- The market value of Bitcoin has crossed $ 2 trillion, so that the use of Trump’s tariff plan has been collected even higher.

- Is the crypto market with gold and the dollar about to make its biggest sale?

Trump’s radical tariff plan is sharp. What started as an import load of 10% on Canada, Mexico and China is now just the start of a much larger strategy.

Is the cryptomarkt with the first quarter that the crypto market is well positioned to absorb the pressure, or threatens a big sale?

What’s at stake?

With the total cryptomarket with a value of more than $ 3 trillion and bitcoin [BTC] The deployment has 60% of the market share and is towering.

Even a small shake in the price of BTC could even leave the most established coins in red. A long -term strategy can be the safest gamble in such a climate.

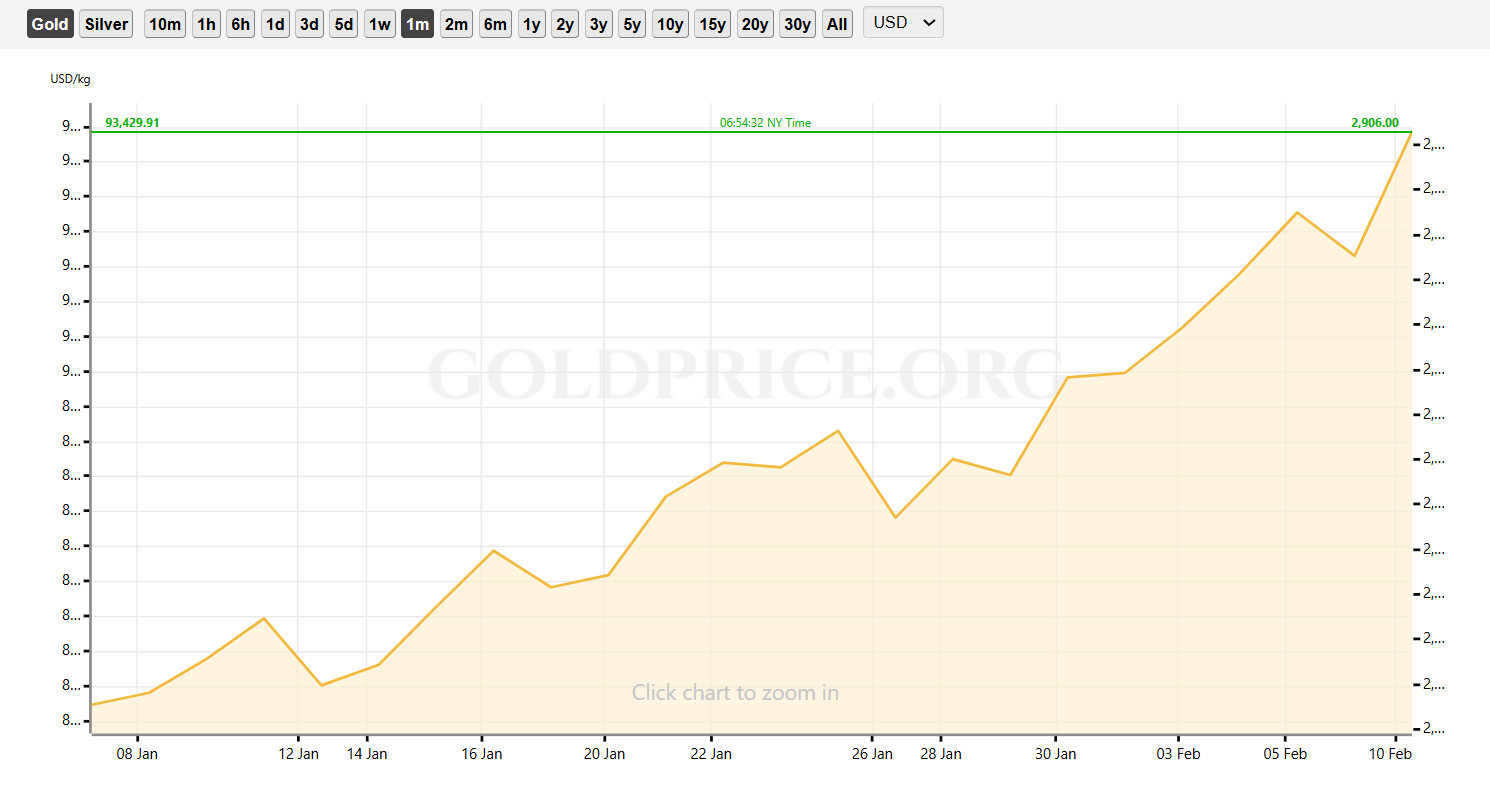

But at the moment many investors are following fast profits, and gold seems to be the Go-to-Safe Haven. The 30-day rating has risen with a huge 247.18%, with 4% of that jump just in February.

Source: Goldprice.org

While capital flows into traditional assets, Bitcoin has felt the pressure, with a decrease of 4% in the same time frame. Although the recovery has been fast, the status is clearly in the spotlight as a ‘risk -active’.

What does this mean for crypto? With Trump’s rates at important suppliers who indicate a deeper shift, investors can turn to profits in the short term, which means that long -term hodling is at risk.

Assessment of Bitcoin’s long -term provision

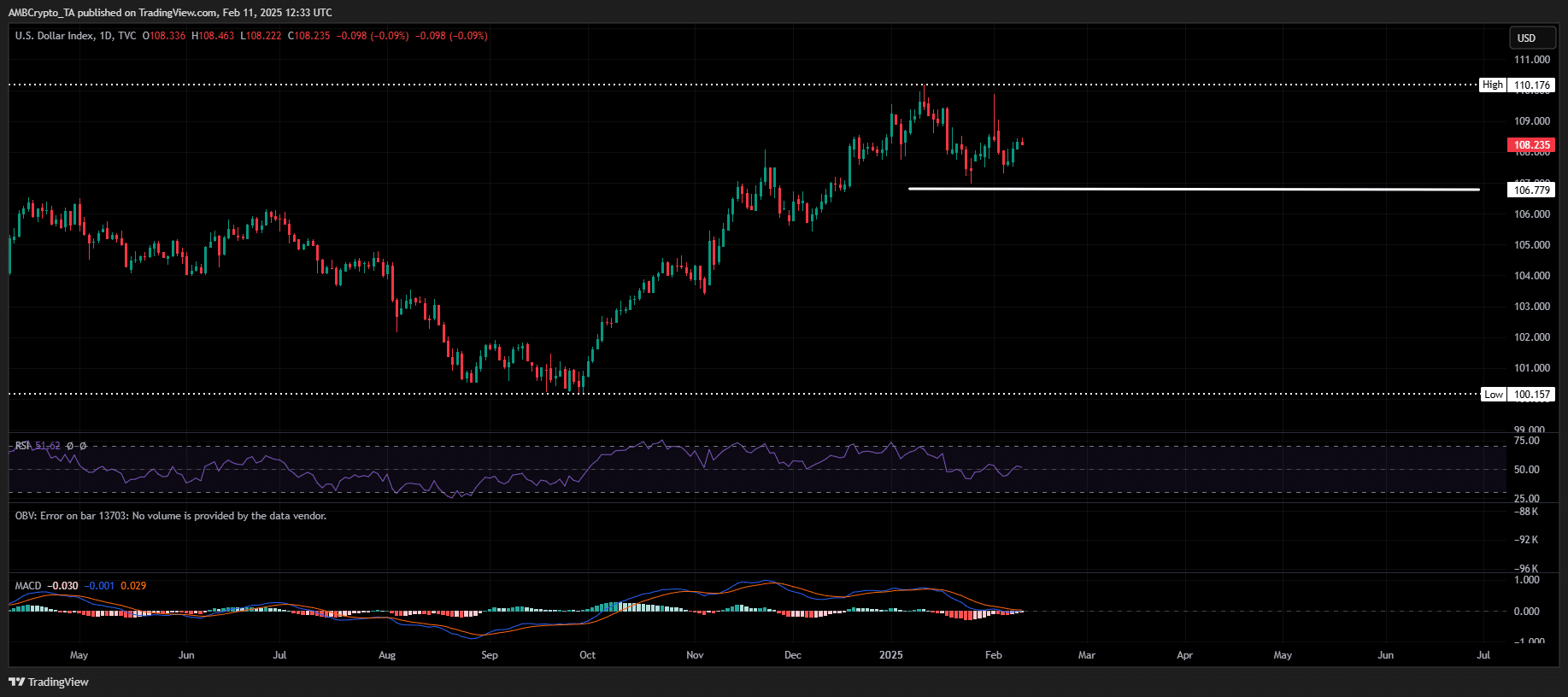

With crypto increasingly tied to macro trends, keeping an eye on important statistics is crucial. The US Dollar Index (DXY) has just recovered 108 after Trump’s 25% rate on important metal – Bitcoin placed in a vulnerable place.

Source: TradingView (DXY)

Historically, DXY and BTC move the other way around. Because Dxy is still climbing and only 1% discount on his annual peak, Bitcoin could be renewed pressure.

Read Bitcoin’s [BTC] Price forecast 2025–2026

Flashback to mid-December DXY for the last time 108 struck, BTC dropped 15% to $ 89k in two weeks.

While Bitcoin is fighting to reclaim $ 100k, the market is shifting from long -term conviction to profit in the short term? The signs are difficult to ignore.