- Tron outperformed the rest of the top blockchain cohort in terms of transaction efficiency.

- TRX showed signs of a possible reversal as bears lose momentum and whales pile up.

TRON[TRX] has become the blockchain network with the highest transaction value among its top peers. A recent analysis shows that Tron scores highest in terms of cost-effectiveness.

According to CryptoQuantTron had the highest transaction price ratio (TPR). This metric compares the total daily transaction value to the price of the network’s native cryptocurrency.

Tron’s TPR surpassed major blockchain rivals, including Bitcoin [BTC]Ethereum[ETH]And Tonmint [TON].

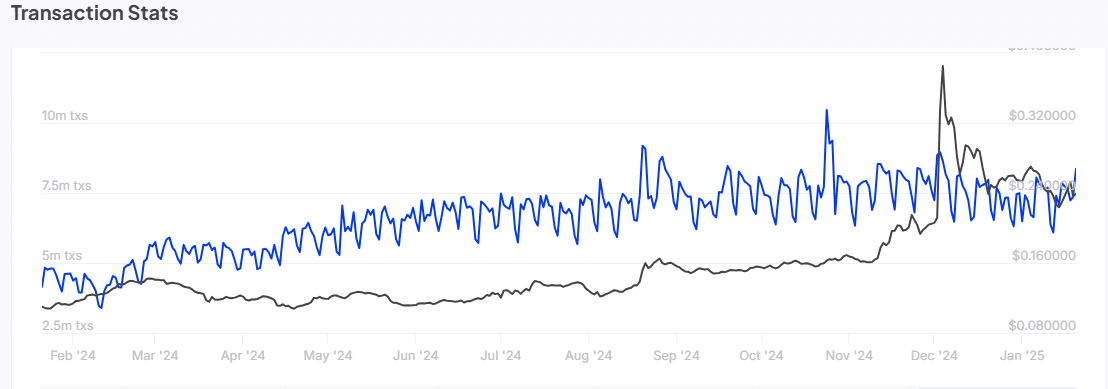

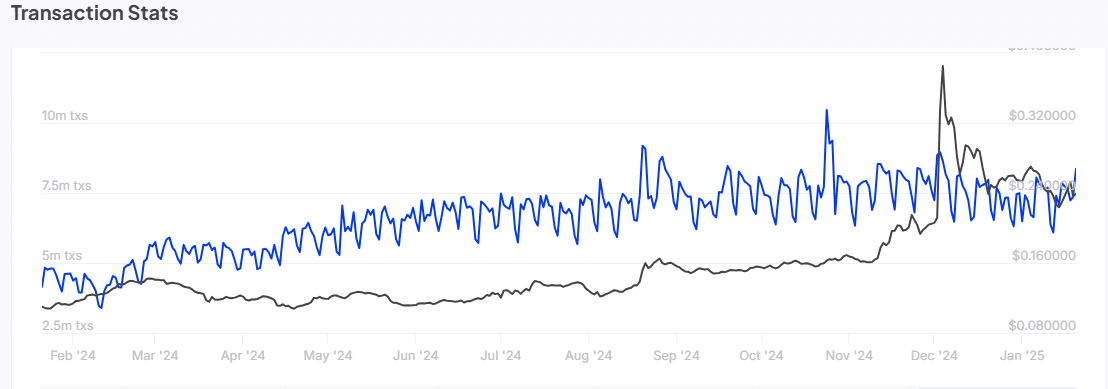

This transaction efficiency positively impacted the Tron network. The number of daily transactions grew from 3.4 million to 10.47 million over the past twelve months.

Source: IntoTheBlock

In the short term, daily transactions on the Tron network grew from 6.09 million on January 12 to 8.37 million on January 20. This increase reflects the recent excitement in the market, showing Tron’s ability to capitalize.

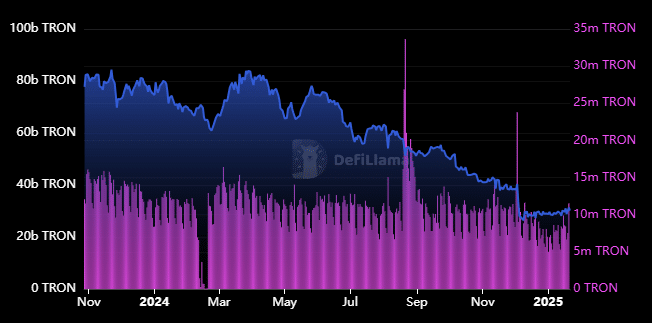

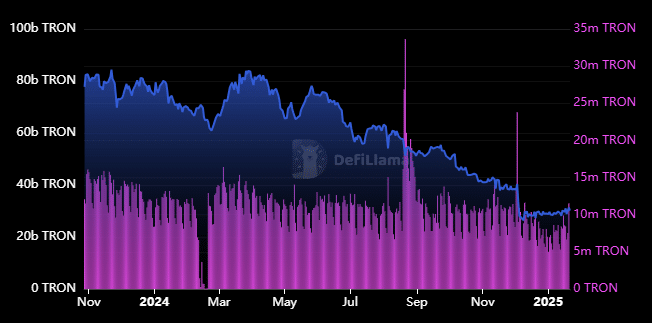

Tron network rates have fallen slightly in 2024 after reaching impressive levels earlier this year.

For example, daily fees fell below $6 million in late December as bearish momentum ran out in Q4 2024.

source: DeFiLlama

Tron fees rose to $11.49 million on January 20, reflecting the recent transaction spike. The TVL outflow has also leveled off over the past six weeks.

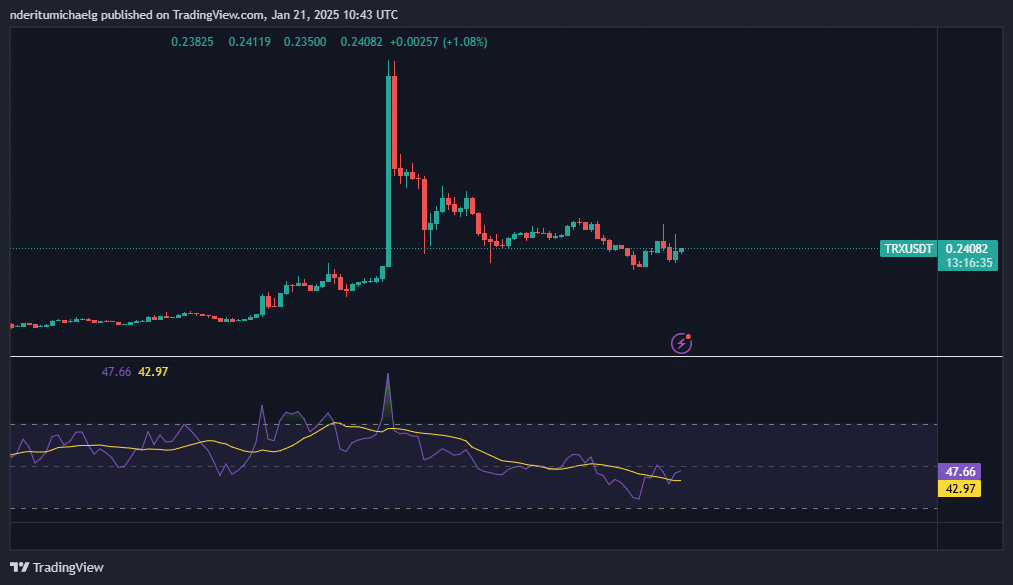

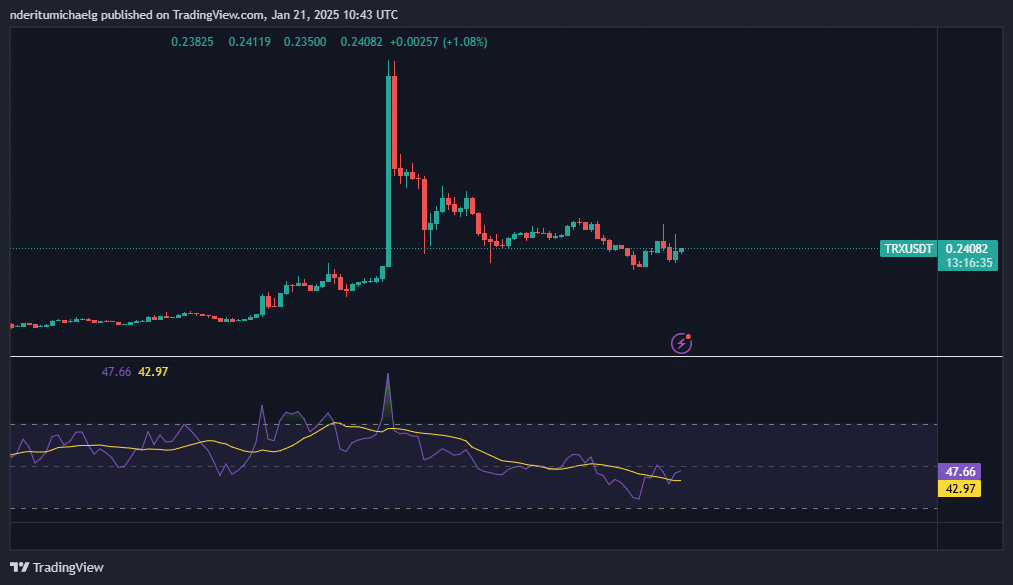

TRX Consolidates, But Can the Bulls Benefit?

The bearish momentum TRX has been experiencing since early December is finally showing signs of reversing. The price fell 51% from the December 2024 high to the lowest price of $0.21 on January 13.

It has since consolidated, with some upside from its press-time price of $0.24.

Source: TradingView

The RSI has shown a pivot, indicating that bullish momentum has been building. Coinglass has noted a strong increase in inflows since mid-January. Although outflows continue, inflows have offset the selling pressure.

This revival in demand coincided with the cooling of selling pressure. TVL has shown positive flows, an increase in volume and a slight increase in Open Interest.

Read TRONs [TRX] Price prediction 2025-26

Could these observations signal an impending turnaround? Historical concentration data showed that whale stocks grew from 56.43 billion TRX on January 1 to 56.89 billion TRX on January 20.

This indicates that whales have bought the dip. While it hasn’t sparked a major rally, it’s a healthy sign for the bulls.