- Degen crypto rose above the psychological level of $0.02.

- The token could not defend this level during the retracement and could fall another 14%.

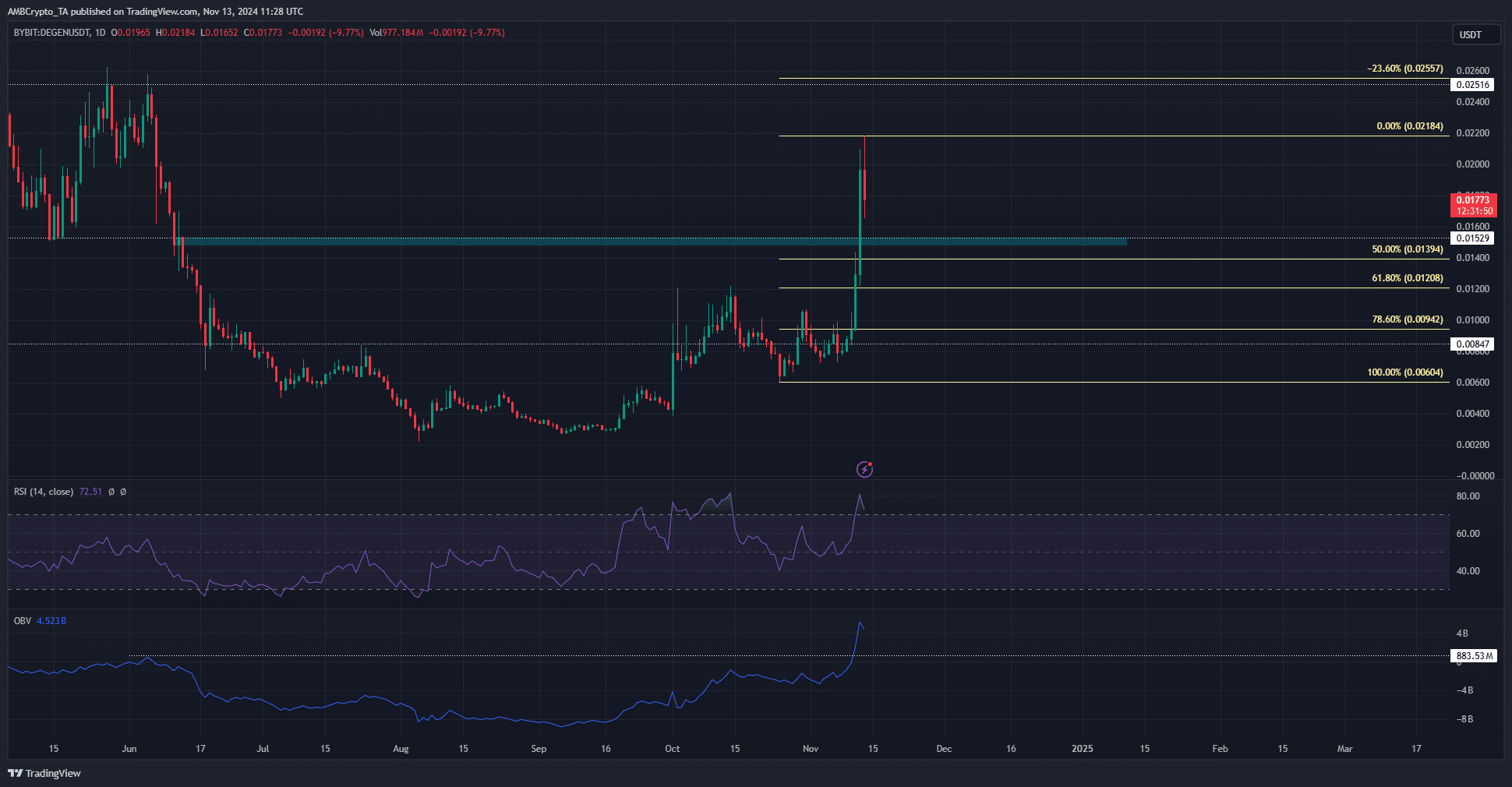

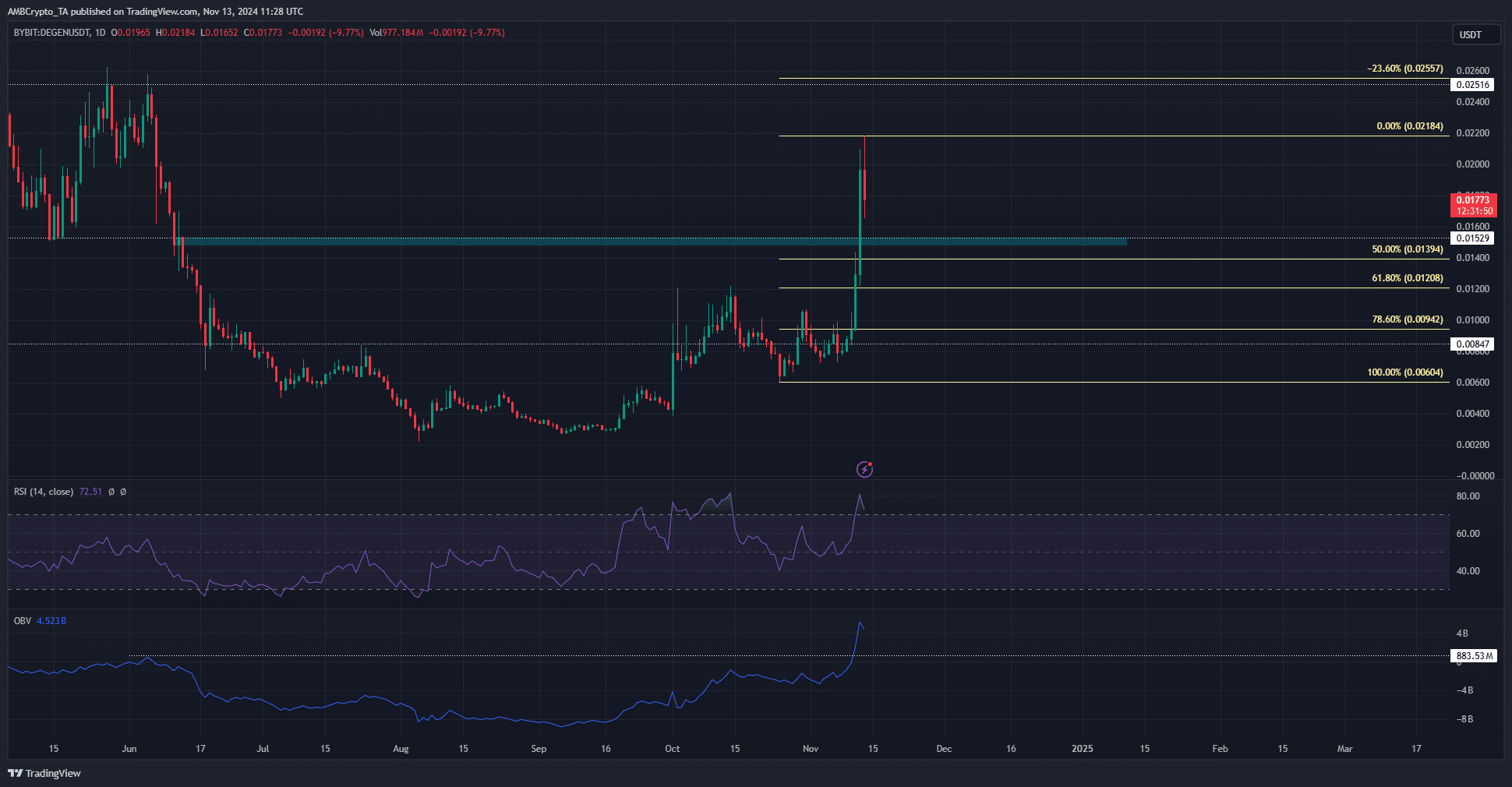

Epee [DEGEN] was successful in its attempt to break the local resistance zone at $0.012, which had been keeping the bulls at bay since early October. Degen’s crypto rally started at $0.0079 on November 8.

In just over four days, DEGEN rose 172% to reach a new local high of $0.0218 while Bitcoin [BTC] reached new all-time highs.

The $0.02 level has some historical significance, but the bulls were unable to defend this level as support.

How deep will DEGEN go back?

Source: DEGEN/USDT on TradingView

Degen crypto has been on an upward trend since October 1, when the local resistance zone at $0.0055 was decisively broken.

The bulls experienced some setbacks in the $0.0085 region but eventually regained the zone as support.

The recent rally came from this region and started at $0.0079 and went to $0.0218. The RSI was still in overbought territory, despite the pullback in recent hours.

An RSI above 70 does not in itself guarantee a retracement.

Contextually, Bitcoin’s $87,000 dip has led to a wave of profit-taking, but DEGEN is likely to go much higher. This is because the OBV has climbed past the June high of $0.0153.

The market structure has been solidly bullish and the next overhead targets are at $0.0255 and $0.0316, based on the Fibonacci levels plotted for the recent rally.

To the south, the $0.015 area is expected to be retested as support.

Will DEGEN crypto go to $0.012?

Is your portfolio green? View the DEGEN Profit Calculator

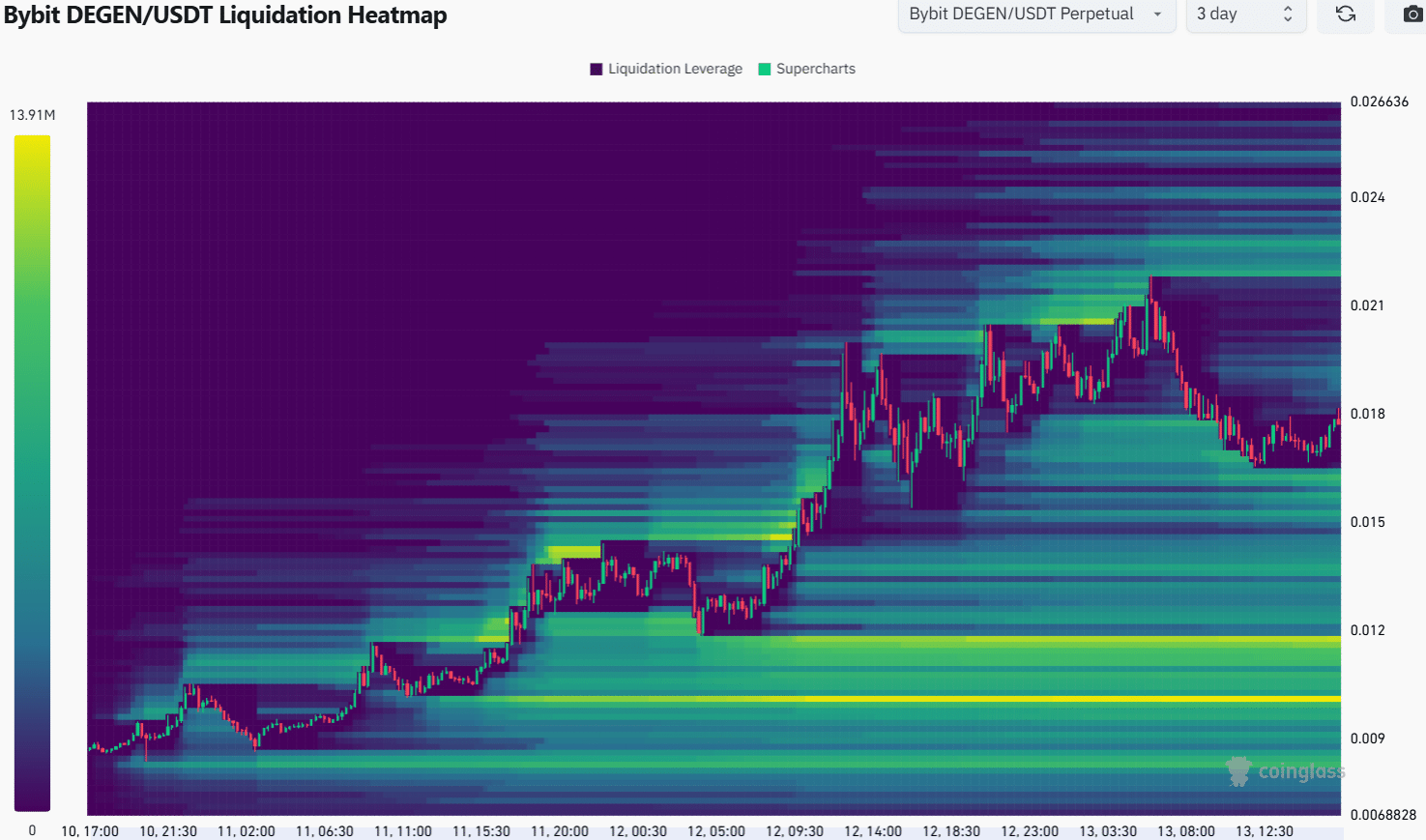

At the time of writing, a drop in the liquidity pool to $0.0117 seemed unlikely. Still, the cluster of liquidation levels there was strong, and the magnetic zone was able to pull DEGEN down.

Prices are attracted to liquidity, and a deeper dip for BTC would likely panic altco traders and force overextended positions to liquidate, driving prices down.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer