This article is available in Spanish.

Cardano (ADA) is trading above the critical $1 level, fueling optimism among investors who expect further gains in the coming weeks. After a strong bullish run in recent weeks, the recent pullback appears to be a temporary pause in an uptrend.

Crucial on-chain data supports this outlook, indicating robust network activity that reinforces bullish sentiment for ADA.

Related reading

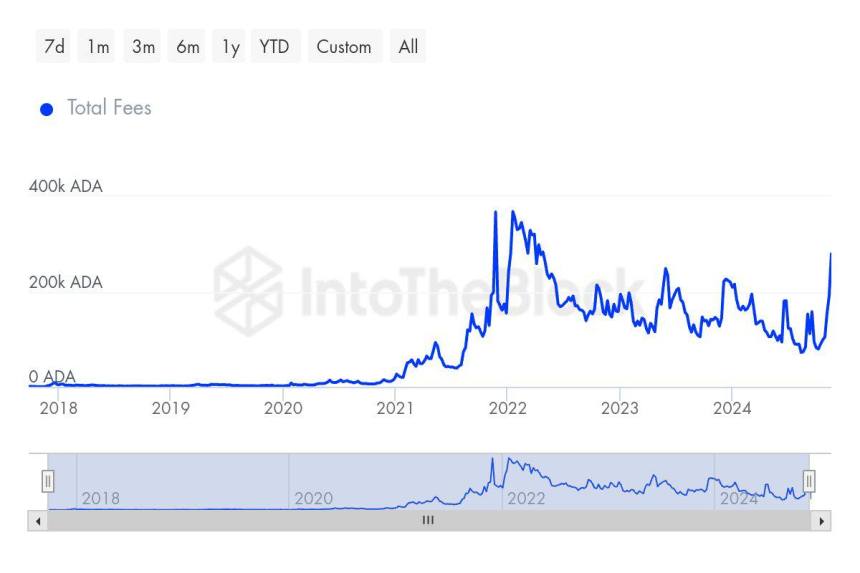

Key statistics shared by IntoTheBlock reveal more than 840,000 transactions recorded on the Cardano network, with total fees reaching up to 279,000 ADA. This data underlines the growing usage and demand for the Cardano blockchain, contributing to its fundamental strength. Such network activity often correlates with price appreciation, suggesting that ADA could soon maintain its momentum.

As ADA consolidates above $1, the market will be keeping a close eye on whether it can hold this key level and continue moving forward. Investors and analysts are bullish, citing the network’s increasing adoption and solid transaction numbers as critical factors driving the bullish outlook. The coming weeks could be crucial for Cardano, with a sustained move above $1 likely signaling a continuation of the uptrend.

Cardano activity is growing

Cardano is trading at multi-year highs and appears poised to continue its impressive rally. After breaking through the critical $1 level at the start of this bull run, ADA has shown strong momentum, driven by increasing adoption and investor confidence. Data about the chain shared by IntoTheBlock analyst C Thumbs highlights key milestones, signaling continued growth in the Cardano ecosystem.

The latest data shows that Cardano recently surpassed 840,000 transactions, with a total amount of 279,000 ADA. The last time transaction volumes and fees were this high was in March 2022. This resurgence reflects the growing utility of the Cardano blockchain, which is moving from primarily speculative to demonstrating real value.

A closer look at holding bond trends further underlines this shift. From July 2022 to today, ADA has seen continued growth in the number of holders, indicating increasing confidence in the long-term potential of the blockchain. Unlike previous cycles, where ADA price movements were driven primarily by speculation, the current rally appears to be supported by tangible network activity and adoption.

Related Reading: Bitcoin Is Above $90,000 – On-Chain Data Reveals Key Demand Levels

As Cardano continues to gain popularity, investors are focusing on the next major level of offering. With robust network activity and bullish sentiment prevailing, ADA appears poised to reach new highs, cementing its status as the leading blockchain in the crypto space.

ADA tests critical inventory

Cardano has experienced a remarkable rally of 250% in less than a month, showing strong bullish momentum as it gains traction in the market. Currently, ADA is trading at $1.06 and approaching its yearly high of $1.15, a crucial resistance level that could determine its next price trajectory.

If ADA successfully breaks above the $1.15 level, it could open the door for a significant rally targeting the next supply zones at $1.25 and possibly $1.60. Such a breakout would be a sign of renewed investor confidence and sustained demand, further cementing Cardano’s position as one of the most dynamic assets in the crypto space during this cycle.

However, there is a risk of further consolidation below the $1.15 mark. If ADA fails to maintain momentum at this critical level, price may retreat to test support at $1.00 or below. Such a scenario could indicate a temporary pause in the uptrend, allowing investors and traders to reassess market conditions.

Related reading

As Cardano trades near these crucial levels, market participants will be closely watching the price action to determine if the rally can continue or if consolidation will shape the short-term outlook for this fast-rising altcoin.

Featured image of Dall-E, chart from TradingView