to more traditional strategic reserves such as oil or medical supplies. He compared Bitcoin with real estate and called on a historical analogy: “We bought 75% of this nation with around 40 million dollars […] We bought Louisiana. We bought California. We bought Texas. We bought Alaska. It is owned. If you consider Bitcoin as property in Cyberspace and you say where all the money in the world is going? Well, it goes from abroad […] It wants to go from the physical world to the digital world. “

For those who are concerned about the fundamental ethos of Bitcoin as a decentralized active without the government’s involvement, Saylor insisted that the official adoption does not have to contradict the original design of the cryptocurrency. “Satoshi gave us a process, a protocol for prosperity. That’s what we call Bitcoin, “he said. Although Early Adopters may have given preference to minimal regulations, Saylor believes that nation states are “interested in economic empowerment and prosperity” inevitably individuals and companies in the digital domain will follow.

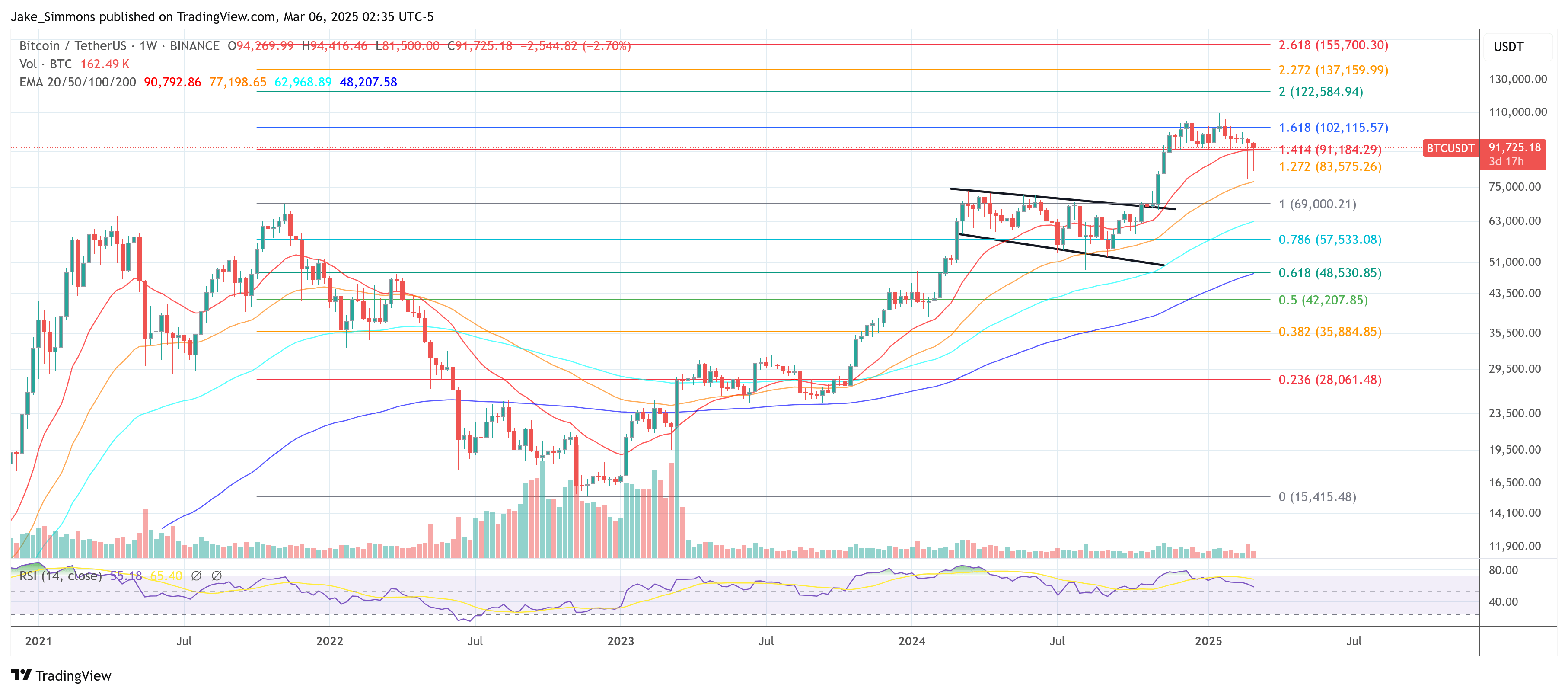

At the time of the press, BTC traded at $ 91,725.

Featured image of YouTube, graph of TradingView.com