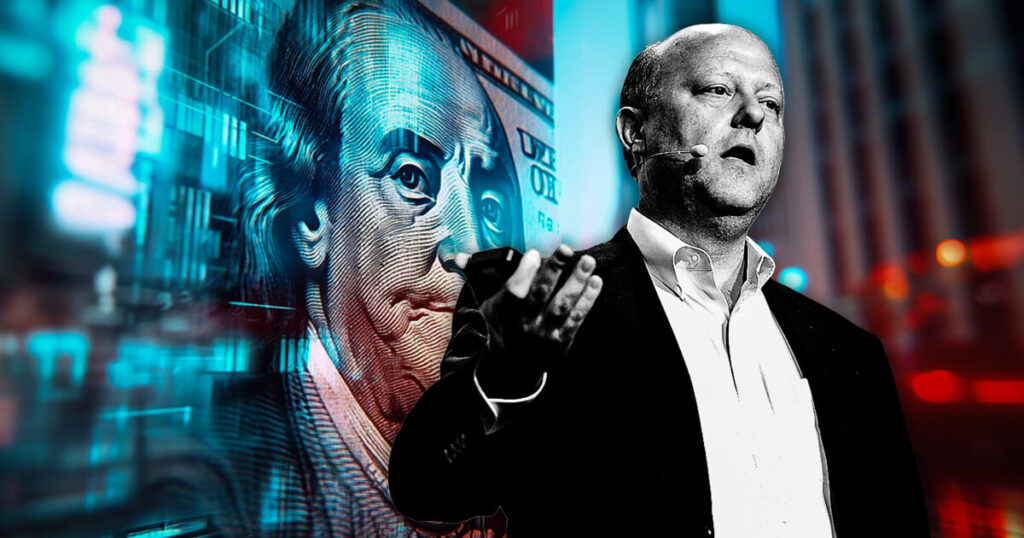

Co-founder of the Circle Jeremy Allaire has called for US dollar spending spending to be registered in the United States, and emphasizes the need for the clarity of the regulations, since legislators introduce new legislation on digital assets.

Allaire made the statement during a Bloomberg interview on 26 February in the midst of growing discussions in Washington about the supervision of Stablecoin, an important problem in shaping the future of crypto regulation.

The call for formal registration corresponds to efforts from some policymakers to bring Stablecoin emission under a clear legal framework, in particular the dollar market with dollar digital assets.

Legislative efforts

Stablecoins play an important role in digital asset markets and serve as a bridge between traditional finances and cryptocurrencies.

However, regulatory uncertainty has existed, with questions about reservebacking, consumer protection and risks for financial stability.

Earlier this month, Senator Bill Hagerty (R-tenn.) Introduced a bill that was aimed at creating a federal framework for Stablecoin regulations. The legislation is one of the first crypto-related measures that are expected to be discussed under President Donald Trump’s second term.

Trump has indicated support for positioning the US as a leader in the crypto industry, making it a scene for possible legal shifts that can influence stablecoin emissioners such as Circle.

Industry is on clarity

Circle’s USDC is the second largest stabilecoin through market capitalization, after USDT from Tether Limited. The company has positioned itself as a more transparent and regulatory issue in comparison with its rivals.

The company has long advocated a clear legal framework with which Stablecoins can operate within the American financial system rather than in regulatory gray areas. However, some claim that this could possibly hinder innovation and competition in a global market.

Allaire’s call for American registration corresponds to broader industrial efforts to establish trust and stability in the market. Although some legislators and supervisors have expressed concern about the potential impact of stablecoins on financial stability, others claim that well -regulated issues can improve the efficiency and innovation of payments.

With stablecoins that are now central to the Cryptocurrency Ecosystem, the ongoing debate on their regulation will probably shape the future of digital financing in the US, or Hagerty’s bill will get a traction or undergoing important revisions, the urge to clarify the supervision of the Stablecoin.