- Bitcoin options are seeing bullish sentiment, with rising whales pointing to potential gains in November.

- Ethereum options are showing indecisiveness as prices hover near a low, which contrasts with Bitcoin’s strong momentum.

The crypto options expiration date, dated October 25, yielded mixed results Bitcoin [BTC] And Ethereum [ETH]according to data from Greeks.live.

The expiration event, which involved a combined notional value of $5.28 billion, illustrated different investor behavior for the two leading cryptocurrencies.

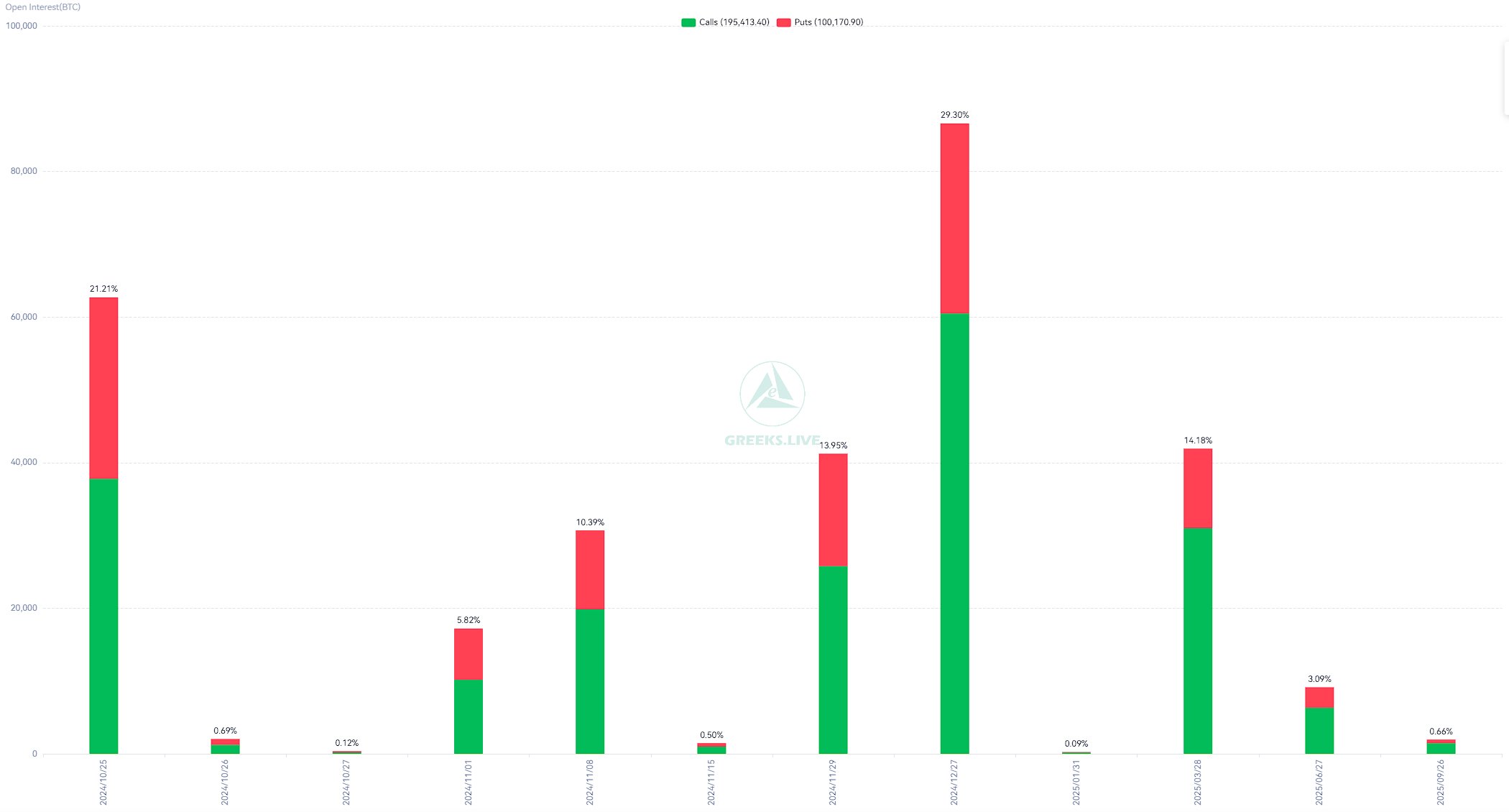

BTC options expire

On October 25, 63,000 Bitcoin Options contracts expired, showing a Put-Call Ratio of 0.66, indicating generally bullish sentiment among traders.

The ratio indicated that the number of call options was greater than the put options, indicating that traders were more inclined to upward price movements.

Meanwhile, the Max Pain point, where most options would expire worthless, was quoted at $64,000.

The total notional value of expired BTC options was $4.26 billion, indicating significant activity in the market.

Bitcoin was trading around $67,000 at expiration, down to a recent high of $68,000. Still, BTC remained close to its all-time high of $70,000.

Source:

Bitcoin’s implied volatility (IV) – dated November 8 – has stabilized at 55%, signaling a potential opportunity for traders anticipating the US election, which could trigger significant market shifts.

Rise of Bitcoin Whales

Recent data from Santiment supports the bullish sentiment revealed an increase in the number of Bitcoin whales in the past two weeks.

DDuring this period, 297 new wallets holding at least 100 BTC were added, reflecting an increase of 1.93% and bringing the total number of such wallets to 16,338.

Historically, an increase in the number of large Bitcoin holders often corresponds to upward price momentum, signaling potential further gains for Bitcoin.

Source:

The increase in whale addresses coincided with Bitcoin’s recent price action, where its value briefly exceeded $68,000 before a small correction to $67,000.

This accumulation of whales could indicate continued interest among major investors, potentially supporting Bitcoin’s resilience ahead of expected market volatility in November.

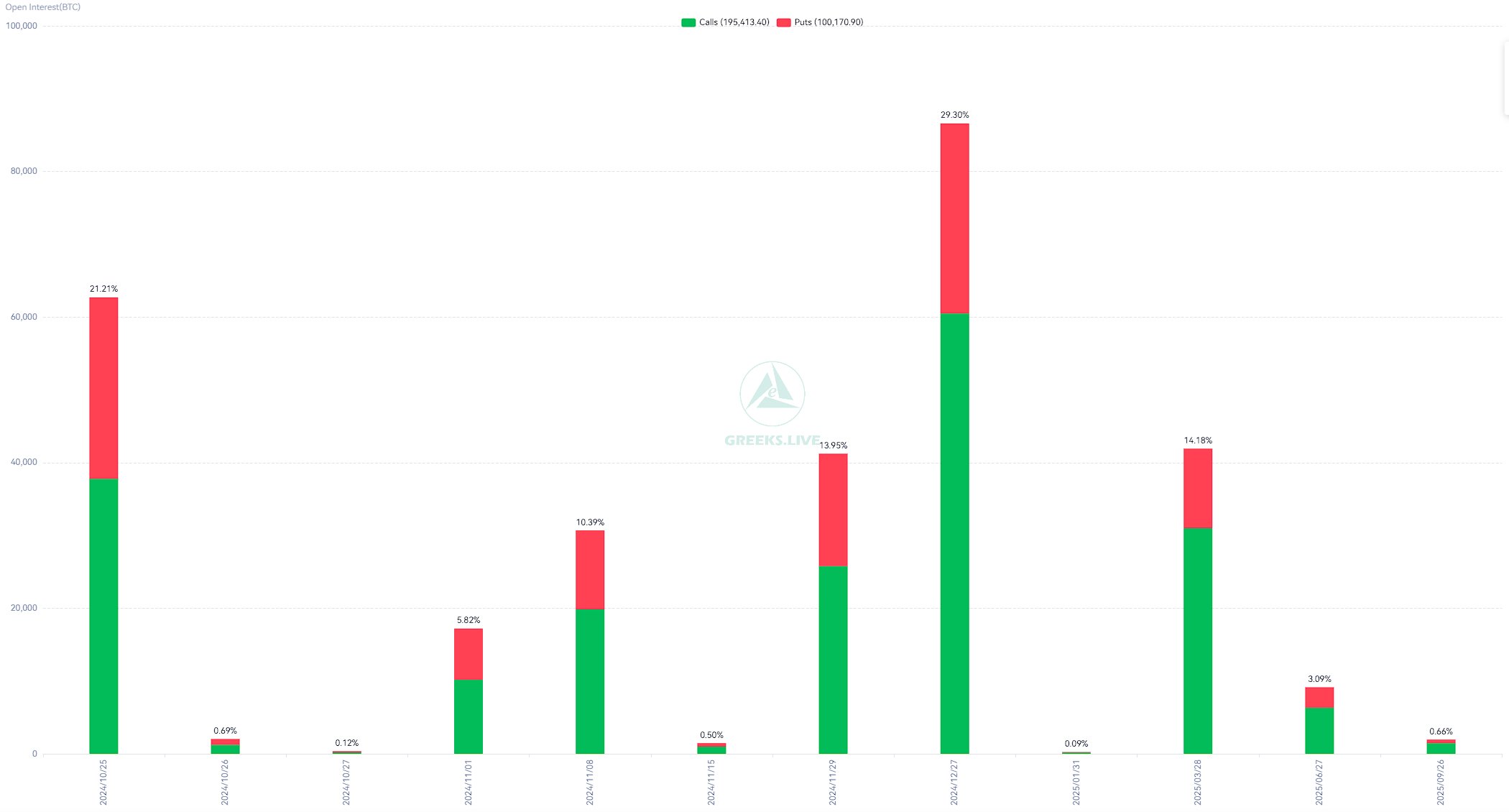

ETH options expire

October 25 also saw 403,426 Ethereum options contracts expire, with a Put-Call ratio of 0.97, reflecting a near-balanced sentiment between bullish and bearish positions.

The Max Pain point was set at $2,600, indicating where the largest number of options would expire worthless.

The notional value of expired ETH options reached $1.02 billion, highlighting Ethereum’s significant presence in the market, although its performance has been stagnant compared to Bitcoin.

Source:

Realistic or not, here is the market cap of ETH in terms of BTC

At the time of writing, Ethereum was trading at $2,468near the Max Pain point, indicating limited price movement.

This contrasted with Bitcoin’s stronger price dynamics, as the former’s market behavior showed signs of investor indecision, compounded by challenges associated with spot Ethereum ETFs.