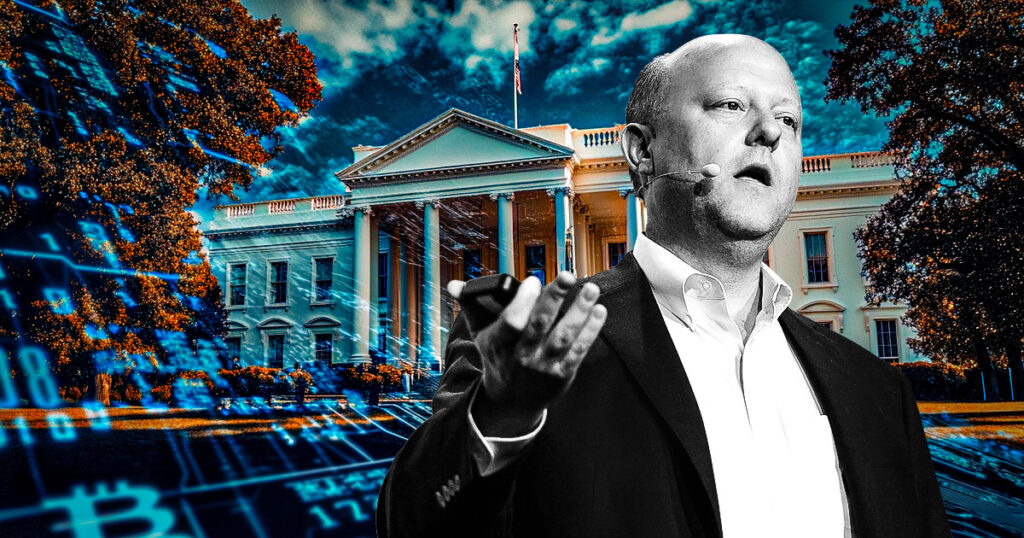

Circle CEO Jeremy Allaire expressed optimism about President Donald Trump’s potential to issue policies beneficial to the crypto industry, including executive orders that could remove barriers to digital asset adoption, Reuters reported on January 20.

Speaking at the Reuters Global Markets Forum during the World Economic Forum in Davos, Allaire emphasized the urgency of reversing restrictive measures such as the SEC’s Staff Accounting Bulletin (SAB) 121.

According to Allaire:

“SAB 121 has effectively penalized banks and financial institutions for holding cryptocurrencies on their balance sheets.”

He emphasized that repealing such regulations could significantly improve the integration of digital assets within traditional finance.

Circle, the issuer of USD Coin (USDC), has been vocal in its call for regulatory reforms to support innovation in the crypto sector. The company illustrated its commitment with a $1 million USDC donation to Trump’s inauguration committee, signaling confidence in the administration’s potential crypto policy.

Despite Allaire’s comments, Trump’s January 20 inauguration speech omitted any mention of Bitcoin and crypto. Instead, he focused on topics like tariffs, immigration and energy independence, leaving investors speculating about the timing of possible crypto-related announcements.

Nevertheless, the market experienced significant volatility throughout the day. Bitcoin (BTC) rose to an all-time high of $109,000 ahead of the inauguration before falling to a low of $100,000.

According to CryptoSlate According to data, Bitcoin was maintaining a six-figure price level of around $103,500 at the time of writing.

Optimism under Trump

Overall, Bitcoin has risen nearly 50% since Trump’s election in November, with investors buoyed by expectations of favorable policies.

Recent data indicates strong institutional interest in digital assets. Last week, Bitcoin Exchange-Traded Products (ETPs) recorded an inflow of $1.9 billion, part of a larger total inflow of $2.2 billion into crypto-focused ETPs.

Adding to the momentum, Trump’s newly launched memecoin, TRUMP, debuted on the Solana blockchain, with its value skyrocketing 490% within 24 hours. The token’s meteoric rise pushed its market cap to nearly $11 billion before selling pressure set in for a correction.

While a proposed strategic Bitcoin reserve remains speculative, gambling platforms suggest a 60% chance of such an initiative becoming a reality within the year.

Industry leaders remain hopeful that the Trump presidency will catalyze a period of growth and regulatory clarity for cryptocurrencies, promoting broader adoption and integration across financial systems.