- A summary of how Ethereum has fallen behind compared to some of its top rivals.

- Why Bitcoin’s dominance could be the key to unlocking ETH’s explosive growth

Ethereum [ETH] recently became the subject of criticism, with many accusing the king of altcoins of underperforming. But things could change soon; one of the most important catalysts could be that of Bitcoin [BTC] dominance.

Ethereum gained about $100.61 billion in market cap from its lowest point so far this month. In contrast, Bitcoin gained over $480 billion in market capitalization during the same period.

Perhaps the biggest measure of the underperformance was the fact that Ethereum did not reach any new ATHs.

As has been the case with some of his top rivals. For example, TVL peaked at $66.77 billion on November 12. However, this was still lower than June’s TVL peak of $72.72 billion.

Source: DeFiLlama

Transaction data also showed a similar picture. Ethereum’s on-chain transactions peaked at 1.29 million transactions on November 12. These were the highest single-day transactions it achieved last week.

However, the number was still lower than the peak number of daily transactions in October, which peaked at 1.32 million transactions on October 18.

Another key area where people thought it had fallen behind was price action. Note that ETH has had a bullish performance so far in November.

It rose 44.61% from the lowest to the highest price in the past two weeks. However, Bitcoin has been in price discovery, while ETH is still miles away from its historical ATH.

Ethereum Could Redeem Itself If…

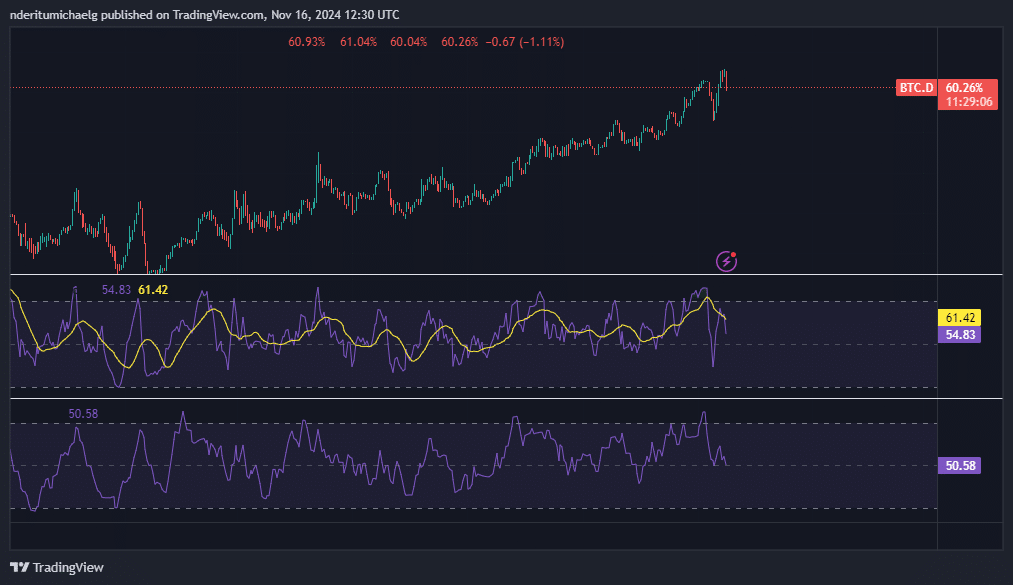

Bitcoin’s dominance has been increasing for months, indicating that most of the liquidity flowing into crypto went to BTC. However, this could quickly change if Bitcoin’s dominance begins to decline.

Source: TradingView

Bitcoin’s dominance already seemed poised for a downside at the time of writing. This was due to a downside in the last 24 hours and a bearish divergence pattern with the RSI.

Also his money flow indicator confirmed that liquidity flows may already be in favor of altcoins.

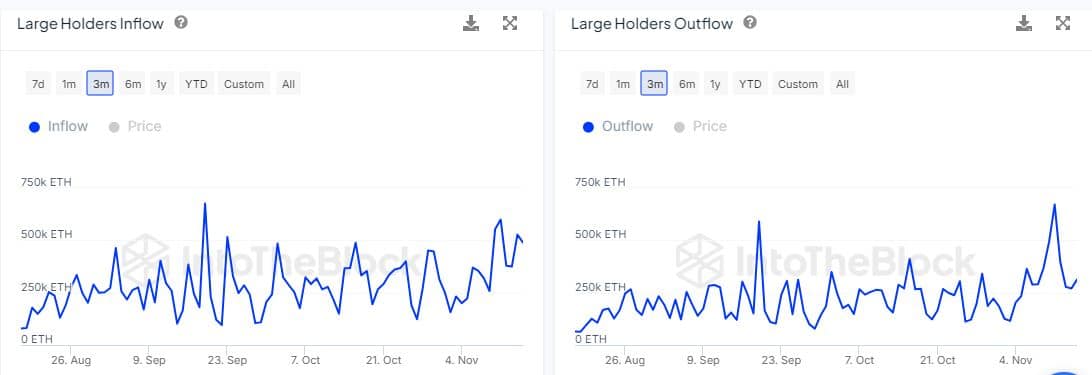

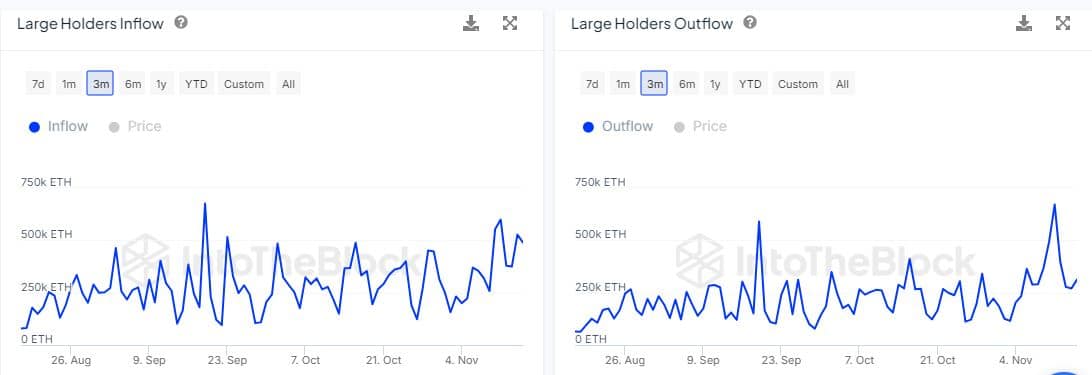

The flow of liquidity to Ethereum may already be happening. The gap between the inflow and outflow of large farmers has widened.

Source: IntoTheBlock

Read Ethereum’s [ETH] Price forecast 2024–2025

The inflow from large holders was significantly higher on November 15, with over 488,000 ETH. However, the outflow from large holders during the same trading session was significantly higher at 312,430 ETH.

This could indicate that ETH is building more momentum as BTC’s dominance begins to decline.