- Bitcoin miners’ reserves fell sharply, increasing selling pressure in the fourth quarter of 2024

- So far in 2025, sales have declined, indicating a possible market shift toward consolidation

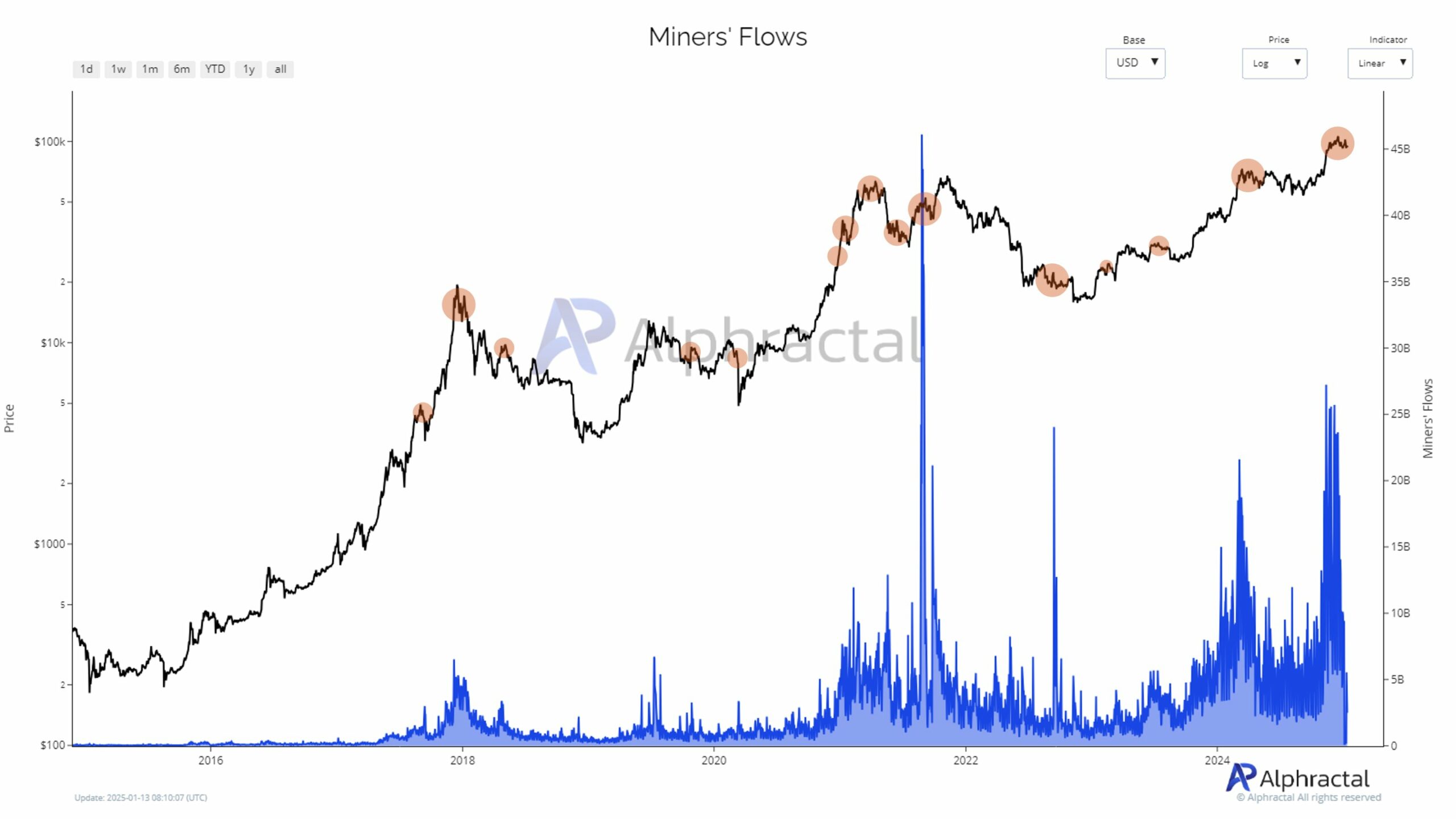

By the end of 2024 Bitcoin [BTC] miners set a new record for the highest ever dollar value, with significant outflows from their reserves increasing selling pressure in the market. Record high hash rates have driven up mining costs, forcing miners to liquidate Bitcoin to cover costs. However, data from January 2025 revealed a slowdown in miner sales, raising questions about the future of the market.

Increasing outflow of miners

Late 2024 saw an unprecedented surge in Bitcoin miner outflows, with dollar values reaching new all-time highs. This increased activity is consistent with apparent selling pressure as miners chose to liquidate significant portions of their reserves.

Source: Alpharactal

Recent data shows that these large-scale liquidations closely align with local price spikes, suggesting miners have been strategically selling their power to maximize returns. This dynamic has amplified volatility in the Bitcoin markets, creating a feedback loop in which higher mining activity fuels bearish sentiment.

And yet, the recent tapering of outflows in early 2025 seemed to indicate a possible shift in market conditions, with miners appearing less incentivized to offload their assets despite increased operational pressure.

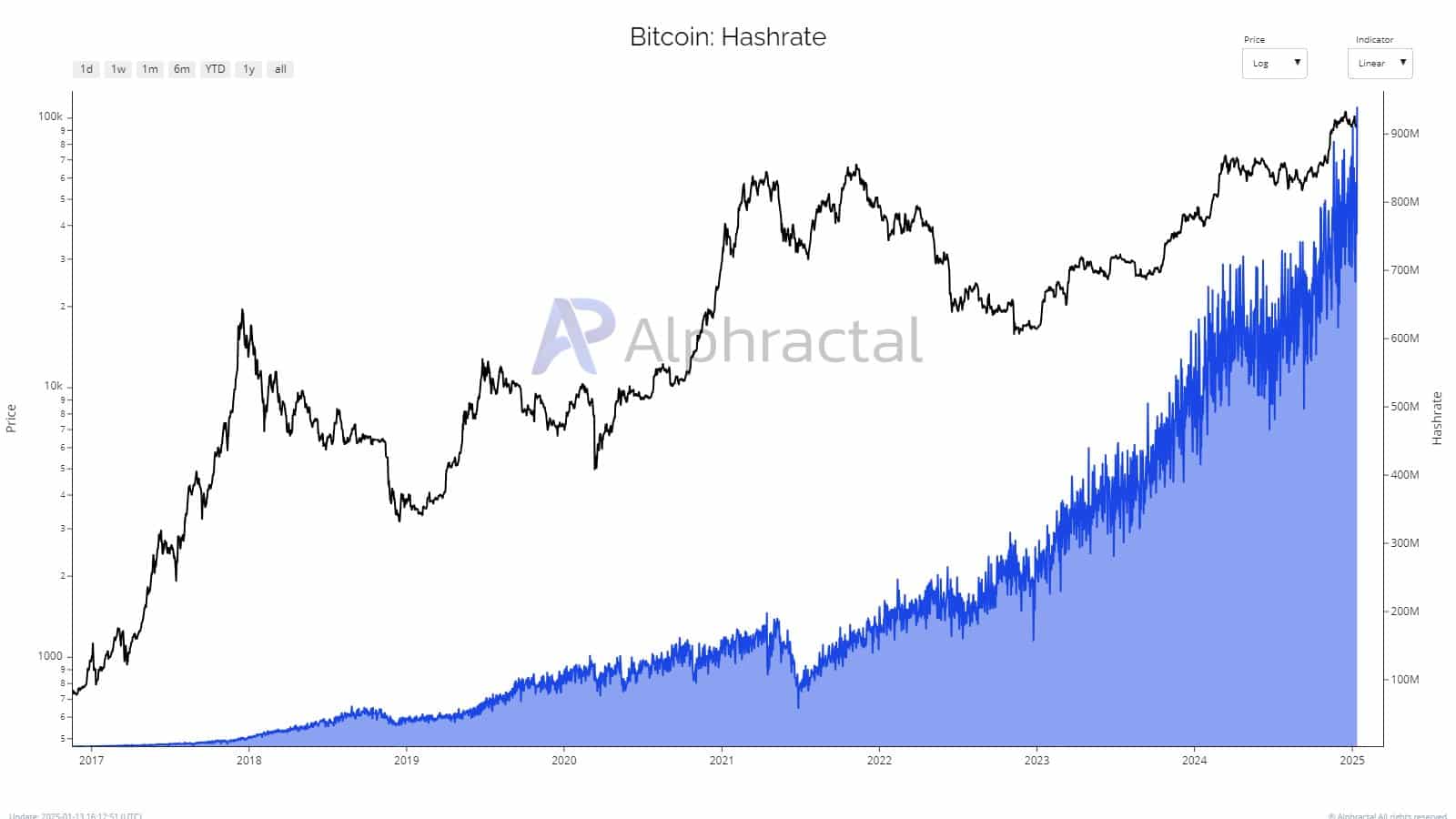

An ATH hashrate

Bitcoin’s hashrate reached an all-time high in late 2024, reflecting the network’s robust security and fierce competition among miners. The rapid increase correlated with the increasing difficulty of mining new Bitcoin, which pushed operating costs to their peak.

While higher hash rates indicate confidence in Bitcoin’s underlying protocol, they also place significant financial pressure on miners. Especially because they then have to maintain expensive hardware and energy-intensive operations.

Source: Alpharactal

This imbalance forced many to liquidate assets in the last quarter of 2024, exacerbating the downward price momentum. With stable hash levels seen in early 2025, miners may find some short-term relief. However, sustainability concerns loom as energy prices and competition continue to rise.

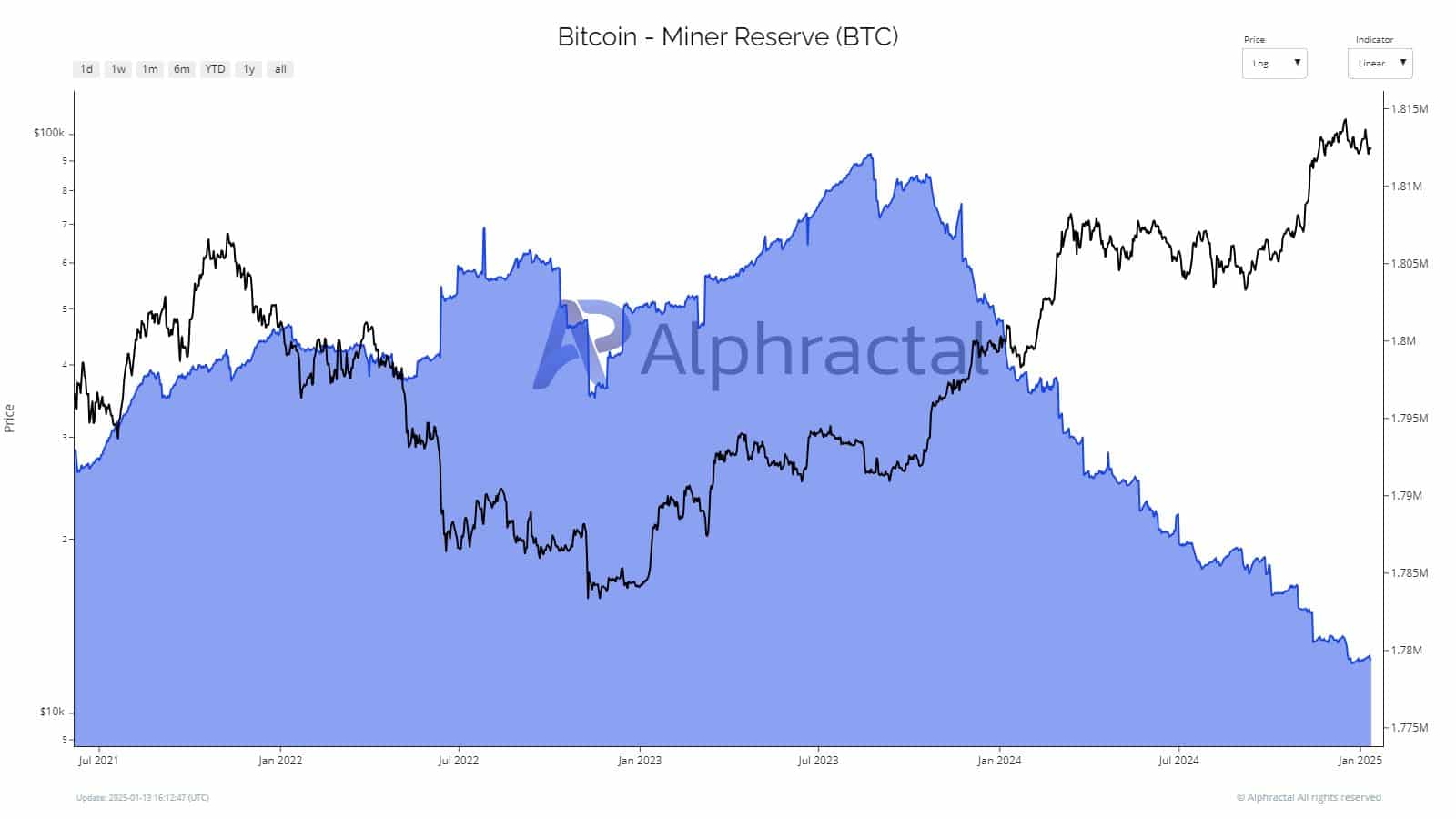

Falling Miner Reserves and Sell-off Dynamics

Bitcoin miners have been steadily reducing their reserves since mid-2023, driven by rising operating costs due to record hash rates and rising energy costs. This strategic shift highlights miners’ need for liquidity in an increasingly uncertain market, with the largest reserve reductions occurring during local price spikes.

Source: Alpharactal

With reserves approaching multi-year lows in 2025, concerns have increased about miners’ declining ability to stabilize the market during corrections.

Meanwhile, ongoing sell-offs have added to market pressure. However, BTC miner reserves indicated a slowdown in sales activity as miners balanced rising costs with profit margins. This reduction could indicate improved operational efficiency or external support, potentially leading to less volatility and a more stable market in the coming months.

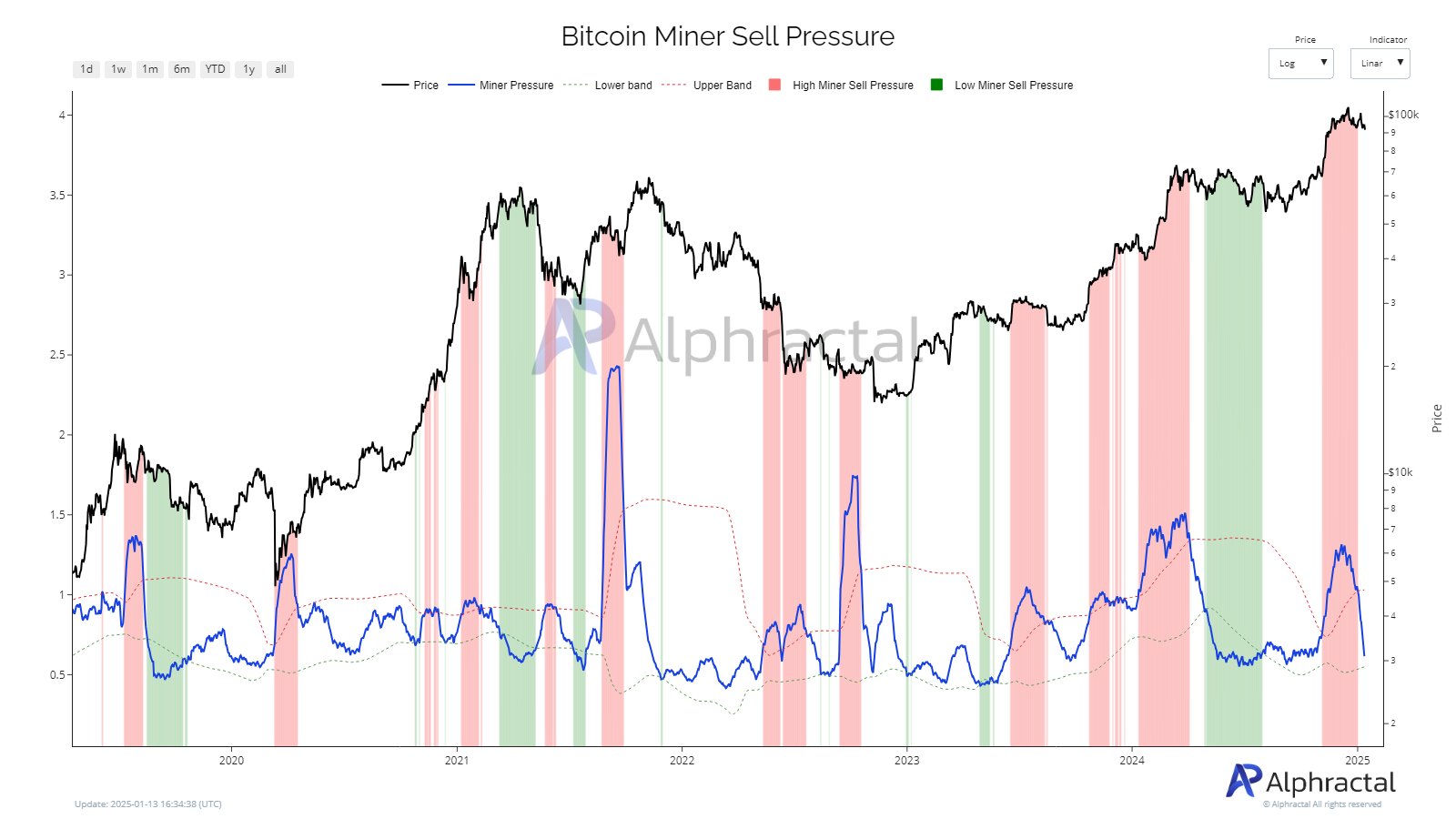

Decline in sales activities in 2025

Source: Alpharactal

January 2025 has marked a noticeable drop in selling pressure from Bitcoin miners so far. Miners’ selling pressure chart showed a sharp decline in outflows compared to the end of 2024, indicating a possible shift in market dynamics.

This suggested miners are taking a more strategic approach and may be holding reserves in anticipation of higher prices. Additionally, operational adjustments or external financing may have alleviated the need for aggressive liquidations, reducing the bearish influence of mining activity on the Bitcoin markets.

Read Bitcoin (BTC) price prediction 2025-26