- BTC is about to retest its all-time high as it surges towards the $70,000 price level.

- Indicators indicate that a bull run may be in the offing.

Like Bitcoin [BTC] remains strong above the $70,000 level, but investors are becoming increasingly optimistic about the potential for a Bitcoin bull run. By analyzing key indicators such as the NVT (Network Value to Transactions) ratio, active address data, and current price momentum, we can understand whether Bitcoin is paving the way for a long-term bullish phase or whether caution is needed.

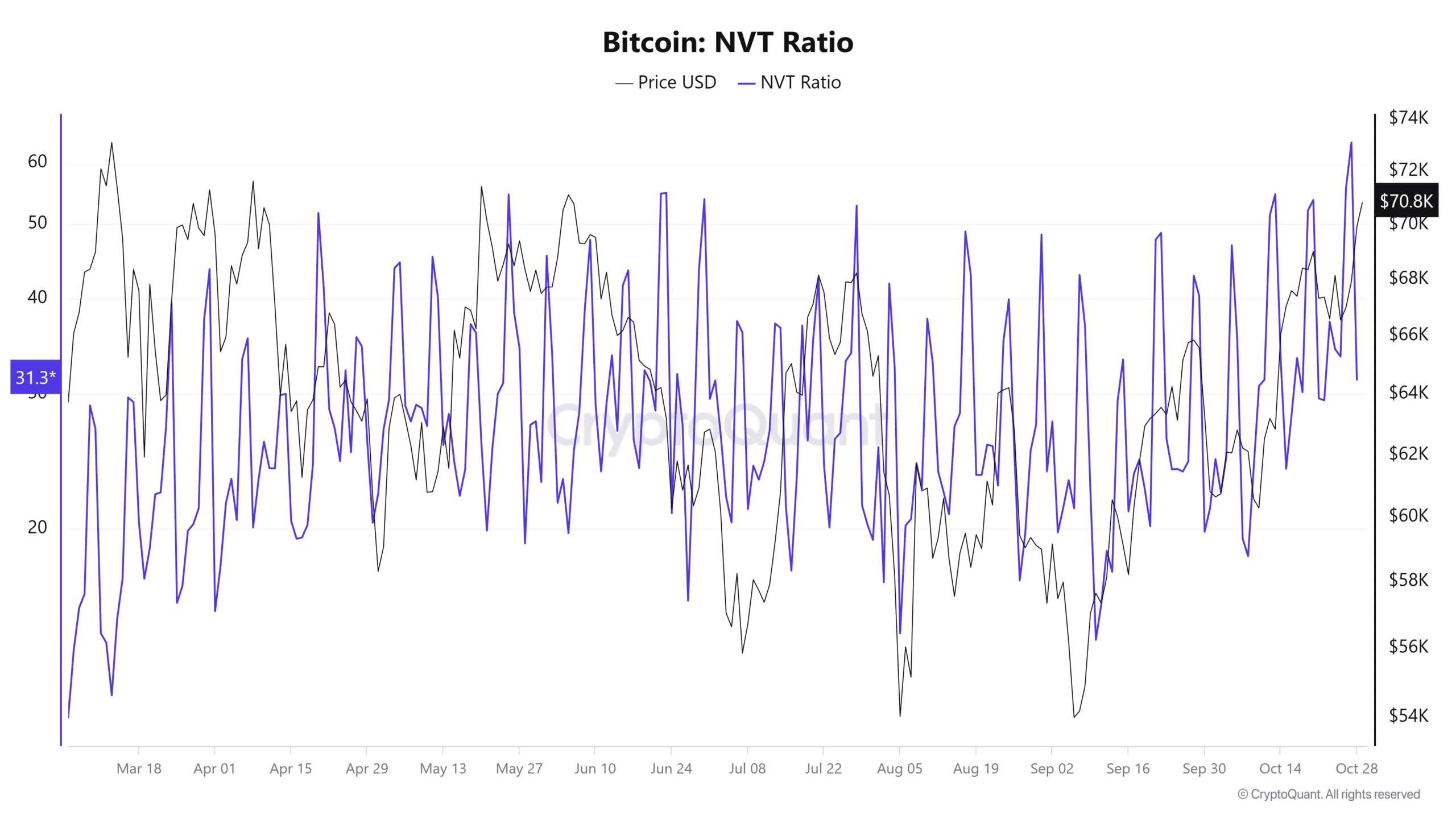

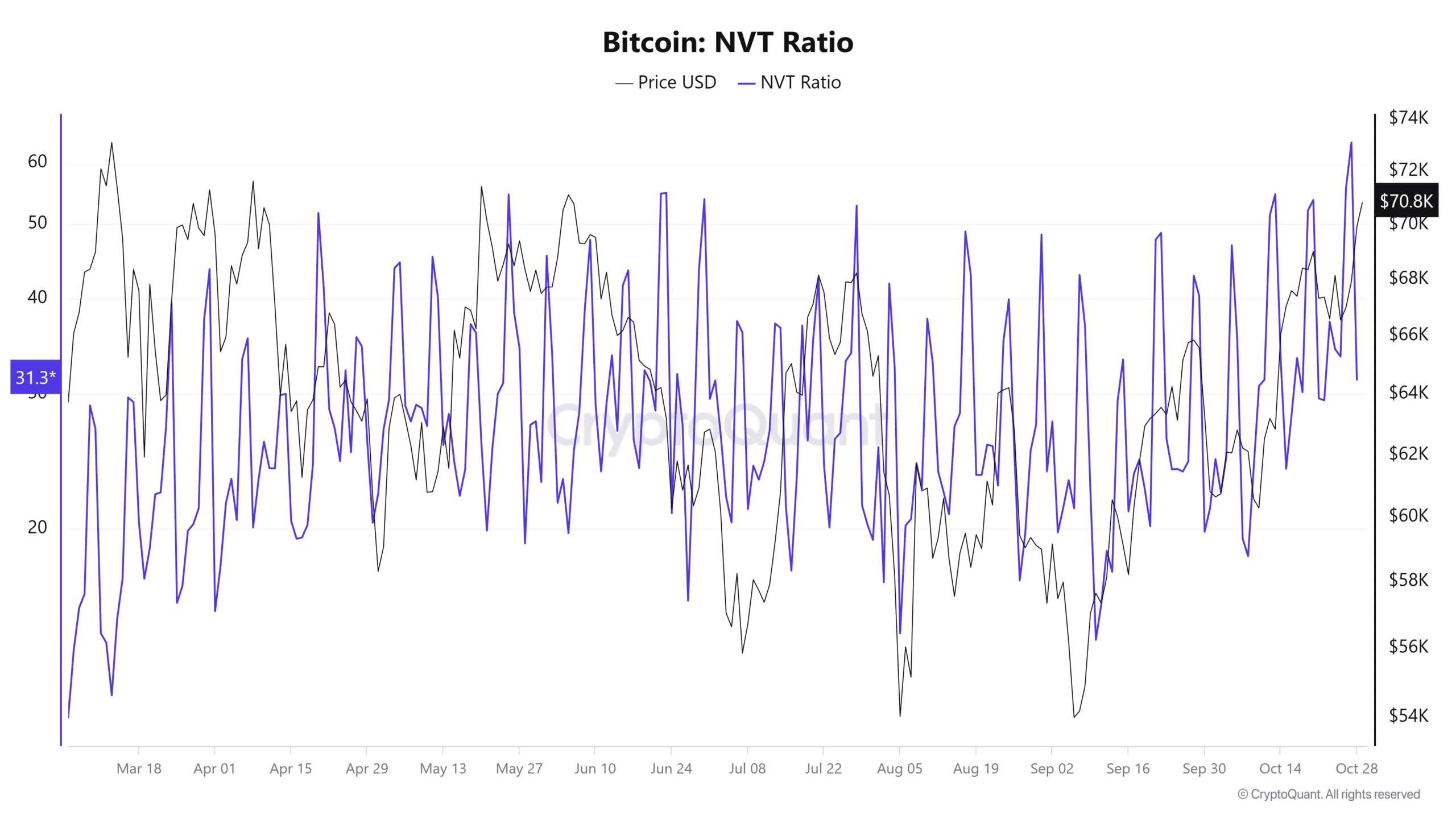

NVT Ratio signals stability for Bitcoin bull run

The NVT ratio, often compared to Bitcoin’s price-to-earnings ratio, provides insight into whether the asset is overvalued or undervalued based on network activity.

Currently, the NVT ratio reflects a balanced and healthy market, showing that Bitcoin’s network can handle the increased demand without signs of overheating.

Source: CryptoQuant

Historically, a stable or low NVT ratio during price growth has laid the foundation for a Bitcoin bull run as it suggests the rally has a strong foundation.

This favorable NVT rating indicates that current price momentum could have the resilience needed to sustain a longer bullish trend.

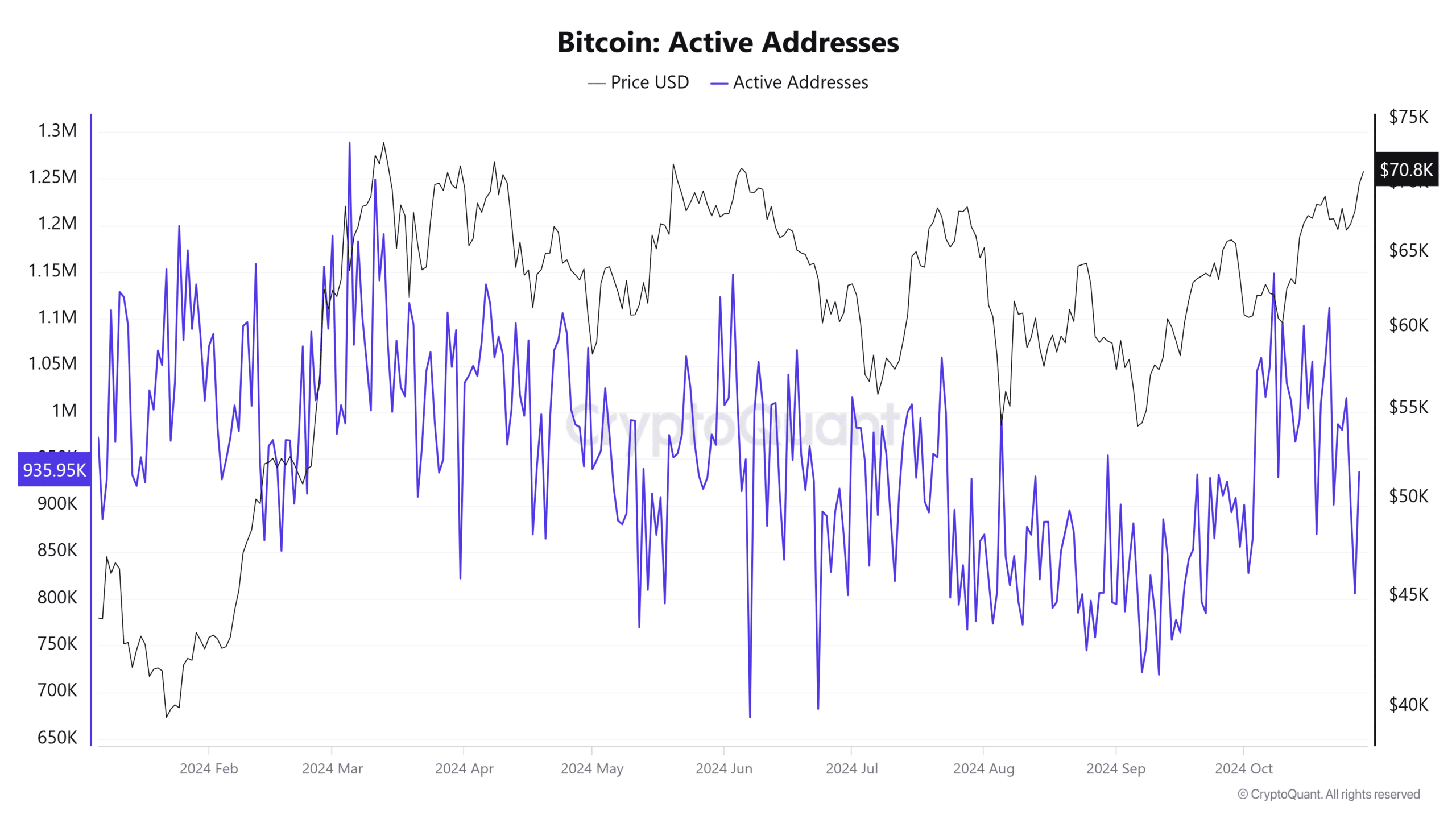

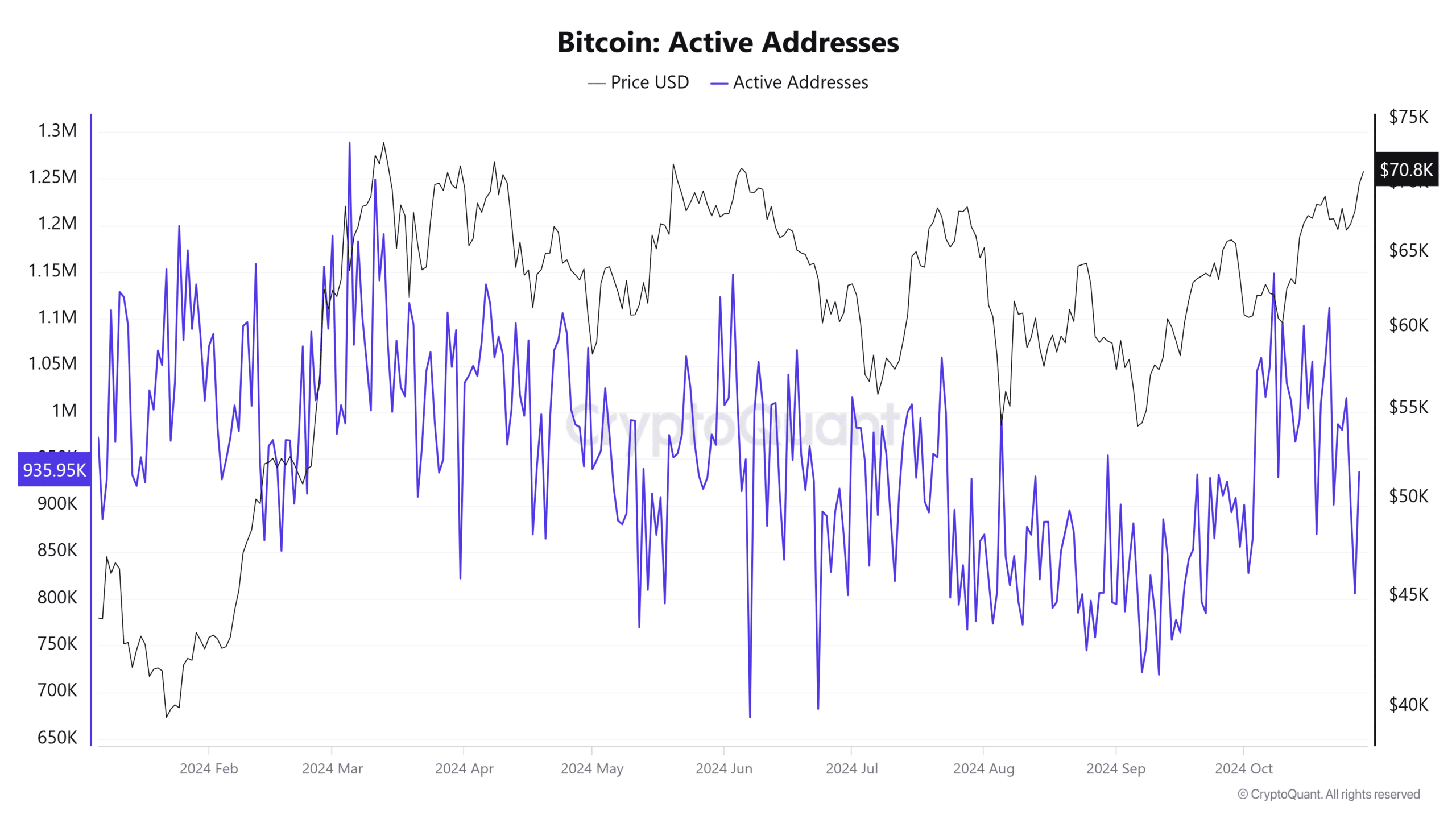

The increase in the number of active addresses adds fuel to the bullish sentiment

A recent surge in the number of active Bitcoin addresses also supports the case for a Bitcoin bull run. With the number of active addresses consistently above 935,000, network activity is showing healthy growth.

Source: CryptoQuant

Increased active addresses generally indicate greater user engagement, which translates into greater demand for Bitcoin. This trend, which is often associated with price increases, may indicate renewed interest in the asset.

Therefore, the continued rise in the number of active addresses is a key indicator that could strengthen the ongoing rally and contribute to the broader narrative of a possible bull market.

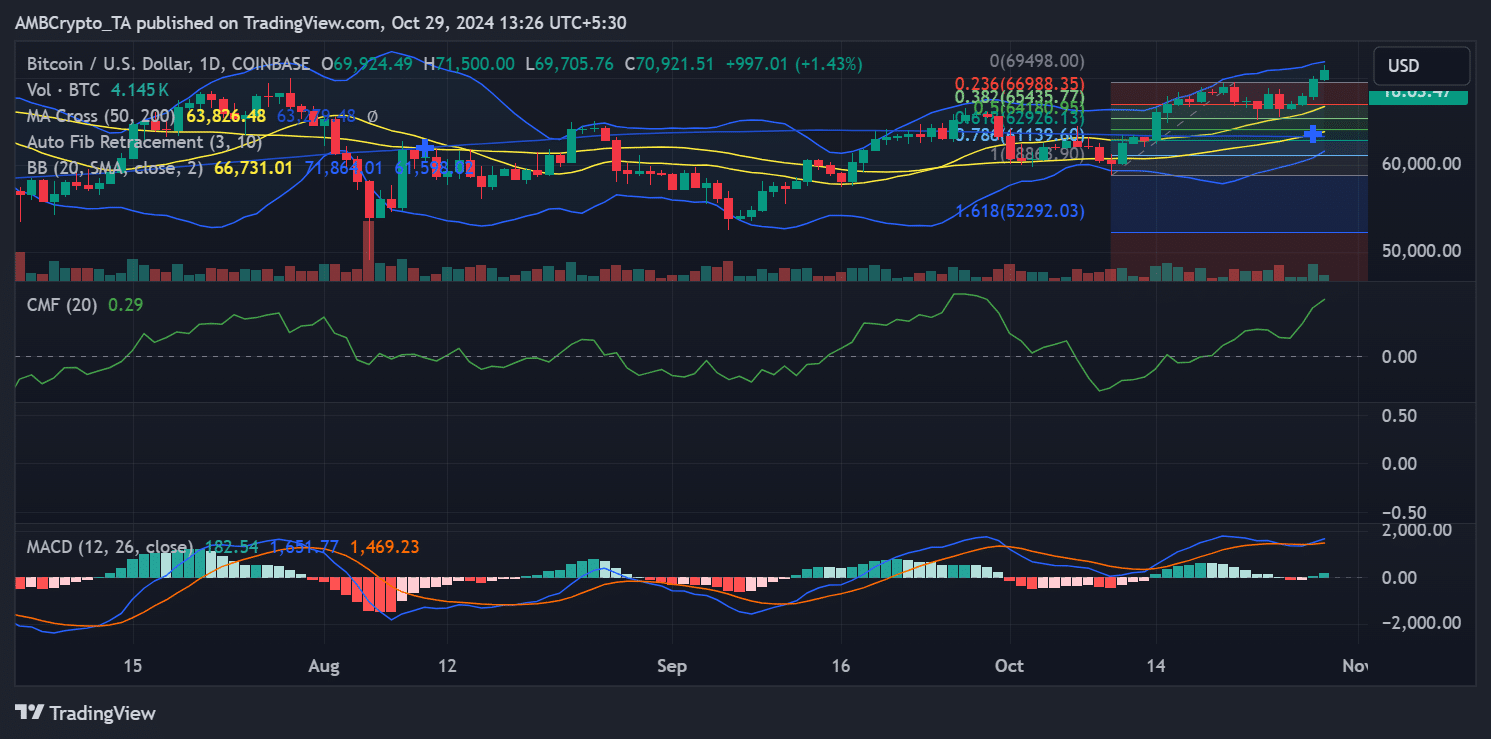

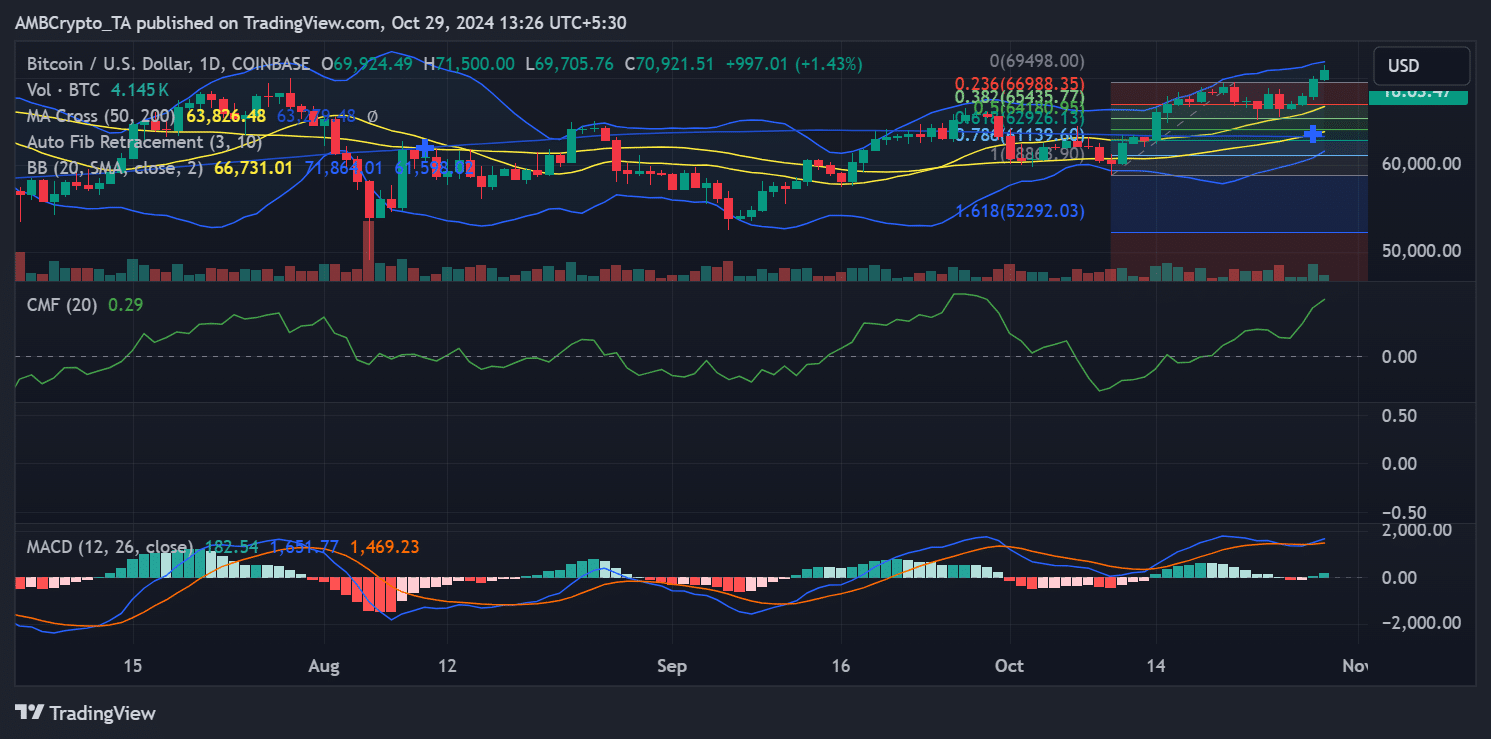

Technical indicators support the potential of Bitcoin Bull Run

Bitcoin’s price chart reveals several bullish signals that reinforce the potential for continued upward momentum. Bitcoin recently broke major resistance levels and has shown solid support around the 50-day moving average.

This indicator has often served as a basis for bullish momentum.

Source: TradingView

Moreover, the Chaikin Money Flow (CMF) is currently at a positive 0.29, indicating strong buying interest. At the same time, a recent bullish MACD crossover is adding to this momentum.

Together, these technical indicators align well with Bitcoin’s fundamental strength, making a compelling case for a Bitcoin bull run.

In summary, Bitcoin’s fundamental metrics and technical indicators point to a favorable environment for a potential bull run.

A balanced NVT ratio, growing active addresses, and supportive technical strength all indicate that Bitcoin’s upward momentum could continue.

Read Bitcoin (BTC) price prediction 2024-25

Investors watching the market for signs of a Bitcoin bull run can find encouragement in these numbers.

However, close monitoring of key indicators remains essential to gauge the sustainability of this rally as Bitcoin is poised to reach new all-time highs in the coming months.