- Bitcoin saw 47k BTC outflows, but the price remained somewhat stable on the charts

- Exchange reserves have continued to fall on the market

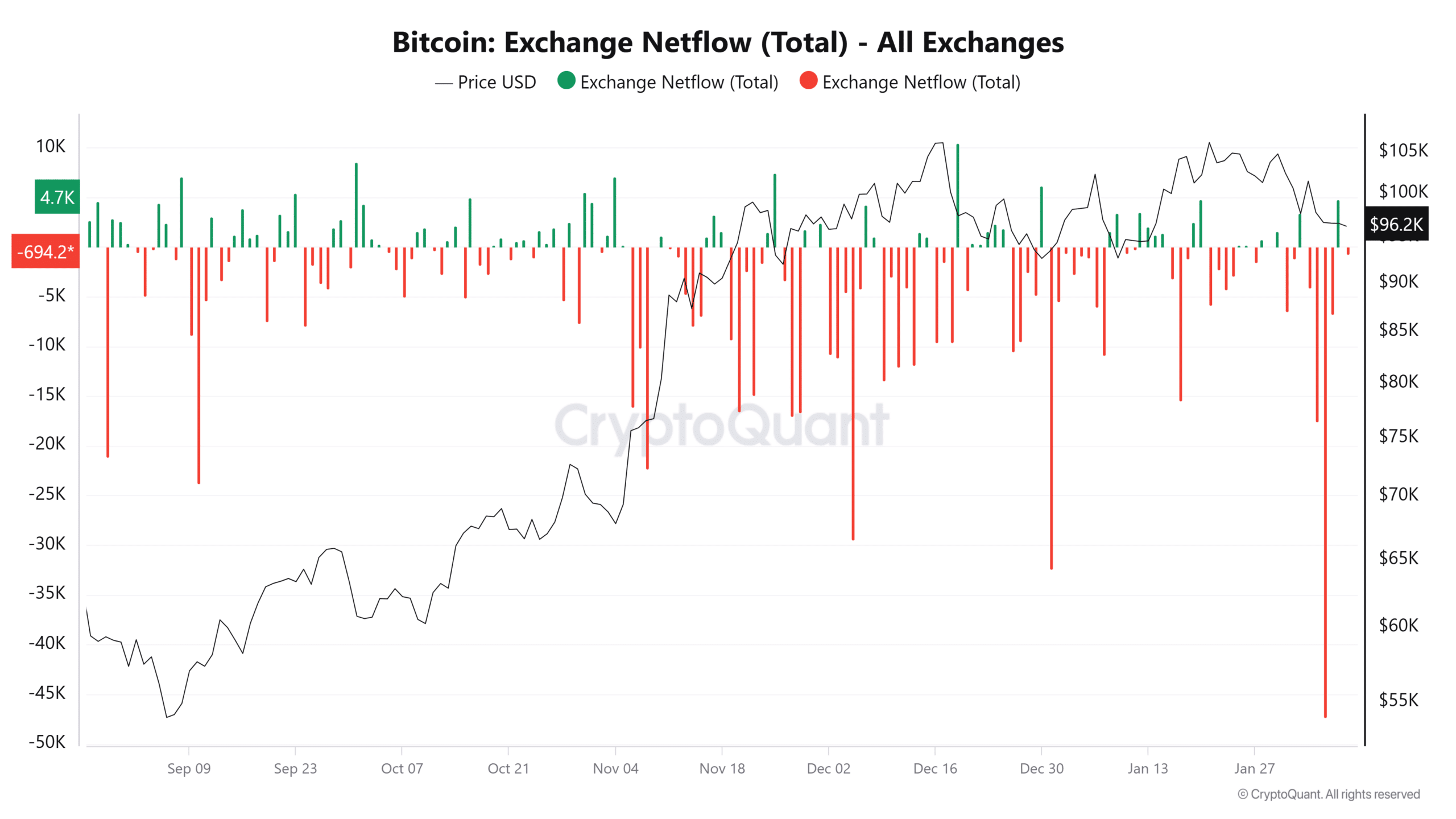

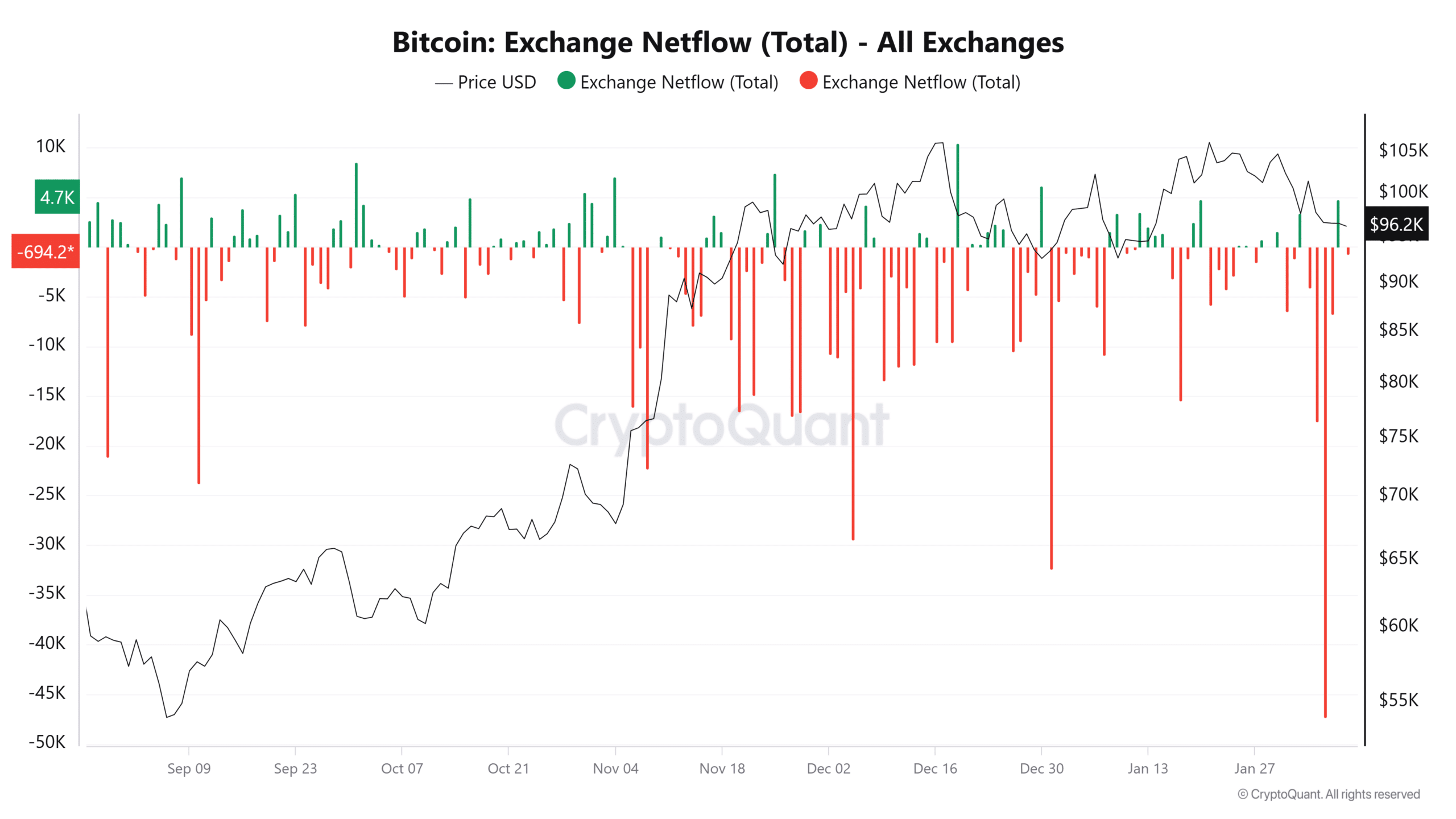

Bitcoin recently saw an important outflow of 47,000 BTC, a movement that led to a debate on whether it represents a real supply shock or a routine internal transaction. Historically, great flow are associated with long -term accumulation, which reduces btc’s liquid supply and possibly has set the stage for Bullish Momentum.

However, this last step requires a further consideration of data on chains and price action.

Analyze Bitcoin Exchange Reserves – Is Accumulation in the game?

An analysis of Bitcoin’s Netflows showed that it saw important outflows before the peak saw it a few days ago. BTC outflows are accelerated to more than 47,000 BTC, making it the biggest movement since 2022.

The meaning of these outlets led to conversations about a supply shock. However, this alone did not fully confirm a supply shock.

Source: Cryptuquant

Also the Bitcoin Reserve -graphic Unveiled a continuing decline in BTC that was held over stock exchanges, which fell in the mid -2024 from more than 3 million BTC to around 2.45 million BTC in February 2025.

A shrinking exchange calfs usually means that investors are moving BTC to private portfolios for long -term position, which reduces the available offer for immediate sale.

How did the price of Bitcoin react?

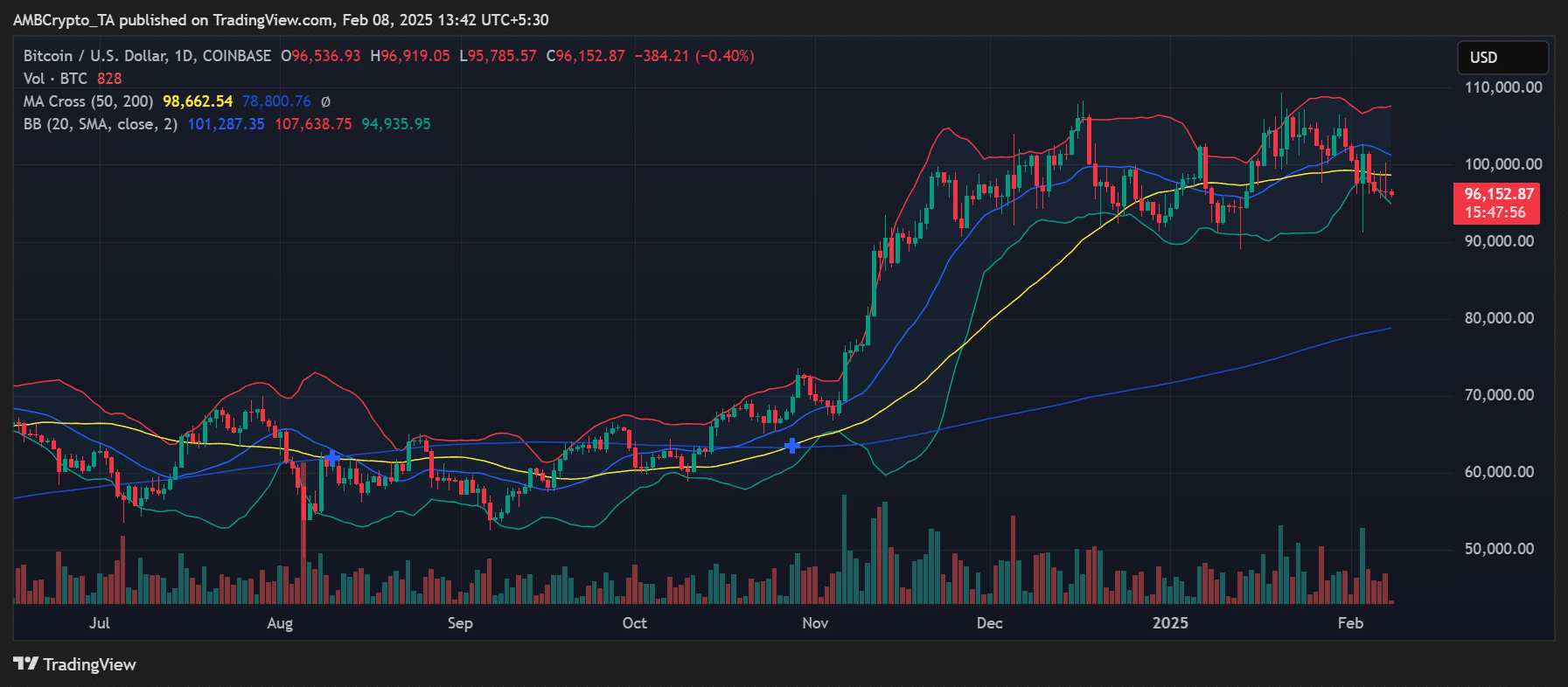

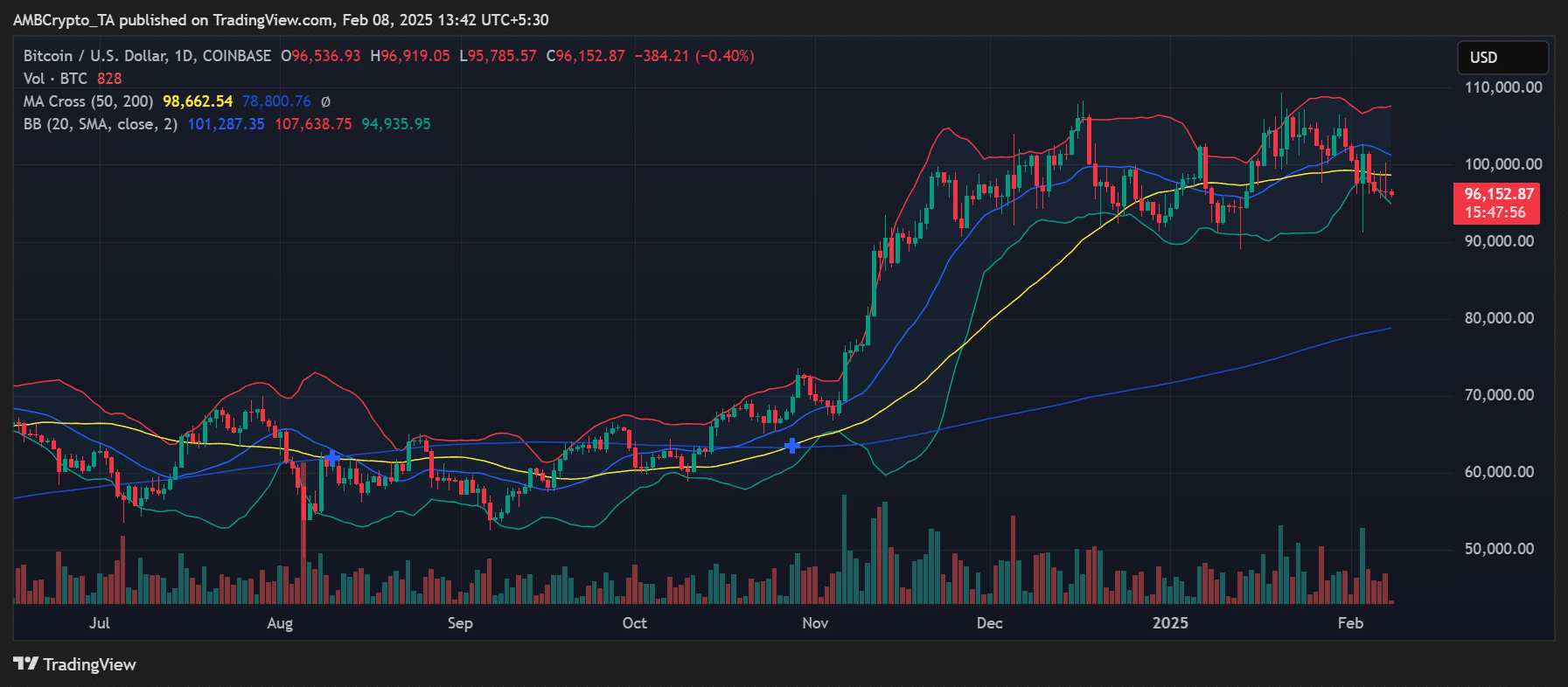

After the outflow, the price of Bitcoin remained stable around $ 96,152 – a sign that the immediate market impact was minimal.

The Bollinger tires indicated moderate volatility, with the price between $ 94,935 and $ 107,638 consolidated. The 50-day progressive average was $ 98,662 and acted as a short-term resistance level.

Source: TradingView

Although major outflows may indicate accumulation, a lack of strong price reaction means that this movement was not seen as a market -changing event. At least in the short term.

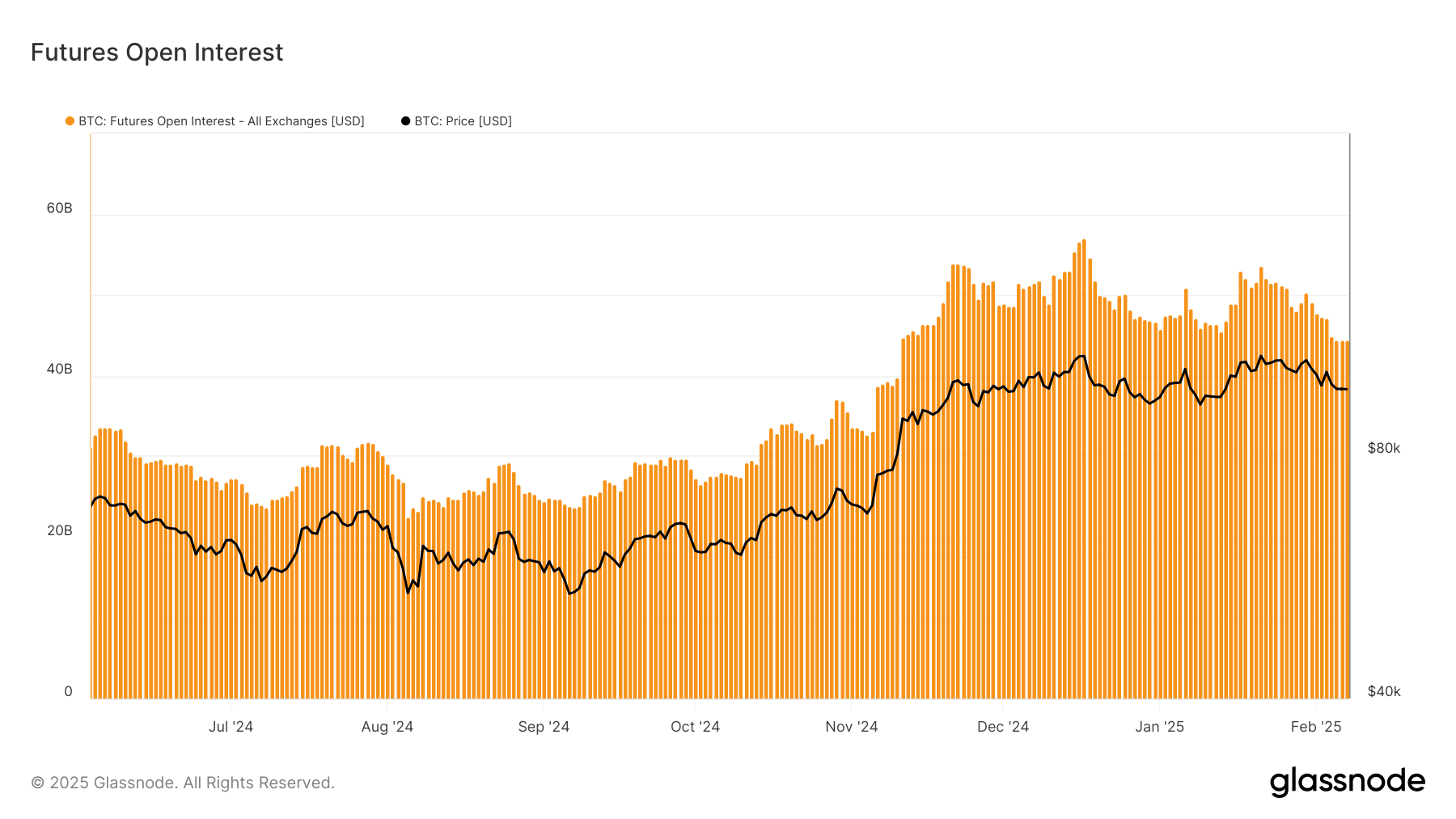

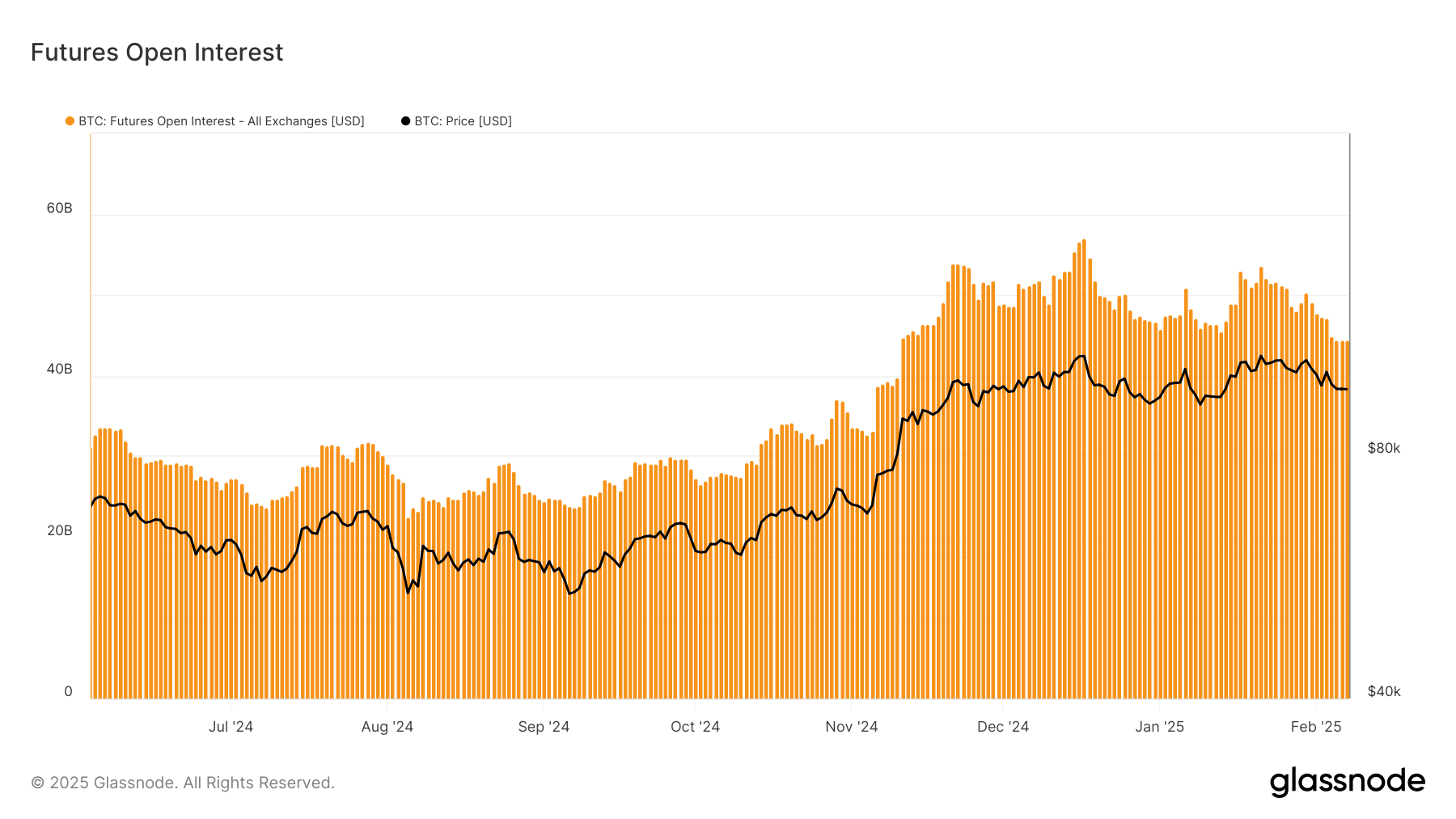

Futures Market underlines speculation

The Futures Open Interest Chart of Glassnode revealed a steady increase in speculative positioning in January, with open interest that is approaching $ 60 billion.

Rising open interest and important exchange outflows often mean that traders bet on an upcoming Squeeze range. At the time of writing, the OI had a lecture of around $ 44 billion.

Source: Glassnode

However, if the financing percentages become overly positive, this may indicate that the market is used too much. Bitcoin can make this susceptible to pullbacks powered by liquidation.

Delete a shock or routine movement?

While the 47k BTC outflows seemed to adjust to a wider trend of falling exchange reserves, its immediate market impact was damped.

Various factors, including a lack of a competitive price movement and the potential for internal wallet, suggest that this was not an immediate shock. Instead, part of a long -term accumulation trend.

-Elet Bitcoin (BTC) Price forecast 2025-26

That said, if Bitcoin enters and whale activity continue like this, an offer could arise in the coming months. The trend will gradually exert upward pressure on the price of Bitcoin.