- Cumulative inflows into Ethereum ETFs turned positive for the first time since July.

- Blackrock’s ETHA has been ranked as one of the best ETF launches this year.

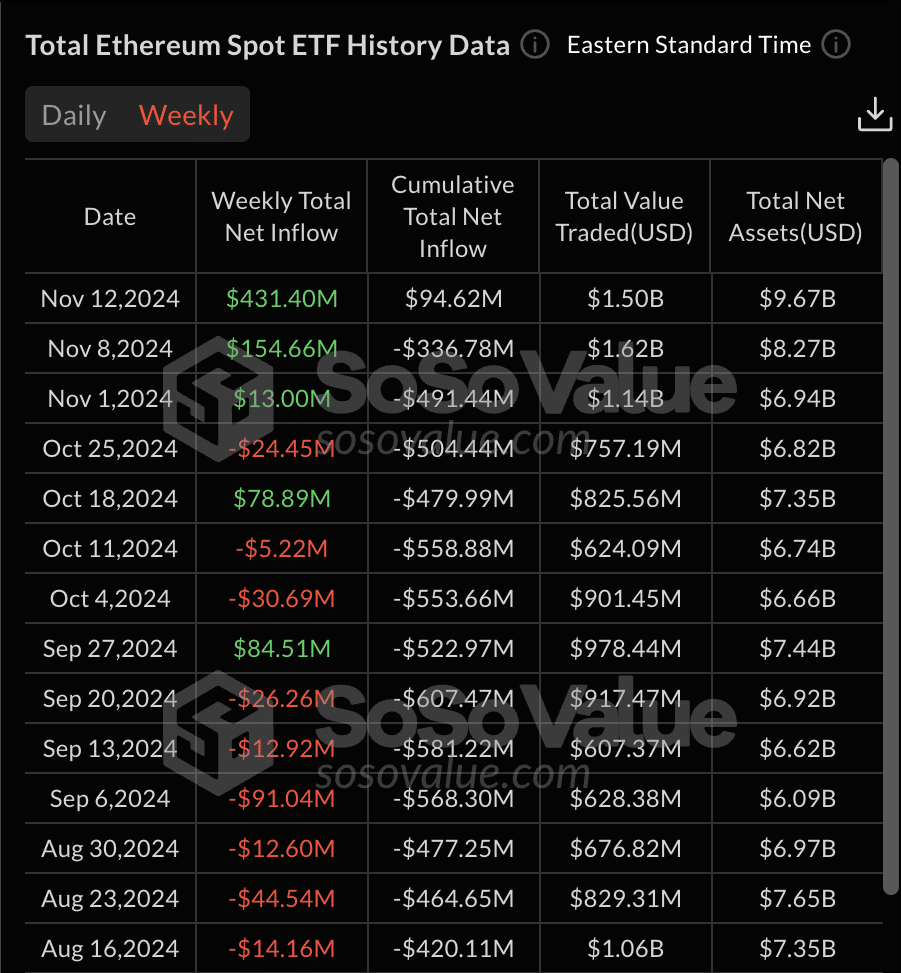

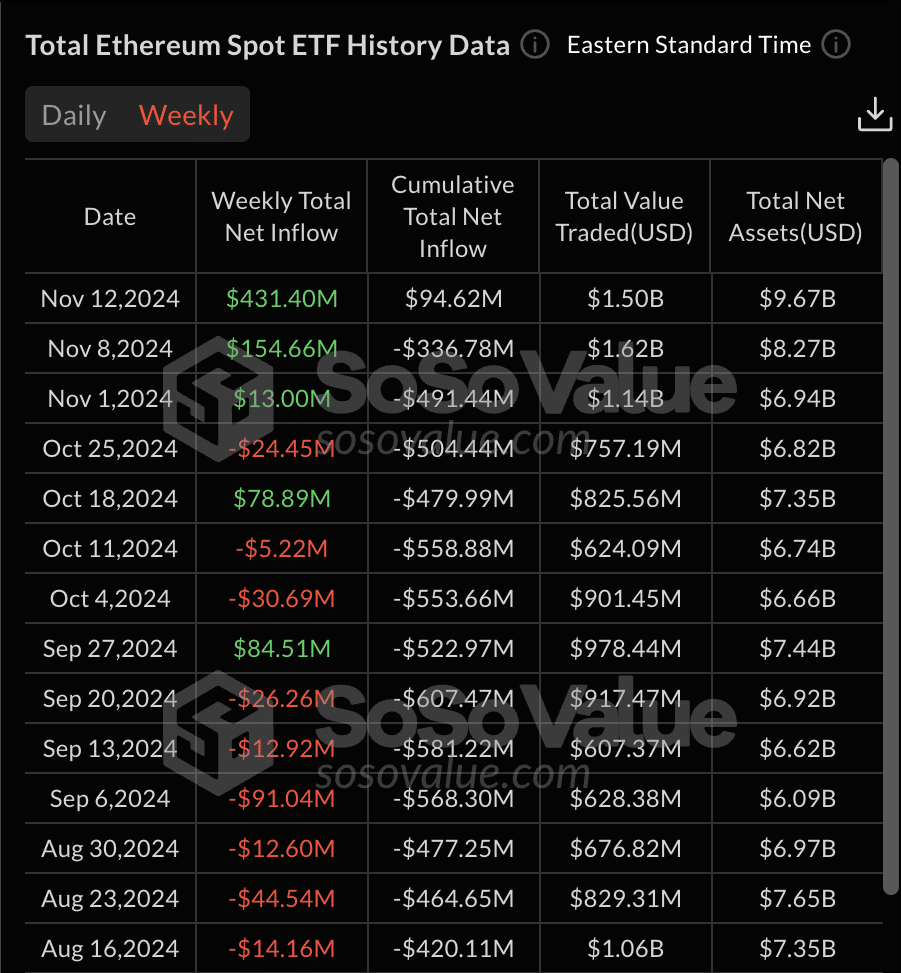

On November 12, Ethereum [ETH] ETFs were groundbreaking, ultimately moving total net inflows in a positive direction – for the first time since their launch.

Source: SoSo value

Facts of SoSo Value revealed daily net inflows of $135.92 million, bringing cumulative inflows to $94.62 million.

Trading activity also increased, with total traded value reaching $582.18 million and total net assets rising to $9.67 billion.

Of the nine ETFs, five saw inflows. Meanwhile, only Grayscale Ethereum Trust [ETHE] an outflow was recorded, while the remaining funds showed no new inflows.

Executives weigh in

The latest development caught the attention of industry leaders on X (formerly Twitter).

Nate Geraci, President of the ETF Shop, marked the net positive flows mark an important milestone for ETH ETFs as they have:

“Overcoming $3.2 Billion in Outflows from ETHE.”

Moreover, Geraci be which includes 19 of this year’s top 50 ETF launches Bitcoin [BTC]ETH, or MicroStrategywith 12 in the top 18 – an impressive figure out of a total of 610 launches.

Furthermore, the Ethereum Trust from iShares [ETHA] ranked as the 6th best ETF launch of 2024

Bankless co-founder Ryan Sean Adams, too commented on development. He noted that ETHE’s dominant outflows essentially offset ETFs’ upward pressure.

However, now that the inflow is turning positive for the first time, this could indicate a shift.

Adams even predicted that this shift would be a…

“Prescription for an ETH rocket to $10k.”

Ethereum ETFs hit record inflows

This latest milestone comes a day after ETFs had a record day on November 11, recording inflows of $295 million.

This influx, led by industry giants like Fidelity and BlackRock, marked nearly triple the previous peak of $106.6 million recorded on launch day.

Eric Balchunas, Bloomberg senior ETF analyst, noted on X that were ETFs,

“Trending in the right direction.”

The analyst further anticipated a positive trend for the ETFs, stating:

“Sunny days ahead, although still several country miles behind BTC ETFs.”

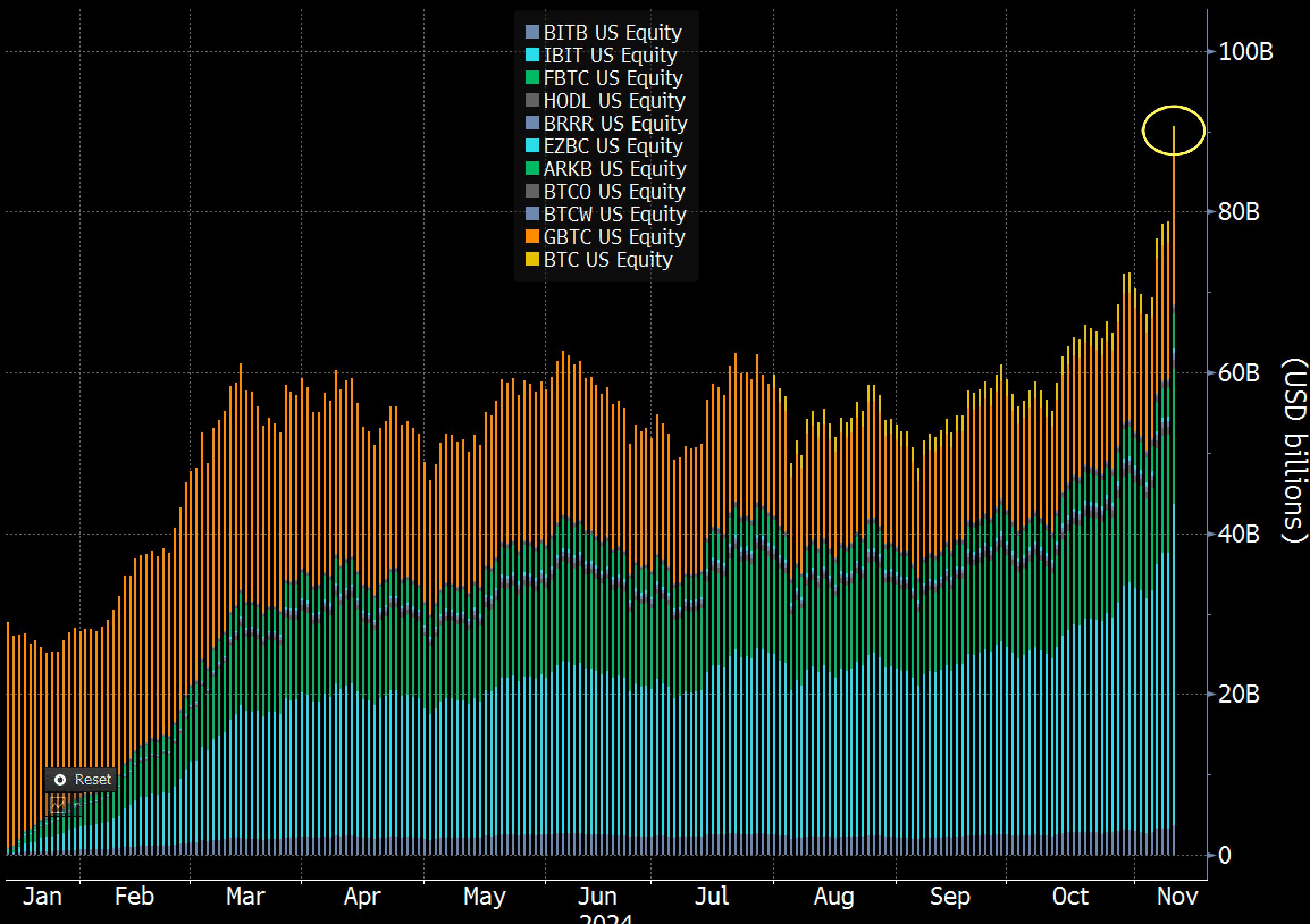

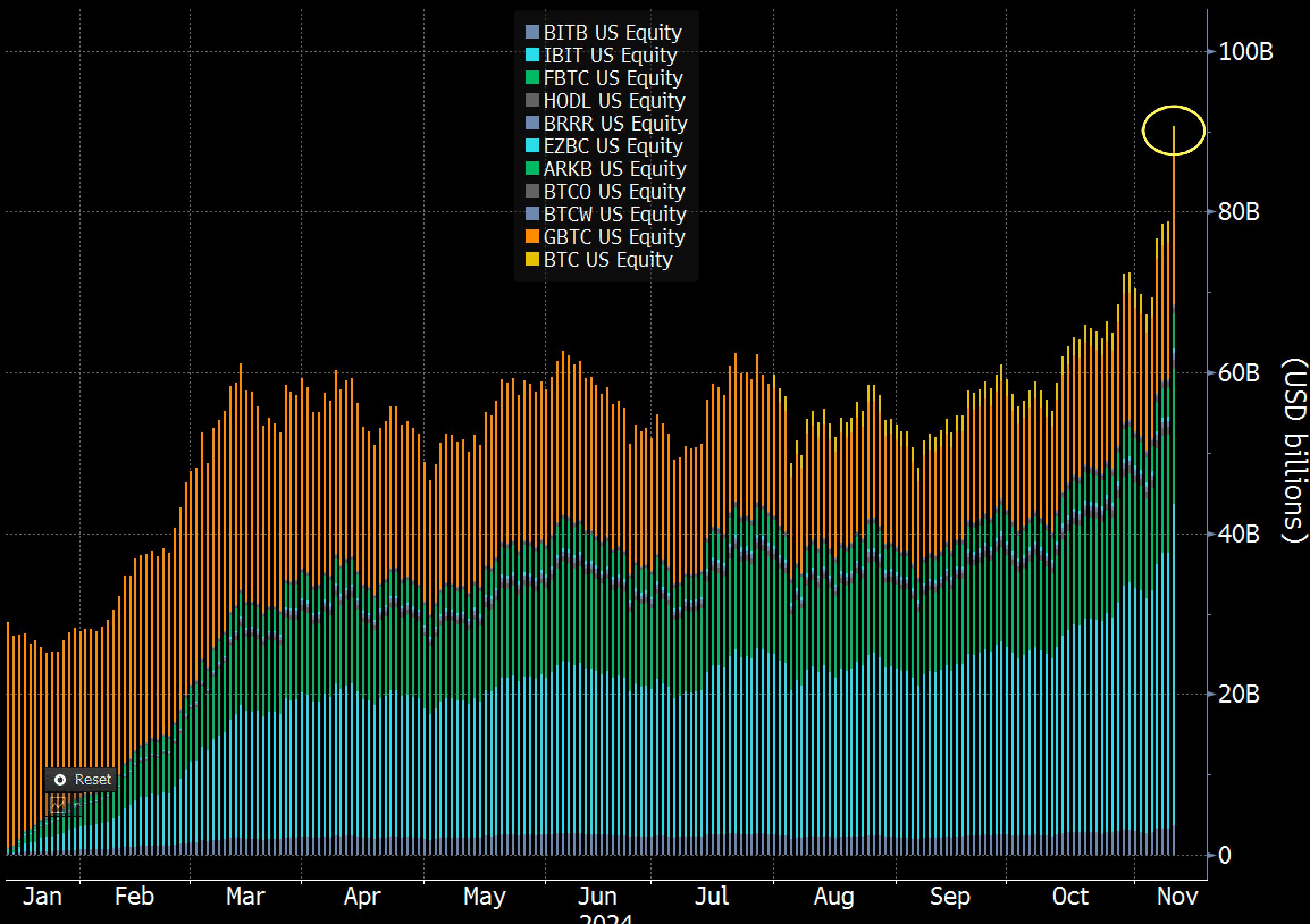

How are BTC ETFs doing?

In the meantime, BTC ETFs also achieved its own record. Balchunas revealed on X that Bitcoin ETFs crossed the $90 billion mark in assets under management, after a substantial increase of $6 billion.

This included $1 billion in new inflows and $5 billion in market appreciation. This increase means that Bitcoin ETFs were now 72% of the way to surpassing gold ETFs in total assets.

Source: Eric Balchunas/X

As another sign of demand, IBIT reached $1 billion in trading volume in just 25 minutes – faster than the previous day, when it broke a record.

Balchunas described the continued interest in BTC ETFs as a “feeding frenzy” that shows no signs of slowing down.