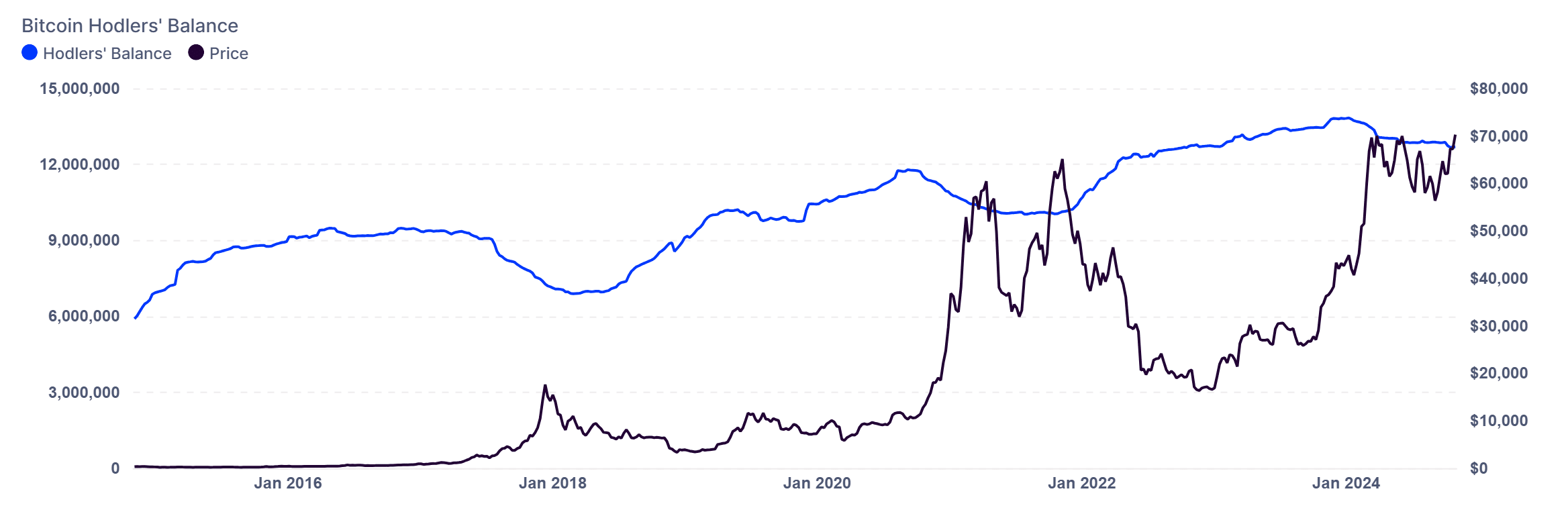

- BTC Hodler’s balance has fallen slightly recently.

- Despite this decline, the price of BTC has maintained a strong trend.

Bitcoin [BTC] is witnessing an intriguing shift in market dynamics as long-term holders, or “Hodlers,” take a more cautious approach to selling in the current market cycle.

Unlike previous bull runs marked by aggressive sell-offs, data now shows a modest decline in Hodlers’ balance sheets. This behavior signals caution despite Bitcoin’s rising prices, potentially marking a new trend in Bitcoin market behavior.

Bitcoin hodlers’ balances are showing a gradual decline

According to recent data from InTheBlokHodlers’ Bitcoin balance has been steadily, albeit mildly, declining in recent weeks.

On November 4, the Hodlers’ balance was approximately 12,681,159 BTC, down slightly from 12,686,790 BTC on October 28.

Unlike previous cycles, where significant sell-offs have often coincided with peak prices, this measured decline signals a change in strategy among Hodlers, reflecting caution and a desire to maintain current price growth.

Source: IntoTheBlock

This tempered approach contrasts with historical behavior, in which rapid price increases led to more aggressive sales.

As Bitcoin price trends rise, Hodlers appear to be more patient and are gradually reducing their holdings rather than overwhelming the market with a quick sell-off. This change could reflect a more mature approach to managing profits in an evolving market landscape.

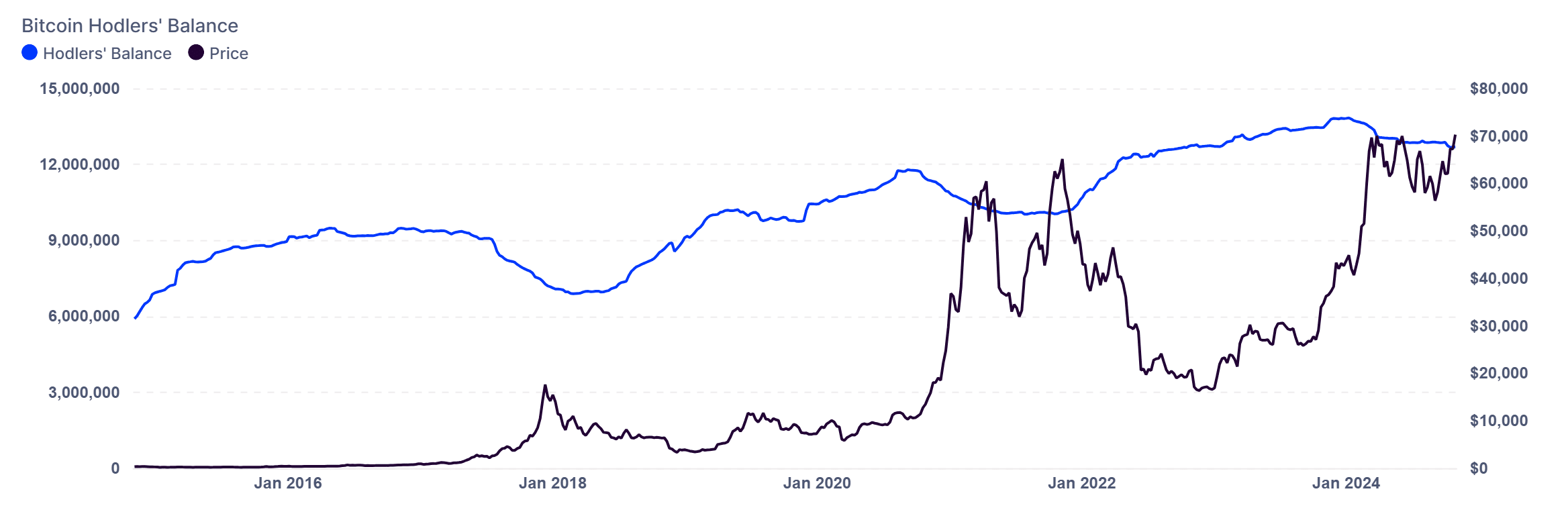

Bitcoin Price Dynamics Amid Moderate Selling Pressure

Bitcoin’s current price action reflects its stability despite Hodlers’ subdued selling. As Bitcoin trades around $68,789, it is showing resilience despite mild selling activity from long-term holders.

Technical indicators further illustrate this balanced environment. The Relative Strength Index (RSI), currently at 54.66, indicates neutral to slightly bullish sentiment, with a reading above 50 indicating that buying pressure is slightly stronger than selling pressure.

The RSI remains well below the overbought threshold of 70, indicating that the asset still has room to grow before it faces stronger selling resistance.

Source: TradingView

The Choppiness Index (CHOP) also indicates stability and stands at 49.90, indicating a relatively balanced trend without excessive volatility. A CHOP value around 50 usually implies that the market is not in a strong trend nor is it very volatile.

This corresponds well with the gradual decline in Hodlers’ balance sheets, suggesting that selling activity is being met by steady buying interest without causing major price swings.

This stability can be attractive to both retail and institutional investors looking for less volatile entry points.

A new market cycle dynamic?

The recent behavior of Bitcoin Hodlers could indicate evolving cycle dynamics. Their reluctance to sell aggressively, even in a favorable price environment, could indicate continued or even further price growth expectations.

This conservative approach could also reflect cautious optimism, as Hodlers appears to be testing the market by making smaller, incremental sales rather than taking significant profits all at once.

Read Bitcoin (BTC) price prediction 2024-25

As the Bitcoin market matures, the trend of gradual sell-offs rather than sharp sell-offs could signal a shift toward a more stable market environment.

This behavior could help reduce the extreme volatility traditionally associated with Bitcoin cycles, supporting the asset’s resilience. If this trend continues, it could mark a long-term shift in the way Bitcoin holders interact with the market.