Ethereum (ETH), the world’s second largest cryptocurrency per market capitalization, is ready for a huge price decrease because it has formed a bearish price pattern on its daily period. Investors and holders in the long term, however, seem to benefit from these market prospects and constantly collect tokens, as reported by the on-chain analysis company Coinglass.

$ 321 million in ETH outflow

Data from Spot -entry/outflow showed that during the constant fall in price of Ethereum, trade fairs have been an outflow of more than $ 321 million in Ether tokens, indicating potential accumulation.

Such outsource in a bearish prospect indicate an ideal buying option and can lead to purchasing pressure and a further upward rally.

Traders bets on short positions

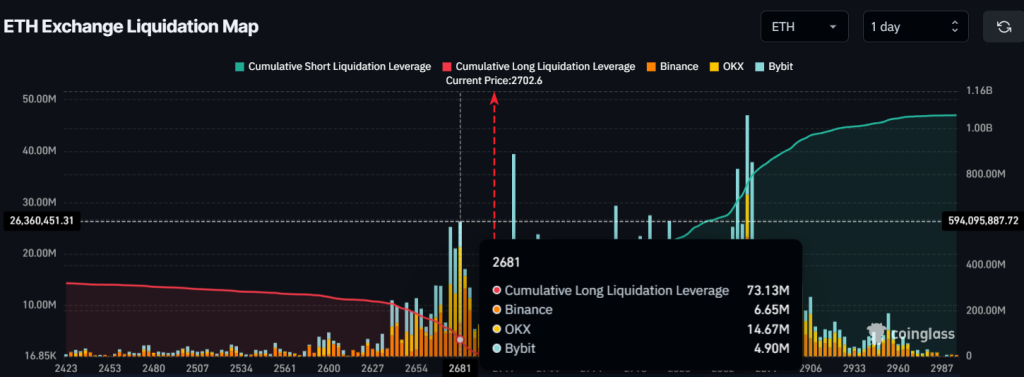

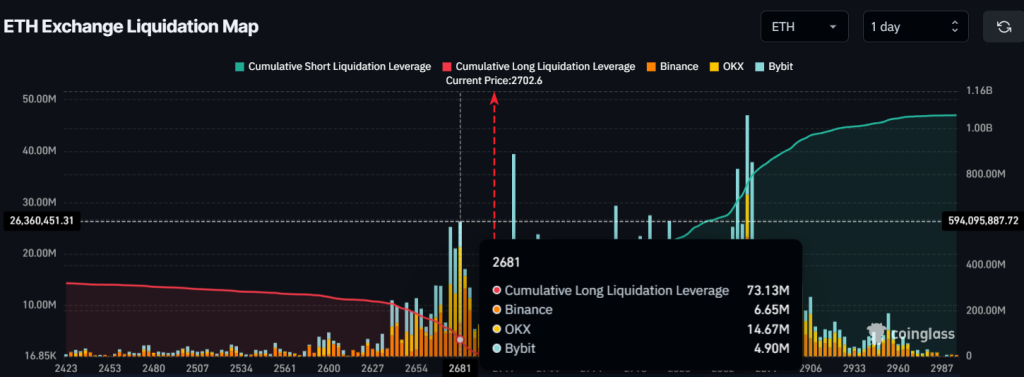

In the meantime, intraday traders seem to follow the current market sentiment. According to Coinglass Data, traders bet strongly on the short side.

From now on, the two most important liquidation levels are nearly $ 2,680, with traders for $ 73.50 million in long positions, while $ 2,780 is another important liquidation level, with traders for $ 325 million in short positions.

This data shows how bears bet on the current sentiment, which leads to a continuous price decrease.

Current price momentum

Ether is currently being traded near the level of $ 2,690 and has witnessed a price drop of 1.30%for the past 24 hours. However, during the same period, due to the Bearish market sentiment and continuous market insecurity, the trade volume fell by 25%, which indicates a lower participation of traders and investors compared to the previous day.

Ethereum (ETH) Technical analysis and upcoming level

With all these factors, the technical analysis of experts suggests that Ethereum Beerarish has become because it has not supplied above the crucial level of support of $ 2,800 and seems to be constantly falling.

Based on the recent price promotion and the historic momentum, if ETH closes a daily candle below the $ 2,700 level, there is a strong possibility that it could fall by 20% to reach the $ 2,200 level in the future.

The relative strength index (RSI) of ETH, however, is near the over -sold area, which suggests a bearish trend and the potential for further price decreases.