- Bitcoin buying pressure on Binance increased sharply.

- However, BTC could face headwinds as a number of indicators turned bearish.

After a brief withdrawal, Bitcoin [BTC] has once again started to move towards its all-time high.

Investors took the opportunity to buy the dip during BTC’s price decline in the recent past, which could have played a role in helping BTC regain momentum.

Will this increase in buying pressure push BTC to a new ATH soon?

Investors are stockpiling Bitcoin

Ali, a popular crypto analyst, recently posted one tweet noting that there was a significant spike in BTC buying pressure on Binance.

This clearly indicated growing bullish sentiment, indicating that upward price movements could be in store.

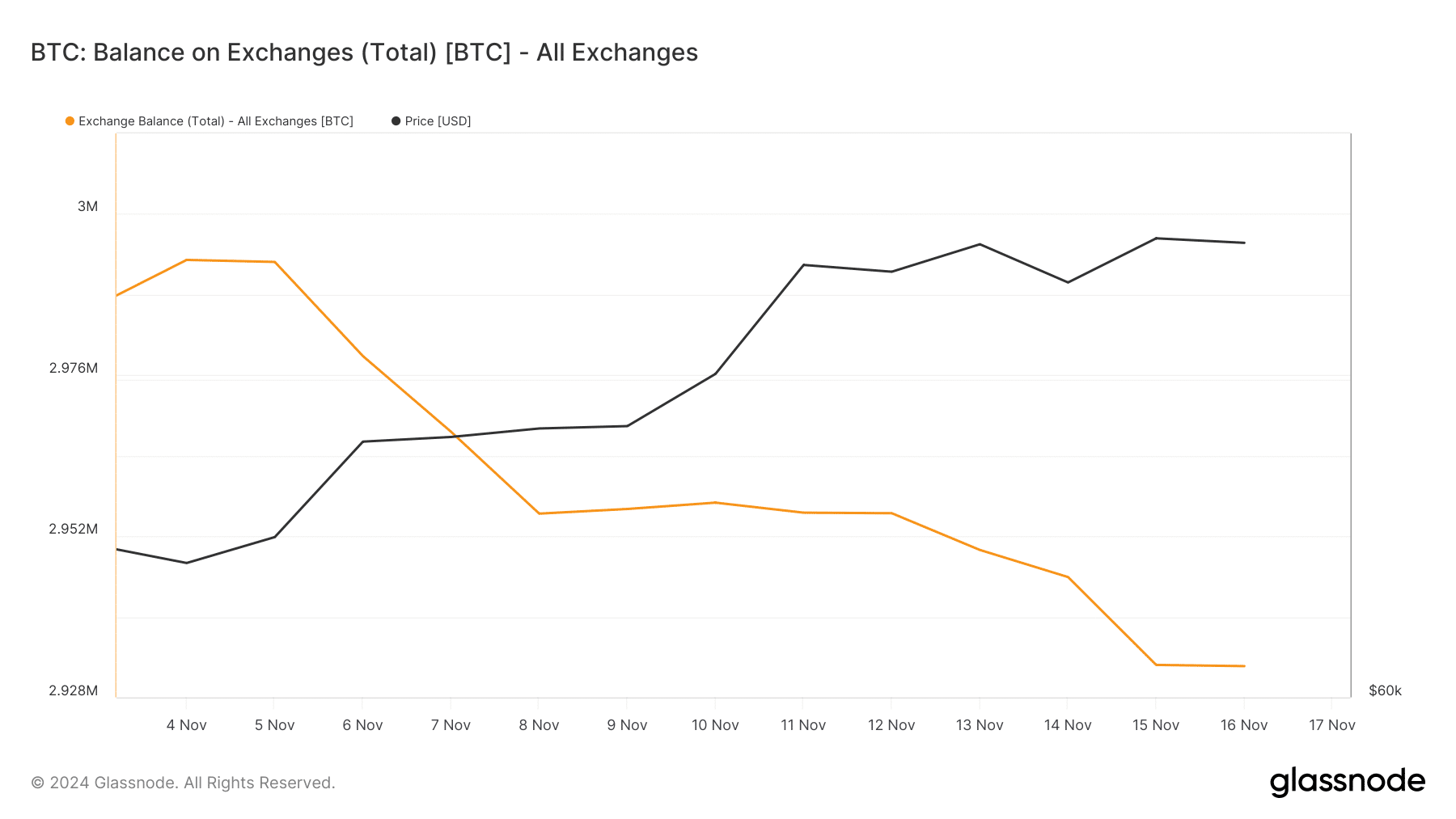

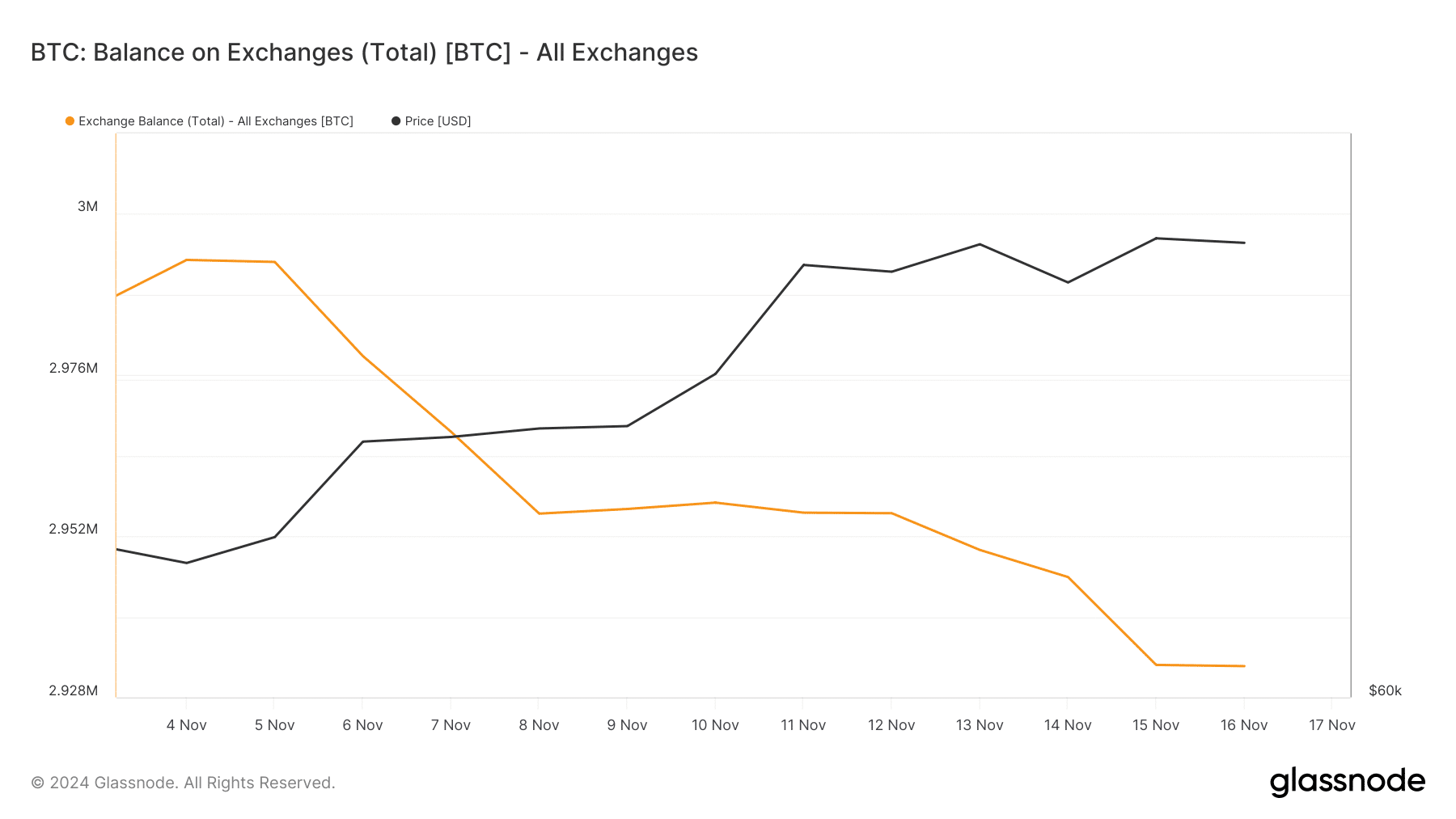

The fact that buying pressure in the overall market was high was further proven by BTC exchange rates.

The metric has fallen sharply over the past two weeks, indicating that investors were stockpiling the king of cryptos.

Source: Glassnode

CryptoQuant’s facts revealed that Bitcoin’s Coinbase bounty was green. This meant that buying sentiment among US investors was strong.

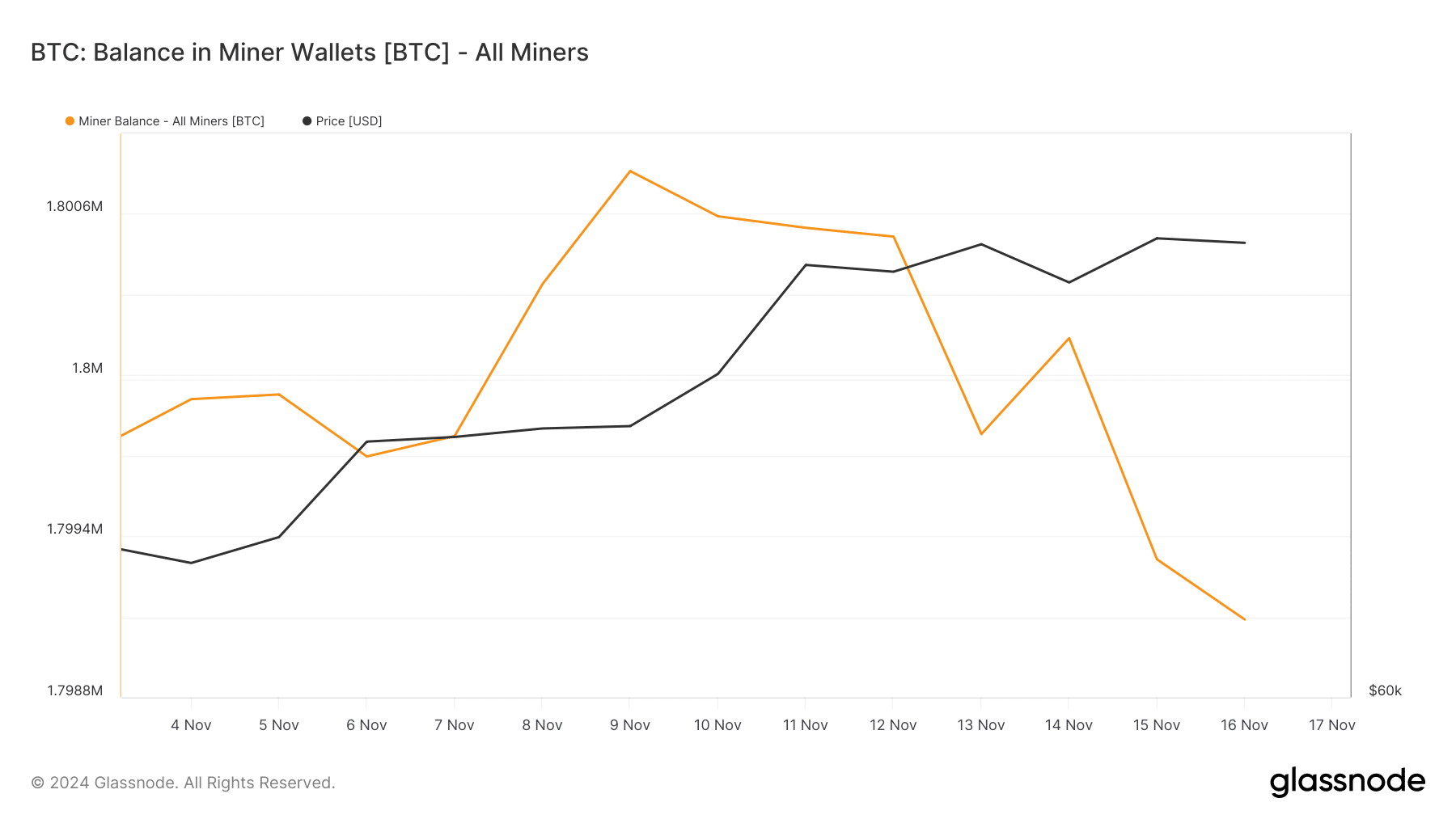

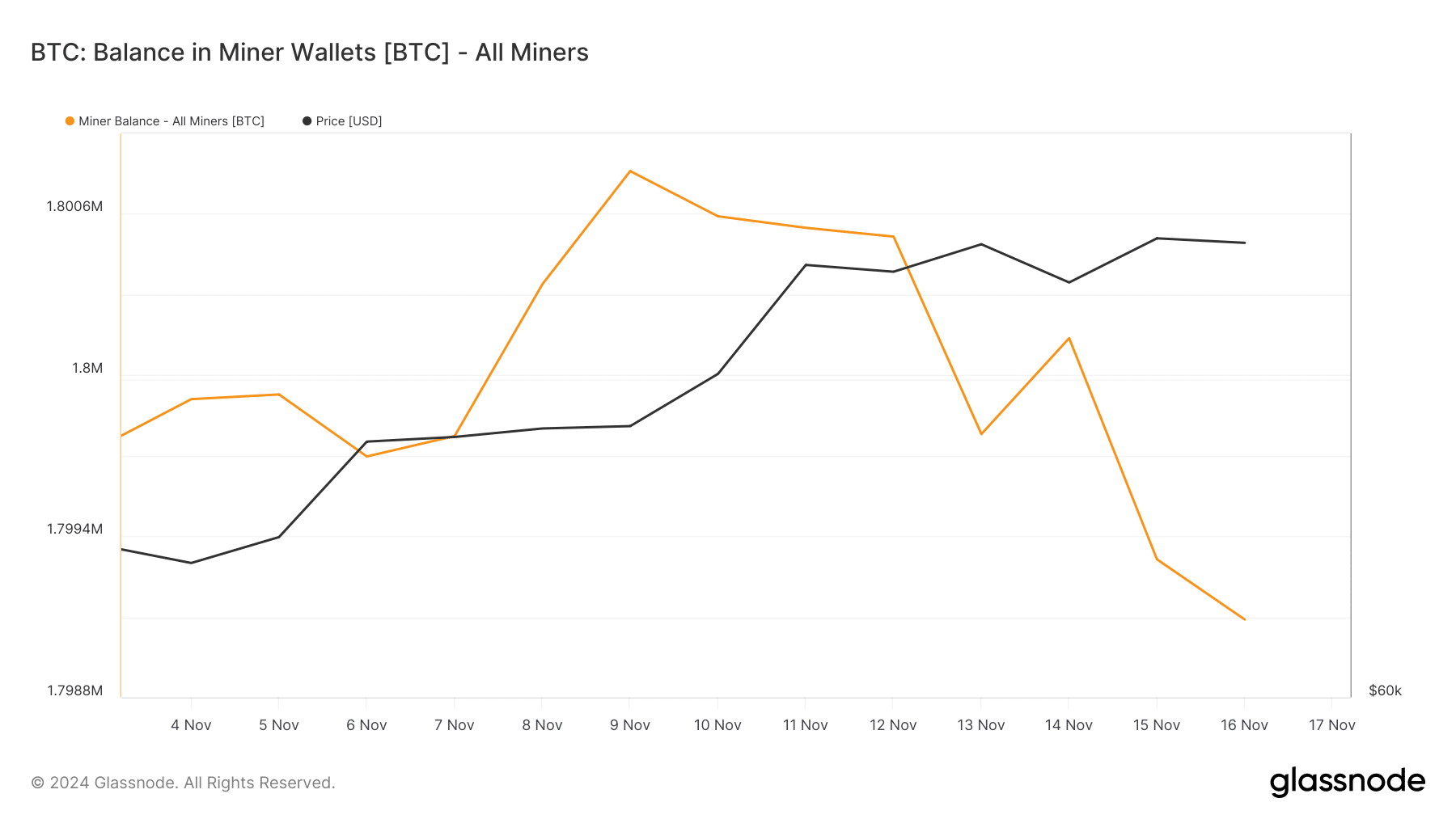

Nevertheless, Bitcoin miners showed no confidence in the king coin. This was evident in the significant drop in BTC’s miner balance – a sign of the miner sell-off.

Source: Glassnode

Will this be enough for a new ATH?

The increase in investor buying pressure has fueled 14% price growth over the past week, allowing BTC to move closer to $91,000 again.

If the accumulation trend continues, it won’t be surprising to see Bitcoin reach a new high soon.

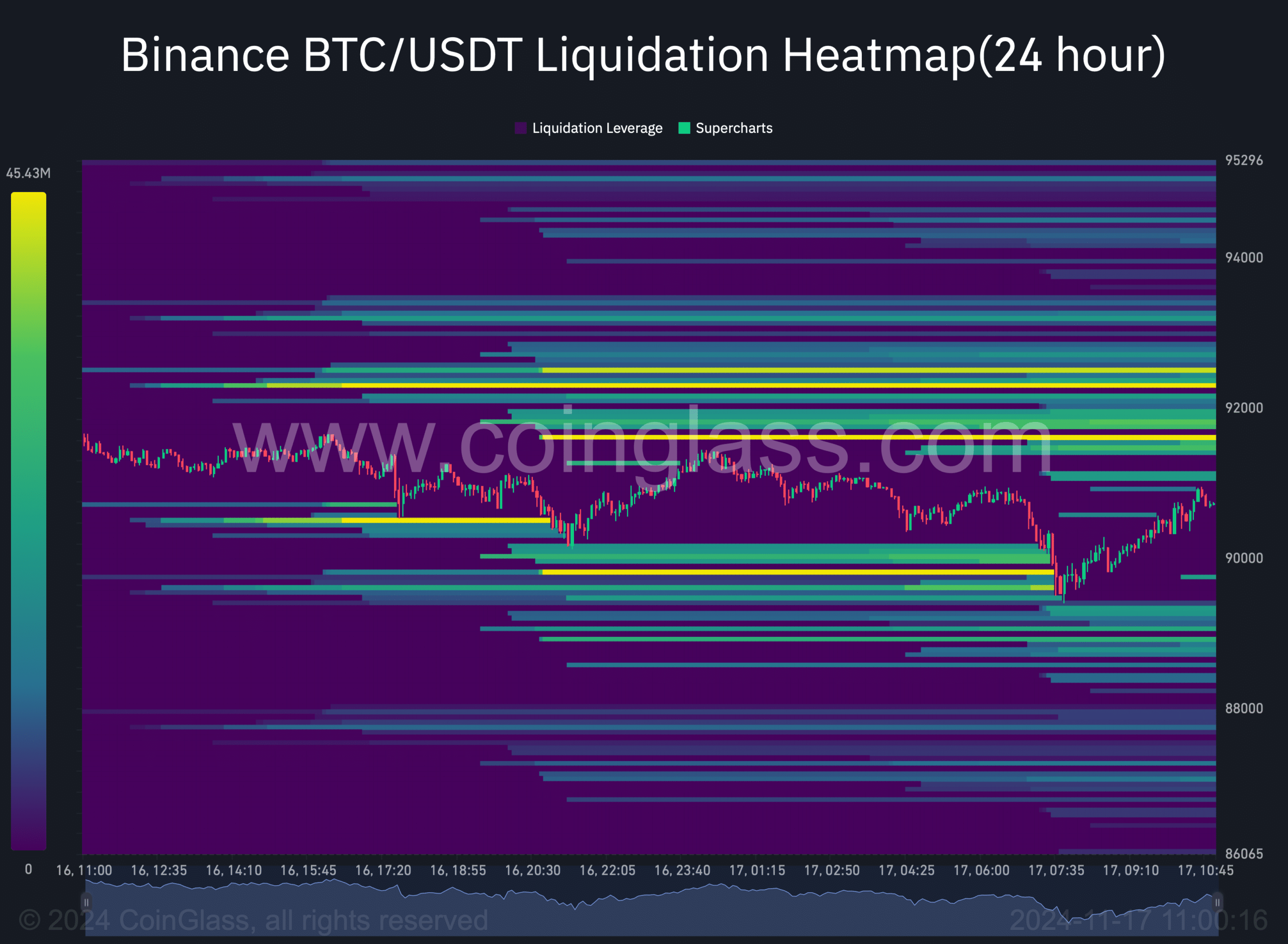

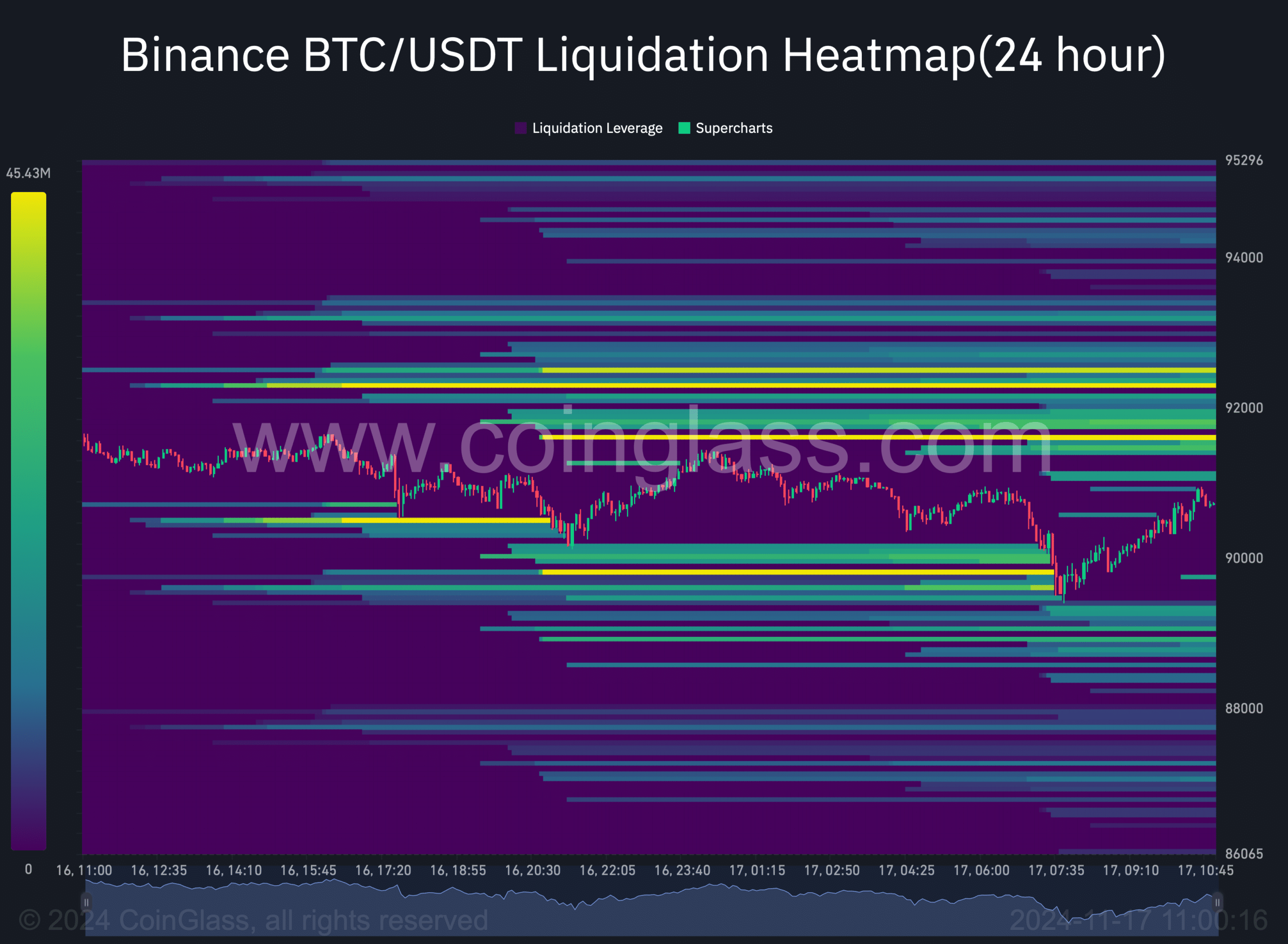

In the short term, retesting $91,000 didn’t seem like a big deal for BTC. This was the case because the liquidation of BTC will exceed the $91.6k mark.

When liquidation increases, it indicates that the likelihood of a price correction is high.

Source: Coinglass

However, not everything was in favor of a price increase. BTC for example aSORP turned red, meaning more investors sold at a profit. In the middle of a bull market, this could indicate a market top.

The King Coin Binary CDD suggested that the movement of long-term holders over the past seven days was higher than normal. If they are moved for the purpose of sale, this could have a negative effect.

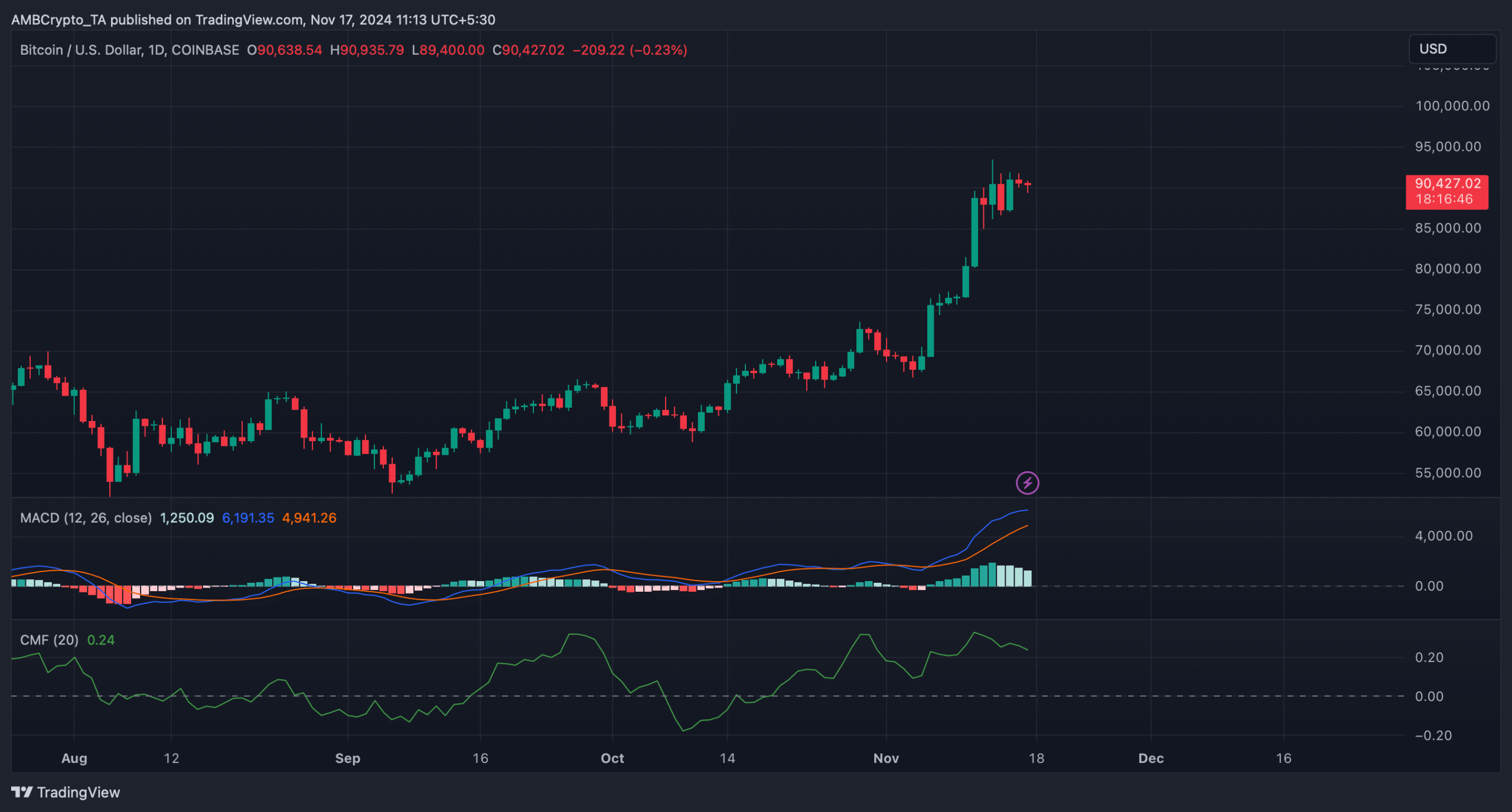

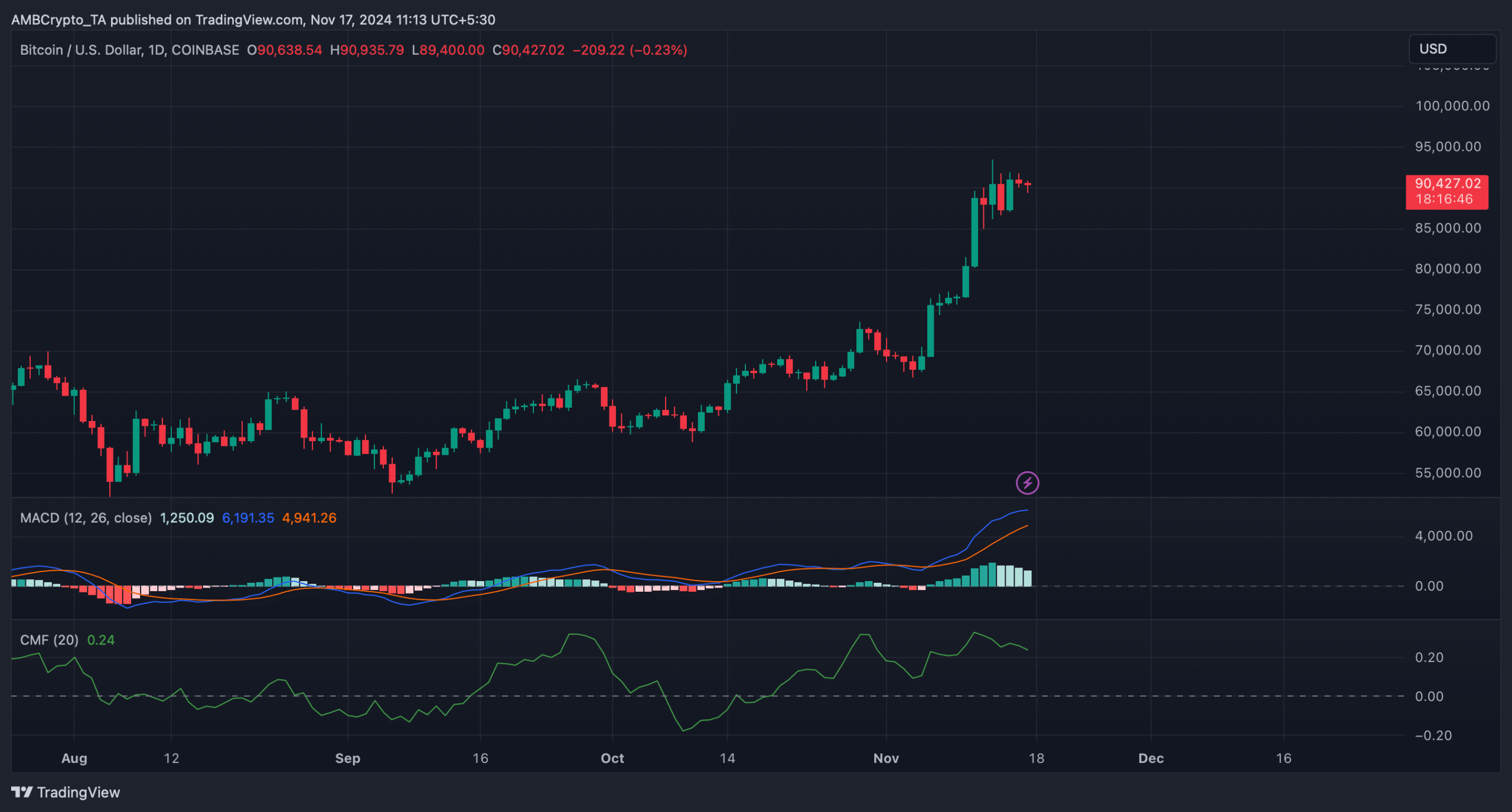

Complementing the aSORP, Bitcoin’s Chaikin Money Flow (CMF) recorded a decline. The indicator measures the buying and selling pressure of an asset.

Read Bitcoin (BTC) price prediction 2023-24

A falling CMF confirms a downtrend, which on this occasion could cause problems on BTC’s path to $91,000.

Nevertheless, the MACD continued to show a bullish edge on the market, indicating that the possibility of BTC retesting its ATH cannot yet be ruled out.

Source: TradingView