- Ethereum’s dominance fell below 14%

- Short-term net inflows indicated selling pressure, while long-term outflows indicated potential accumulation

Ethereum (ETH) The dominance within the crypto market fell from 18.85% a year ago to 13.36%. This marked a significant drop in ETH’s share of the overall crypto market noted by analyst Benjamin Cowen. In fact, the aforementioned decline can be seen as a sign of continued selling pressure. Especially as ETH struggles to maintain higher levels of dominance.

Historically, Ethereum has faced resistance at the 16% and 22% dominance levels, and has failed to break through these barriers several times since 2018. The continued decline is part of a descending triangle pattern – generally a sign of a bearish trend.

Source: TradingView

In the accompanying chart, the upper trendline highlighted lower highs, while the lower trendline acted as a long-term support level.

Freefall to 9-10% ETH dominance?

According to Cowen, if downward momentum continues, the next major support level could be between 9% and 10% dominance levels. This would represent a deeper decline caused by declining purchasing interest.

The historic support around 9% could become a pivotal point for ETH, especially if broader market trends do not favor the altcoin sector in the coming months.

If this support level holds, ETH’s dominance could stabilize, paving the way for a potential recovery in 2025. However, if ETH falls below the 9% mark, it could signal an extended period of underperformance versus other altcoins and the overall cryptocurrency. market.

Ethereum’s recent price action and market activity

Ethereum was trading at $2,542.29 at the time of writing, up 0.59% in the past 24 hours and down -3.11% in the past week. The 24-hour trading volume was approximately $17.6 billion – a sign of active trading. With a circulating supply of 120 million ETH, the market cap appeared to be around $306.29 billion.

According to DefiLlama dataTotal Value Locked (TVL) on Ethereum’s network at the time of writing was $47.91 billion, with daily fees of $3.55 million and revenue of $2.55 million. Over the past 24 hours, inflows to the network amounted to approximately $38.78 million, and the number of active addresses reached 372,911.

Together, these statistics highlighted the sustainable use of Ethereum despite its declining dominance.

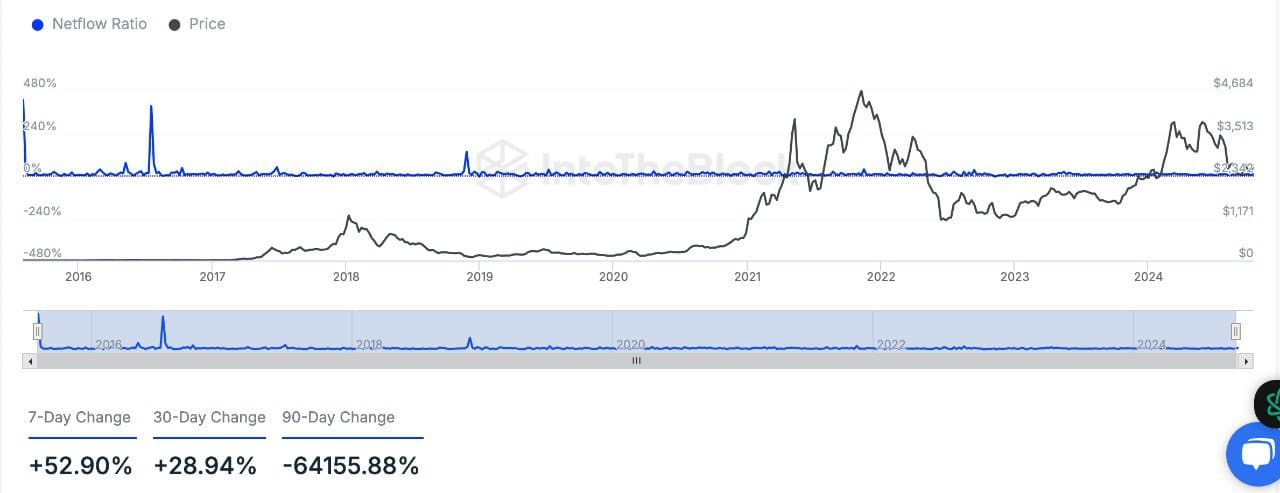

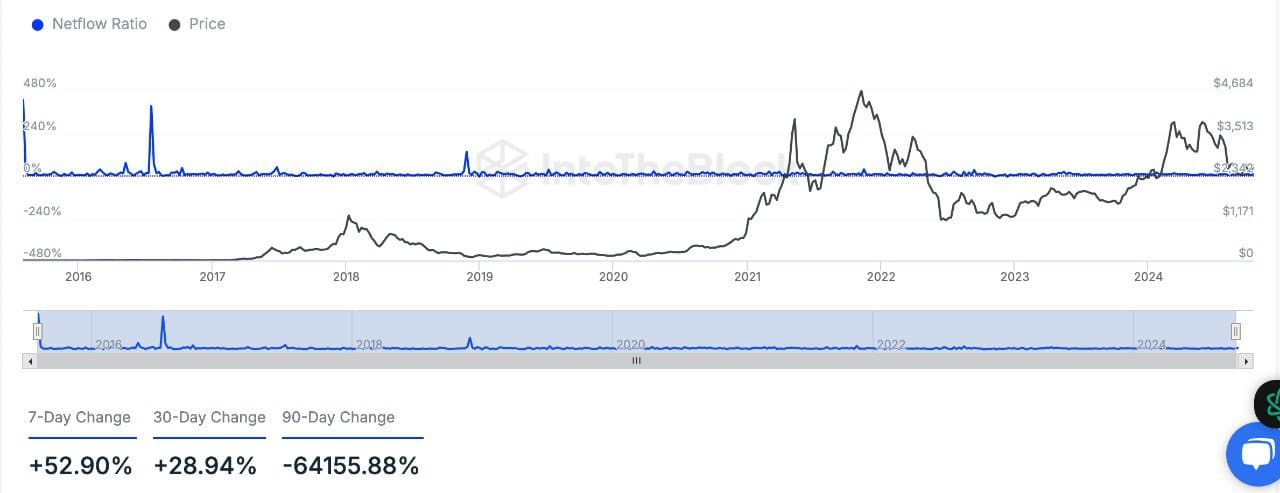

Netflow data underlines the near-term selling pressure

Finally data from InHetBlok highlighted an increase of +52.90% in the last seven days and an increase of +28.94% in the last 30 days, indicating an increase in inflows into the stock markets. Such a trend is often seen when traders move assets to platforms in preparation for selling or profit taking.

However, over the 90-day period, there was a huge shift of -64,155.88% towards net outflows – indicating a longer-term trend of investors withdrawing ETH from exchanges.

Source: IntoTheBlock

The increase in short-term inflows is in line with broader bearish sentiment in the market. Especially as more Ethereum is moved to exchanges, which usually signals an intent to sell.

Rather, the net outflow over time indicates possible accumulation as users withdraw ETH from exchanges for storage or staking.

All things considered, analysts believe that while ETH could see a further decline in the short term, a potential recovery can be expected in 2025.