ADA, the native token of the Cardano blockchain, appears to be struggling to maintain its crucial support level amid market uncertainty. Today, December 27, 2024, general market sentiment for cryptocurrency appears to be experiencing a price drop, which includes major assets such as Bitcoin (BTC), Ethereum (ETH), and XRP.

This decline in the price of key assets has shifted market sentiment completely to the downside.

Cardano (ADA) Current Momentum

At the time of writing, ADA is trading around $0.864, after falling more than 6.9% in the past 24 hours. Amid this price drop, the altcoin has reached a crucial level. If this level does not hold, the asset could plummet 15% and fall below the $0.75 mark.

This bearish price action has struck fear among traders and investors, leading to a drop in trading volume. According to data from CoinMarketCap, ADA trading volume has fallen 16% in the past 24 hours.

Cardano (ADA) Technical analysis and upcoming level

According to expert technical analysis, ADA recently broke away from a bearish head-and-shoulders price action pattern. Over the past seven days, it has consolidated below the neckline of the pattern. Amid the recent price decline, ADA’s price has reached the lower limit of the consolidation zone and is on the verge of a collapse.

Based on the recent price action, if the altcoin breaches this level and closes a daily candle below the lower limit of the zone, there is a strong possibility that it could fall by 15% and reach the $0.77 mark in the future.

ADA’s bearish thesis will only hold true if it closes a daily candle below the $0.85 level, which marks the lower bound of the consolidation zone. Otherwise, the bearish scenario may not materialize.

On-Chain metrics reveal mixed sentiment

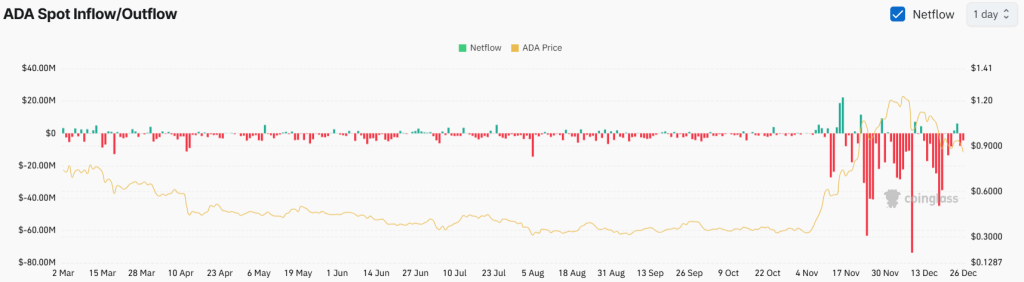

Despite this bearish outlook, long-term holders appear bullish, while traders are hesitant to enter new positions, as reported by the on-chain analytics firm. Mint glass. Data from ADA spot inflows/outflows shows that the exchanges have witnessed significant ADA outflows worth $4.7 million, indicating possible accumulation and buying pressure.

Conversely, traders appear to be liquidating their positions, as evidenced by an 8.2% drop in ADA open interest over the past 24 hours.