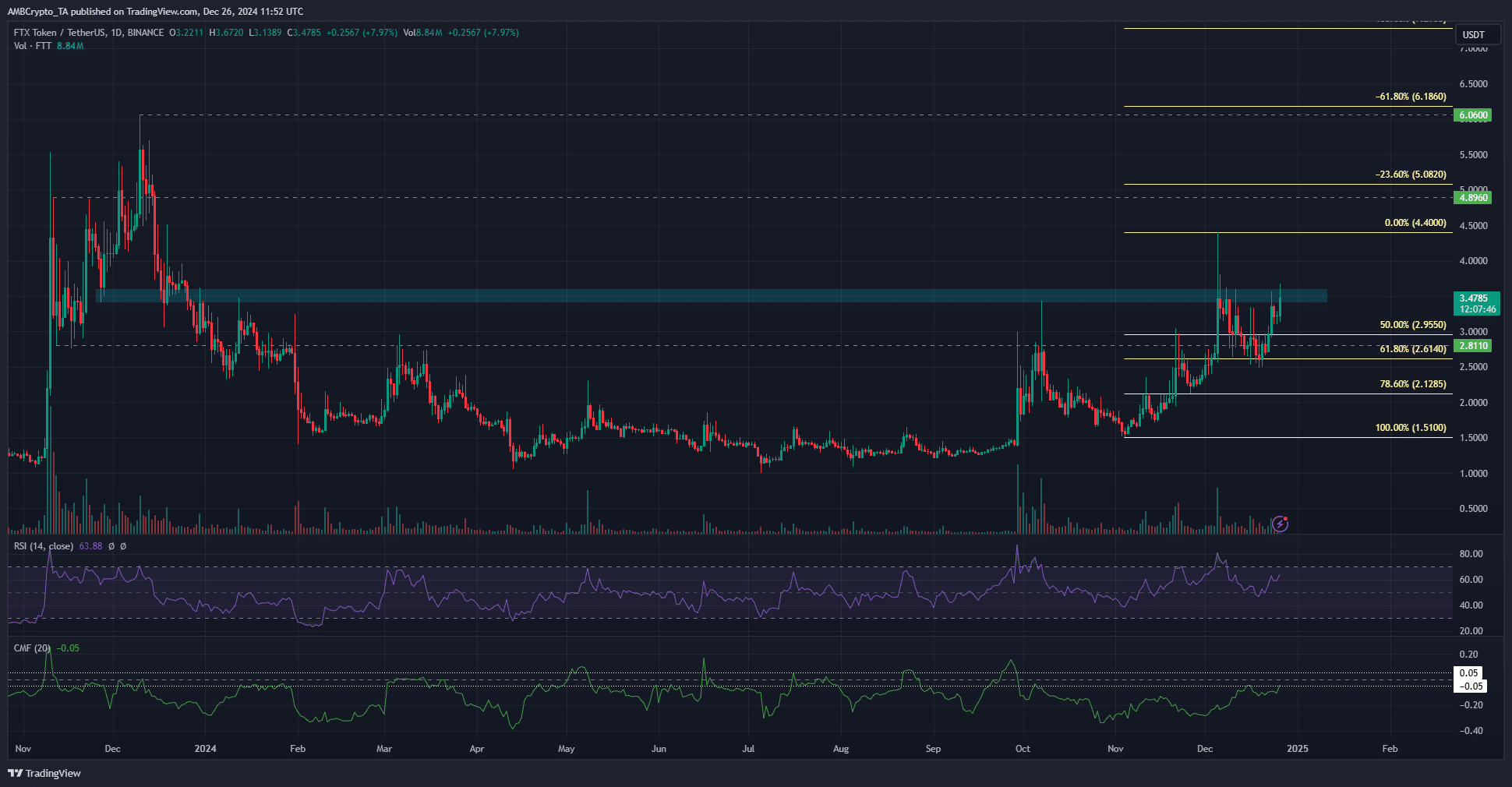

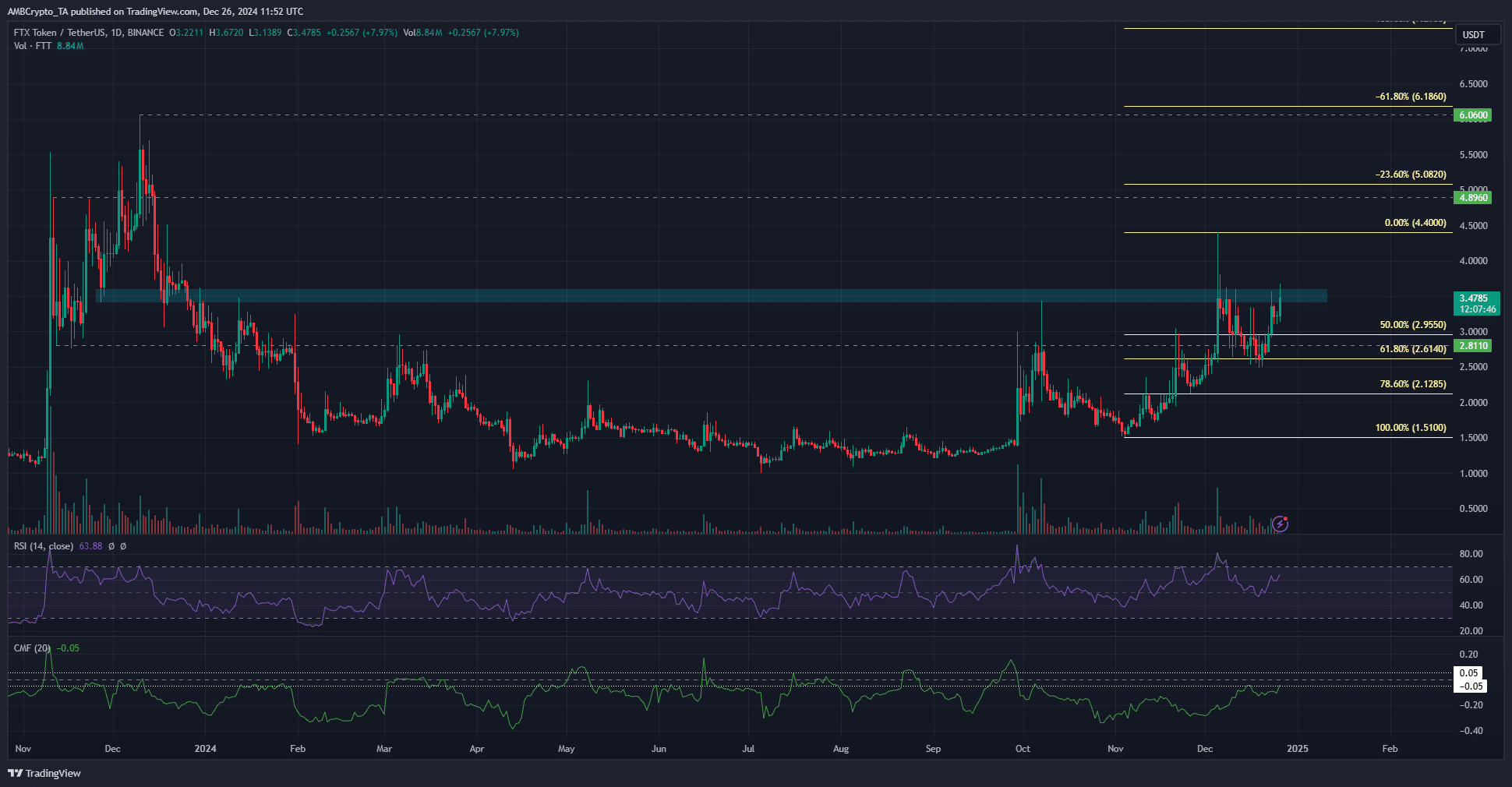

- The FTX token has a bullish bias on the daily time frame.

- The negative figures on the CMF showed that an upward trend may be unsustainable.

FTX token [FTT] has seen increased volatility in recent weeks. The US government had approved the reorganization plans of the defunct crypto exchange FTX in October.

The plan aimed to refund 119% of the claimed value to approximately 98% of former FTX users.

There has also recently been speculation about a presidential pardon from Joe Biden for the exchange’s disgraced CEO, Bankman-Fried.

The bankruptcy proceedings are scheduled for January 2025, further increasing the likelihood of a volatile FTT token.

The rumors were fueled by one message on X by user Wall Street Mav. Polymarket odds saw a 9% increase in pardon odds after Elon Musk’s remark.

This also explained the short-term bullish rise behind the FTX token.

FTT is again testing the resistance at $3.5

Source: FTT/USDT on TradingView

In June and July, the exchange token appeared to have reached a bottom around $1 and slowly started to climb higher in the second half of September.

Since November, this upward trend has started to manifest itself again. On November 21, the daily chart showed a bullish market structure again.

Since then, the structure has remained bullish on the 1-day time frame. The RSI has also been above the neutral 50 for the past month, giving further credence to the idea of bullish momentum behind the token.

Yet the CMF has remained consistently below -0.05 for most of the past year. This showed that capital flows are not consistently inward, making the rally of the past two months suspect.

Is your portfolio green? Check the FTX Token Profit Calculator

The CoinMarketCap page for FTX Token is decorated with a warning,

“The FTX bankruptcy proceedings are ongoing. The FTT token no longer has any use and can be liquidated by the estate to pay creditors. Please proceed with caution.”

Therefore, investors should avoid the token, while traders should be wary of news developments that could hurt their positions.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer