- RENDER’s bearish sentiment has grown noticeably, with an increasing number of sellers providing downward pressure.

- This has added to the problems for the asset as it encounters multiple resistance levels, making further declines likely.

Cause [RENDER] was among the market’s top performers last month – up 45.28% – but momentum has since waned. After failing to break key resistance points, the value has fallen 10.01% in the past 24 hours, raising concerns about its near-term trajectory.

Unless RENDER regains interest from market participants, the current decline could continue, leaving recovery prospects uncertain.

RENDER price under pressure

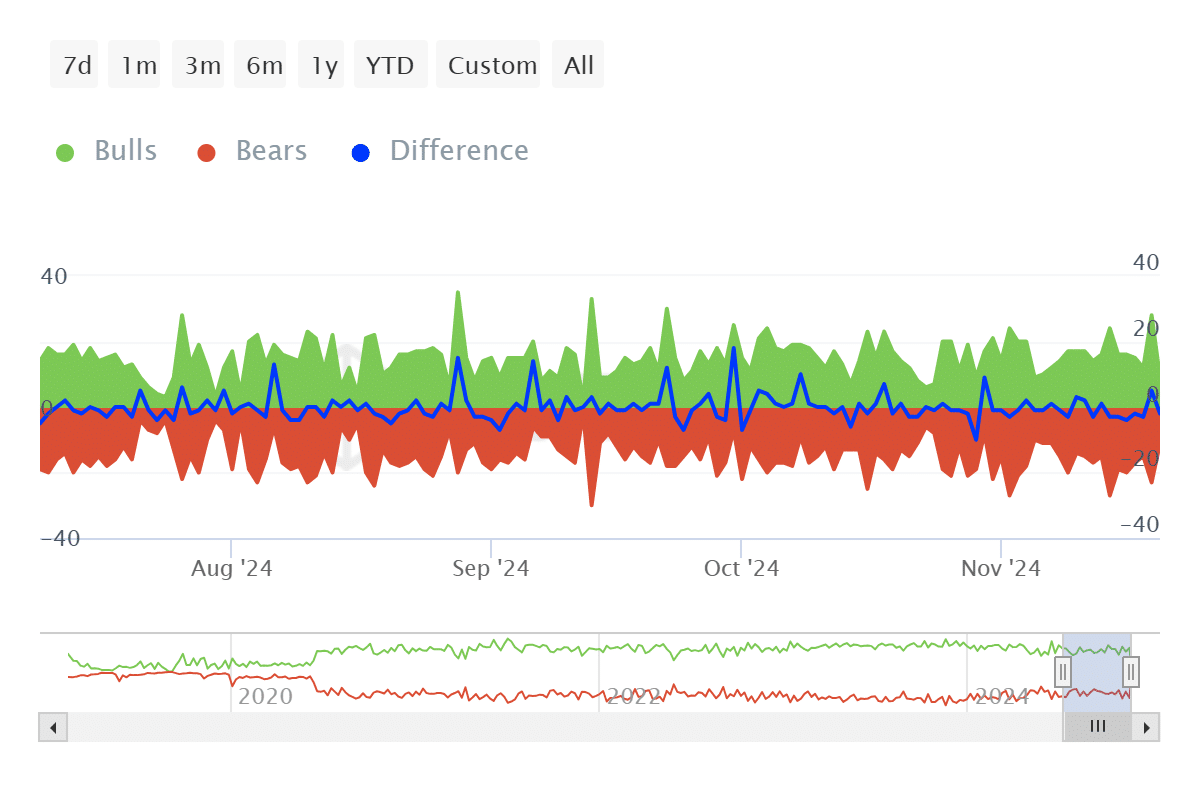

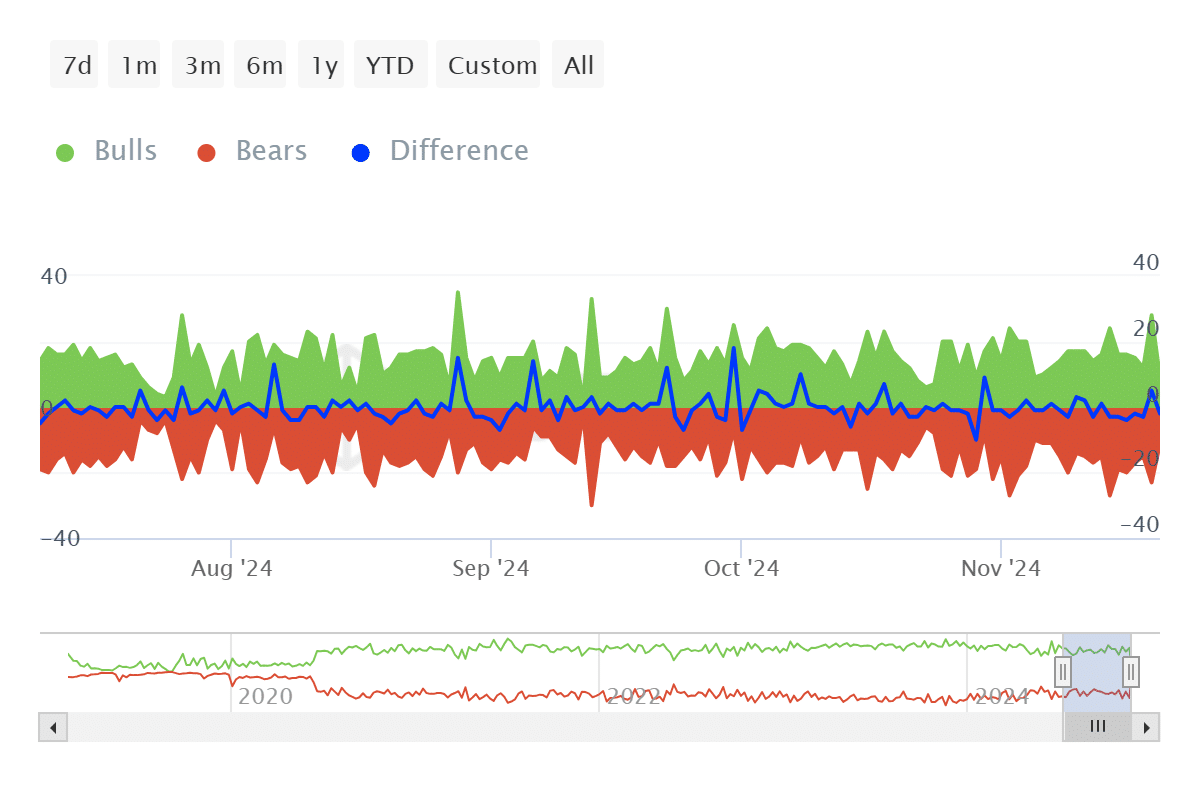

The bears have firmly taken control of the RENDER market, outnumbering the bulls and exerting significant downward pressure. According to InHetBlokThere were 132 bear addresses active over the past seven days, compared to just 120 bull addresses.

In this context, bulls and bears are defined as addresses responsible for buying or selling at least 1% of the total trading volume. This current disparity highlights the growing influence of bearish participants.

Source: IntoTheBlock

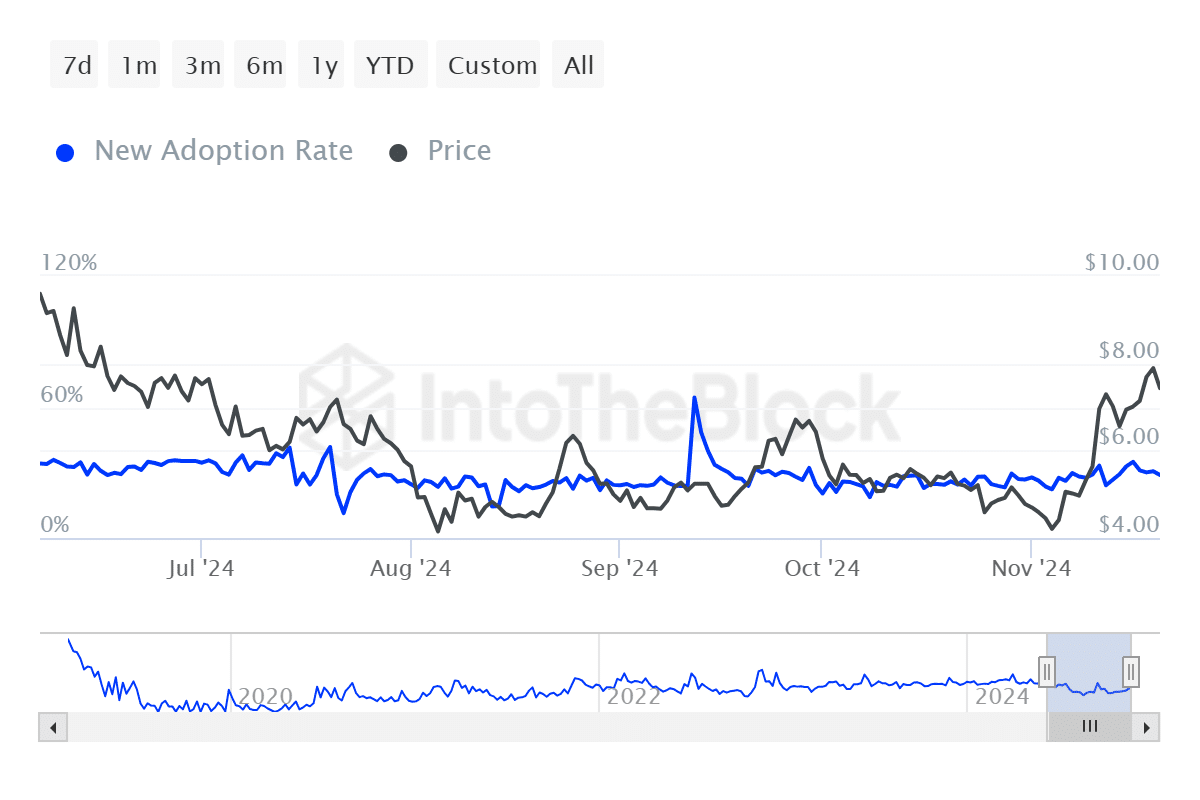

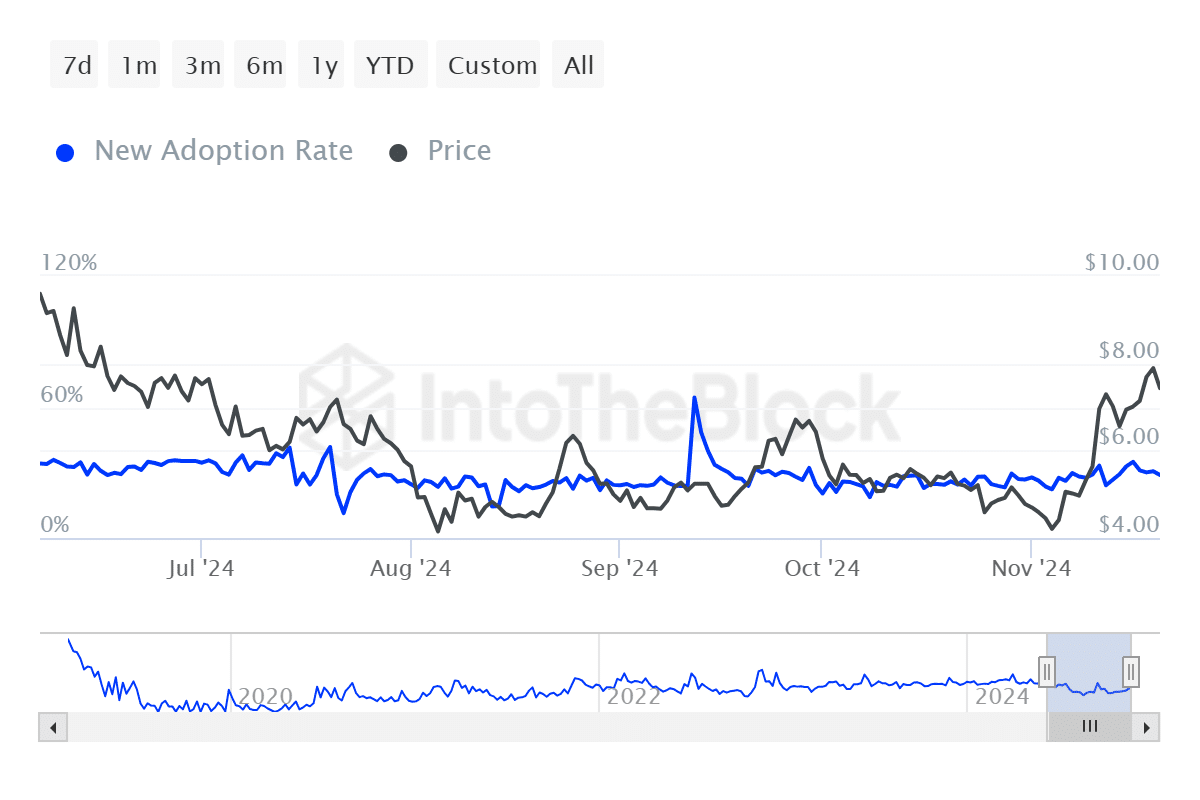

Adding to the pessimism, the Active Address Ratio (which measures active addresses versus those that have a balance) has fallen to 1.09%. Such a decline is usually a strong indicator of negative market sentiment.

Source: IntoTheBlock

Meanwhile, RENDER’s New Adoption Rate, which tracks the first transactions in which the asset is involved, has fallen to 28.82% at the time of writing. This decline reflects declining interest in the asset and signals potential challenges to its recovery.

Resistance levels weigh on RENDER

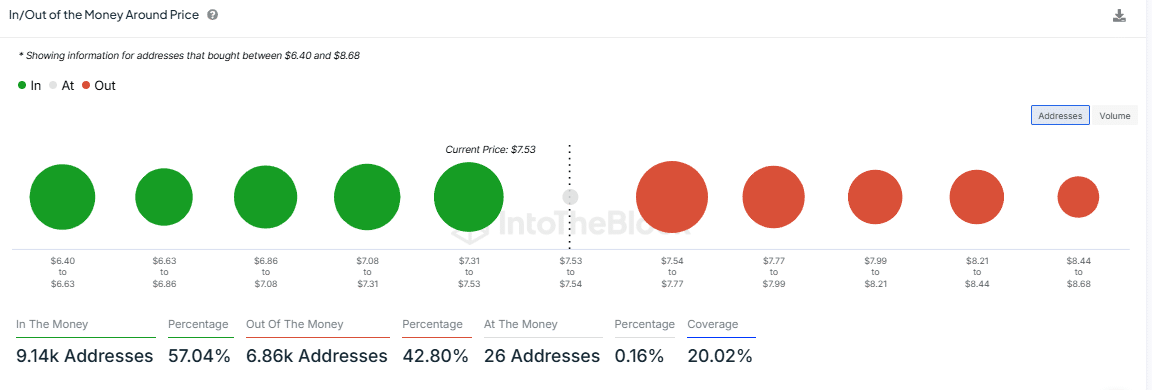

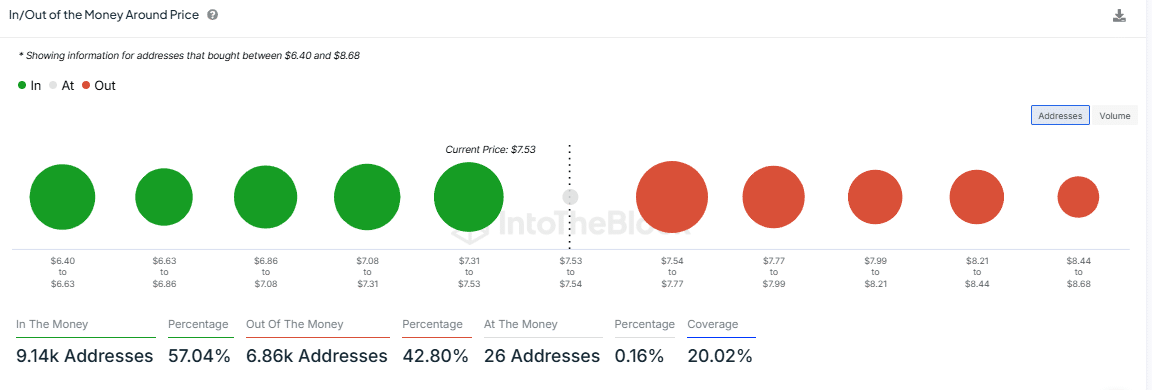

RENDER has encountered a significant resistance zone, as shown by the ‘In/Out of the Money Around Price’ (IOMAP) metric. This tool identifies key support and resistance levels and reveals catalysts and obstacles that could hinder price momentum.

Data from IntoTheBlock shows that the previous day’s high at 8.211 corresponds to an IOMAP resistance range between 7.99 and 8.21. This zone is strengthened by a sell order of 3.28 million RENDER tokens, increasing bearish pressure.

Source: IntoTheBlock

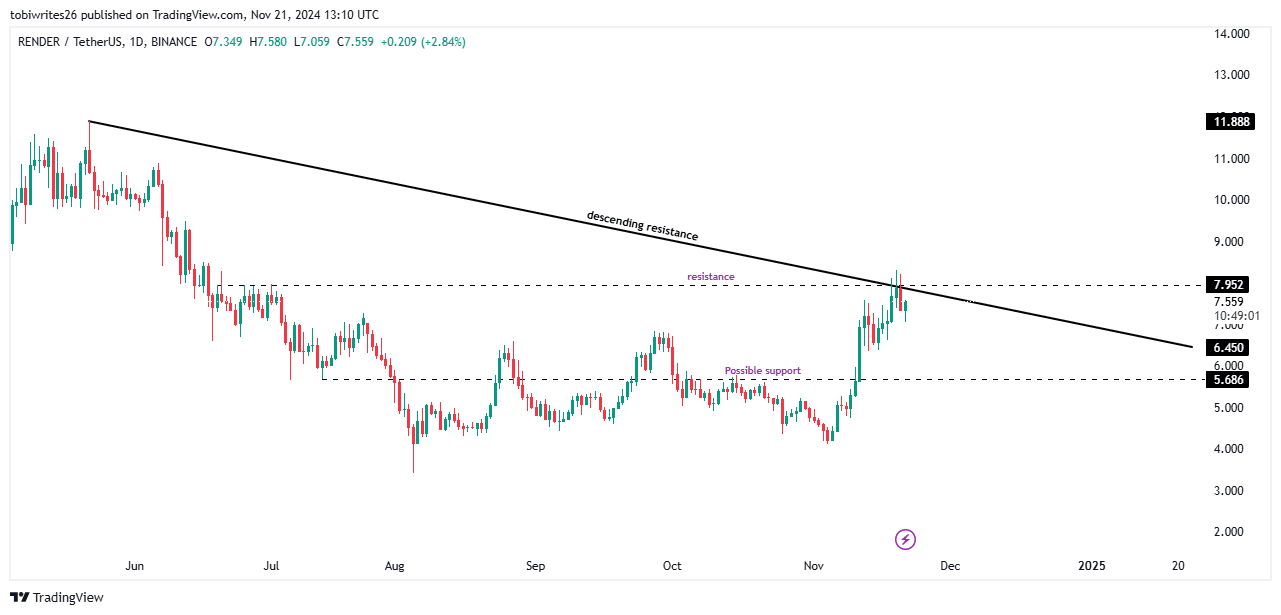

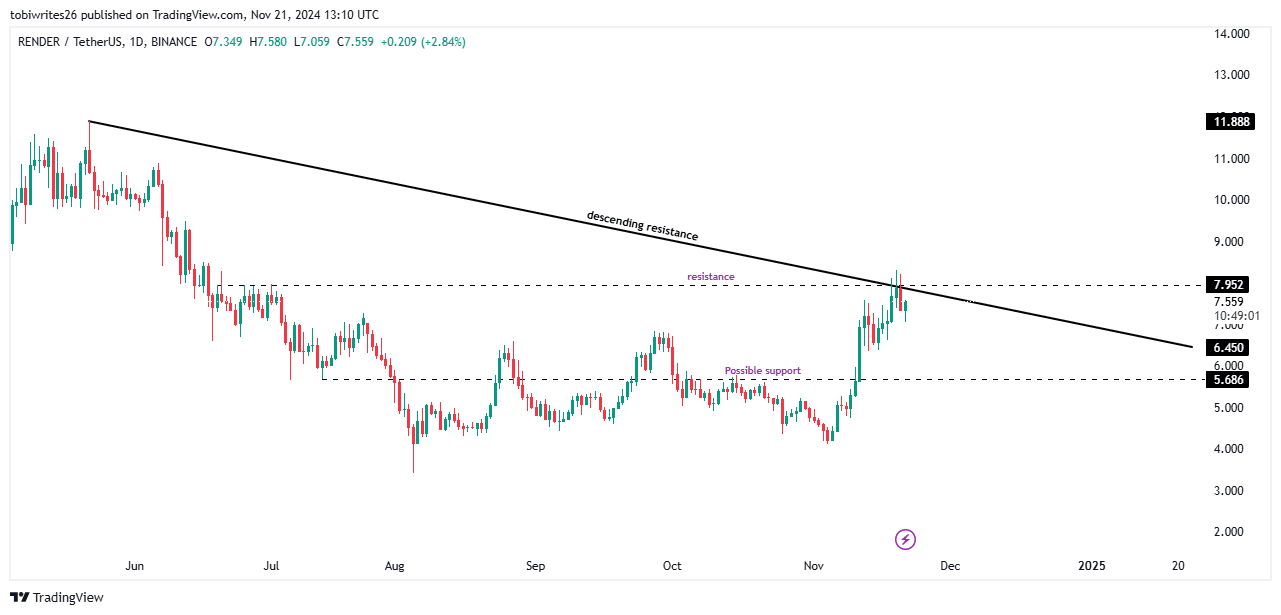

Technical analysis further reflects the challenges facing RENDER. The token has reached two critical resistance points simultaneously: a descending trendline and a horizontal resistance level at 7.97, both of which correspond to the IOMAP resistance range.

Is your portfolio green? Check the render profit calculator

These overlapping barriers make a further decline increasingly likely.

Source: trading view

If the selling momentum continues, RENDER could fall to the next major support level at 5,686.