- Seeing a solo miner claim a large reward can have a psychological effect on other Bitcoin holders.

- It could potentially change the mining landscape in the long term.

In the middle of a “high risk” market, where Bitcoin [BTC] Investors choose prudence over greed. One lucky place made an exit by taking advantage of pure luck and not market fear.

This is the case with a Bitcoin value of $97,475 address claimed 3,195 BTC, generating a total of $311,432 in gross revenue from the exit. The kicker? It wasn’t a whale, an institution or a long-term investor – it was a solo miner.

Typically, miners quickly exit when Bitcoin enters a high FUD zone, securing profits on their mining fees. But this unusual move by a solo miner has caught the attention of AMBCrypto.

Sell-the-news event?

It’s no surprise: mining a Bitcoin block is no easy feat. It requires enormous computing power, high-end hardware and a hefty energy bill – all of which adds up quickly.

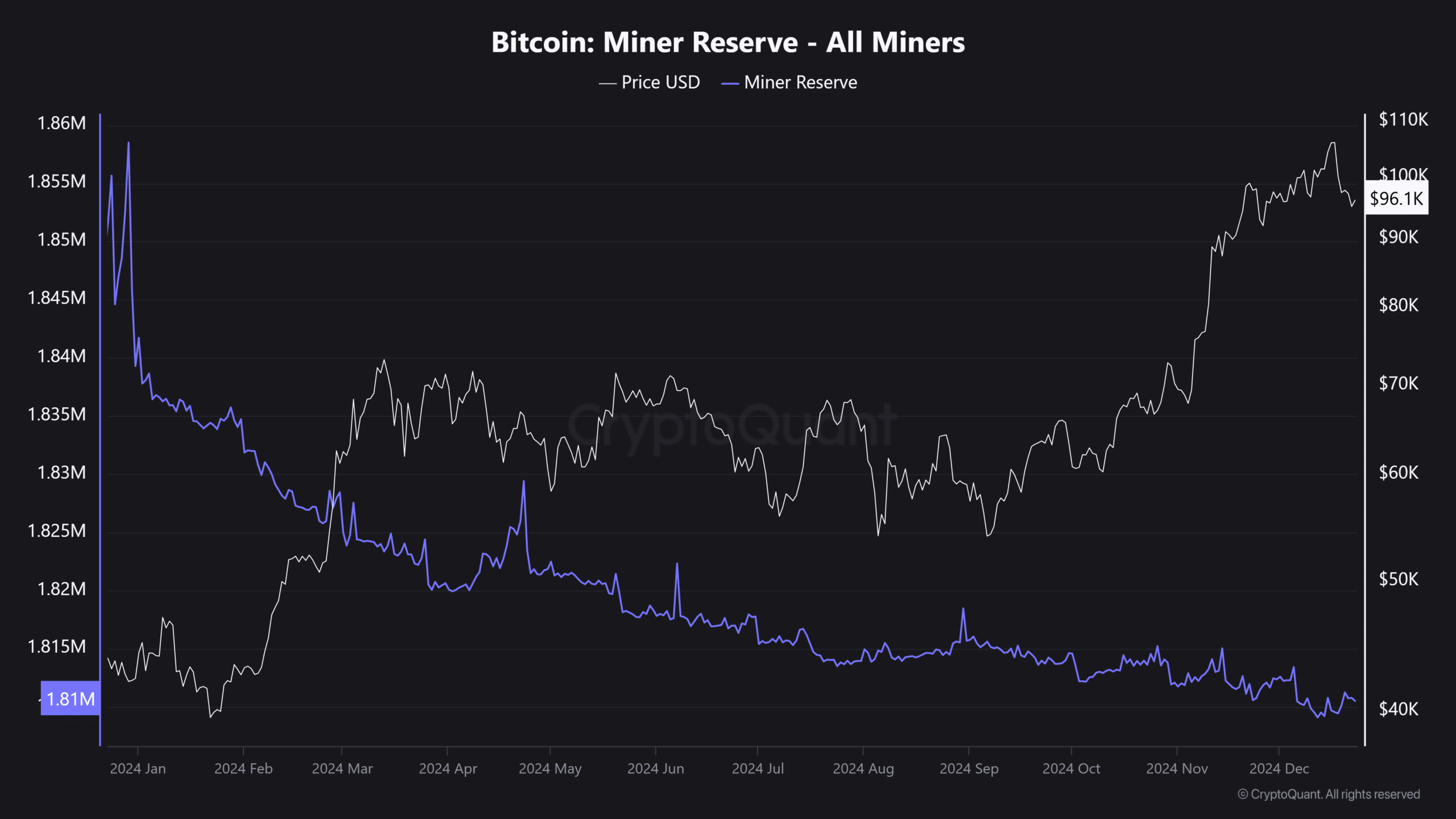

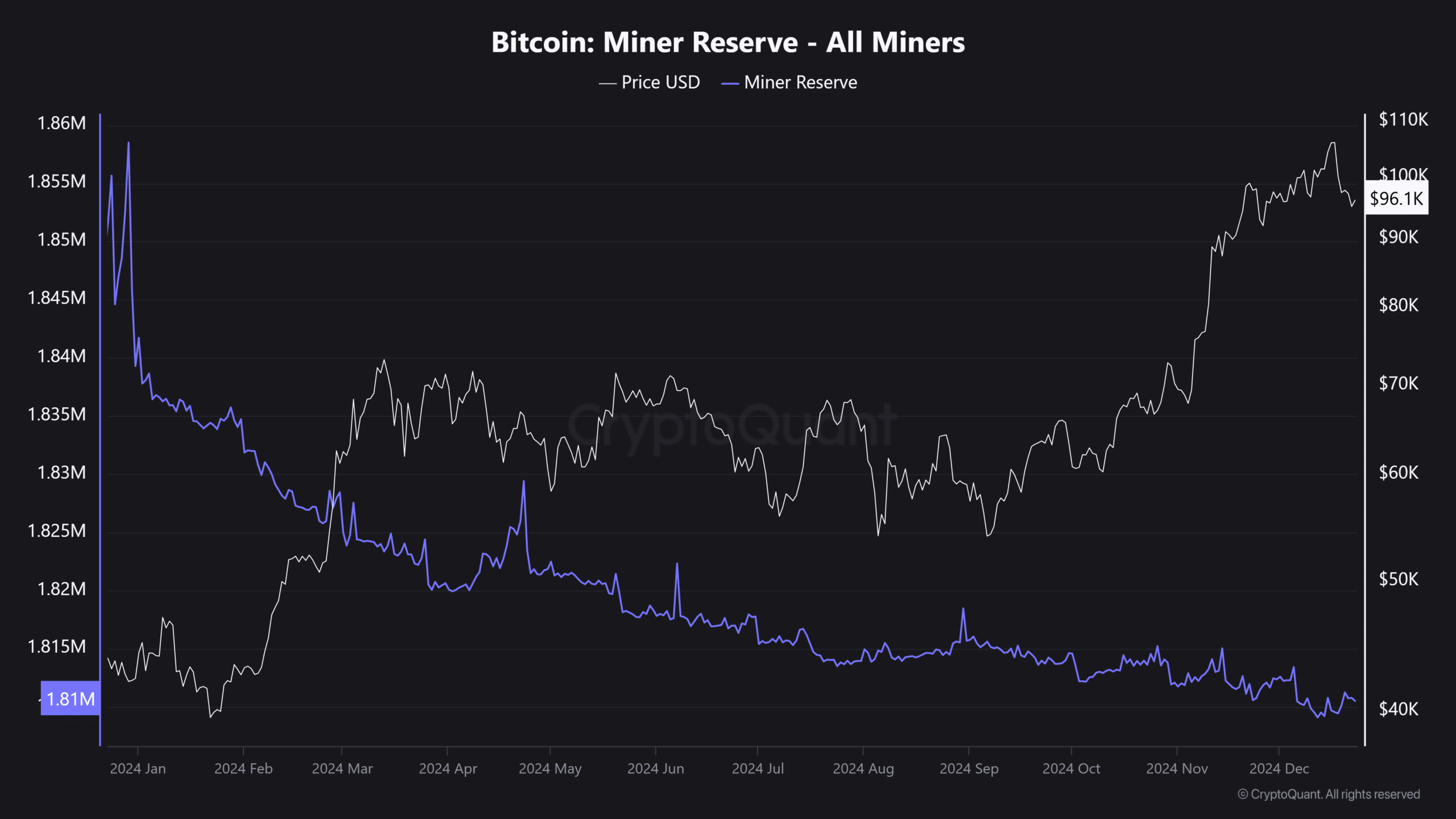

Since the introduction of Bitcoin fifteen years ago, mining has only become more difficult. With each new block, the difficulty increases, putting pressure on profit margins for miners. As a result, the miner’s reserve is at an annual low.

Source: CryptoQuant

Looking at the chart, we can see a clear pattern: every time Bitcoin reaches a new high, miner portfolios experience a sharp decline in their holdings – and the opposite is true when prices fall.

So when a solo miner unexpectedly scores a big win, claiming a block and raking in a six-figure reward, it begs the question: is this a classic sell-the-news event?

Or could there be more surprises in store? While solo miners rake in huge profits.

Bitcoin’s centralization at risk from solo miners?

The mining industry is the backbone of Bitcoin. Without this, BTC would not be traded. That’s why it’s so important to investigate this story. But beyond the technical aspects, miners control a significant portion of the total BTC supply.

So if solo miners continue to make big profits, it could tip the balance, creating an imbalance in supply and demand.

Read Bitcoin’s [BTC] Price forecast 2024-25

On the other hand, with the lure of big rewards, more solo miners could be encouraged to try their luck, making the network more decentralized. In other words, it could create a sense of FOMO or raise concerns that the market is too volatile, prompting more traders to buy in or sell out.

On the other hand, this shift could pose greater security risks, creating a new set of challenges.

Clearly there is a delicate balance between the two. Treating these wins as rare strokes of luck might help keep volatility in check, but it’s certainly a trend worth thinking about.