- The exchange reserves of Bitcoin are at multi -year lows, which expresses concern about a possible supply shock.

- With less BTC available for trade, analysts predict a potential price dump if the demand remains strong.

Bitcoin [BTC] Reserves on spot fairs have fallen in recent years, according to their lowest levels, according to Cryptoquant -Data. Exchange reserves grew between 2020 and 2022, but have since been in a steep decrease.

Investors continue to take BTC from stock markets and move to cold storage, which strengthens a long -term holding trend.

A shrinking exchange supply reduces the number of available Bitcoins for trade, which can cause an upward pressure on the price if the demand remains strong.

With Bitcoin who shows an upward trend in 2024 and 2025, this shift suggests a tightening of the delivery-based balance.

Source: Cryptuquant

The continuous decline of the reserve has increased speculation on a possible supply shock, because less BTC can lead to price increases that are comparable to earlier cycles.

Data on chains suggest a strong bitcoin accumulation

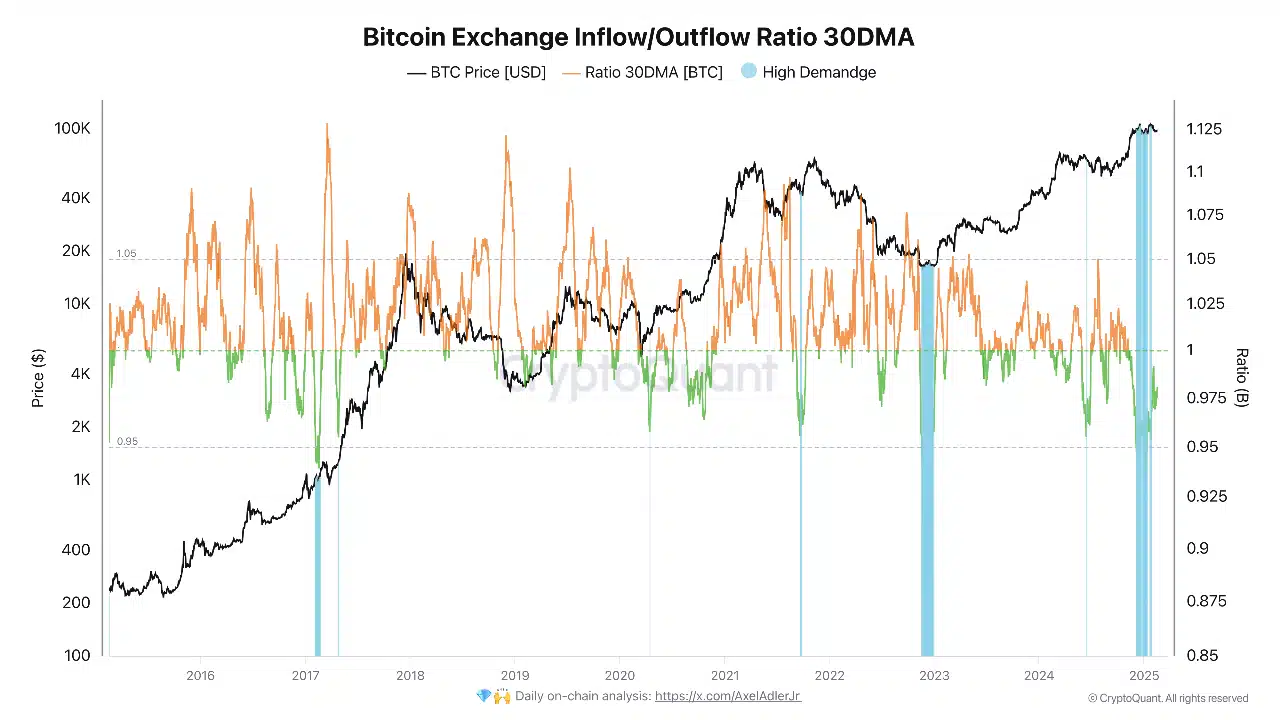

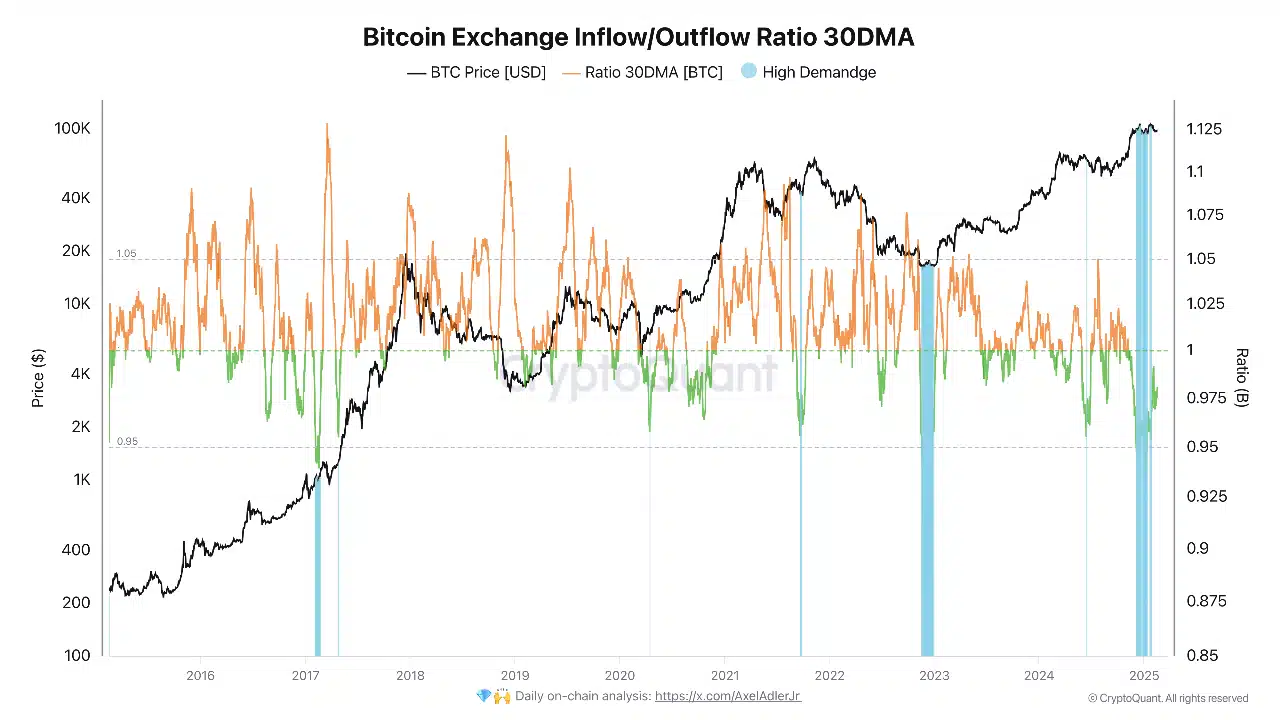

Bitcoin has hit between $ 90,000 and $ 105,000, and Give information to Continuous accumulation. The 30-day advancing average (30DMA) of the exchange of exchange/outflow ratio has remained under 1, indicating that more BTC is leaving stock exchanges than arriving.

Analysts often consider this a bullish signal, because it suggests that investors instead of selling instead of selling.

When this ratio drops under 1, this suggests that the inflow of dominates, a condition that many professional investors regard as a bullish signal.

If historical patterns are in force, Bitcoin could see a price for the short term as soon as the sales pressure weakens.

Source: Cryptuquant

However, some of these outlets can be linked to routine activations by centralized exchanges to storage portfolios, such as ETFs, institutional accounts or OTC agencies.

Bitcoin -Market trends and price movement

From the moment of the press, Bitcoin was traded at $ 96,071reflection of a decrease in -1.23% in the last 24 hours and a decrease of -1.43% in the last seven days.

The total circulating offer is 20 million BTC, which gives Bitcoin a market capitalization of $ 1.9 trillion.

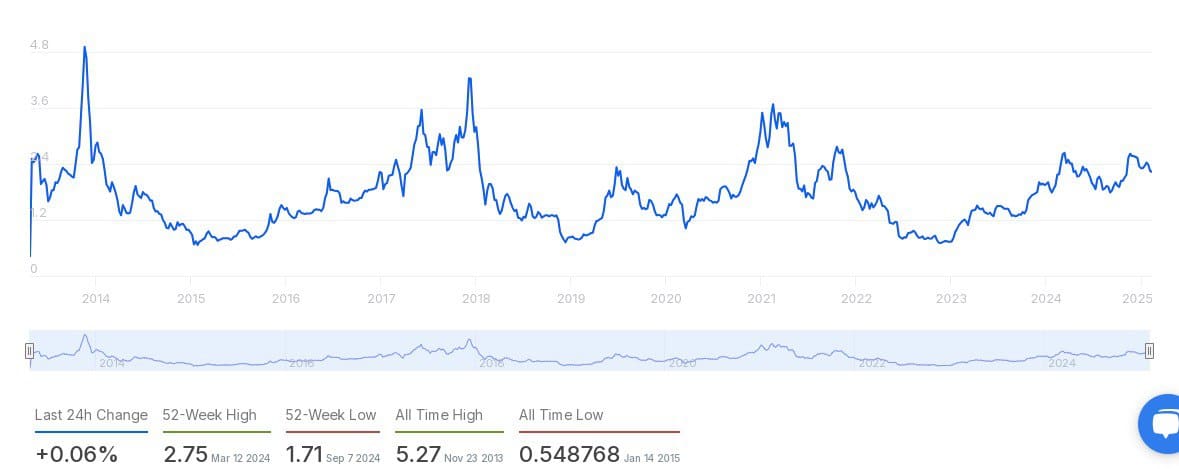

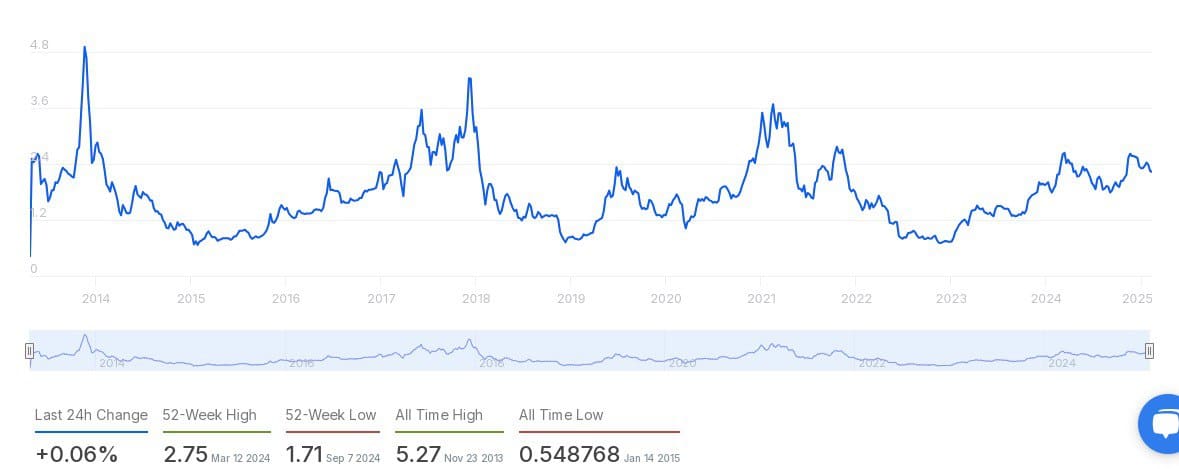

The market value and realized value (MVRV) ratio, which measures the market rating at the price at which BTC was last moved, remains within a moderate range.

The all-time high of 5.27 on November 2013, reflected extremely optimism, while the low point of 0.548768 suggested a deep undervaluation on January 2015.

Source: Intotheblock

In the past year, the MVRV ratio reached a peak of 2.75 on March 2024 and a low point of 1.71 on September 2024. With only a +0.06% change in the last 24 hours, the market sentiment seems stable.

Institutional transactions remain active

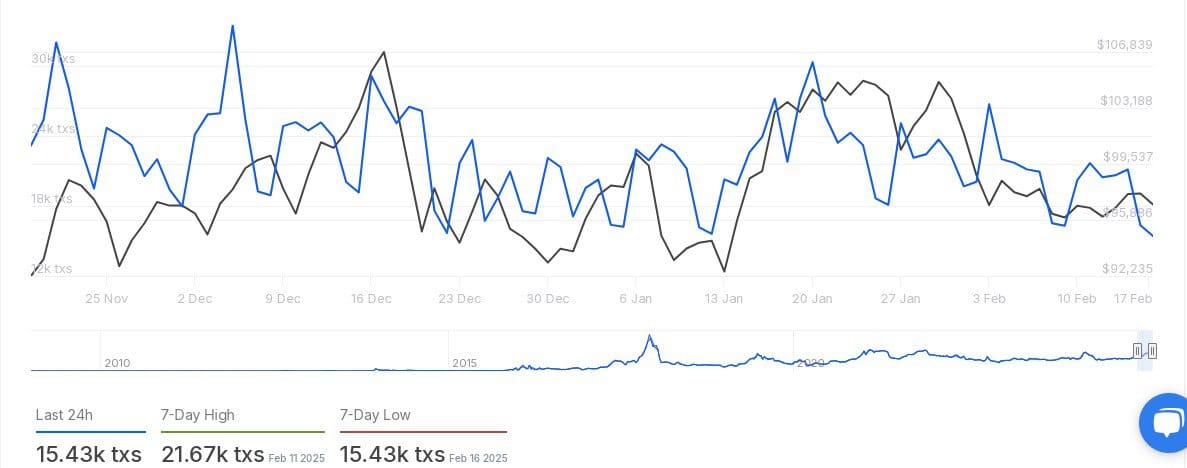

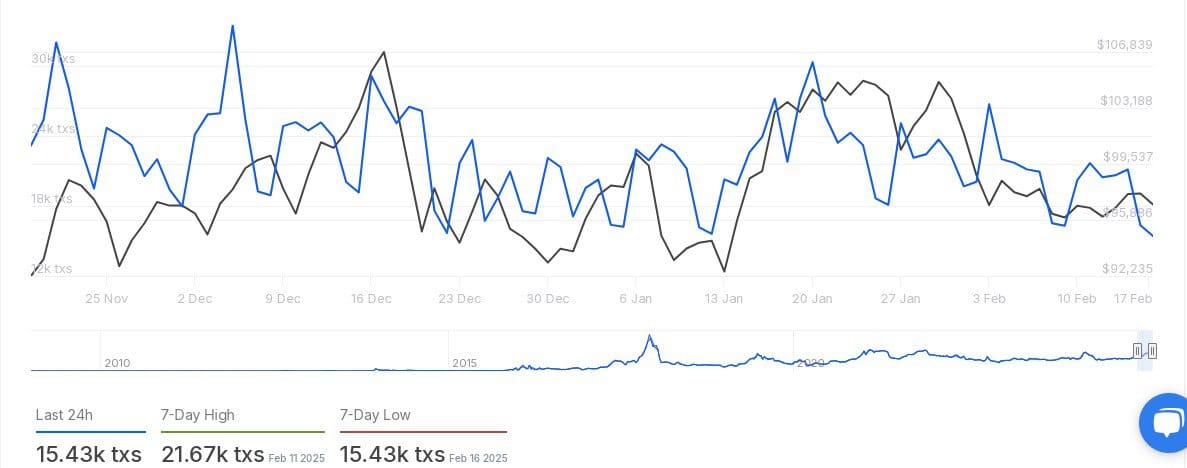

The number of Bitcoin transactions worth $ 100,000 or more shows fluctuations in large-scale activities. The last 24-hour transaction count is 15.43k, which also marks the 7-day low point that was registered on February 16, 2025.

Source: Intotheblock

On February 11, 2025, Transactions peaked at 21.67K, which indicates a high institutional activity. Although the transaction volume has decreased from the end of January, it remains within a historic active reach.

This indicates continuous interest of institutional investors and Hoognet-worthy people.

What is the next step for Bitcoin?

With BTC reserves when shrinking fairs, the possibility of a supply shock remains an important focus. If the question remains or increases, Bitcoin could experience an upward price pressure.

While the market looks at the next major movement, many assess whether this trend can indicate the start of the next Bull Run.