Ada, the native token of the Cardano -Blockchain, has experienced a considerable fall in price in the last 24 hours and reached a crucial level of support. From today, February 25, 2025, ADA has fallen 13% and is currently being traded near $ 0.67, while trade volume has risen by 110%.

Cardano (ADA) Technical analysis and upcoming level

According to the technical analysis of experts, the recent price fall in ADA has brought it at a crucial level of support at $ 0.65. Historically, this level has acted as a strong price turnout. In addition, the daily map of ADA blinks a bullish signal, because technical indicators show a bullish divergence in the same period.

In addition to this bullish divergence, the daily graph of ADA seems to form a price pattern with double bottom on the daily period. These bullish prospects suggest that the price of ADA could recover quickly and experience a remarkably upward momentum.

Based on recent price action and historical trends, if ADA is above the level of $ 0.65, there is a strong possibility that it could actively rise by 20%and reach the level of $ 0.84 in the near future.

Mixed sentiment by statistics on-chain

After a remarkable price decrease and if ADA reached a crucial level of support, whales and long-term holders have collected Ada-Tokens, according to on-chain analysis company Coinglass. Data from Spot -entry/outflow shows that stock markets have witnessed a considerable outflow of $ 22 million in ADA -Tokens.

This substantial outflow of exchanges suggests potential accumulation, which can cause purchasing pressure and generate further upward impulse, a trend that has already started to experience the price gradually.

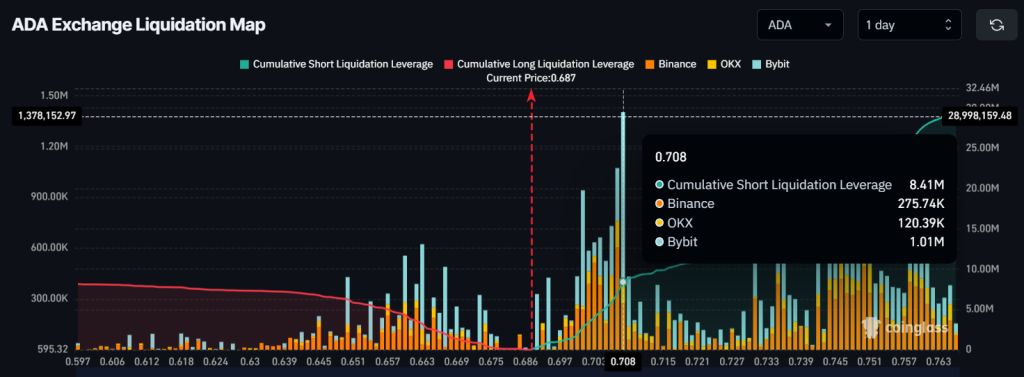

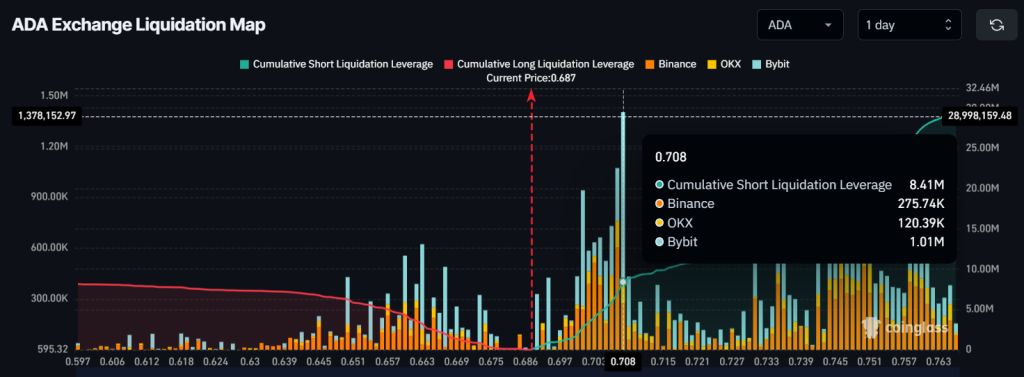

Despite the bullish market sentiment under whales and long -term holders, traders seem to bet on the short side, in the expectation that the prize will continue to fall in the coming days. At the time of the press, the most important liquidation areas are $ 0.663 at the bottom and $ 0.708 at the top, whereby traders at these levels are used too much.

In addition, traders have held $ 3.25 million in long positions and at these levels for $ 8.41 million in short positions. This data indicates that bears remain active and currently actively dominate.