- ETH/BTC ratio is approaching the critical 0.05 BTC level, which makes potentially losses instructions as key support fail.

- Institutional preference for Bitcoin and the lack of catalysts from Ethereum contributes to the long -term underperformance of ETH.

The Ethereum[ETH]-To-bitcoin[BTC] (ETH/BTC) Ratio has had to deal with ongoing battle, with no less than 77% of the trade days that are unprofitable for ETH holders against BTC.

The recent market turbulence has exacerbated these conditions, as according to data on chains and price performance. But what does this mean for traders and investors?

Insight into the ETH/BTC winning graphic

The graph illustrates ETH/BTCs profitability over time By marking profitable and unprofitable trading days. Green means days that ETH performed better than BTC, while Rod emphasizes underperformance periods.

The Orange Ding area at the bottom represents the increasing percentage of unprofitable days in time.

Source: Checkonchain

Analysis shows that since the beginning of 2022 ETH has consistently subtracted Bitcoin, with only a few short intervals of profitability.

The last decline in the early 2025 has strengthened this Bearish trend, with the relative weakness of ETH that pushes the unprofitable trading days than 77% – a historically significant threshold.

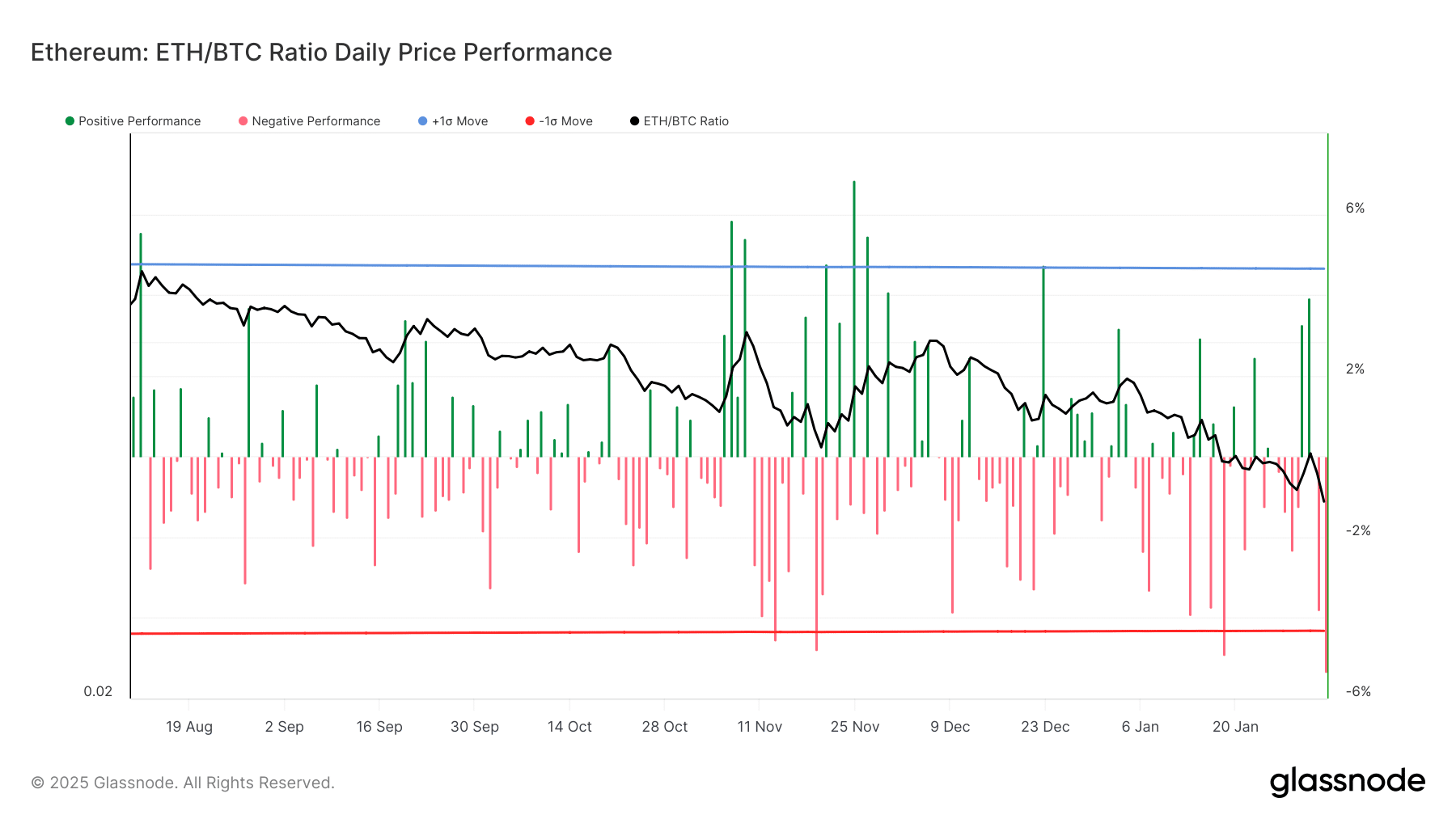

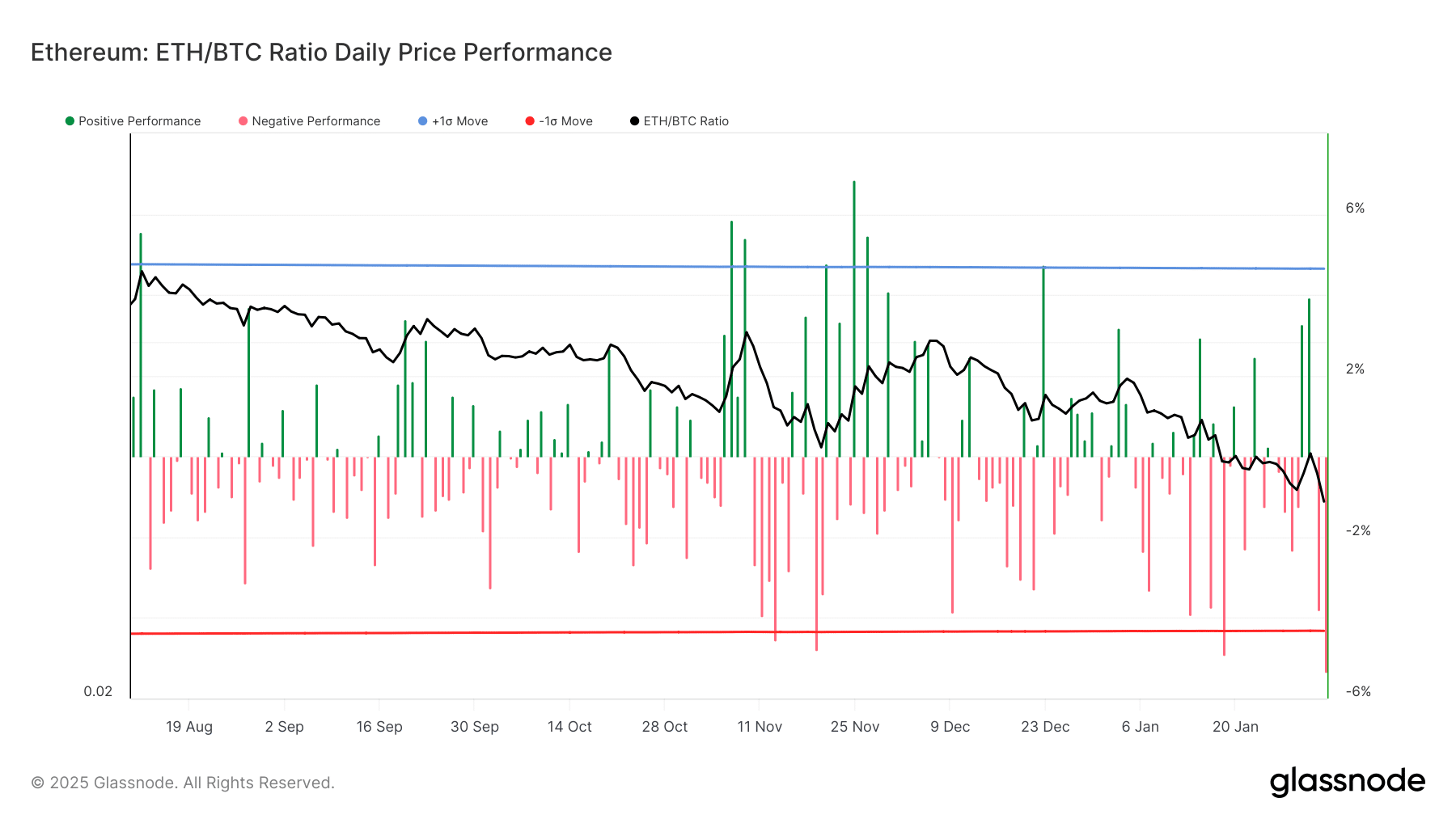

Eth/BTC Price promotion: a brutal wick

Analysis of the ratio graph shows the daily price performance of ETH/BTC and emphasizes extreme volatility.

The last price promotion included a brutal wick, which underlined a sharp rejection of resistance levels and heavy sales pressure.

Daily negative performance bars exceed positive, which indicates a persistent bearish trend.

Source: Glassnode

From mid -2024, ETH has trouble maintaining an upward momentum against BTC, creating a steady trend. Every attempt at recovery has been obtained with sales pressure, which pushes the ETH/BTC ratio lower.

The newest decrease saw the value of ETH compared to BTC-Gaststeen to a multi-year low, with the ETH/BTC ratio around the 0.05-level-level psychological and technical support zone.

Why is ETH struggling against BTC?

Bitcoin remains the go-to assets for institutional adoption, especially after the approvals of Bitcoin ETF at the beginning of 2024. Capital continues to flow to BTC instead of altcoins, including ETH.

While Ethereum remains a large blockchain, BTC investors prefer a safer bet.

In contrast to Bitcoin, who benefits from macro -economic stories and institutional acceptance, Ethereum misses immediate, strong catalysts.

Despite the ETH ETF approval, the impact has not been significant, as seen by the current compared to the BTC ETF -Stroom.

-Eleeum (ETH) Price forecast 2025-26

What is the next step for ETH/BTC?

With ETH/BTC that approaches historically significant support levels, traders must keep a close eye on 0.05 BTC level. If ETH/BTC breaks below this level, the ratio can fall further to 0.045 or even lower.

This could cause a wave of liquidations and panic sales. Although the Trend Beerarish remains, a rebound of important support levels is possible, especially if Ethereum sees an institutional interest.