- Whale shots and resistance tests highlighted Chainlink’s crucial position at $24-$25.

- Mixed on-chain metrics and declining foreign exchange reserves suggested reduced selling pressure but uncertain momentum.

Whale activity has roiled Chainlink over the past week [LINK] market, when a whale withdrew 594,998 LINK, worth $17.31 million, from Binance, including a recent withdrawal of 65,000 LINK worth $1.81 million.

This development has investors speculating: are these moves indicative of long-term confidence or preparation for significant market activity? At the time of writing, LINK is trading at $24.63, reflecting a decline of 9.11% in the last 24 hours.

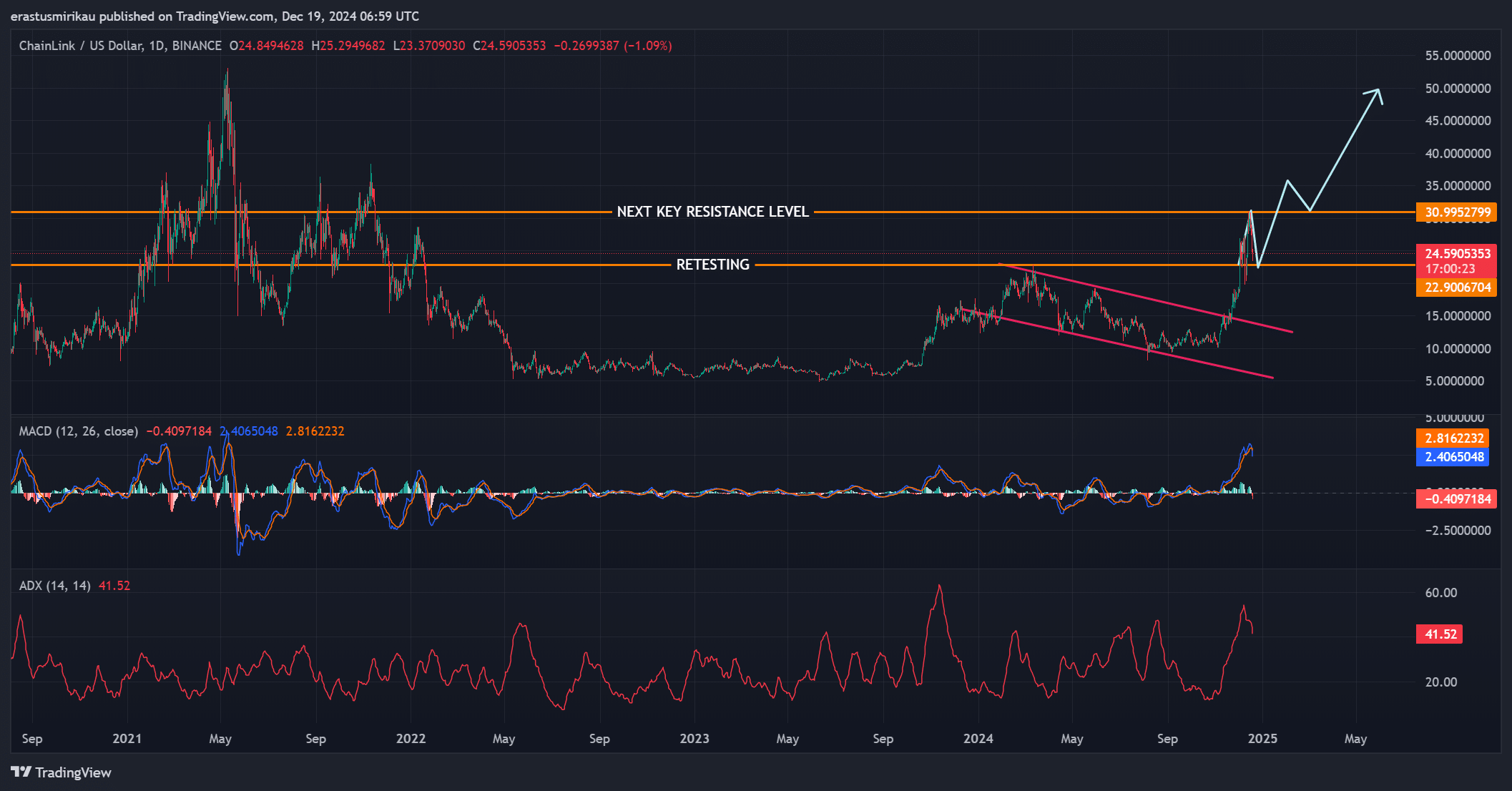

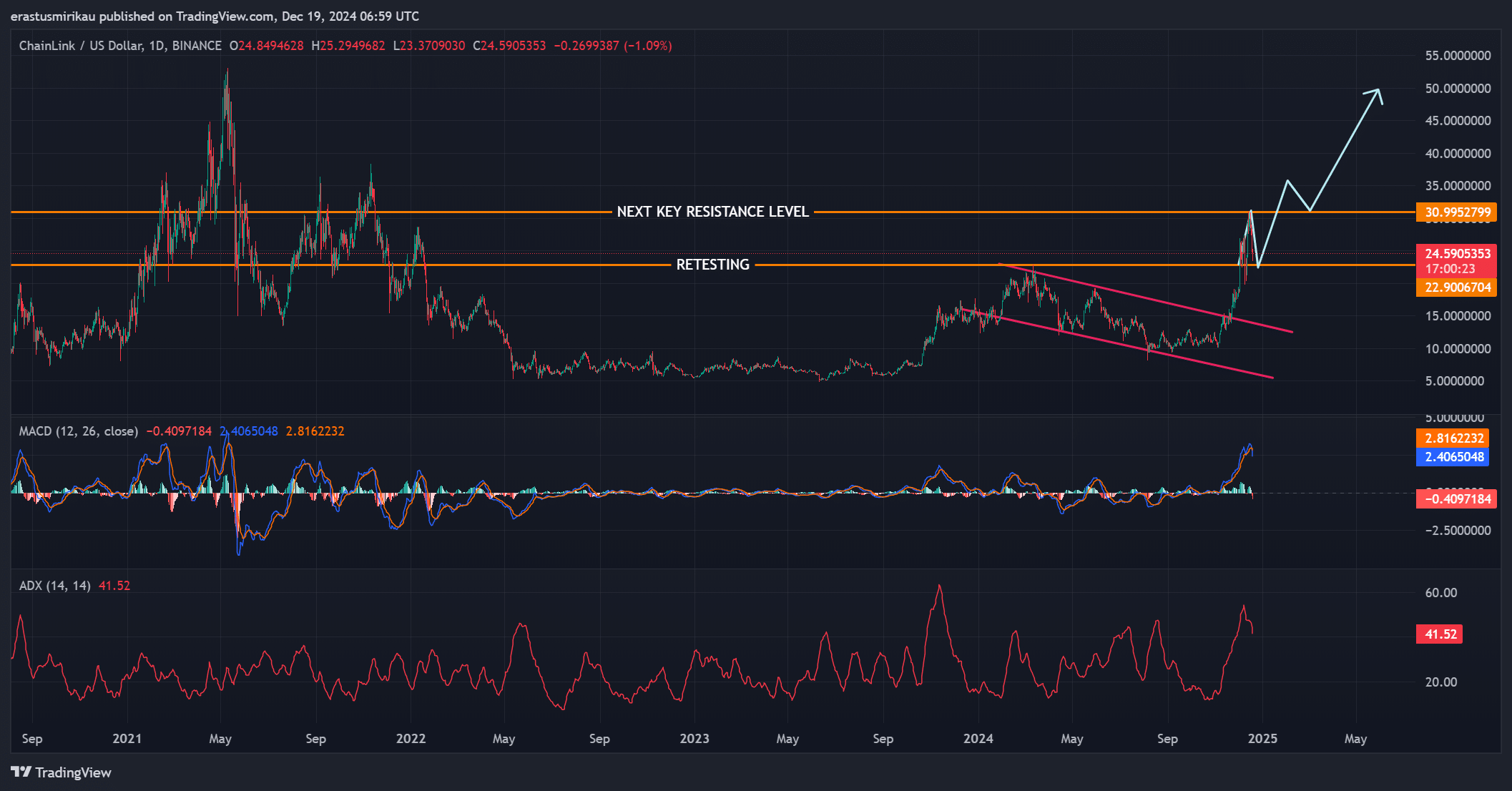

Analyze price momentum and resistance levels

At the time of writing, Chainlink was testing a crucial resistance zone between $24 and $25, a level that has served as a key barrier during previous rallies. The MACD suggests that the bullish momentum continues, although it appears to be losing steam.

Furthermore, the ADX value of 41.52 highlights the strength of the current trend. If LINK can decisively break this resistance, the next target is $30.99, an important psychological and technical level.

However, if this momentum is not maintained, it could result in a decline towards $22, an area of strong support.

Source: TradingView

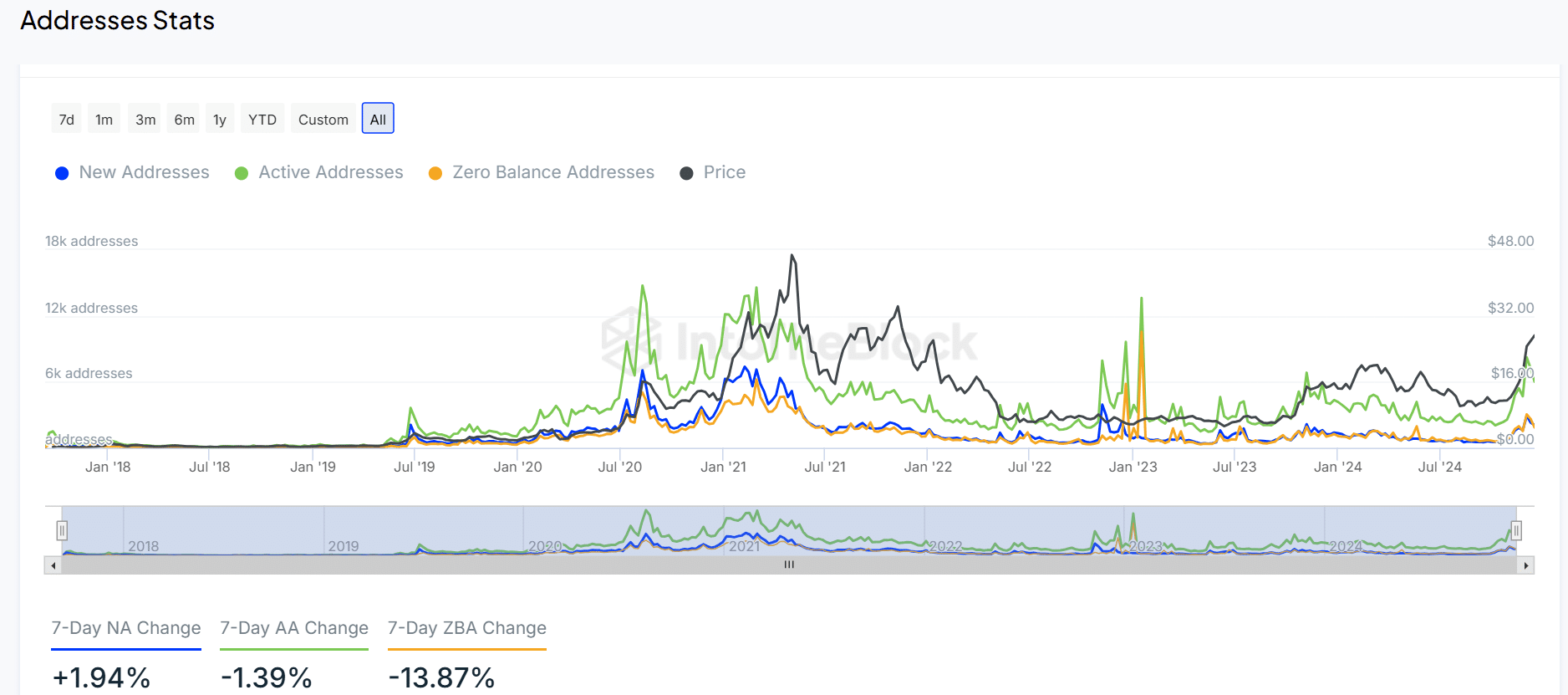

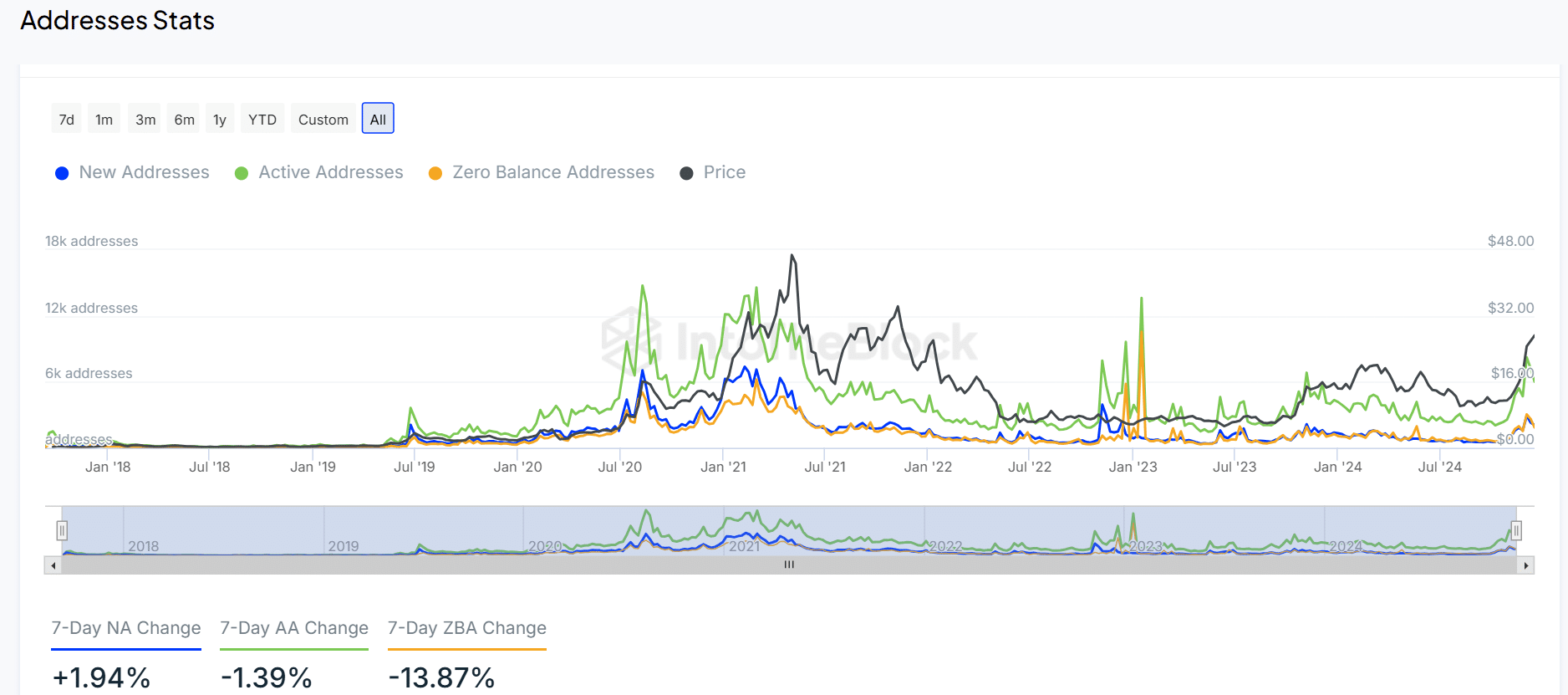

LINK address activity shows mixed trends

On-chain statistics show contrasting trends in LINK’s address activity. The number of new addresses has increased by 1.94%, which indicates new interest. However, the number of active addresses decreased by 1.39%, indicating that engagement has decreased somewhat.

Additionally, zero-balance addresses have dropped significantly by 13.87%. This shift from LINK investments to wallets signals confidence among long-term holders. These mixed signals indicate growing interest, but also highlight uncertainties about the short-term trajectory of the asset.

Source: IntoTheBlock

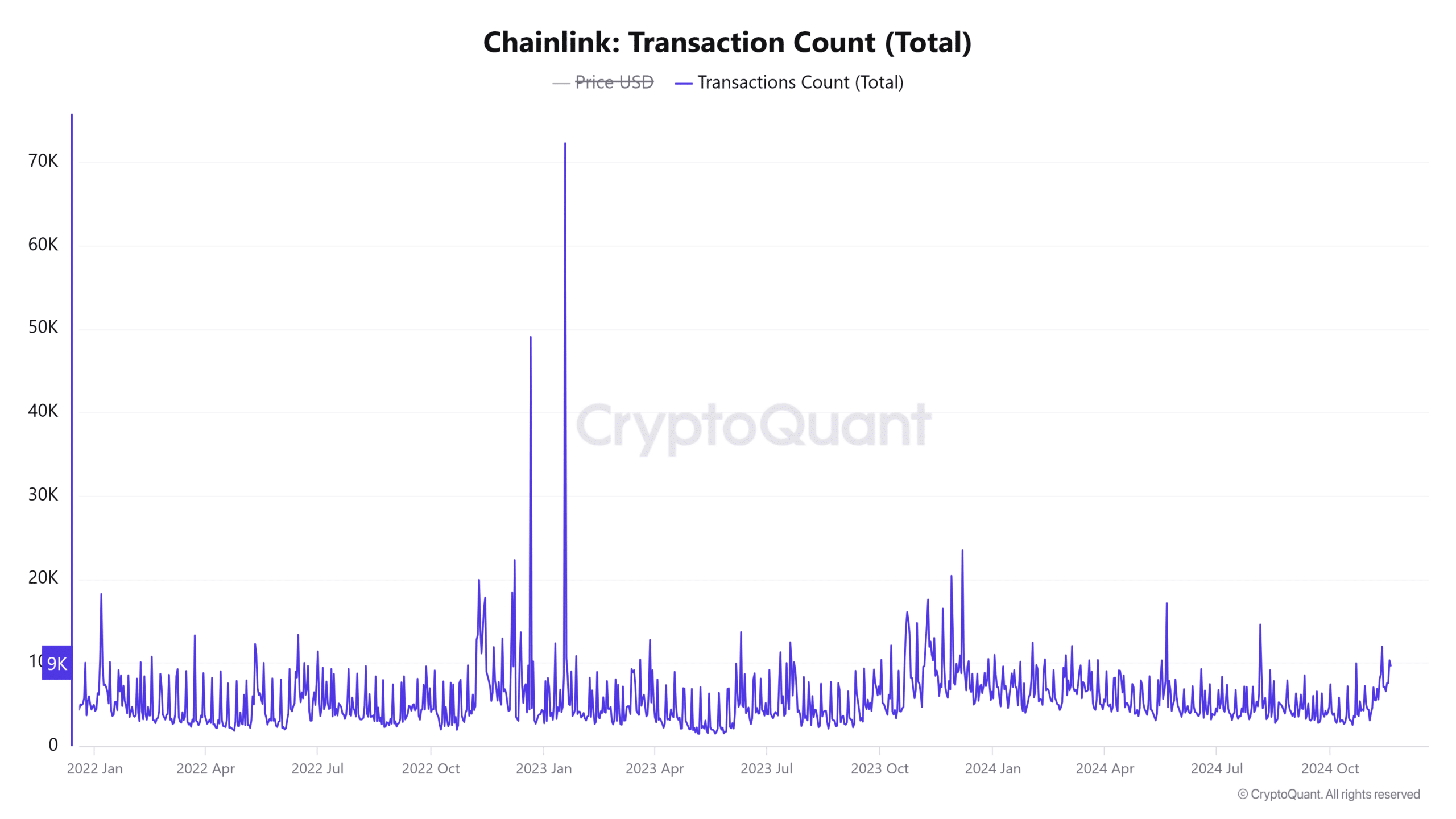

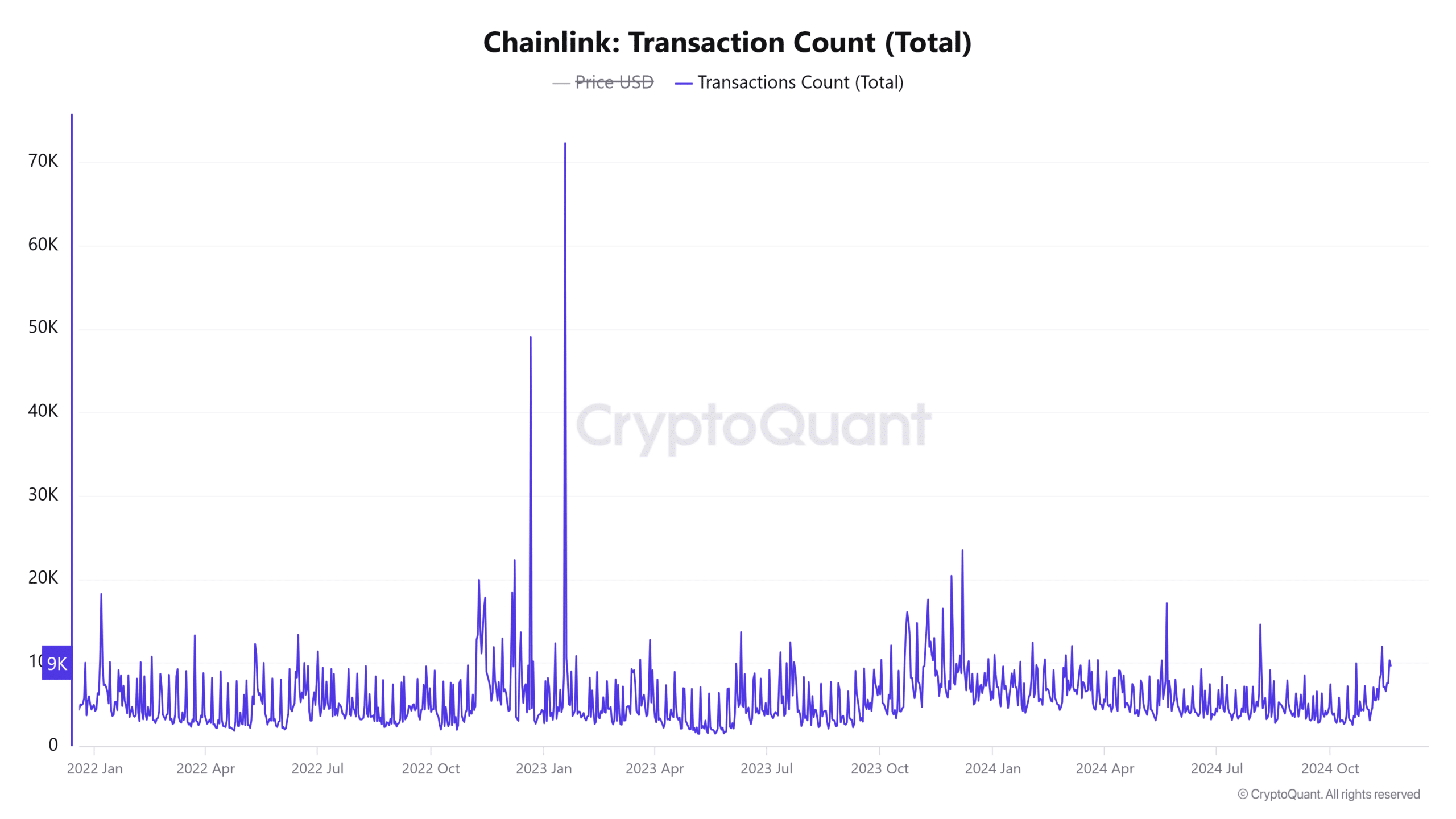

The number of transactions reflects growing market activity

Transaction activity has seen steady growth, further reinforcing the story of greater market engagement. In the last 24 hours, the number of transactions increased by 0.69% to 12,11,000 transactions. This increase indicates that a growing number of participants are actively adjusting their position.

Whether these moves are a response to the whale retreat or the broader market environment remains unclear. However, the increase in transaction volume indicates that the market is preparing for potentially significant price action.

Source: CryptoQuant

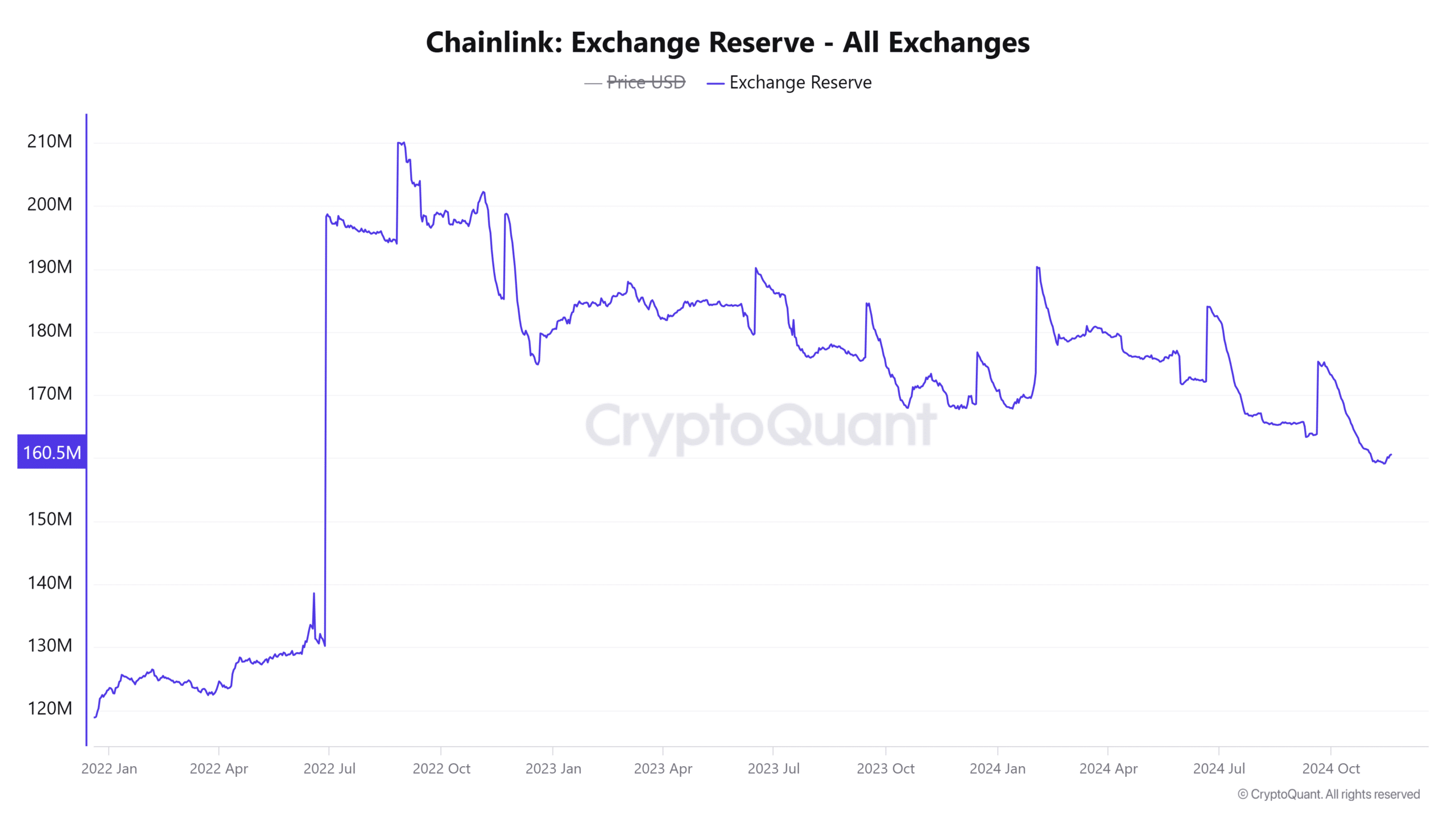

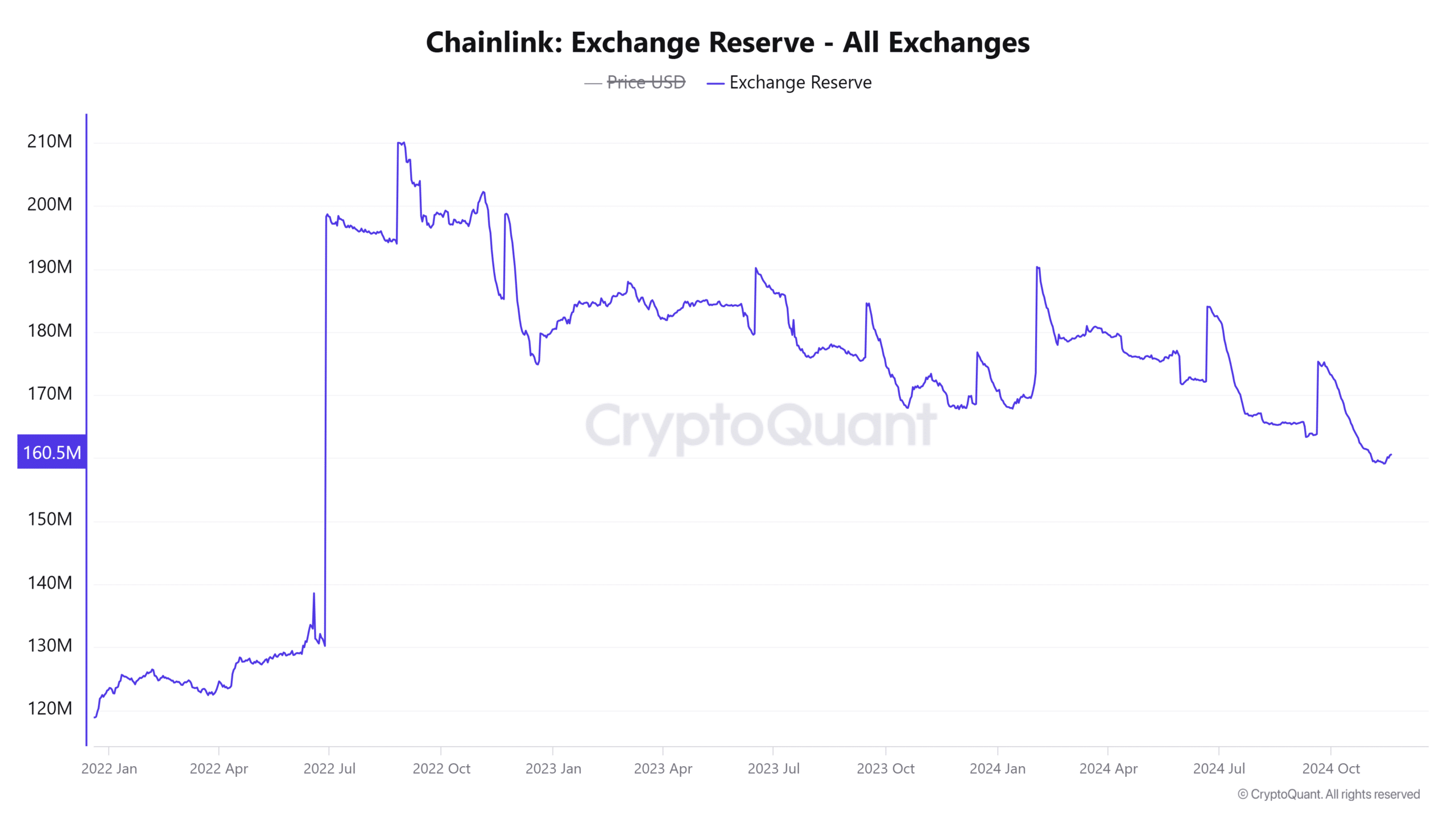

LINK exchange reserves show lower selling pressure

Foreign exchange reserves for LINK have fallen slightly by 0.17% over the past week and now stand at 163.1489 million LINK. This decline is consistent with the retreat of whales and suggests a reduction in immediate selling pressure as large amounts of LINK disappear from the exchanges.

Reduced reserves often indicate stronger sentiment among holders, as coins leaving exchanges usually indicate long-term storage. This trend supports bullish sentiment, but leaves room for caution as liquidity diminishes.

Source: CryptoQuant

Is your portfolio green? View the LINK Profit Calculator

The recent whale withdrawal and price resilience tests put Chainlink in a decisive position. If LINK can maintain its momentum and break the critical resistance zone, a bullish breakout is very likely.

However, should momentum wane, a return to lower support levels seems inevitable. For now, LINK’s ability to clear the $25 resistance will determine the near-term direction of the market.