- The sentiment of the crowd and the smart money both pointed to market optimism

- Higher transaction numbers and active addresses, combined with declining foreign exchange reserves, supported XRP’s bullish chances

XRPs Market sentiment at the time of writing predicted a strong one bullish outlookwith public sentiment scoring a positive 1.77 and smart money sentiment scoring 0.76. Together, this alignment between private and institutional investors could be a sign of growing confidence across the board.

At the time of writing, XRP was trading at $0.514, marking a small decline of 0.14% in the past 24 hours. However, increased market sentiment indicated some potential for upside momentum. Hence the question: could this double bullish sentiment be the spark for XRP’s next rally?

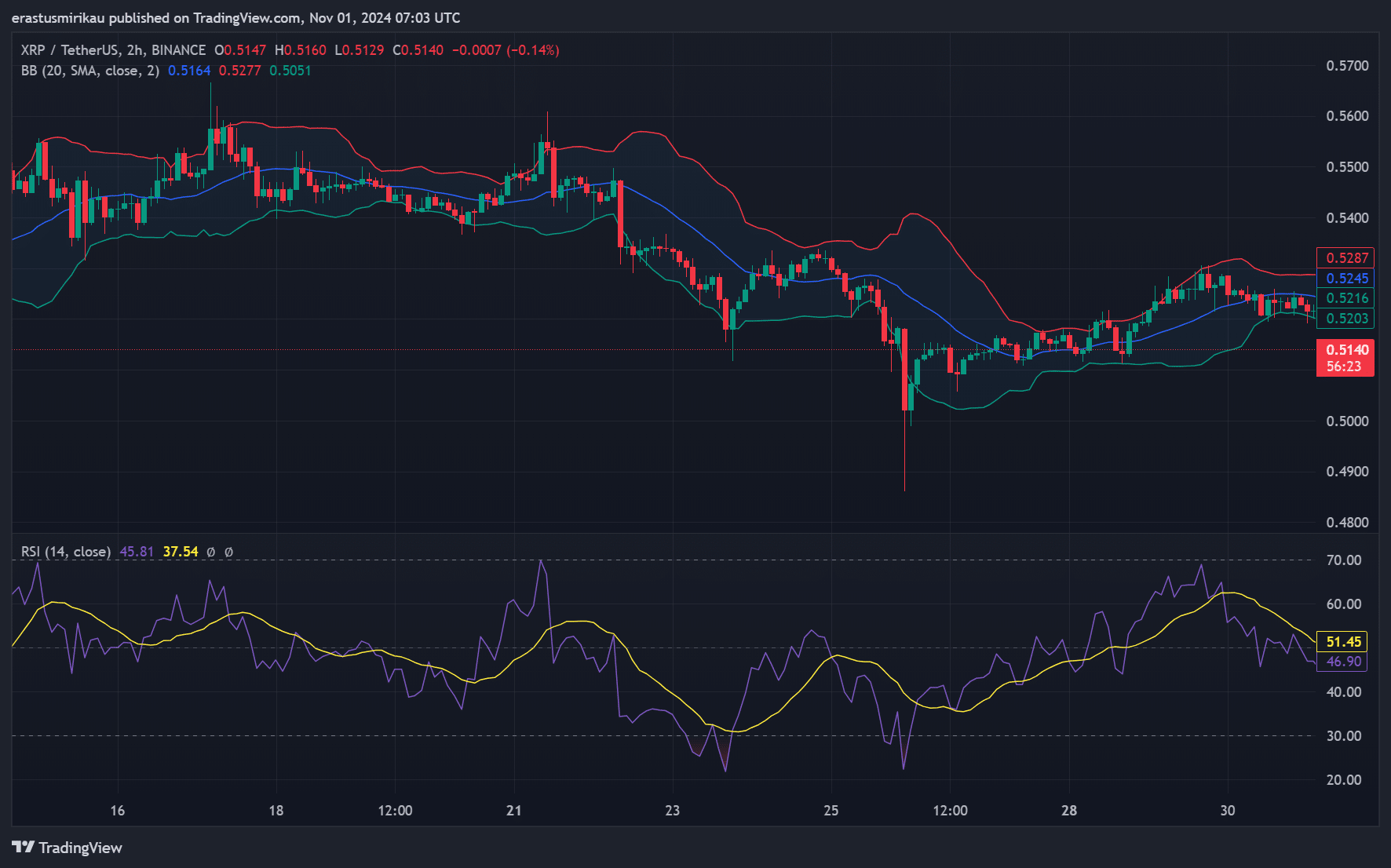

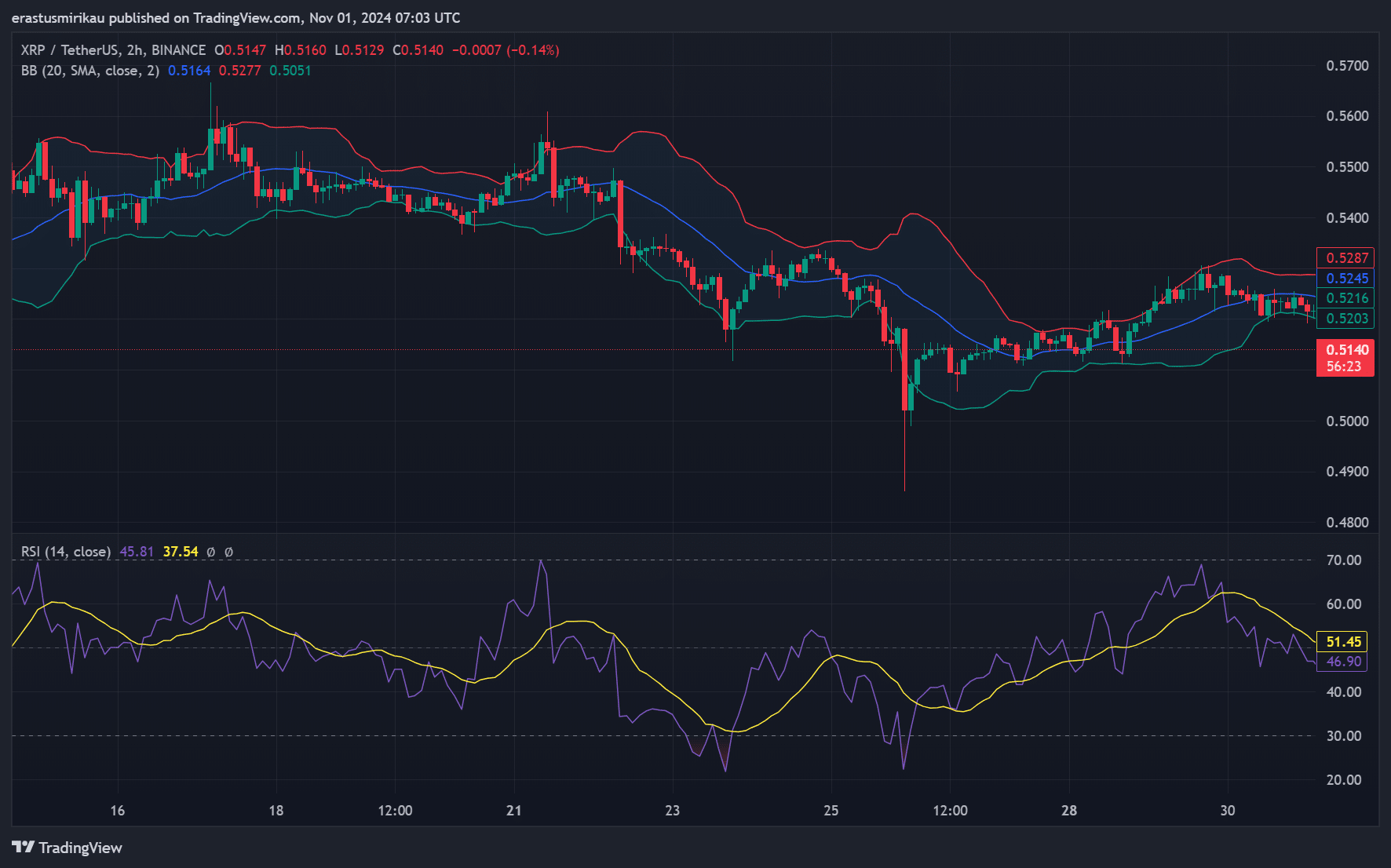

Price Action Review – Can XRP Break Free From Its Range?

When examining the recent price movements, the token appeared to be consolidating within a narrow range, fluctuating between $0.51 and $0.52. The Bollinger Bands data even showed a contraction, indicating that short-term volatility is decreasing.

Nevertheless, the Relative Strength Index (RSI) hovered near 45.81, indicating that XRP could be approaching the oversold level. Consequently, this setup could pave the way for a breakout if buying pressure rises in line with the prevailing positive sentiment.

Source: TradingView

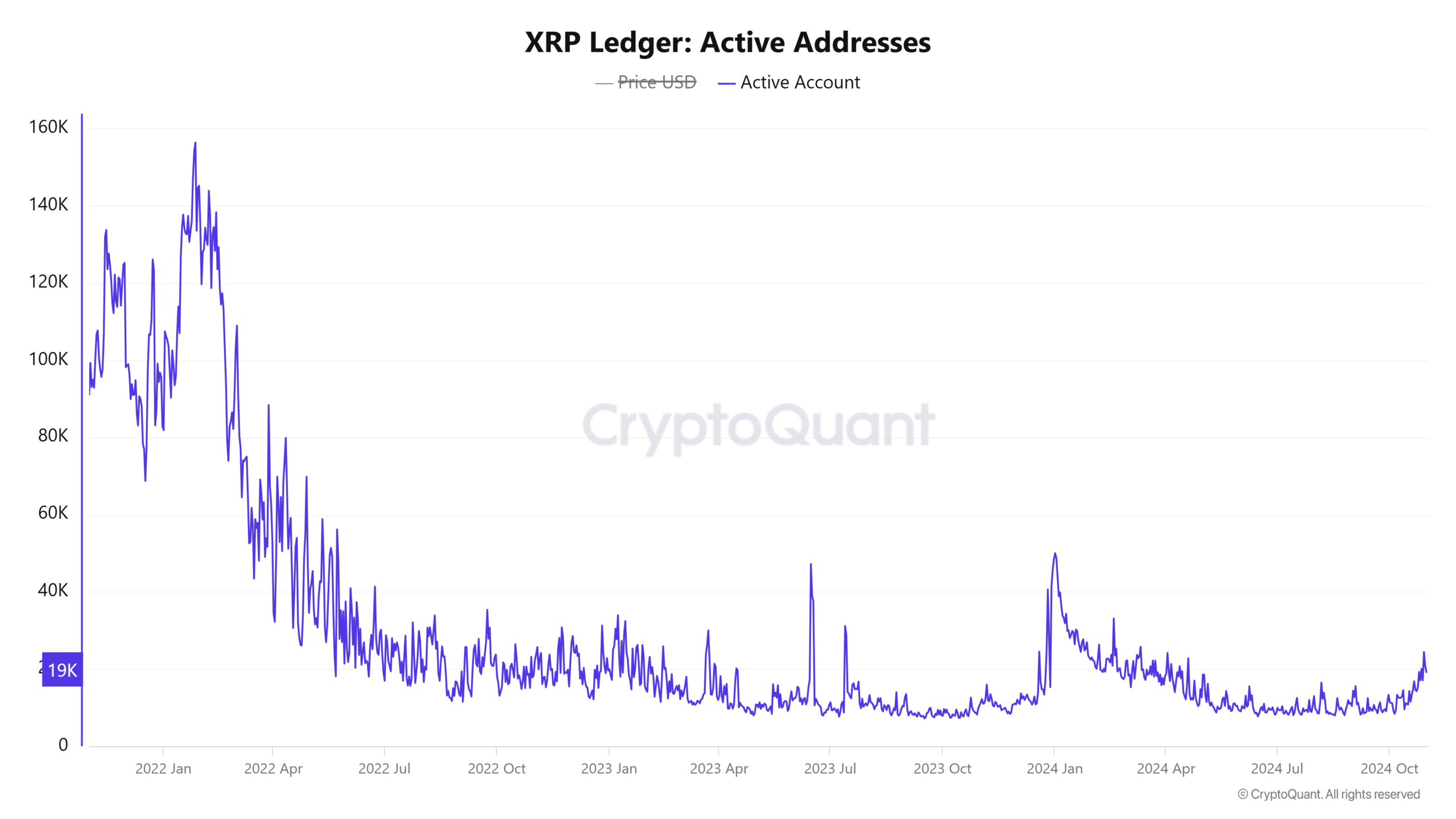

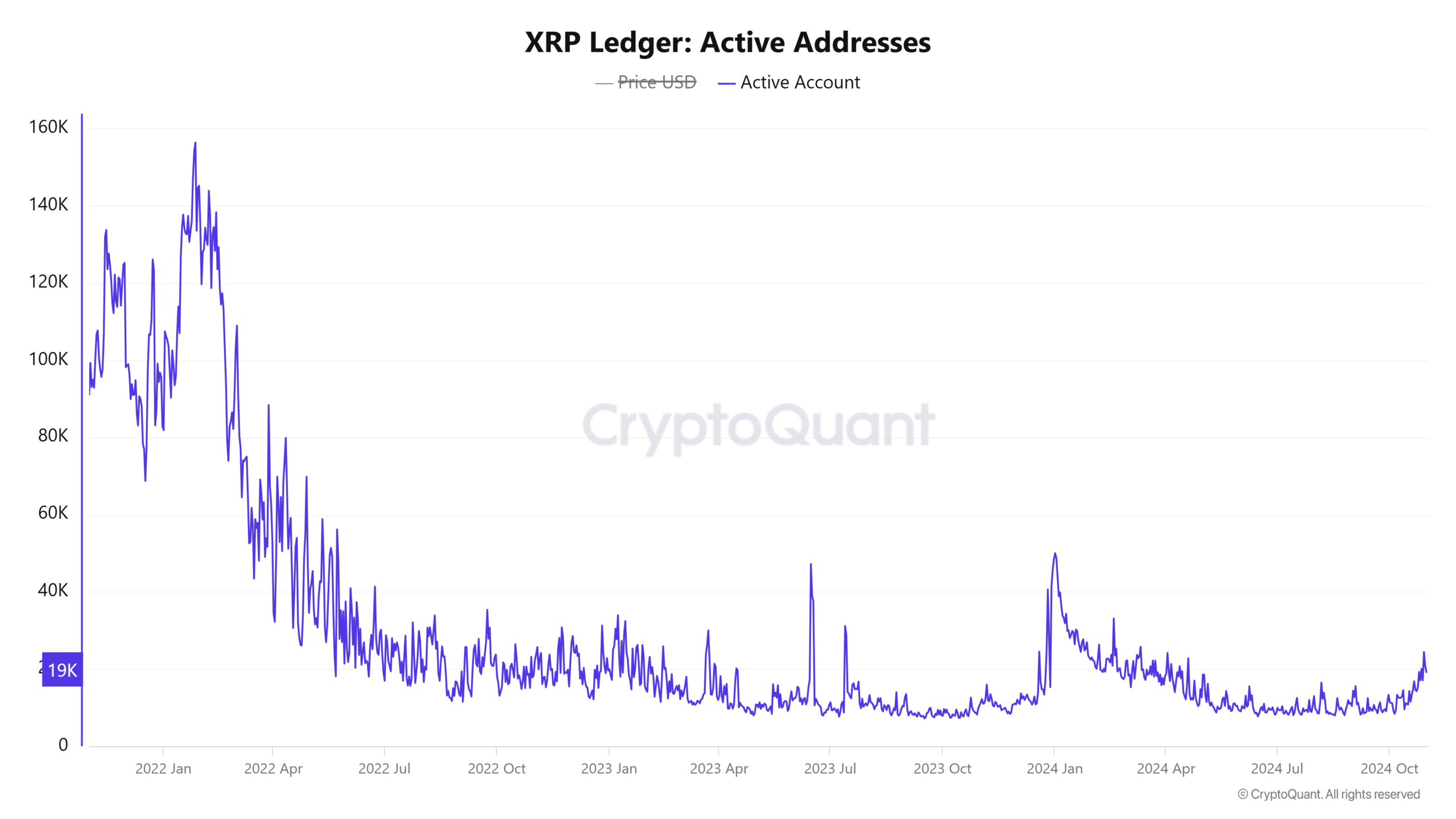

XRP Active Addresses Rising – Bullish Network Signal?

Moreover, network strength also seems to be gaining momentum. The number of active addresses increased by 0.92% over the past 24 hours, reaching a total of 19,191,000 unique addresses. This increase in the number of active addresses can be interpreted as a sign of increased user engagement with the XRP ledger.

In general, more active addresses indicate growing user interest, often a precursor to higher transaction volumes.

Therefore, the increase in the number of active addresses is a sign of rising demand – a development that fits well with the broader bullish sentiment surrounding XRP.

Source: CryptoQuant

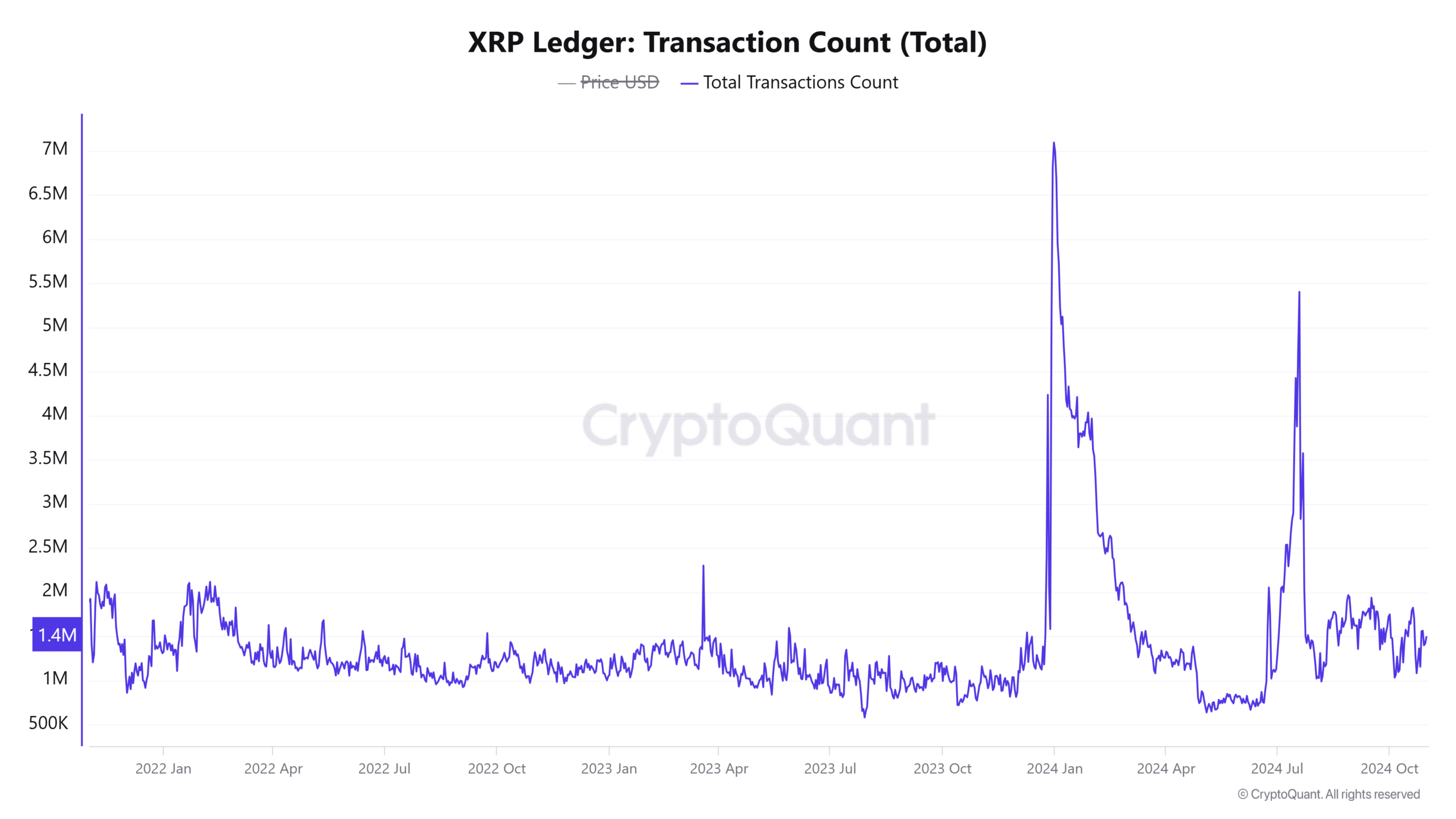

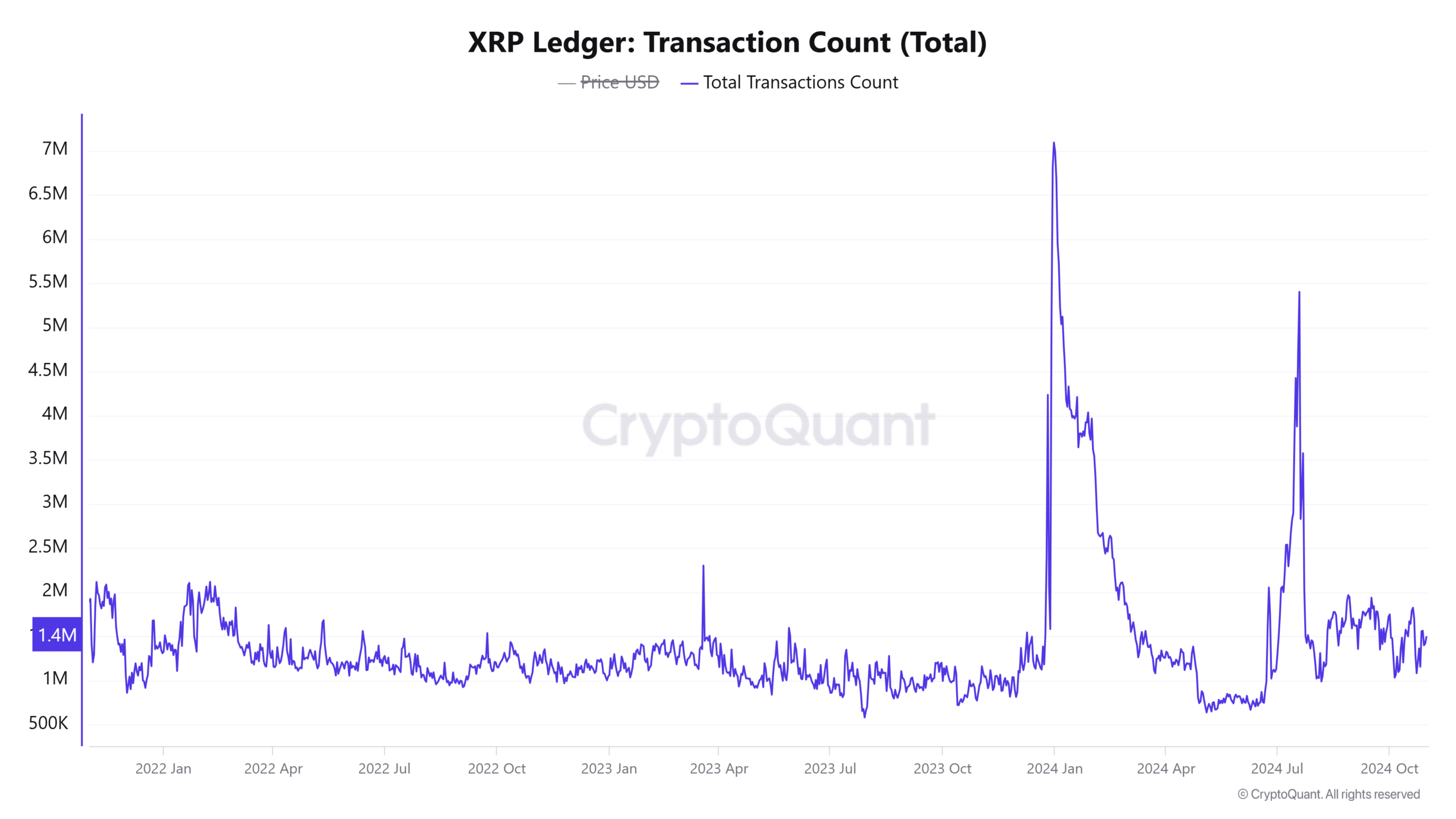

Growth in the number of XRP transactions – Higher network utility

The increase in transactions further highlighted the growing utility of XRP.

The total number of transactions increased by 0.98% to 1.4089 million over the past 24 hours. An increase in transaction activity on the network often leads to stronger demand for the token – a positive signal for price stability and potential growth.

Source: CryptoQuant

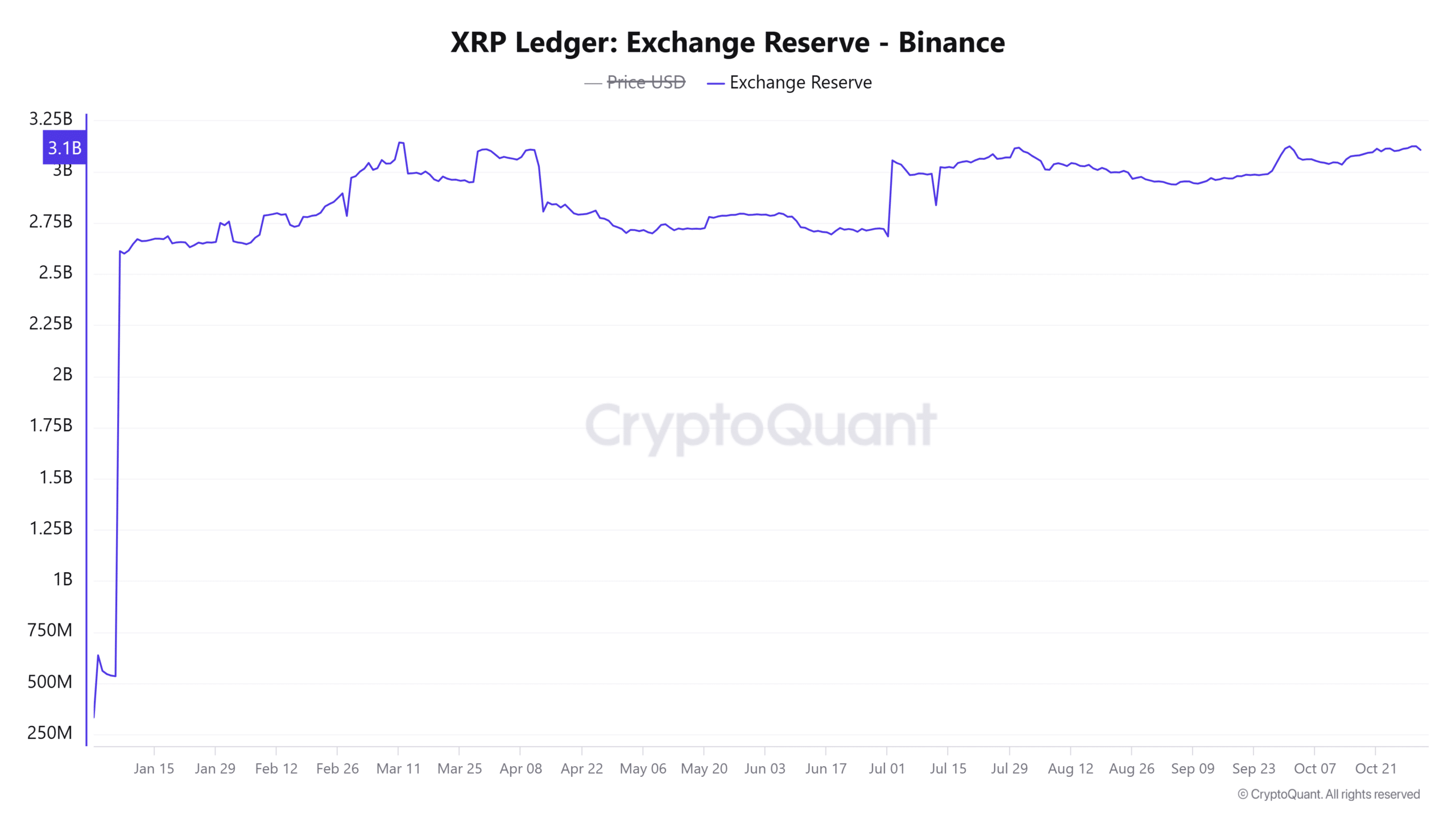

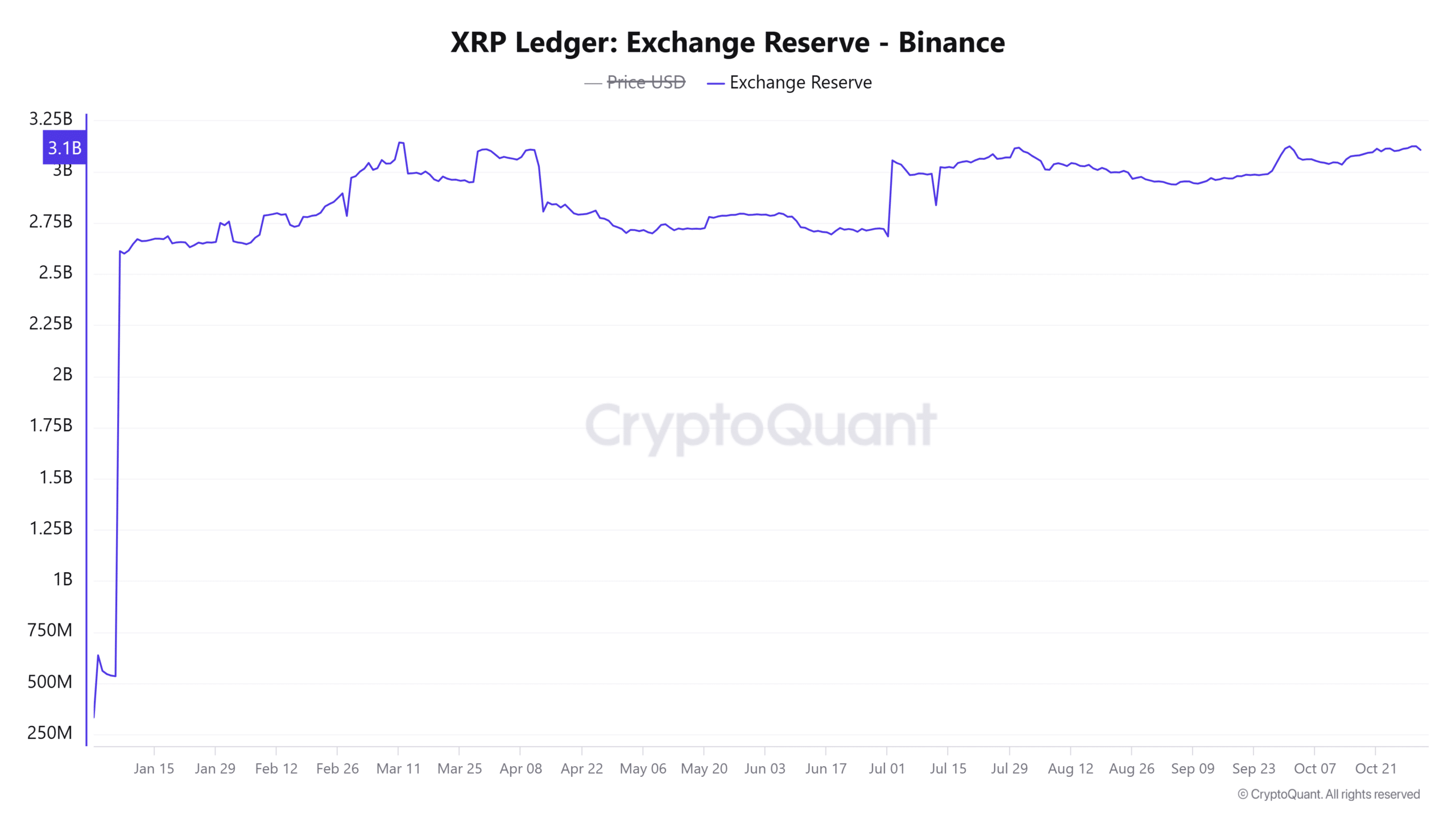

Foreign exchange reserves falling – Lower selling pressure ahead?

Another positive development is that foreign exchange reserves have decreased by 0.59% in the last 24 hours. In general, a decline in foreign exchange reserves implies lower potential selling pressure, as fewer tokens are held on exchanges for immediate sale.

Investors delisting XRP from exchanges could be a sign of confidence in the asset’s long-term prospects. Therefore, this reduction in reserves complements bullish market sentiment, suggesting that selling pressure could remain contained in the near term.

Source: CryptoQuant

Read Ripple’s [XRP] Price forecast 2024-25

In short, the indicators collectively underlined a strong basis for potential upside. Both public and smart money sentiment was bullish, while on-chain metrics such as active addresses and transaction numbers appeared to show positive growth.