Bitcoin: The impact of predominant long positions

At the time of the press, Bitcoin acts at around $ 97k. Despite a strong bullish story, Bitcoin is confronted with considerable resistance in the psychological barrier of $ 100,000.

Recent data emphasizes that a market is strongly crooked in the direction of long positions, a dynamic that could contribute to the stagnation in price action.

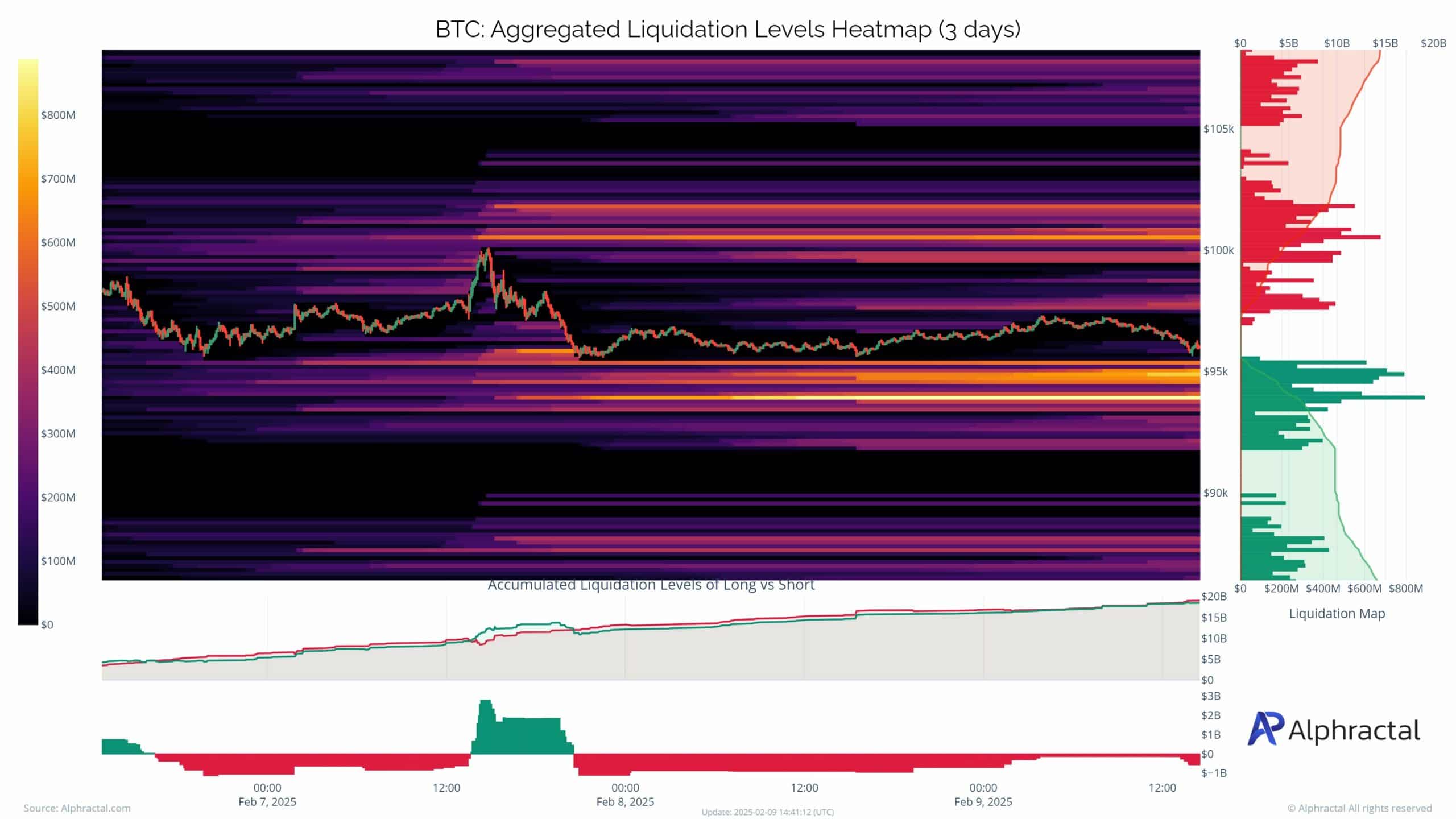

Source: Alfractaal

The liquidation HeatMap gives a clearer picture of the current state of the market. It shows dense clusters of potential liquidation levels near $ 100,000, with a considerable accumulation of liquidations around $ 95,000 on the disadvantage.

These zones are of crucial importance because they represent areas where abrupt price movements can be activated by forced liquidations, which strengthens volatility.

In the short term, breaking the $ 100,000 resistance remains essential for retaining Bitcoin’s Bullish Momentum.

However, not maintaining the support level of $ 95,000 can push prices to the range of $ 92,000, where further liquidation zones can intensify the Bearish pressure.

Traders must follow these important levels closely to anticipate shifts in market dynamics.

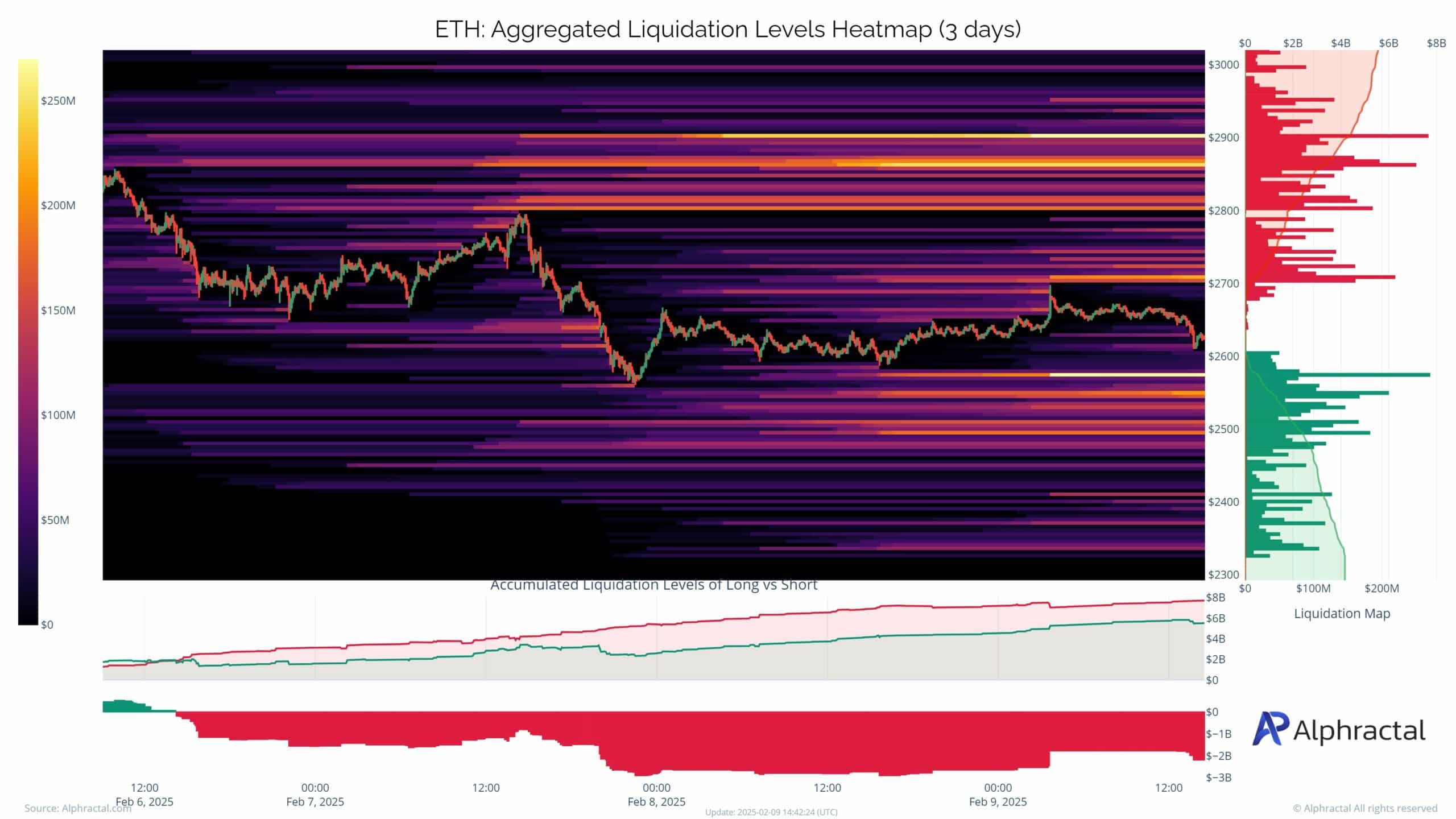

Eth -Liquidationones: a cascade that waits to happen?

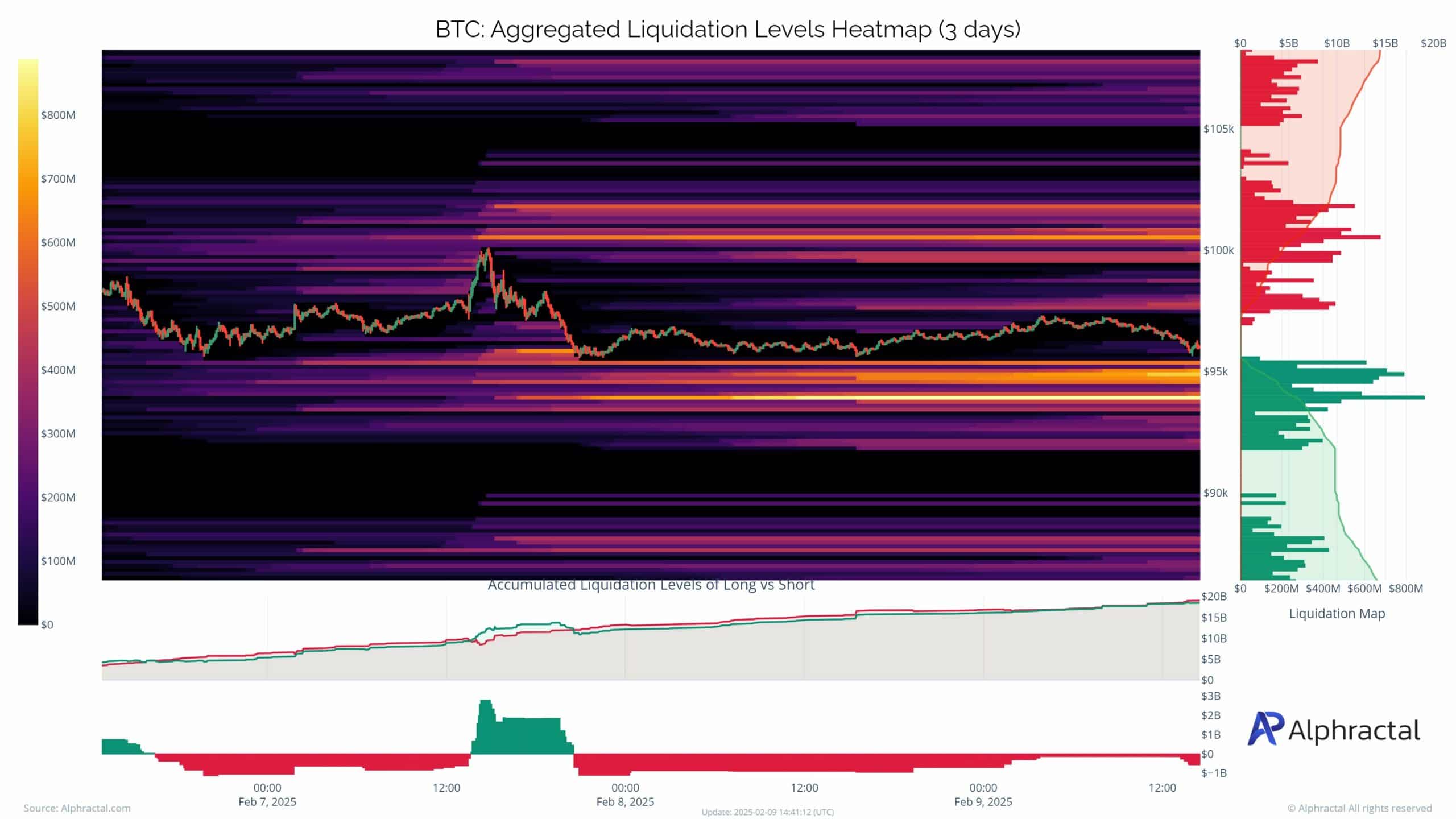

The Ethereum HeatMap reveals important clusters of liquidation levels that concentrated around the range from $ 2,700 to $ 2,800 for long positions and almost $ 2,500 for shorts.

These zones represent areas of increased vulnerability, where price movements can cause a cascade of liquidations, thereby strengthening volatility.

Source: Alfractaal

In particular, the liquidity card suggests a gradual structure of the sales, since the prices approach the $ 2,700 figure, with a substantial activity visible in the $ 2,800 zone.

On the other hand, shorts remain heavily concentrated under $ 2,500, which indicates robust support for ETH, unless wider market sentiment shifts.

This dynamic creates a narrow trade band for ETH, with liquidations that may act as the catalyst for an outbreak or breakdown.

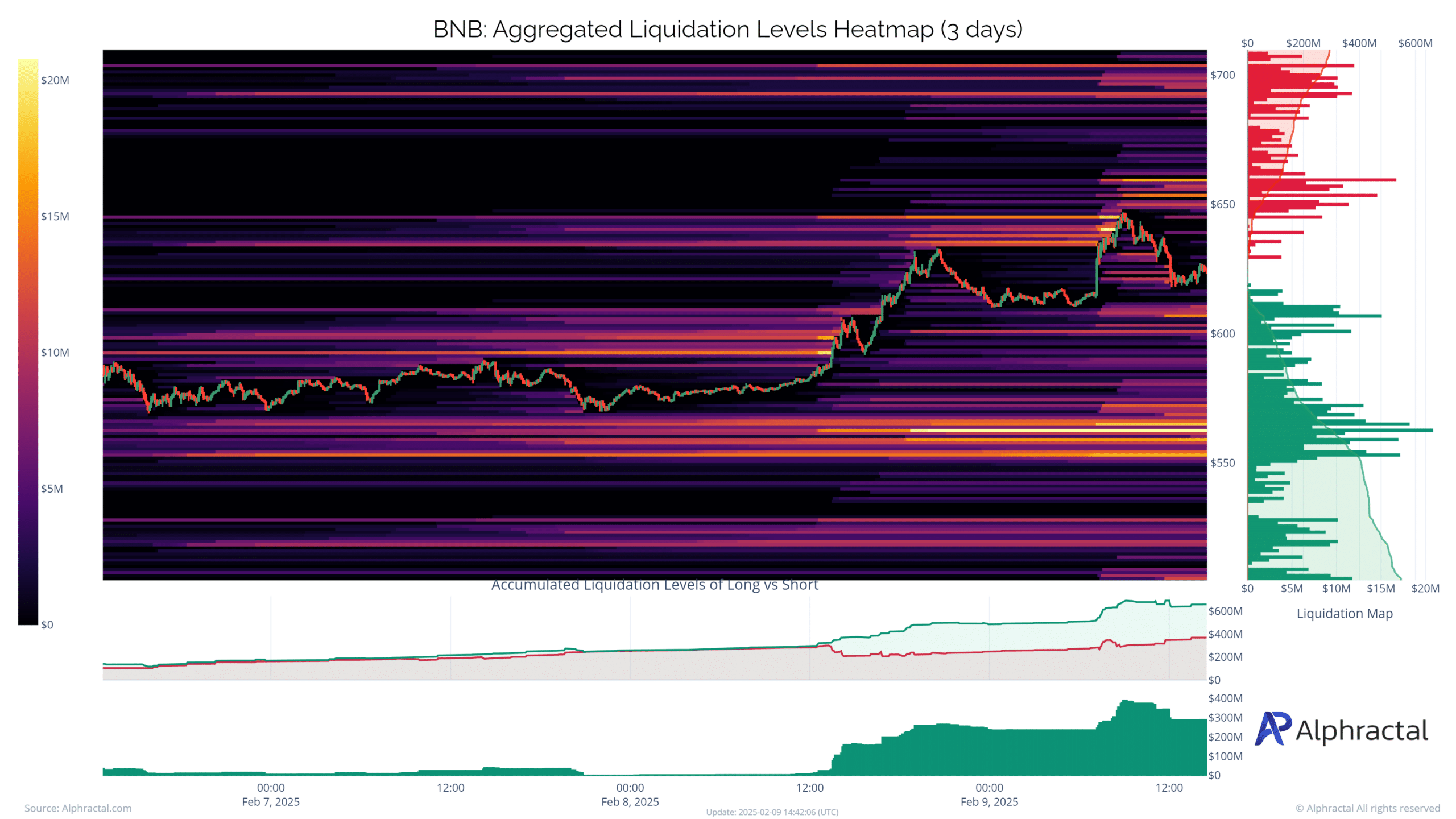

BNB’s Market Patalemate

Source: Alfractaal

The BNB Liquidatie Heatmap emphasizes concentrated activity at $ 650 for lungs and $ 600 for shorts, creating a tight trading range. The structure of liquidation levels above $ 650 suggests a strong resistance, while dense short clusters near $ 600 indicate support.

Despite the recent prictering, every decisive movement can cause a cascade of liquidations, intensifying volatility. A break above $ 650 can bullish momentum of fuel, while a slip below $ 600 can lead to fast downward movement if shorts are liquidated.

With liquidity balance on both sides, BNB seems ready for a strong directional movement.

Read Bitcoin’s [BTC] Price forecast 2025–2026

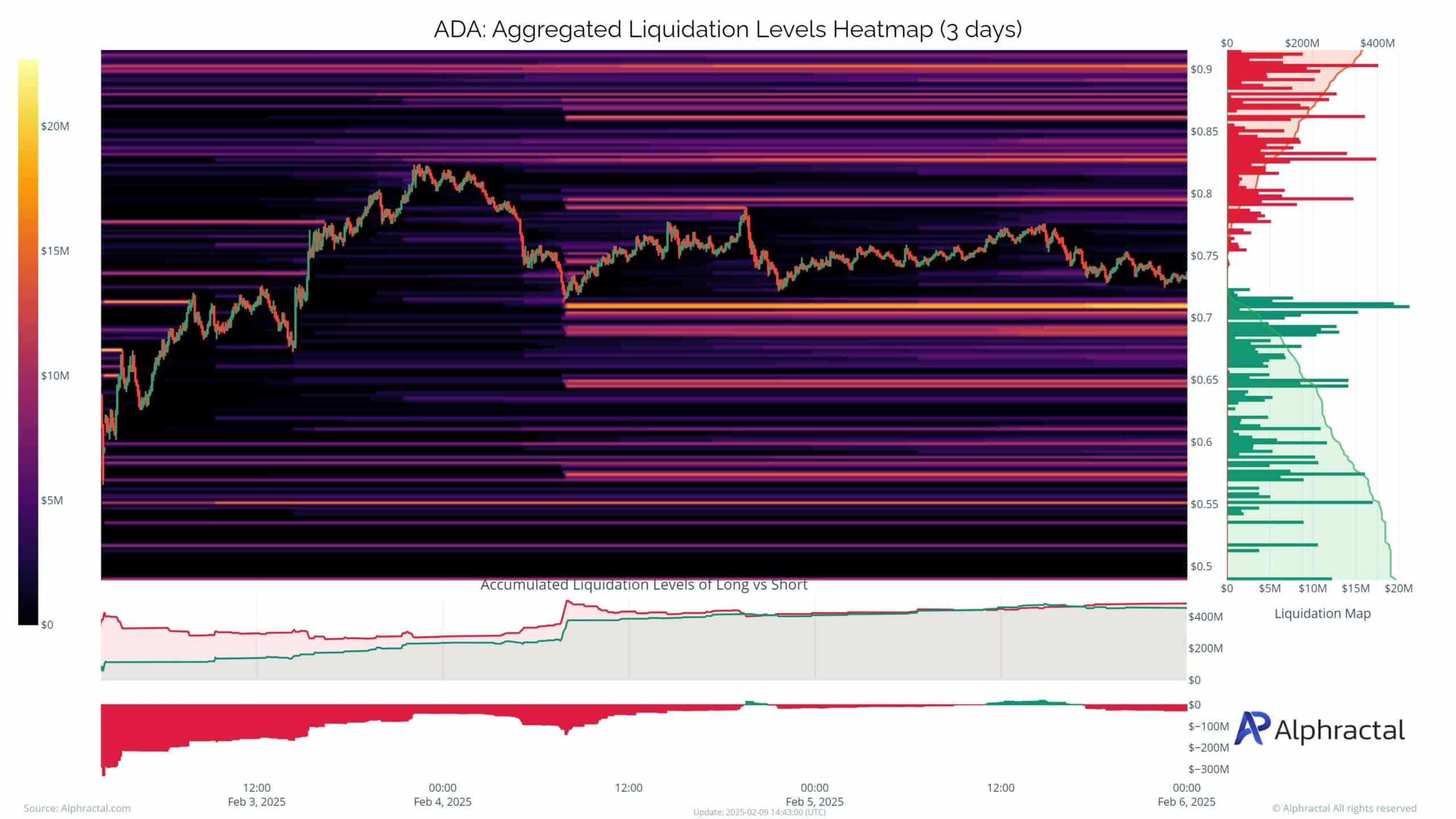

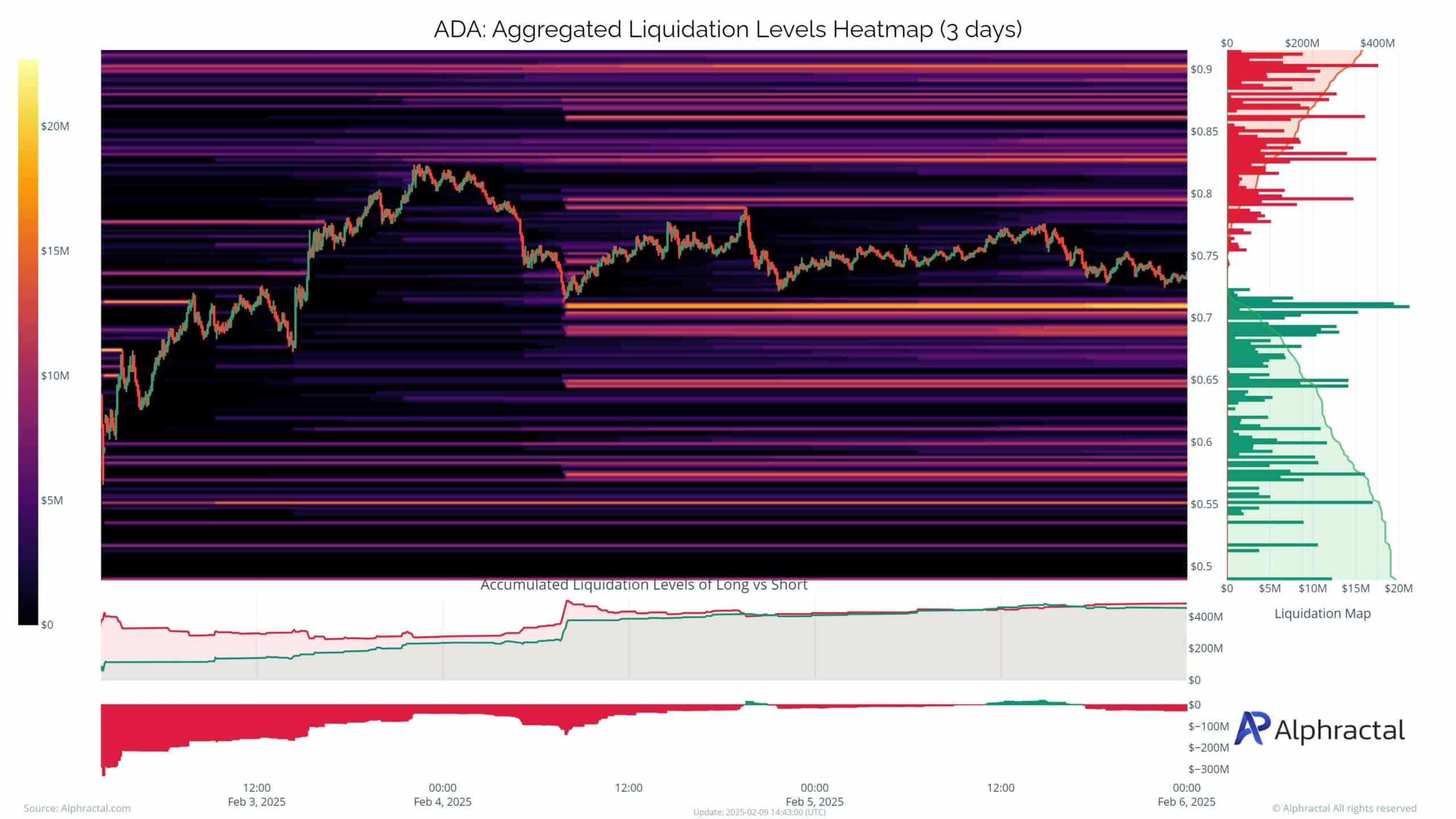

Cardano’s support and risk zones: a pinch on the horizon?

Source: Alfractaal

The Ada -Liquidation heat juice shows substantial support in the vicinity of $ 0.70, with significant long positions concentrated.

This indicates a safety net for ADA in case of downward pressure. However, the high density of longs around this level can make it a risk zone if the price dives further, which activates a cascade of liquidations.

Resistance builds up almost $ 0.90, which means that upward potential is immediately limited. If Ada experiences sharp sale, the range of $ 0.70- $ 0.65 becomes a potential squeeze zone, where forced liquidations can intensify a downward momentum.

Conversely, holding this level can strengthen the bullish sentiment, making it a theater for a rebound to $ 0.85 and then.